Queensland Premier Anna Bligh MP has a problem. Reacting to sensationalized media reports of runaway population growth as well as an infrastructure lag revealing itself in everything from mounting congestion to a lack of hospital beds, Queensland residents are starting to say ‘enough.’ The prospects of continuing population growth at around 2.5% or 100,000 people per annum, despite the economic benefits this brings, are increasingly unpopular, something that gets the attention of most politicians.

In many ways it’s ironic for Premier Bligh to find herself in this position. She follows a succession of Premiers who managed to get away with weekly media boasts of “1500 people every week” moving into the State, drawn – it was alleged – by our climate and lifestyle. In the past, any Premier who questioned this growth would have felt the result at the ballot box.

Bligh’s response has been (in a time honoured tradition) to convene a ‘summit of experts’ and community representatives (you can read it all here), designed to thrash out a policy accord for the future. No politician worth their salt holds an inquiry unless they have a fair idea of the outcome in advance, so it’s a fair bet the outcomes will include even more regulatory controls on urban growth, in the name of ‘sustainability’ to appease the anti-growth coalition of greens and neo-Malthusians. Pro-growth lobbies on the other hand will be promised a ‘business as usual’ attitude to economic expansion, only under more ‘responsible’ oversight.

But the biggest irony is that attempts to contain or control growth may be too late. It is just possible that the unthinkable will happen: growth will stall, and in coming years, a future Premier will be wondering what went wrong.

How could this happen?

First, a bit of history. Queensland’s growth status in the Australian context has been driven over the past 30 years almost entirely from interstate migration. Low state taxes, relatively cheap housing, aggressively pro business governments (including one which famously went too far) and a ‘Florida-like’ allure of lifestyle and warm climate all combined to make the state a population magnet. “The Sunshine State” – just like Florida – was how tourism promoters labeled it. “The low tax state” was the label peddled by business promoters. Both became interchangeable.

In contrast, international migration to Australia was largely focused on Sydney and Melbourne. The rate of natural births over deaths was barely in the positive, resurrected recently by a Federal Government baby bonus of questionable long lasting effect. This left interstate migration as Queensland’s growth driver.

Arrivals from Victoria or Sydney could famously relocate to the south east corner of Queensland and find themselves in a better quality home, in a more convenient location, and with cash left over. They were faced with shorter commute times, lower taxes and overall a better quality of life than the one they left behind.

But in the late 1990s this all started to change. Increasing land use controls appeared as planners sought to ‘manage’ the growth of the state better. “We can’t destroy what you came to enjoy” became a new mantra, and an urban growth boundary for the popular south east was introduced under ‘smart growth’ principles. In the 1995-2000 period, three statutory plans appeared for the south east, followed by a 10 year regional planning program in 2000 (SEQ 2021) followed by an Office of Urban Management in 2004, a South East Queensland Regional Plan in 2005 and then an updated version in 2009.

It’s become an industry joke that we now produce more plans than houses. But the inevitable consequence of this explosion of planning regulation – matched at the same time by the surreptitious introduction of exorbitant per lot housing levies under the guise of ‘user pays’ – was to drive up housing costs rapidly while drying up new supply.

Queensland housing construction is now at a 20 year low. The median house price, which in 1999 was half that of Sydney’s, is now 80% of Sydney prices and roughly at 8 times average incomes. A thirty year or more tradition of relatively lower cost housing in Queensland has been smashed in the space of six or seven years.

Also over the same period, the state’s tax advantage has been eroded. Once Queensland boasted some of the lowest vehicle registration fees in the country; now it has the highest. Electricity prices, also once amongst the cheapest of any state, are now just as expensive. Land and other property taxes have rapidly caught up with other states and overshot others. According to the Institute of Public Affairs IPA, state business taxes in just one year went from being the second lowest in the country in 2008 to mid field by 2009. Roads and other infrastructure which were once enjoyed as part of the general tax contribution are separately tolled, water is priced and charged separately from council rates to residents. Overall, the general cost of living advantage compared to interstate rivals has evaporated.

The rapid erosion of Queensland’s relative tax and cost of living advantage prompted a writer for The Australian newspaper to lament in late 2009 that: “Queensland has squandered its low-tax edge and become a public-sector spendthrift, putting at risk its long-term growth potential and ability to attract investment.”

In fairness, maintaining low taxes and funding a generational catch up in infrastructure might be mutually exclusive. The state is now undergoing a record level of infrastructure investment, in response to the growth it has witnessed. The timing for Premier Bligh though is not good: the benefits of this new wave of infrastructure might not be felt for some years. In the meantime, residents are growing increasingly impatient and the prospects of adding to population numbers are being met with increasing hostility. Some of the more alarmist messages of green and ‘no growth’ advocates are finding traction. Even leading Australian business figure like entrepreneur Dick Smith is warning that we will soon run out of food. This in a state larger than Texas with a population of just 4 million, and in a country with five times the amount of arable land per capita than the USA.

Faced with funding a much larger public sector plus a big infrastructure program, the state is whetting its tax appetite. Plus, the popular sentiment now turning against population growth suggests that relief from excessive land use controls on housing supply or a meaningful reduction in the level of upfront per lot levies is remote at best.

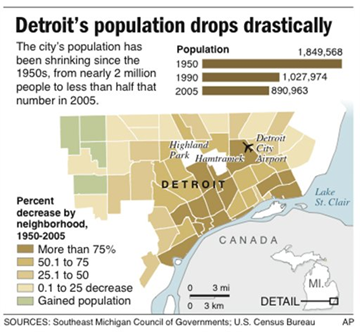

The results are already apparent. Interstate migration – once the single biggest driver of growth in Queensland – has collapsed and now accounts for just half the level of births over deaths and only one third the level of international migration. The sun still shines in the Sunshine State but Queensland is now longer the low tax (and low cost of living) state. With lower average incomes than other states, the sums no longer add up for many people. And as birth rates slow, without the international migration tap, Queensland’s population growth overall could hit the brakes. The risk here is compounded by the increasing pressure on Prime Minister Kevin Rudd to slow down international migration to Australia (for an example, see here). If that happened, growth could fall to record low levels almost overnight.

So while Premier Bligh prepares for the population summit and its aftermath, it could prove the ultimate irony that measures to control the rate of population growth in Queensland become quickly redundant and the very least of our worries.

Ross Elliott is a 20 year veteran of property and real estate in Australia, and has held leading roles with national advocacy organizations. He was written and spoken extensively on housing and urban growth issues in Australia and maintains a blog devoted to public policy discussion: The Pulse.