During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing trillions of investor equity. The Federal Government pushed TARP, a $700 billion bail-out, through Congress to rescue the beleaguered financial institutions. The collapse of the financial system was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

*******************************************

In September 2009 the Fed proclaimed “The Recession is Over.” President Obama said his Stimulus Package saved the US economy and his international actions have “brought the global economy back from the brink.” Vice-President Biden declared, “The Stimulus Package worked beyond my wildest dreams.” I feel so much better. Living in California, I must have missed these events.

If the recession is over, why is unemployment in California 12.2%? (Functional unemployment, the real number, is closer to 16%). In decimated areas like the Central Valley, unemployment is at Great Depression levels of 26%. If the economy was saved, why do our homes continue to lose value? And it is not just “our homes” that are impacted. Treasury Secretary Timothy Geithner was forced to rent out his Larchmont, N.Y., home after it failed to sell. President Obama’s Chicago home, purchased for $1.65 million with a $1.3 million jumbo mortgage at the height of the real-estate bubble is now worth less than $1.2 million according to an estimate by Zillow.

The recession may be over but Americans are now experiencing The Roller Coaster Recession. Like a roller coaster chugging its way up to the top, home values climbed between 2002 and 2007. Beginning in the fall of 2007, home values declined, first slowly but inexorably until they bottom out and began to climb again. Have we bottomed out? The Atlantic screamed, “Home sales soared 11% in June”.

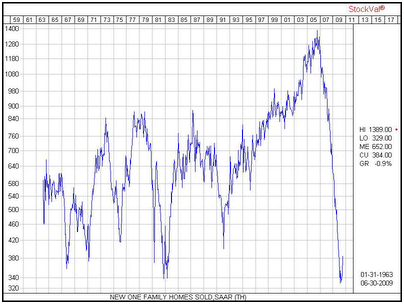

Not so fast. Like the cars in a roller coaster, the first cars will begin to climb out while the last cars are still screaming downward at top speed. The Commerce Department reported sales in August rose a tepid .07% in August. What they did not highlight is that new home sales of 429,000 are at historical off the chart low compared to the last 50 years (see chart below).

Such is the case with the Roller Coaster Recession. In California’s roller coaster ride the first car, The Inland Empire, crested the top in 2007. When pink slips were issued, these homeowners did not have deep pockets to sweat it out. All of their savings had been plowed into their down payment. When values declined, they had no staying power. They were gone in the first wave of foreclosures.

Meanwhile, the rear car, Coastal California, continued to climb in value seemingly immune to the problems inland. The reason was staying power. The residents of tony Corona Del Mar were able to dump their third car, the Range Rover to keep solvent. When that ran out, Coastal California tapped their savings and finally used their equity lines to maintain their high mortgage payments while they waited for a buyer. But it is 2009 and the buyers have not materialized. More Jumbo Loans are falling behind in their payments. Watch the 60-day delinquency rate on prime Jumbo Loans. According to First American Core Logic, Jumbos in default jumped to 7.4% in May versus 4.9% for conforming loans

Like our proverbial roller coaster, now it’s the turn for the first cars to rise. As the Inland Empire seems to have bottomed, Coastal California is still racing downward. There are 200 homes for sale between $1.5 and $3 million in ritzy Corona Del Mar. Even with a hefty 25% down payment, a $2 million property will require a $1,500,000 mortgage. Today’s lenders will require proof that the borrower can afford the $7,500 per month mortgage payment. They will demand a W-2 or 2008 tax return showing at least $22,500 per month in income to support a 30% housing expense ratio.

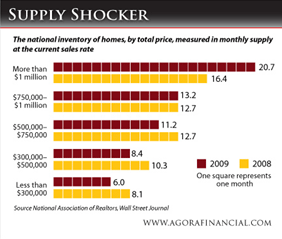

The reality is there simply are not enough buyers earning $250,000 per year to buy up the 200 homes in Corona Del Mar. The current inventory will take 17 months to sell out but, as the recession continues, more homes are posting For Sale signs each month. Coastal California has not yet seen their bottom and they are still heading down at a rapid pace.

Our national leaders may proclaim the end of the recession, but Californians have no reason to party. The Stimulus Package that shipped $50 billion to California was a one-time windfall that delayed but did not end California’s structural $26 billion budget deficit.

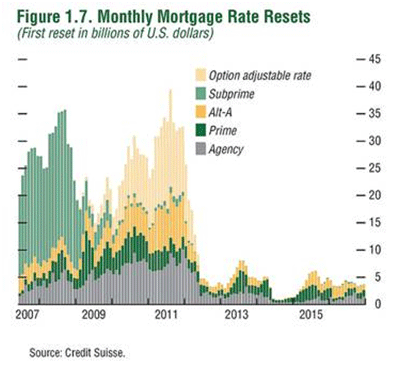

Add to that the “Mortgage Armageddon” that is scheduled to hit next February. As the sub-prime mortgage defaults subside, the Option ARMS (adjustable rate mortgages) and Prime ARMs will begin to reset in early 2010 (see chart). This is not a working class but primarily a middle and upper-class problem. It is more a coastal than inland crisis; in New York terms, more Larchmont and less exurbia.

There is a problem, however, with dinging the rich. They are the very folks expected to spend in our consumer-driven economy and invest in new ventures. If they have to re-route more dollars to mortgage payments, they not going to be able to help the economy.

The Roller Coaster Recession will see more rises and dips before a sustainable recovery comes to California and other high-priced marekts. Those in the first car, like The Inland Empire, have nearly completed their ride. Any remaining dips will be minor in drop and brief in duration. But the genteel folks in the last car, in places like Coastal California, have another precipitous drop in front of them. This may come as a surprise to those believing the headlines that the recession was over. The wild ride for many is hardly over yet.

***********************************

This is the fourth in a series on The Changing Landscape of America. Future articles will discuss real estate, politics, healthcare and other aspects of our economy and our society.

Robert J. Cristiano PhD is a successful real estate developer and the Real Estate Professional in Residence at Chapman University in Orange, CA.

PART ONE – THE AUTOMOBILE INDUSTRY (May 2009)

PART TWO – THE HOME BUILDING INDUSTRY (June 2009)

PART THREE – THE ENERGY INDUSTRY (July 2009)

Comments

25 responses to “Crash in High-end Real Estate or a Roller Coaster Recession? :”

Wow. You paint a bleak picture of the real estate markets in California. I lived in the Inland Empire, and watched friends and family pay $600k-plus for a home in the hills, only to watch them lose about half of their value with a couple of years. According to Movoto, things might improve soon, but no one is quite sure when.

Now, we’re seeing what the bottom of the market looks like in areas such as the bay, coast and desert areas. New available real estate used to create a buying frenzy, and now it’s a dilemma. Do I purchase a vacay home or wait until things sort out even further?

I’d jump on it now, but that’s just me!

I do not about The Roller Coaster Recession. Please tell me more about this term. From Overall this blog post, I have learned a lot. Thanks for discussing about real estate markets in California. I am going to invest money in serviced apartments.

Regards,

http://www.sydneygardenview.com

I think It’s a Roller Coaster Recession. Otherwise who will waste such precious land?.

http://www.invillas.com/

Hi,

Now you can manage your multiple residential, commercial, letting and overseas records all in one system. Just buy a Estate Agent Software Today and get rid out of worries.

The recession may be over but Americans are now experiencing The Roller Coaster Recession. Like a roller coaster chugging its way up to the top, home values climbed between 2002 and 2007. Beginning in the fall of 2007, home values declined, first slowly but inexorably until they bottom out and began to climb again. Have we bottomed out? The Atlantic screamed, “Home sales soared 11% in June”.

SEO Services Company

The residents evacuate to the realtors newport beach of real estate on the said lot to build company buildings.

Working in real estate profession provides the opportunity to satisfy a wide range of customers while using a variety of distinct tasks and also responsibilities. It can be extremely satisfying to help people with essential decisions like buying, offering or renting a home as well as investment.

It takes a particular person to be effective in real estate: someone who is committed to offering exceptional customer service. Developing the skills required to be confident, capable and effective takes devotion and request.

realtor marketing

I have read the article about densification vs. best essays and it is very interesting. I’m so thankful that I’ve found this article because it helps me a lot for my project research.

People always seem to post pictures of rulers or tape measures when they talk about evaluation, which, online essays, have to be some of the dullest objects in the world.

Take a while and really think about your valuable functions. fridge

This is not a working class but primarily a middle and upper-class problem. It is more a coastal than inland crisis; in New York terms, more Larchmont and less exurbia aerogel insulation.

The business news is really my concern as I invest in share and buy them. This dropping of Dow Jones has really caused me very much by making me loose most of the money I have invested. I liked the reference you made i.e. it is like a shift of tectonic plates.

wooden embroidery hoops

Barak Obama did a great job, when he made this budget he stated that economy will be save than previous. Apps for Android Tablet

I wanted to thank you for this great read!! I definitely enjoyed every little bit of it. I have you bookmarked to check out new stuff on your post.

Plastic Ball Valves

It was very useful for me. Keep sharing such ideas in the future as well. This was actually what I was looking for, and I am glad to came here! Thanks for sharing such a information with us.

PVC ball valves

If you just walk to the shop, not only could it take smaller interval, because you won’t have to find a automobile vehicle parking recognize, but you will be protecting money on gas and helping to protect globe World by not dropping those power sources.Learn More

But the numbers converted out amazingly different. In fact, its demographics depend came in nearly 250,000 below forecasts and included the smallest share of New You are able to urban area growth since the Nineteen seventies. Rosemary

I belong to the real estate market. you have really provided good information of current position of real estate industry.

الرياض عقارات للايجار

Activity in the housing market is picking up and house price inflation appears to be gaining momentum. As a result there is no longer a need to provide further broad support to household lending.

Fast sale of house in London

Property dealers concerned within the business get complete data of hotels available in USA and once satisfying themselves with the deed of the property show it available. The property dealers someday show the terms of the hotels business for sale however play a very important role in negotiating the value. Property dealer’s role is large and might not be forget by the owner as most of the property dealer have wonderful communication ability and find the client convinced a lot of simply.

The post is written in very a good manner and it entails many useful information for me. I am happy to find your distinguished way of writing the post. Now you make it easy for me to understand and implement the concept.

PVC valves

Some firm offer a unique set of products not generally available or offered by your banks and credit unions. Whether you need a mortgage to buy or build…or a mortgage refinancing, these firms helps you in your business. Fast House Sell in Liverpool

Thanks you so much for sharing us very new new things we are recommending to visit your blog again and again

levelpro data logger

Im glad to see that people are actually writing about this issue in such a smart way, showing us all different sides to it. Please keep it up.

Hayward Strainers

Thanks for valuable and excellent post, as share good stuff with good ideas and concepts, lots of great information and inspiration .

Plastic Butterfly Valve