During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing trillions of investor equity. The Federal Government pushed TARP, a $700 billion bail-out, through Congress to rescue the beleaguered financial institutions. The collapse of the financial system was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

***********************************

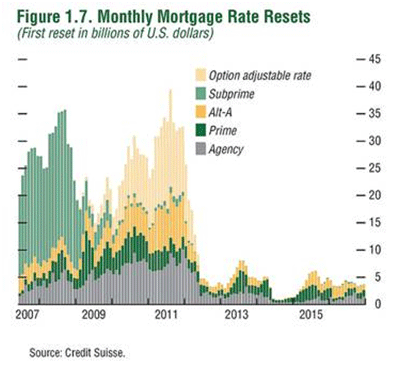

Like the Roaring Twenties of a century ago, the real estate bull market of the last ten years crashed in dramatic style in late 2008. The collapse of the residential market was led by massive defaults in ill-conceived “sub-prime loans”. Millions of American homes are now in default and in the process of loan modification, abandonment or foreclosure. There is no end in sight as Prime, Alt-A, and Option ARM loan resets come due beginning in 2010.

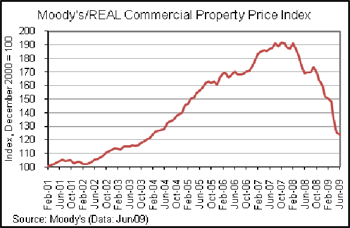

Lurking around the corner, literally unnoticed by the average American worried about keeping his home, is a similar crisis in commercial real estate. For over a year commercial property values have been plummeting and have not begun to recover. A drive through both major cities and suburbia tells the story. Vacant stores, empty shopping malls, cancelled mixed use developments and eerily empty car lots presage bad things to come.

We have discussed the origins of the housing crash before and the role played by feckless politicians and over-ambitious bankers. Now this crisis has spread to the commercial sector. Banks and commercial lenders saw in the new housing starts an equally promising demand for new shopping malls and suburban offices. Lenders forgot about pre-leasing requirements and made speculative loans on buildings that had no pre-leasing. As with housing, the rule book was thrown out the window. Like the aftermath of any wild party, there is hell to pay in the morning. It is morning in the commercial marketplace and the fat lady is singing.

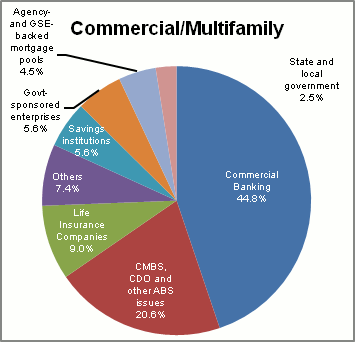

Depository institutions hold about half of the $3.2 trillion of debt on US commercial property. The default rate in the first quarter of 2009 was just 2.25%. Sounds OK until you do the math and realize that $36 billion was in default and it is just beginning. The FDIC puts troubled banks on “the problem list”. In early 2008, there was one bank on the list. At the end of June 2009 there were 416, up from 305 at the end of the first quarter when the default rate was just 2.25%. Total assets at these problem institutions total $299 billion. The problem is that the total reserves of the FDIC are just $42 billion. The FDIC has closed over 100 banks and one good estimate is that they will close around 10% of US banks, 500 to 1,000, before the crisis runs its course. The losses will dwarf the $394 billion of the RTC and may surpass a trillion dollars. Is there any wonder why banks are loathe to make new loans?

So what happens to commercial real estate? With prices plummeting, there must be some great buys out there, one must assume. But do not bet on it. This was not just an earthquake. The plates shifted, and like musical chairs, when the music stops there will be fewer chairs and many people left standing. Consolidation is the next step. There will be the inevitable drop in rents and with it property values. The better and stronger tenants will flee the less attractive Class B and Class C space and move to Class A properties. Class A properties will survive due to full occupancy and stable cash flow. But the lesser properties that were leased will empty.

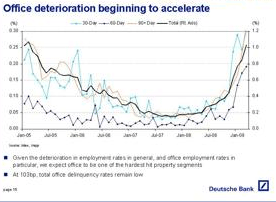

Like the suddenly quiet auto malls with the empty Pontiac, Saturn and Chrysler dealerships, lesser properties will lose their anchor grocery stores, Targets, and big box users. With the anchors gone, and traffic with it, the mom and pop small businesses cannot survive. There is no future for the marginal Class C shopping center. Tenants will flee to better locations and more affordable lease rates. Class A offices will survive. Well located and attractive Class B properties may muddle through at reduced revenues – if they can survive the refinancing maze. But, the poorly located Class C office will remain a “see-through” for years to come. Old, tired, and mostly vacant Class C office buildings line the crumbling freeways of Detroit, Cleveland, Youngstown, and countless smaller rust belt cities where excess capacity has eliminated the need for new development.

A year from now, the landscape of America will be forever changed. The office and retail markets will be vastly different than they look today. Not much of it will be good. Five years from now, will empty shopping centers and auto dealerships remain shuttered or will they be rebuilt or torn down and their use converted to something more productive? Will our politicians cease their meddling in the market and allow the market to heal itself? These are questions that will haunt our economy for the next decade.

***********************************

This is the fourth in a series on The Changing Landscape of America. Future articles will discuss real estate, politics, healthcare and other aspects of our economy and our society.

Robert J. Cristiano PhD is a successful real estate developer and the Real Estate Professional in Residence at Chapman University in Orange, CA.

PART ONE – THE AUTOMOBILE INDUSTRY (May 2009)

PART TWO – THE HOME BUILDING INDUSTRY (June 2009)

PART THREE – THE ENERGY INDUSTRY (July 2009)

PART FOUR – THE ROLLER COASTER RECESSION (September 2009)

Comments

18 responses to “When the Fat Lady Sings: The Fate of Commercial Real Estate”

When you realise such effects have happened it becomes pretty scary at what could in effect create devastation!

radiators

It will take decades to recover from this one, i think the changewill have permanent aspects.

designer radiators

Prices for real estate have fallen and there are less buyers and there are more people looking to sell their properties. Prices will remain low for quite sometime. This also presents the few people who have money in their pockets to buy properties at substantially low rates as compared to a few years ago.

Montecito Houses

Well things have started to change, it slow but its on right path so i believe that Real Estate sector will be in full swing in year and half. And i feel it is best time for International investors to invest in real estate abroad like in Dubai real estate or in Abu Dhabi real estate. Things have change there in a good direction now and Real estate market is growing well. And with that demand for materials for construction is also on the rise.

Well the Dow Jones Industrial average is back to above 10,000 points in 2010 and the real estate market is looking better too. People are starting to look at the real estate market with optimism and investors are coming back.

Also great news is that Tampa Bay area in Florida is where a lot of buying and selling activity is taking place. Tampa Bay offers great real estate properties both for investors and buyers. If you are looking for the dream home then Tampa Bay has all of it that you would probably want.

Visit us for Tampa FL Homes for Sale

James

It makes a lot of sense to buy a foreclosed home, because if you can find a home that meets your requirements and is 30 odd percent less as compared to its original price then I think that’s a great deal.

For more information on how you can buy or sell residential property in Boerne and San Antonio visit us at http://www.myboernebroker.com. Its the best way to go about Boerne TX homes for sale

I was just thinking about Real Estate Auction and you’ve really helped out. Thanks!

Spot Coolers | 3M Filtrete 24x30x1 Filters | Honeywell Humidifiers

Thanks for taking the time to post such a detailed and informative article. It has given me a lot of inspiration.

Executive Suites St Louis

Informative Post. Make Money Online | Paypal Alternative Thanks.

I like this concept. I visited your blog for the first time and just been your fan. Keep posting as I am gonna come to read it everyday!!

Furnace installation Cincinnati

Nice post.I like the way you start and then conclude your thoughts. Thanks for this information .I really appreciate your work, keep it up

Furnished Apartments Manila

Buying a home is not an easy decision but the even harder thing is to identify a new home in a place that you are completely new to. That is why you have real estate agents because they have knowledge about property listings of new homes, condos, villas and home for sale that you probably would never find out about.

Real estate agents not only help you find your dream home but they also are of great help when it comes to getting the property deal finalized is concerned.

If you happen to be looking for a home in Colorado then the people at Crested Butte Real Estate can prove to be really helpful. To know more about their services and properties available for purchase in Crested Butte visit their website here

You got a really useful blog I have been here reading for about an hour. I am a newbie and your success is very much an inspiration for me.

Terrazzo Tiles

In case you are planning to buy a new home in a city or for that matter county that is completely new to you then your first thoughts will linger around who can you find the right home that you would like to make your home.

Well that is why you have real estate agents. If you are looking for a home in Lake Norman then our website has all the information that you can use. With prime property listings you can find condos, apartments, villas, luxury homes in the most sought after neighborhood. Lake Norman offers water skiing, sailing, canoeing, kayaking, or a glass of wine at a waterfront restaurant and more.

For more on Lake Norman Real Estate visit us.

James

Interesting read, thanks for helping keep me busy at work 😉

Cooling Towers New York City

In this period of time because of the commercial collapse the real estates suffer a little bit but it is not the case of the real estate Chicago or other real estates in LA .

Serviced Apartments Sydney – Australian Executive Apartments – Serviced apartment rentals and furnished holiday accommodation rentals with own bedroom, kitchen, laundry, living-room, Foxtel and balcony.Serviced Apartments at Low Prices. Wide Range of Locations near Coogee Beach, Sydney CBD and Sydney Airport.

Lift Maintenance Sydney – Electra Lift services a broad range of lift and escalator equipment manufactured both locally and overseas. We stock a comprehensive range of spare parts to cater for all makes of lifts, plus we have the ability to manufacture and repair parts in our own factory. Electralift are Residential & Commercial Lift Specialists that provide 24hour service.

Find in the surrounding areas of Dallas, Villa Rica, and Douglasville, Georgia. Our rental homes are conveniently located near Arbor Place Mall, Atlanta’s best school districts, local Hospitals, and downtown Atlanta.Atlanta Rental Homes