From Appalachia to Alaska, the growth is eye-popping. Thousands of new jobs have sprouted up, most well-paying and all boons to their regions. There’s no denying oil and gas extraction jobs are on the rise, and not just in Texas and Oklahoma.

North Dakota is drilling oil at a blistering pace. Pennsylvania and West Virginia, along with parts of New York and Ohio, are seeing a natural gas boom with their Marcellus Shale reserves. And Colorado, Wyoming, Alaska, and other Western states are adding extraction jobs in droves.

The six fastest-growing jobs for 2010-11, according to EMSI’s latest quarterly employment data, are related to oil and gas extraction. This includes service unit operators, derrick operators, rotary drill operators, and roustabouts. Each is expected to grow anywhere from 9% to 11% this year, in an otherwise stagnant economy.

But that’s not all. A mixed bag of other extraction and petroleum-related jobs—wellhead pumpers, all other extraction workers, geological and petroleum technicians—are also expected to see healthy gains. In total, nine of the top 11 fast-growing jobs in the nation are tied in one way or another to oil and gas extraction.

|

Occupation

|

2010 Jobs

|

2011 Jobs

|

Change

|

% Change

|

|

Service unit operators, oil, gas, and mining

|

42,110

|

46,766

|

4,656

|

11%

|

|

Derrick operators, oil and gas

|

23,323

|

25,747

|

2,424

|

10%

|

|

Rotary drill operators, oil and gas

|

28,116

|

30,981

|

2,865

|

10%

|

|

Roustabouts, oil and gas

|

75,636

|

82,678

|

7,042

|

9%

|

|

Helpers, extraction workers

|

44,303

|

47,247

|

2,944

|

7%

|

|

Petroleum engineers

|

29,063

|

30,917

|

1,854

|

6%

|

|

Biomedical engineers

|

16,065

|

17,061

|

996

|

6%

|

|

Wellhead pumpers

|

24,186

|

25,616

|

1,430

|

6%

|

|

Extraction workers, all other

|

23,423

|

24,784

|

1,361

|

6%

|

|

Geological and petroleum technicians

|

35,304

|

37,205

|

1,901

|

5%

|

What’s driving this employment spike? A push for increased domestic oil production is certainly a factor, as are technology breakthroughs in collecting massive shale gas deposits. But more subtle shifts are also happening, including how federal and state agencies track the oil and gas extraction workforce.

A Prime Example

For a case study on the skyrocketing employment picture on the shale front, just look at Pennsylvania. Without a tax on natural gas extraction and perfectly located to take advantage of the Marcellus Shale formation, parts of the commonwealth have become a hotbed for drilling. More than 3,000 wells have been drilled in the last three years, and much more is expected in coming years.

Since 2008, Pennsylvania has added more than 15,000 jobs in the mining, quarrying, and oil and gas extraction industry, a 41% jump. Only Texas and Oklahoma have added more of these jobs in the last three years. Meanwhile, North Dakota has seen an 80% jump in employment in this sector, second only to Delaware since 2008.

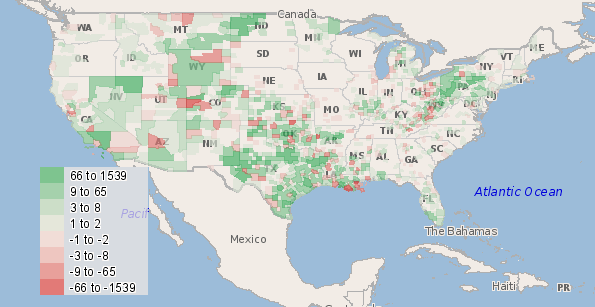

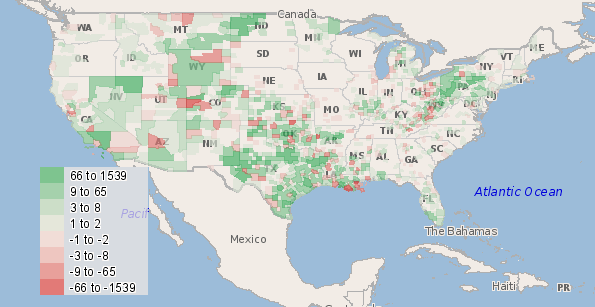

Where are these well-performing oil and gas jobs located? We mapped the data for the four fastest-growing jobs — roustabouts, service unit operators, derrick operators, and rotary drill operators. Here’s what we found: Texas and Oklahoma of course have a large percentage of these jobs, but California, Alaska, and other Western states have a fair share, too.

The map below shows 2-year job growth in these oil and gas extraction jobs for every county in the continental US. Williams County, North Dakota is No. 1 with 1,539 jobs added, which amounts to 80% growth.

More Than a One-Year Trend

Mining, quarrying, and oil and gas extraction is expected to grow 6% in the US from 2010-2011. That’s the fastest projected growth among the 20 broadest-level industries—twice the rate in fact, as the next fastest-growing industry (administrative and support and waste management and remediation services,).

This is hardly a one-year bump, though. Over the last five years, the explosion in the sector has been than staggering—even with a minor employment dip from 2009-2010. The industry added more than 345,000 jobs nationally from 2007 to 2009, and is expected add another 85,000 this year, which equals 11% growth.

It’s also helpful to break out mining and oil and gas extraction from the broad sector to more specific industries to locate the real driver of the growth. In this case, it’s easy to see: Of the 506,401 new jobs in the sector since 2006, more than 431,000 have been in the crude petroleum and natural gas extraction industry (NAICS 211111). This sub-sector has grown by a whopping 113% nationally in the last six years while mining (except oil and gas) remains at its ’06 employment level.

Every state except for Maine has added jobs in crude petroleum and natural gas extraction since 2006, with Texas, Oklahoma, California, and Kansas leading the way.

The Rise of Contract Oil and Gas Workers

In last month’s GOVERNING Magazine, William Fulton wrote about the “1099 economy”—the shift by employers to hire temporary workers who file a 1099 form with the IRS rather than a W-2 and don’t receive benefits. No other industry has seen this move to 1099 workers more dramatically than mining, quarrying, and oil and gas extraction.

A recent EMSI analysis revealed that the share of 1099 workers in this sector increased from 33% in 2005 to 53% in 2010, the biggest percentage jump among the 20 broadest-level industries. Mining, quarrying, and oil, and gas extraction now has the third-highest share of contract workers, behind real estate (74%) and agriculture, forestry, fishing and hunting (68%).

At least part of this influx could be attributed to land owners cashing in on royalties after leasing their property for drilling. Through the quirks of how the Census’ Bureau of Economic Analysis* tracks the oil and gas extraction industry — and how the industry data is tied to occupations — some of these jobs could be counts of landowners who are claiming additional income from oil and gas royalties. If that’s the case, these jobs would be better placed in the real estate and leasing industry.

Please note: For these reasons, EMSI “noncovered” data (i.e., data on 1099 workers plus more traditional state data, etc.) for oil and gas jobs should be treated with caution. Also, the jobs numbers for 2010 are estimates at this point, so it will take more time to see how these trends play out.

*The Bureau of Labor Statistics measures only workers covered by unemployment insurance and who thereby file a W-2. EMSI’s “complete” dataset adds proprietors and other “noncovered” workers by combining BLS and state data with various Census datasets.

Joshua Wright is an editor at EMSI, an Idaho-based economics firm that provides data and analysis to workforce boards, economic development agencies, higher education institutions, and the private sector. He manages the EMSI blog and is a freelance journalist. Contact him here.

Lead illustration by Mark Beauchamp.