The cloud of the global financial meltdown has not even cleared, yet another crisis of massive proportions looms on the horizon: global sovereign (public) debt.

This crisis, like so many others, has its root in the free flow of credit from the preceding economic boom years. The market prices of assets were rising steadily. Rising valuations, especially where they were based on improving revenues from robust economic activity, led to rising income streams for governments. This encouraged governments to borrow more, perhaps often to expand services – and the bureaucracy required to offer services – although sometimes to improve infrastructure.

At the same time, rising market prices for financial assets encouraged more savers and investors into the market. That led to an increasing supply of investable funds, which drove demand for sovereign and municipal debt (in addition to the mortgage-backed securities). This process, driven by the financial services industry instead of the real economy, is eerily similar to the driving forces behind the “subprime crisis.” The demand for public offerings pulled more debt issuance out of borrowers with seemingly little concern for repayment: the financial sector gains its profits from issuance fees, trading fees, underwriting fees, etc. As in the case of mortgages, it will be those who buy and hold the debt, along with the borrowers, who will suffer the consequences.

Certainly, emerging nations took advantage of the depth of rich nation capital markets to increase their debt through public offerings. At the end of June 2009, only Italy, Turkey and Brazil were covered by more credit default swap contracts than JP Morgan Chase and Bank of America. In addition to those two global banks, Goldman Sachs, Morgan Stanley, Deutsche Telekom AG, France Telecom and Wells Fargo Bank all have more credit derivate coverage than the Philippines.

Yet there is clearly a potential default problem here. Gross credit default swaps outstanding for the debt of Iceland are equal to 66 percent of GDP, about 20 percent of GDP for Hungary and the Philippines and around 18 percent for Latvia, Portugal, Panama and Bulgaria. If these countries default on their debt, those global banks who sell credit derivatives will be making enormous payments – whether or not the defaulting countries receive any support or bailouts from international donor organizations (like World Bank or International Monetary Fund).

The table below shows the GDP for the countries named in the most credit default swap contracts (as most recently reported to Depository Trust and Clearing Corporation). For each sovereign (country, state or city), we show the value of their public debt both as a figure and as a percent of GDP. The telling factor here is that the “financial markets,” if they are to be believed, judge these entities as more likely to experience “a credit event” than others. A credit event, as we learned when the AIG saga unraveled can be anything from a decline in the market price of debt to an outright default on payments.

| Sovereigns named in most credit default protection* |

| Sovereign Entity |

GDP (2008) |

Share World GDP (est) |

Public Debt (current) |

Debt % GDP |

| JAPAN |

$ 4,348,000,000,000 |

8.6% |

$ 7,408,992,000,000 |

170.4% |

| REPUBLIC OF ITALY |

$ 1,821,000,000,000 |

3.4% |

$ 1,888,377,000,000 |

103.7% |

| HELLENIC REPUBLIC (Greece) |

$ 343,600,000,000 |

0.4% |

$ 309,583,600,000 |

90.1% |

| KINGDOM OF BELGIUM |

$ 390,500,000,000 |

0.6% |

$ 315,524,000,000 |

80.8% |

| STATE OF ISRAEL |

$ 200,700,000,000 |

0.4% |

$ 151,929,900,000 |

75.7% |

| REPUBLIC OF HUNGARY |

$ 205,700,000,000 |

0.3% |

$ 151,806,600,000 |

73.8% |

| FRENCH REPUBLIC |

$ 2,097,000,000,000 |

3.8% |

$ 1,404,990,000,000 |

67.0% |

| PORTUGUESE REPUBLIC |

$ 237,300,000,000 |

0.4% |

$ 152,346,600,000 |

64.2% |

| FEDERAL REPUBLIC OF GERMANY |

$ 2,863,000,000,000 |

4.7% |

$ 1,792,238,000,000 |

62.6% |

| UNITED STATES OF AMERICA |

$ 14,290,000,000,000 |

21.4% |

$ 8,688,320,000,000 |

60.8% |

| REPUBLIC OF AUSTRIA |

$ 325,000,000,000 |

0.5% |

$ 191,100,000,000 |

58.8% |

| REPUBLIC OF THE PHILIPPINES |

$ 320,600,000,000 |

0.5% |

$ 181,139,000,000 |

56.5% |

| KINGDOM OF NORWAY |

$ 256,500,000,000 |

0.3% |

$ 133,380,000,000 |

52.0% |

| ARGENTINE REPUBLIC |

$ 575,600,000,000 |

0.8% |

$ 293,556,000,000 |

51.0% |

| REPUBLIC OF CROATIA |

$ 73,360,000,000 |

0.1% |

$ 35,873,040,000 |

48.9% |

| REPUBLIC OF COLOMBIA |

$ 399,400,000,000 |

0.6% |

$ 191,712,000,000 |

48.0% |

| UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND |

$ 2,231,000,000,000 |

3.5% |

$ 1,053,032,000,000 |

47.2% |

| REPUBLIC OF PANAMA |

$ 38,490,000,000 |

0.0% |

$ 17,859,360,000 |

46.4% |

| KINGDOM OF THE NETHERLANDS |

$ 670,200,000,000 |

0.3% |

$ 288,186,000,000 |

43.0% |

| MALAYSIA |

$ 386,600,000,000 |

0.3% |

$ 165,078,200,000 |

42.7% |

| KINGDOM OF THAILAND |

$ 553,400,000,000 |

0.9% |

$ 232,428,000,000 |

42.0% |

| REPUBLIC OF POLAND |

$ 667,400,000,000 |

0.7% |

$ 277,638,400,000 |

41.6% |

| FEDERATIVE REPUBLIC OF BRAZIL |

$ 1,990,000,000,000 |

2.7% |

$ 809,930,000,000 |

40.7% |

| SOCIALIST REPUBLIC OF VIETNAM |

$ 241,800,000,000 |

0.5% |

$ 93,334,800,000 |

38.6% |

| KINGDOM OF SPAIN |

$ 1,378,000,000,000 |

1.8% |

$ 516,750,000,000 |

37.5% |

| REPUBLIC OF TURKEY |

$ 906,500,000,000 |

1.1% |

$ 336,311,500,000 |

37.1% |

| KINGDOM OF SWEDEN |

$ 348,600,000,000 |

0.6% |

$ 127,239,000,000 |

36.5% |

| SLOVAK REPUBLIC |

$ 119,500,000,000 |

0.2% |

$ 41,825,000,000 |

35.0% |

| REPUBLIC OF FINLAND |

$ 195,200,000,000 |

0.3% |

$ 64,416,000,000 |

33.0% |

| REPUBLIC OF KOREA |

$ 1,278,000,000,000 |

1.4% |

$ 417,906,000,000 |

32.7% |

| IRELAND |

$ 191,900,000,000 |

0.4% |

$ 60,448,500,000 |

31.5% |

| REPUBLIC OF INDONESIA |

$ 915,900,000,000 |

1.7% |

$ 275,685,900,000 |

30.1% |

| REPUBLIC OF SOUTH AFRICA |

$ 489,700,000,000 |

0.5% |

$ 146,420,300,000 |

29.9% |

| CZECH REPUBLIC |

$ 266,300,000,000 |

0.5% |

$ 78,292,200,000 |

29.4% |

| REPUBLIC OF PERU |

$ 238,900,000,000 |

0.2% |

$ 57,574,900,000 |

24.1% |

| REPUBLIC OF ICELAND |

$ 12,150,000,000 |

0.0% |

$ 2,794,500,000 |

23.0% |

| REPUBLIC OF SLOVENIA |

$ 59,140,000,000 |

0.1% |

$ 13,010,800,000 |

22.0% |

| KINGDOM OF DENMARK |

$ 204,900,000,000 |

0.4% |

$ 44,668,200,000 |

21.8% |

| UNITED MEXICAN STATES |

$ 1,559,000,000,000 |

1.9% |

$ 316,477,000,000 |

20.3% |

| BOLIVARIAN REPUBLIC OF VENEZUELA |

$ 357,900,000,000 |

0.6% |

$ 62,274,600,000 |

17.4% |

| REPUBLIC OF LATVIA |

$ 39,980,000,000 |

0.1% |

$ 6,796,600,000 |

17.0% |

| REPUBLIC OF BULGARIA |

$ 93,780,000,000 |

0.2% |

$ 15,661,260,000 |

16.7% |

| PEOPLE’S REPUBLIC OF CHINA |

$ 7,800,000,000,000 |

7.7% |

$ 1,224,600,000,000 |

15.7% |

| ROMANIA |

$ 271,200,000,000 |

0.3% |

$ 38,239,200,000 |

14.1% |

| REPUBLIC OF LITHUANIA |

$ 63,250,000,000 |

0.1% |

$ 7,526,750,000 |

11.9% |

| UKRAINE |

$ 337,000,000,000 |

0.6% |

$ 33,700,000,000 |

10.0% |

| REPUBLIC OF KAZAKHSTAN |

$ 176,900,000,000 |

0.3% |

$ 16,097,900,000 |

9.1% |

| RUSSIAN FEDERATION |

$ 2,225,000,000,000 |

4.3% |

$ 151,300,000,000 |

6.8% |

| STATE OF QATAR |

$ 85,350,000,000 |

0.2% |

$ 5,121,000,000 |

6.0% |

| STATE OF NEW YORK |

$ 1,144,481,000,000 |

2.1% |

$ 48,500,000,000 |

4.2% |

| STATE OF CALIFORNIA |

$ 1,801,762,000,000 |

3.4% |

$ 69,400,000,000 |

3.9% |

| REPUBLIC OF CHILE |

$ 245,300,000,000 |

0.3% |

$ 9,321,400,000 |

3.8% |

| REPUBLIC OF ESTONIA |

$ 27,720,000,000 |

0.1% |

$ 1,053,360,000 |

3.8% |

| STATE OF FLORIDA |

$ 744,120,000,000 |

1.4% |

$ 24,100,000,000 |

3.2% |

| THE CITY OF NEW YORK |

$ 1,123,532,000,000 |

2.1% |

$ 55,823,000,000 |

** |

| *List from Depository Trust and Clearing Corporation. [www.dtcc.com] Dubai was also on this list, but debt and GDP data were not available. |

| **NYC GDP includes entire NY-NJ-PA metropolitan statistical area; debt is for City of NY only. |

|

| Countries in Italics have never failed to meet their debt repayment schedules (Reinhart and Rogoff 2008); Thailand and Korea received IMF assistance to avoid default in the 1990s. |

The obvious consequence is that a crisis in sovereign debt would cause problems not just within those nations, states or cities – but also among their trading and economic partners, among their lenders (banks, sovereigns or international donor organizations) as well as the global financial institutions who sold default protection through the credit derivatives markets. The financial impact would be more than anything we have seen so far: most global financial institutions received bailouts from their sovereign governments to soften or at least delay the impact of the September 2008 financial crisis. Yet, I believe the more dire consequence of a widespread sovereign debt crisis, if there is one, will be civil unrest fomented by the deterioration in governments’ critical functions that will result from their weakened financial positions.

Policy makers will have few options available across the globe to combat this crisis. The rich world’s governments have not been able to contain their debt burdens through budgetary discipline alone. Between Federal Reserve Chairman Ben Bernanke and Treasury Secretary Tim Geithner, they’ve done everything except load the helicopter with dollar bills to finance the bailout with freshly-minted U.S. dollars.

Policymakers are just as likely to precipitate a financial crisis as any other investor or borrower – they seem to have no prescient knowledge of the dangers associated with over-speculation, lack of solid accounting practices, balancing a budget, etc. How else do we explain their dependence on borrowing? Basic accounting principles – not to mention ideas going back at least to the biblical story of Joseph and the Pharoah – would guide users to monitor income and spending; actuarial analysis directs us to save during times of “feast” and spend the surplus during times of “famine.”

Yet the United States government and others have already decided to monetize their financial problems at levels not seen before. I shudder to even think what sovereign default would mean to a large-country (G8, for example); however, I deem such a scenario as highly unlikely. A quick look at the table indicates the countries that have never defaulted or even rescheduled a debt payment in their history. The defaults will more likely come from spendthrift small countries, or big states like California.

The world economy has encountered these debt situations before. But in this environment, a sovereign debt crisis would be unlike anything we have experienced in the past. Not only have financial markets become more globally integrated – with countries borrowing and lending across national borders with ease – but the use of credit derivate products has increased the chance of a default turning into a global catastrophe. These derivatives will have a multiplier effect on every sovereign debt default. We know for a fact that credit default swap contracts are written without being limited to the total value of the underlying assets. Therefore, there could be nine to fifteen times as many credit default contracts to be paid by global banks as there is debt in default.

Today there are outstanding about $2 trillion of credit default swaps contracts on just fifty of the world’s 200 nations. These contracts could come payable under even the most modest credit event, spreading the damage globally even before debt-service payments are missed. For example, it is now known that AIG’s Financial Products Division wrote contracts that became payable when the market price of debt decreased, regardless of whether or not the borrower had missed a payment. These circumstances did not exist during any previous debt crisis, including the most recent default cycle, the emerging market debt crises of the 1980s and the 1990s. If widespread sovereign defaults happen, we can expect to see something new and potentially much more damaging.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Her training in finance and economics began with editing briefing documents for the Economic Research Department of the Federal Reserve Bank of San Francisco. She worked in operations at depository trust and clearing corporations in San Francisco and New York, including Depository Trust Company, a subsidiary of DTCC; formerly, she was a Senior Research Economist studying capital markets at the Milken Institute. Her PhD in economics is from New York University. In addition to teaching economics and finance at New York University and University of Southern California (Marshall School of Business), Trimbath is co-author of Beyond Junk Bonds: Expanding High Yield Markets .

.

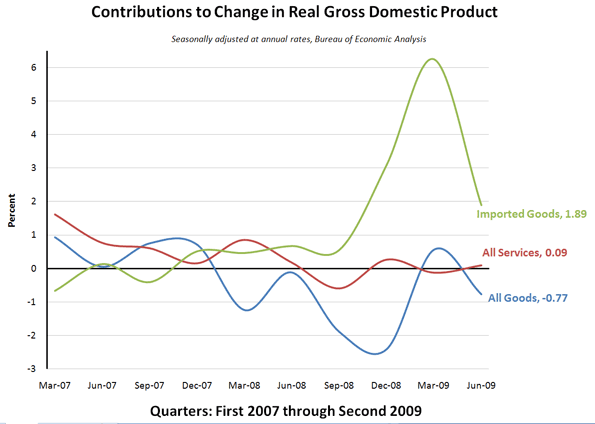

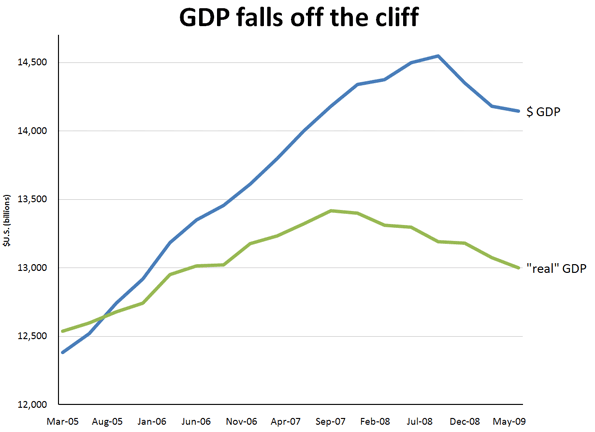

Data from Bureau of Economic Analysis; author’s calculations

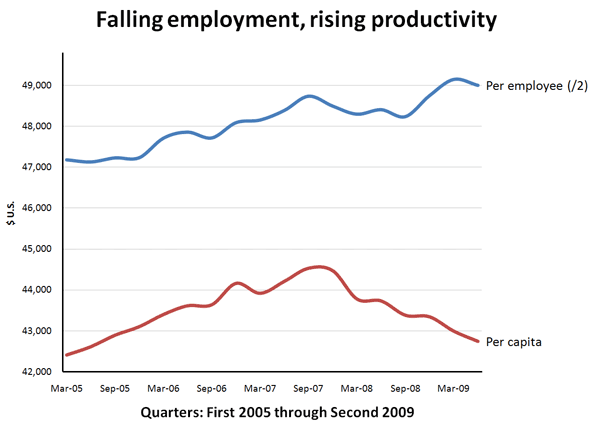

Data from Bureau of Economic Analysis; author’s calculations Data from Bureau of Economic Analysis and Census Bureau. Per employee divided by 2 for scale.

Data from Bureau of Economic Analysis and Census Bureau. Per employee divided by 2 for scale.