The Administration’s Anti-Suburban Agenda: Nearly since inauguration, the Administration has embarked upon a campaign against suburban development, seeking to force most future urban development into far more dense areas. The President set the stage early, telling a Florida town hall meeting that the days of building “sprawl” (pejorative for “suburbanization”) forever were over. Further, a number of bills have been introduced in the Congress that would attempt to discourage suburban development, some under the moniker of “livability,” which promises to improve people’s lives by enforcing planner-preferred density. The war against the suburbs is by no means new, but the Administration and some members of Congress have proposed their own “surge” in hopes of suppressing them permanently.

The Mythical “Demise” of the Suburbs: Nearly since the pace of suburbanization increased, following World War II, critics have been foretelling the demise of the suburbs. During the 1950s and 1960s, some planning “visionaries” such as Peter Blake were predicting widespread municipal bankruptcies in the suburbs and for residents. This was occurring even as other urban planners were tearing up cities with urban renewal projects and freeways, setting the stage for “block-busting” and an ever-widening racial divide. The early criticisms have been repeated through the years, justifying a paraphrase of the old saw about Brazil (“Brazil is the country of the future and always will be”): “The suburbs are the wasteland of tomorrow and always will be.”

The Real Decline of the Cities: In fact, it has more generally been the central cities that nearly went bankrupt, not the suburbs. Examples include New York, Philadelphia, Pittsburgh, Cleveland and that jewel of municipal consolidation, Indianapolis, rescued last year by $1 billion in state taxpayer funds. There are hopeful signs of a renaissance in most central cities, however their financial difficulties remain intractable and large swaths of their land area remain desolate. Meanwhile, the lawns were mowed in the suburbs, the houses painted and a strong sense of community developed among residents that was far too subtle for the prophets of suburban doom to perceive.

Greenhouse Gas Emissions: More recently, the effort to reduce greenhouse gas (GHG) emissions has given suburban critics new ammunition. A simple mantra was dictated by “planning common sense.” Cars produce greenhouse gases, therefore people must get out of cars and live in more dense conditions, where they will not need to drive as much. Further, they will live in smaller, multi-family dwellings, which planning common sense teaches are more GHG friendly than the despised – except by those who choose to live in them – detached housing in the suburbs.

But a funny thing happened on the way toward GHG inspired desurburbanization. Some academics actually began looking at data. The reality of the suburbs turned out to be rather different from that portrayed by the conventional wisdom of the planners. The most comprehensive research comes from Australia, some of which has been previously covered here.

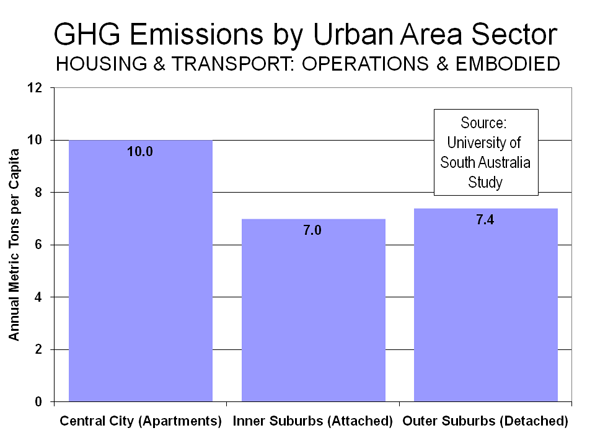

University of South Australia: The most recent (and new) offering comes from a University of South Australia report thatallocates transportation and residential energy produced GHGs by location and housing type in the Adelaide area. The researchers found that the most GHG friendly sector of the urban area was the inner suburbs, which are dominated by single-family attached housing. GHG emissions per capita from housing and transportation were estimated at 7.0 metric tons of GHG emissions per capita annually.

However, the outer suburbs, principally with detached housing, were not far behind at 7.4 tons GHG emissions per capita. The highest GHG emissions per capita, by far, were in the central area, with its predominance of multi-unit housing. There the annual GHG emissions were estimated at 10.0 tons per capita (See Figure). The University of South Australia study includes an element missing from virtually all other examinations of transportation and residential GHG emissions: “embodied emissions.” Embodied emissions are the GHGs from construction or manufacturing materials, and from building cars, transit vehicles and buildings. Embodied GHG emissions are ignored by much research, but are a significant factor in GHG emissions. For example, multi-unit housing, with higher use of concrete and more complex construction methods, tends to be substantially more GHG intensive than building detached housing or townhouses.

GHGs from Common Energy: Previous work by Sydney researchers reached similar results – townhouse development was the most GHG friendly, followed closely by detached housing. Both were substantially less GHG intensive than high-rise condominium development. A principal reason for this conclusion stems in part from the fact that this research included GHGs from common energy, such as the electricity used to power elevators, parking lot and common area lighting, building-provided heating, air conditioning and water heating. American and Canadian research attempting to quantify GHG emissions by residential building type generally has not accounted for common energy and its GHG emission. Yet a gram of GHG from a residential elevator has the same impact as one produced by driving to the local Target store.

GHG Friendly Suburbs: The most comprehensive research was conducted by the Australian Conservation Foundation. This was not the typical, incomplete or theoretical study of greenhouse gas emissions. The study included virtually every gram of greenhouse gas emissions in Australia and allocated them to consuming households in small residential zones within urban areas and around the nation. Suburban locations, with their greater use of cars and higher percentage of low density detached housing, had lower GHG emissions per capita than the core areas, with their greater use of transit and walking and their high-rise multi-unit housing.

Compact Development: These findings provided the impetus to review the potential impact of compact development policies. Compact development policies (also called “smart growth” or “growth management”) generally seek to densify urban areas, by drawing urban growth boundaries, outside of which development is prohibited, and by trying to force people to drive less and to use transit more. Again, “planning common sense” clearly indicated to planners that compact development would yield substantial benefits in GHG emissions, principally because people would drive less.

Yet the more recent research on compact development finds something much different. Densification scenarios from two recent reports, the congressionally mandated Driving and the Built Environment and a smart growth coalition’s Moving Cooler, showed that by 2050, compact development could reduce GHG emissions from driving by only 1% to 9%. At the high end of the range, the most new development would be directed to only a small part of present urban footprints, a policy outcome less believable than a balanced federal budget next year.

Moreover, these projections have to be considered overly optimistic, because they make no allowance for the higher GHG emissions that occur as traffic slows and stops more in higher density conditions.

The President Discovers the Suburbs? Meanwhile, on December 15, President Obama took the opportunity to visit a suburban Washington Home Depot, a chain that is a very symbol of American suburbanization. The President could have taken the opportunity to orate further against the suburbs in the insulation aisle, urging households to abandon the suburbs and move to high rise condominiums in the city.

That was not to be. The President instead proposed providing incentives to people to make their houses more energy efficient, which would reduce greenhouse gas emissions and save money on consumer energy bills. In particular, he cited insulation, saying that “insulation is sexy”. It is worth noting that the Home Depot’s insulation is principally sold to suburban homeowners who can readily arrange for its installation. Residents of high-rise condominiums must rely on their building managers, who tend to purchase their insulation from wholesalers, rather than retailers like Home Depot and Lowes.

The President explained why insulation was sexy, noting that saving money is sexy. Indeed, saving money is what the suburbs are about. The economic research is clear that housing costs are far less where suburban development is not limited by the compact development strategies that artificially create land scarcity. That’s why places like Dallas-Fort Worth, Atlanta and Houston, without compact development, had little, if any housing bubble, while housing bubbles of economy-wrecking proportions occurred in California and Florida, with their compact development.

Yes, Mr. President, insulation is sexy. Saving money is sexy. And, the suburbs are sexy.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”