As traffic levels decline nationally in defiance of the usual state DOT forecasts projecting major increases, a number of commentators have claimed that we’ve reached “peak car” – the point at which the seemingly inexorable rise in vehicle miles traveled in America finally comes to an end. But while this has been celebrated, with some justification in the urbanist world as vitiating plans for more roads, the implications for public policy haven’t been fully faced up to.

Indeed, the “peak car” is antithetical to the reigning urbanist paradigm of highways known as “induced demand.” Induced demand is Say’s Law for roads: supply of lanes creates its own demand by drivers to fill them. Hence building more roads to reduce congestion is pointless. But if we’ve really reached peak car, maybe we really can build our way out of congestion after all.

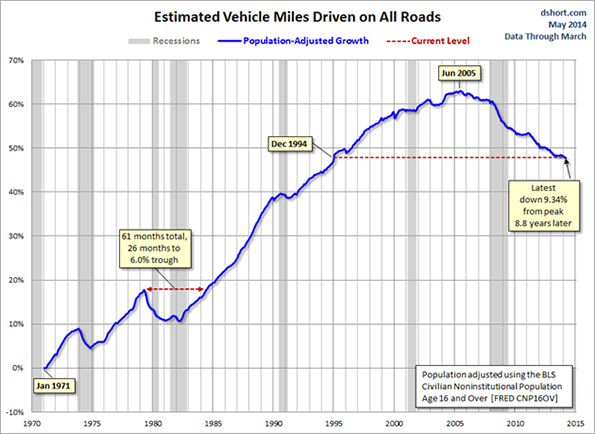

Traffic levels have stabilized or even fallen in recent years. According to analysis by economist Doug Short featured in Streetsblog, aggregate auto travel peaked on a per capita basis in 2005 and has fallen since. Per capita traffic levels are now back to 1994 levels, a two decade rollback in traffic increases.

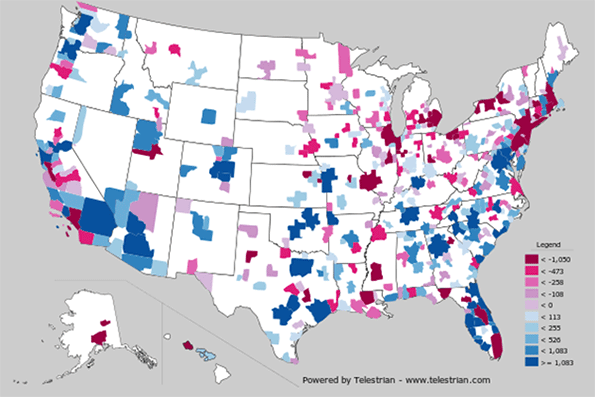

Population adjusted traffic growth. Image via Doug Short

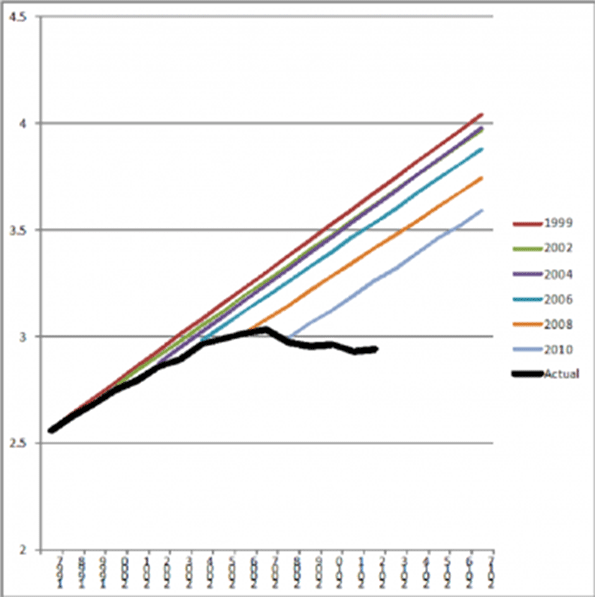

Even looking at total, not per capita travel shows a marked reversal. The State Smart Transportation Initiative, a pro-environmental research center, put together a graph showing how high the US DOT’s traffic projections have turned out to be:

VMT forecasts vs. actual. Source: SSTI

This data is complemented by a slew of recent stories about the poor financial performance of toll roads, resulting in part from traffic falling far below projections. For example, the concessionaire operating the Indiana Toll Road recently went bankrupt. Streetsblog reported that while projections forecasted traffic level increase of 22% in the first seven years, traffic actually fell 11% in the first eight.

Recent traffic declines are a reversal of a long running trend of Vehicle Miles Traveled (VMT) increases at above growth in population. Some of this is no doubt due to the poor macro-economy. But there are reasons to believe we may be in a new era of traffic growth or lack thereof. Many of the trends that drove high growth have largely been played out: household size declines, suburbanization, the entry of women into the workforce, one car per driver, etc. That’s not to say these will necessarily reverse. But we’ve reached the point of diminishing returns in terms of how many more women, for example, will join the labor force given that there’s already 57% female participation and their labor force participation rate is projected to decline in the future.

This is potentially very good fiscal news, especially given tight budgets. Clearly many of the freeway expansion projects on the books that have been driven by speculative demand should be revisited. For example, the state of Wisconsin has massive investments planned in Milwaukee area freeway system even though the metro area is very slow growth in population. Are these really necessary? Projects in more rapidly growing boomtown regions in places like Dallas, Houston or Charlotte may well continue to make sense. From top to bottom, engineers need to recalibrate their forecasting models to better correspond to reality. And to revisit highway plans accordingly.

So the idea that we need to build fewer roads than we thought is sound. But less attention has been paid to the flip side implications of this. To repeat, the induced demand theory says that there is a more or less infinite supply of traffic, thus any new roadway capacity will be used up shortly, leaving congestion as bad as the status quo ante. Despite peak car, articles touting induced demand as a reason not to build roads continue unabated, including recent ones in Wired (“What’s Up With That: Building Bigger Roads Actually Makes Traffic Worse”) and Vox (“The ‘fundamental rule’ of traffic: building new roads just makes people drive more”). In a world of peak car, where traffic levels are flat to declining on a per capita basis, induced demand no longer holds court, certainly not to the level claimed by those who believe it’s pointless to build roads.

In fact, what peak car means is that while speculative projects may be dubious, there many be good reasons now to build projects designed to alleviate already exiting congestion. Places like Los Angeles remain chronically congested, which has great economic and social consequences, not the least of which is the value of untold hours lost sitting in traffic. While individual projects there might indeed be boondoggles, maybe it’s worth building some of the planned freeway expansions there in light of peak car. In short, in some cases peak car strengthens the argument for building or expanding roads.

On the other hands, many of the regional development plans designed to promote compact central city development and transit may be predicated on an analysis that assumes large future traffic increases in a “business as usual” scenario. Not just highways but all aspects of regional planning are dependent on traffic forecasts. That’s not to say that such plans are necessarily wrong, but clearly revised traffic reality needs to be reflected in all plans, not just highway building ones.

It’s not clear how this will all play out, but urbanists and policy makers of all stripes need to think about the full implications of peak car. At a minimum, the traditional “you can’t build your way out of congestion” rhetoric should be supplanted, at least in most areas, by a more nuanced approach that neither overestimates demand, nor ignores the problems caused by rapid growth in some regions and pockets of congestion in others.

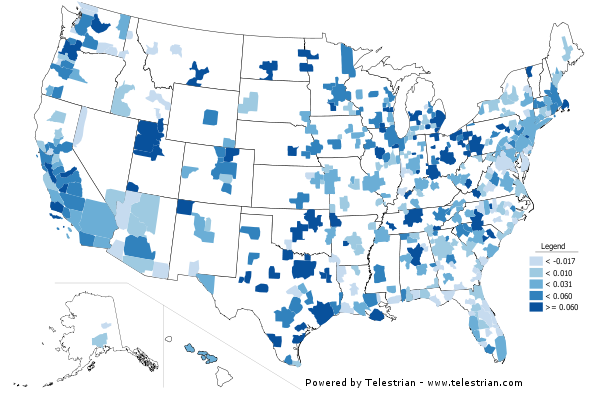

Aaron M. Renn is an independent writer on urban affairs and the founder of Telestrian, a data analysis and mapping tool. He writes at The Urbanophile.