The results of the mid-term election of 2010 will be written over the next two years. Can the Republicans really make good on their promise of fiscal discipline? A glimpse of our future federal budget may be seen in the fiscal actions (and inaction) of America’s governors. Most states are struggling to balance budgets in troubled economic times with projected shortfalls nationwide of more than $100 billion for Fiscal Year 2012. Federal bail-outs are no longer an option. The hard choices are tax increases, reduction of services or innovative fiscal solutions like deconstruction. These bold and innovative governors, or “Deconstructors,” are what Alexander Hamilton had in mind when he wrote in The Federalist that “energy in the executive is a leading character in the definition of good government.”

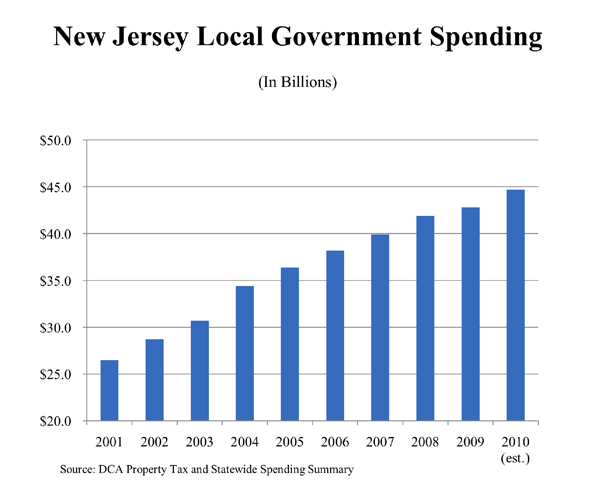

New Jersey Governor Chris Christie was the first Deconstructor to emerge. He wasted no time when he was sworn into office in January of 2010, declaring a fiscal state of emergency and freezing billions of spending. This week he announced 1,200 more public workers will get the axe come January. Governor “Wrecking Ball” is attracting plenty of national attention.

Governor Mitch Daniels of Indiana has an approval rating today over 70%. This Deconstructor, a former U.S. Office of Management and Budget Director, inherited a $600 million deficit and within a year turned it into a $300 million surplus. Four years later, the state had a $1.3 billion surplus. In 2008, “The Blade” as he is called, ushered through the legislature a bill that cut property taxes on the average house by more than 30%, making Indiana one of the nation’s lowest property tax states.

Along the way, Daniels decertified the public service unions. Within a year, 92% of government employees quit paying their union dues. He reduced the number of state employees by 14% to a level last seen in 1982. He leased the Indiana Toll Road to foreign investors for $3.85 billion, which he sequestered in an escrow account, where it can only be used for road construction. Today, Indiana is one of nine states with a triple-A bond rating and, it is creating jobs. Despite only 2% of the national population, Indiana generated 7% of all new jobs created in the U.S. last year.

Mr. Daniels predicted that Americans would come to realize how much of what government now does “we can get by without.” He questions, “will the public sector be the servant, the enabler of the free economy…or will they be the master?” “Some of the anger out there now”, he said, “is directed not just at Wall Street but government employees and their unions.” In August 2010, The Economist wrote of, “his reverence for restraint and efficacy,” adding, “He is, in short, just the kind of man to relish fixing a broken state — or country.”

Another Deconstructor is Governor Bob McDonnell of Virginia. Since taking office in 2010, Governor McDonnell converted a $1.8 billion deficit into a $200 million surplus. He overhauled Virginia’s pension system, saving $3 billion over 10 years. He imposed an immediate, statewide hiring freeze that covers all noncritical areas of state government. He saved $20 million per year by cutting and consolidating boards and agencies. State employees, who experienced a wage freeze for four years, identified $28 million is savings and will be rewarded with an $83 million bonus this year.

Governor Haley Barbour of Mississippi inherited a budget deficit of $720 million deficit when he took office and created a surplus without raising taxes. Today Mississippi runs on less money than required two years ago, a lesson Barbour says the federal government needs to learn. Barbour championed serious tort reform. “We’ve gone from being labeled as a judicial hellhole and the center of jackpot justice to a state that now has model legislation,” says Charlie Ross, a Republican who chairs the state Senate Judiciary Committee. He increased funding for education and job training. The reward for his success is talk that Barbour may be a candidate for President in 2012.

West Virginia Governor Joe Manchin, a Democrat, was elected to take Senator Byrd’s place in the Senate. As governor, he was routinely described as a penny-pincher and a tightwad. Manchin has been so focused on controlling state spending when an employee quit, he refused to allow new hires without his direct permission. West Virginia had a budget surplus last year while other states fired cops, fireman and teachers. The Charleston Gazette called the governor, “Penny wise and pound foolish,” but others praised his budget discipline. Conservative CATO Institute gave Manchin an A for his money management.

What do these Deconstructors have in common? Despite the Great Recession, they each created a budget surplus. They did so by deconstructing the state government (and state deficits) they inherited. They used bold ideas (selling the toll road) and innovation (decertifying the unions) to do what others said cannot be done.

The success of these deconstructors should offer some hope for badly managed states like California, Illinois, New York, and Michigan. The question is whether politicians in Sacramento, Springfield, Albany, or Lansing are ready to learn from these early deconstructors or will continue to bankrupt their states. Crunch time is approaching now since, thanks to the election, there is likely little appetite in Washington to bail these states out of their morass.

**************************

The Great Recession of 2007 – 2012 will be followed by a period during which budget deficits, unfunded obligations and credit restraints force tremendous change to the core structure of governments worldwide. This period will come to be known as THE GREAT DECONSTRUCTION.

Robert J Cristiano PhD is the Real Estate Professional in Residence at Chapman University in Orange, CA and Head of Real Estate for the international investment firm, L88 Investments LLC. He has been a successful real estate developer in Newport Beach California for twenty-nine years.

¬¬¬

Other works in The Great Deconstruction series for New Geography

Deconstruction: The Fate of America? – March 2010

The Great Deconstruction – First in a New Series – April 11, 2010

An Awakening: The Beginning of the Great Deconstruction – June 12, 2010

The Great Deconstruction :An American History Post 2010 – June 1, 2010

A Tsunami Approaches – Beginning of the Great Deconstruction – August 2010

The Tea Party and the Great Deconstruction – September 2010

The Great Deconstruction – Competing Visions of the Future – October 2010The Post Election Deconstructors – Mid-term Election Accelerates Federal Deconstruction – November 2010