Recent events in Ferguson, Missouri and along the U.S.-Mexico border may seem to suggest that race has returned as the signature issue in American politics. We can see this already in the pages of mainstream media, with increased calls for reparations for African-Americans, and expanded amnesties for the undocumented. Increasingly, any opposition to Obama’s policies is blamed ondeep-seated white racism.

Yet in reality, race will not define the 2014 election, or likely those that follow. Instead the real defining issue—class—does not fit so easily into the current political calculus. In terms of racial justice, we have made real progress since the ’60s, when even successful educated minorities were discriminated against and the brightest minority students were often discouraged from attending college. Today an African-American holds the highest office in the land, and African Americans also fill the offices of U.S. attorney general and national security advisor. This makes the notion that race thwarts success increasingly outdated.

But at the same time that formal racial barriers have been demolished, the class divide continues to grow steeper than in at any time in the nation’s recent history. Today America’s class structure is increasingly ossified, and this affects not only minorities, who are hit disproportionately, but also many whites, who constitute more than 40 percent of the nation’s poor. Upward mobility has stalled under both Bush and Obama, not only for minorities but for vast swaths of working class and middle class Americans. Increasingly, it’s not the color of one’s skin that determines one’s place in society, but access to education and capital, often the inherited variety.

Worries about upward mobility have been mounting for a generation, and according to Pew, only one-third of Americans currently believe the next generation will do better than them. Indeed, in some surveys pessimism about the next generation stands at an all-time high.

But race is not the main determinant in looking to the future. The greatest dismay, in fact, is felt among working class and middle class whites, who are generally much more pessimistic about the future for themselves than are either African-Americans or Hispanics.

This pessimism—for all the discussion on campuses about “white privilege”—is even more deeply seated among young whites. According to a poll conducted by the left-leaning advocacy group Demos, only 12 percent of whites 18 to 34 believe they will do better than their parents, compared to 31 percent for African-Americans and 36 percent among young Hispanics.

This suggests that the issue of restoring upward mobility has more widespread resonance than a more narrow race-based approach. The political party that best addresses this concern will be in the strongest position to dominate the political landscape not only in 2014, but well beyond.

The problem for the Democrats in this regard: the record of the last six years. President Obama has presided over an economy that, even when healing, has done little to improve the economic conditions of most Americans. The incomes of middle class Americans have remained stagnant, or shrunk, even as we have seen record corporate profits, a soaring stock market, and huge run ups in elite property markets.

This failure may explain why some Democrats and progressives feel tempted to go back to race-related issues—as well as social concerns such as gay and abortion rights—to stir their political base. The president’s suggestion of executive action on immigration would be in part to “galvanize” support among Latinos, many of whom can relate personally to the dilemma faced by the undocumented.

The stirring of resentment among African-Americans has become the critical component of race-based Democratic strategy. The president’s embrace of hoary racial warlord Reverend Al Sharpton, a well-known charlatan and occasional anti-semite, as his “go to guy” demonstrates the administration’s willingness to use the tragedy of the Ferguson shooting case to rally African-American voters for the off-year election.

These tactics may have some political efficacy, but it’s doubtful that ’60s progressive bromides of race-based politics or calls for redistribution can seriously address inequality or poverty. Certainly the idea that greater dependence on government handouts—the main social focus of modern progressives—has not aided minority uplift or promoted upward mobility. The Great Society may have reduced poverty initially, but in the past decade poverty rates have risen to the highest level since the ’60s.

If anything, under the most progressive-dominated regime since at least the New Deal, things have gotten even worse. African-American youth unemployment is now twice that of whites while according to the Urban League, the black middle class, once rapidly expanding, has essentially lost the gains made over the past 30 years.

In the same vein, Hispanic income also has declined relative to whites. Latino poverty rates now stand at 28 percent. The administration’s leniency that permits impoverished kids to flock here from Central America may make moral or political sense, but its actual impact on communities could prove problematical.

Indeed one has to question the viability of new mass immigration of poor, poorly educated kids at a time when poverty among Latino children already here has risen since 2007, according to the American Community Survey, from 27.5 percent to 33.7 percent in 2012, an increase of 1.7 million. Given their own economic problems, and the vital need to improve their educational performance one has to wonder whether African-Americans or even many Latinos, as opposed to the activist base, actually would welcome a fresh infusion of impoverished refugee children from Central America into the country. A recent Pew survey found that not only half of all whites, but nearly two-fifths of African Americans and roughly a third of Hispanics approved of increased deportations of the undocumented.

Some Latino and African-American Democrats have already departed from the party line on immigration. Texas Rep. Henry Cuellar, a moderate border district Democrat, has called “the border incursion” “Obama’s Katrina moment” and he is co-sponsoring legislation with Republican Sen. John Cornyn of Texas to speed up the deportation process for kids detained at the border.

Perhaps even more serious are divisions among Democrats on key economic and regulatory issues. In California, for example, Latino Democrats, particularly from the hard hit interior, have revolted against their party’s “cap and trade” policies, which will lead to ever higher energy costs, and threaten industries that tend to employ working class Latinos. Similarly some unions in the interior, notably the Teamsters and Laborers, have taken strong positions favoring energy development, notably the Keystone pipeline, in sharp opposition to the president’s core supporters.

And then there’s the reality that blue states—with all the usual progressive policies—suffer the widest gap between the classes. Indeed, notes demographer Wendell Cox, New York City now has an income distribution that approaches that of South Africa under apartheid.

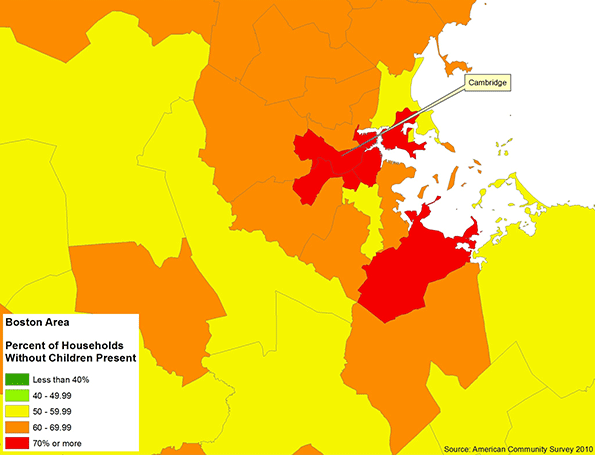

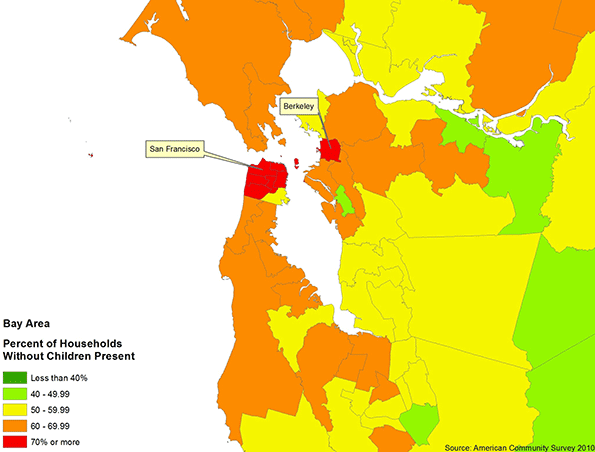

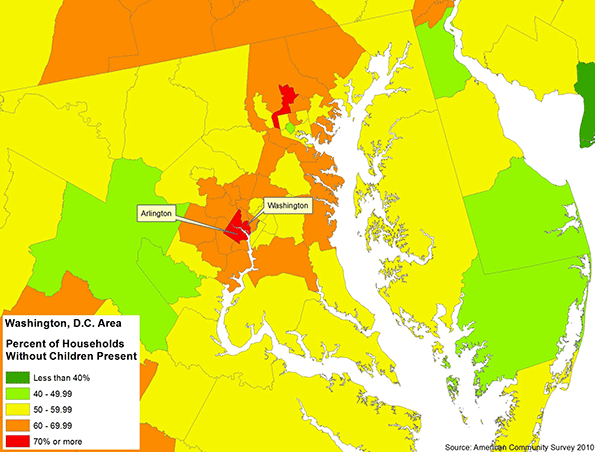

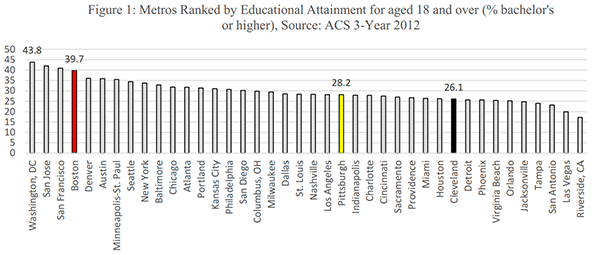

Similarly a recent Brookings report found the greatest income disparity in such bastions of progressivism as San Francisco, Miami, Boston, Washington D.C., New York, Oakland, Chicago and Los Angeles. Oddly enough, minorities seem to do better, relative to whites, in states that have had more conservative governance, in part because they also tend to have lower costs of living.

This disconnect between progressive aims and reality stems from the shift in the Left’s class and geographic base. Once dependent on industrial and construction workers, many of them unionized, the party increasingly depends for support from green activists, urban land speculators, and “creative class” workers in expensive regions where regulatory constraints tend to discourage industrial and housing growth. In contrast many red state metros such as Houston, Oklahoma City, Salt Lake, and Dallas-Ft. Worth tend to produce more higher paid, blue collar growth.

Given these realities, perhaps progressives need to move away from symbolic issues, such as reparations and racial name-calling, and instead directly address middle class and working class concerns. Yet this creates a potential for internecine conflict with other key party constituencies, which seem more interest in suppressing middle class aspirations than fulfilling them.

It should be clear by now that regulatory and tax regimes imposed in blue states tend to stunt middle and working opportunities, with the worst effects on minorities and working class whites. Blue-state progressive can whine about race, inequality, and poverty with the best of them, but they would contribute far more if they started to address these issues with something other than well-rehearsed indignation and rhetoric.

But while progressive attempts to address the class divide have been less than successful, can the Republicans fill the breach? Already working class whites are arguably the GOP’s strongest base and Republicans should be able to exploit class resentment toward the increasingly gentrified Democratic leadership. Yet to date, they have shown a remarkable inability to do so, in part due to the ideological constraints and racial baggage of the increasingly Southern-oriented GOP.

Republicans, particularly those closest to Wall Street, also seem to have a problem even admitting the existence of the class issue. Conservatives economists repeatedly downplay ever greater insecurity about jobs, the affordability of decent housing and generally lower net worths for all but the highly affluent. Convinced that any discussion about these issues constitutes unseemly “class warfare,” the right’s intellectual leadership seems incapable of addressing these concerns.

What would a policy that addresses inequality look like? Some steps would offend some Republicans, such as restarting a modern version of the Depression era Works Progress Administration. Instead of a stimulus directed at government workers and crony-capitalists, as Obama employed in 2009, a program that brought young people into the work force would help them gain needed practical skills while repairing our increasingly woeful infrastructure.

Other reforms would include a major overhaul of the tax system, particularly equalizing capital gains and income taxes. Whatever the benefits we may have seen from lower capital gains rates in the past, the current, incredibly unequal recovery undermines the legitimacy of this approach. Rather than stir investment and create middle income jobs, capital gains have become a ruse for the rich to get even richer, largely through asset inflation. Companies, notes a new Harvard Business Review study, have used the low interest bonanza and access to cheap money to boost profits, not by expanding employment but by buying back their own stock.

Ultimately, the best way to address class concerns, as well as those of minorities, would be to spark strong economic growth, particularly in the energy, manufacturing, and construction sectors, which tend to offer higher wage employment for them. Both Latinos and African-American made their biggest economic strides when the economy was booming under Presidents Reagan and Clinton, both of whom have been criticized for “trickle down” policies.

A growth agenda is a winning one for the party that embraces and effectively advocates it. A recent analysis (PDF) of public opinion by the Global Strategy Group found that although roughly half of Americans believe inequality per se is a major issue, more than three-quarters believe that faster economic growth should be the main priority.

In the old Democratic Party, from Truman to Clinton, this approach would be an easy sell. A policy that encouraged building new water facilities, expanding domestic energy , manufacturing and construction, particularly single family homes, would have widespread appeal to working and middle class voters. But a growth agenda likely would face much opposition from the president’s green gentry base, who seem perfectly content with an economy that rewards insiders, venture capitalists, and companies that employ few people, largely the best educated and positioned.

Republicans could seize the momentum here, but to do so would require shedding some ideological baggage, as well standing up to some of their more ruthless backers on Wall Street and the corporate community. Similar a return to a more traditional growth oriented liberalism would help hard pressed Democrats, particularly in red states, who desperately need to recapture some of their traditional working class backers. It will be here, in the nexus of policy and class, not racial posturing, the political future of the country may well be determined.

This piece originally appeared at The Daily Beast.

Joel Kotkin is executive editor of NewGeography.com and Distinguished Presidential Fellow in Urban Futures at Chapman University, and a member of the editorial board of the Orange County Register. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is author of The City: A Global History and The Next Hundred Million: America in 2050. His most recent study, The Rise of Postfamilialism, has been widely discussed and distributed internationally. He lives in Los Angeles, CA.