From the inception of the Soviet Union, transformation was built, quite consciously, on eliminating those forces that could impede radical change. In many ways, the true enemy was not the large foreign capitalists (some of whom were welcomed from abroad to aid modernization) but the small firm, the independent property owner.

“Small scale commercial production is, every moment of every day, giving birth spontaneously to capitalism and the bourgeoisie … Wherever there is business and freedom of trade, capitalism appears,” noted the state’s founder Vladimir Lenin. He understood that while larger firms could be manipulated to serve the state, “capitalism begins in the village marketplace.”

Later on, this drive to eliminate grassroots capitalists—notably the “rich peasants” or kulaks—took on a particularly deadly form. In 1929 Stalin decided on the “liquidation of the kulaks as a class.” Millions of small rural entrepreneurs were imprisoned, murdered, or starved to death, until by the end of the ’30s independent business in the Soviet Union was largely eliminated, giving the state free rein.

Who are America’s Kulaks?

The United States, fortunately, is not the Soviet Union and even the most “transformation” oriented politician does not—at least yet—have power to create a gulag or openly appropriate the wealth or lives of citizens. Yet lately there is nevertheless a powerful trend to limit and largely disempower the country’s small business community—our kulaks—from a host of antagonists, including the Obama administration, the large financial institutions, and the ever-expanding regulatory apparat.

In the 19th century, the small farmer epitomized the national ideal: independent, hard-working, frugal and engaged in his community. Later, as agriculture’s share of the economy dropped, the “yeoman” farmer gave way to the Main Street business owner, whose conflicts, particularly in the late 19th and early 20th centuries, were more with oligopolistic corporations—notably utilities, oil companies, and railroads—than the government.

Kulaks are not just people with some money and capital. They tend to be engaged in the private sector, where risk is an everyday concern. There are other parts of the affluent middle class who are not Kulaks but actually beneficiaries of the intrusive state, such as academics, parts of big business and, of course, elite members of the ever-expanding governmental nomenklatura. These professionals, as well as corporate executives, have helped make the Democratic Party, as the New York Times’ Tom Edsall suggests, the “favorites of the rich.”

The Decline of a Class

In the ascendance during the Reagan and Clinton booms, our kulaks—the roughly 10 million businesses under 500 employees that employ 40 million people—are clearly in secular decline, with grave implications for the economy, employment, and the future of democracy.

Rather than a new age of democratic capitalism imagined by Reagan era conservatives, we increasingly live in a world dominated by large companies. The overall revenues of Fortune 500 companies have risen from 58 percent of nominal GDP in 1994 to 73 percent in 2013. At the same time, small business start-ups have declined as a portion of all business growth, from 50 percent in the early ’80s to 35 percent in 2010. Indeed, a 2014 Brookings report (PDF) revealed that small business “dynamism,” measured by the growth of new firms compared with the closing of older ones, has declined significantly over the past decade, with more firms closing than starting for the first time in a quarter century. Only 35 percent of small business owners, according to a recent survey by the National Small Business Association, express optimism about the economy.

This decline in entrepreneurial activity marks a historic turnaround. Start up rateshave fallen for young people in particular, dropping to the lowest levels in a quarter century. At the same time the welfare state has expanded dramatically to the point that nearly half of all Americans now get payments from the federal government, notably through Medicare and Social Security. At the same time, the lack of grassroots economic activity may contribute to labor participation rates, now the lowest in almost four decades.

The Obama administration’s progressive-sounding rhetoricmay offend some of the thinner-skinned members of the oligarchy, but his economic policies—the bank bailouts, super-low interest rates, and growing federal power—have also improved the balance sheets of the corporate hegemons and the super-rich. In contrast, these policies do little, or less than little, for the yeoman class. Money today is made far more easily today by playing games with the market than making or selling on Main Street.

High business costs, some related to the rising tide of regulation under President Obama—including Obamacare—have become a huge burden to smaller firms. Indeed, according to a 2010 report (PDF) by the Small Business Administration, federal regulations cost firms with fewer than 20 employees more than $10,000 each year per employee, while bigger firms paid roughly $7,500 per employee. The biggest hit to small business comes in the form of environmental regulations, which cost 364 percent more per employee for small firms than it does for larger ones. Small companies spend $4,101 per employee, compared to $1,294 at medium-sized companies (20 to 499 employees) and $883 at the largest companies, to meet these requirements.

Nowhere has consolidation of power under the current regime been more obvious than in the financial sector. Goldman Sachs’ Lloyd Blankfein has described his firm as “among the biggest beneficiaries of reform.” The new regulatory environment has created huge barriers to any potential competitors and places smaller firms at a distinct disadvantage.

In contrast these regulations have hastened the rapid decline of community banks, for example, down by half since 1990, particularly hurts small businesspeople who depended on loans from these institutions, leaving them, as even Ben Bernanke admits, with major obstacles at achieving credit.

The large banks also benefited from the Obama administration’s steady refusal to prosecute any Wall Street grandees. Their get-out-of-jail-free card is a testament to the pilfering lobbyists of Washington’s K Street and the greed of politicians in both parties.

Resisting the New Duopoly: Big Government and Big Business

Under Lenin and Stalin, the threat to the kulaks was explicit, and in the end genocidal. Here in America, to be sure, the process is far less extreme. And not all the assault on Kulaks can be traced to government.

Technology and globalization often work against small firms. In the past, technology promoted competition whereas now it increasingly works to foster the consolidation of a new oligarchy dominated by such quasi-monopolies as Microsoft, Amazon, Apple, Google, and Facebook.

Indeed, the future being envisioned in the media and by the oligarchs is one dominated by automated factories and computer-empowered service industries. This will reduce opportunity for both middle-class jobs and small business in the future. To some, the American middle and working classes are becoming economically passé. Steve Case, founder of America Online, has even suggested that future labor needs can be filled not by current residents but by some 30 million immigrants. In this he reflects the cosmopolitan notions favored by the oligarchs. But likely not so much by the Kulaks and the bulk of the populace.

Rather than a republic of yeoman, we could evolve instead, as one left-wing writer put it, to live at the sufferance of our “robot overlords,” as well as those who program and manufacture them, likely using other robots to do so. The financial community seems to have little problem with this tendency, as we can see in its support for companies such as Uber, which, however convenient, is growing at the expense of what had been thousands of full time workers. And former top Obama aides are leading Uber’s defense against threatened taxi drivers.

Politicians on both the right and left seek to appeal to middle class voters and small business owners, but neither party can be said to have the interests of these groups at heart. The large corporations and banks have enjoyed an unprecedented surge in profits, but few small business have crashed that party. Republicans and their leading lobbyists generally have no interest in doing anything, such as equalizing capital gains and income rates, that would offend those who support their campaigns and fund their ongoing political activities.

In the past, Democrats may have appealed to Kulaks, but that seems to have died with the end of Bill Clinton’s second term. Whereas the first Clinton accepted limits on government largesse, the newly emboldened progressives, citing inequality, are calling for more transfers to the poorer parts of society. They even plan to hit the kulaks where they live—largely suburbia—as part of an effort to social engineer American communities.

This trend has almost universal support in the mainstream media, the campuses, and some corporations, who can better manipulate the regulatory and tax system. There is even a role model: to become like Europe. As The New York Times’ Roger Cohen suggests, we reject our traditional individualist “excess” and embrace instead continental levels of modesty, social control, and, of course, ever higher taxes.

Trump, Sanders, and the future of the Kulaks

The assault on the kulaks has had significant political consequences, although the endgame remains very much in question. Certainly there’s widespread dissatisfaction towards the Obama administration: in 2012, small business ownersranked as the least approving group for the current regime.

Yet it is not just Republicans or Tea Partiers who are upset with the rising plutocracy. Americans, according to Gallup, greatly favor small companies over big business. Indeed most large institutions—government and media as well as large corporations—now suffer some of the lowest rankings in recent history, with only small business and the military doing well.

Given these attitudes, it’s not surprising that the rising candidates of 2015 were those—Trump, Carson, Sanders , and even Fiorina—who have tried to position themselves in opposition to the status quo. The candidate most feared by Wall Street isn’t the folksy socialist Bernie Sanders but Donald Trump, whose candidacy, reports Politico, is setting off “a wave of fear” among the investor class. This is not just concern over Trump’s xenophobia, but his essential populism.

Both Trump’s support and that of Ben Carson come from Republicans who do not oppose higher taxes on the ultra-rich; they might not be far right culturally but they tend to the left on issues of economic security. These issues are critical toboomers, the group that dominates the small property owning class and the largest share of voters, and have been turning more conservative.

The kulaks may agree with Bernie Sanders on the dangers of corporate power, but they are likely no fans of redistribution. They also may suspect, rightly, that they, and not the grandees at Apple or Goldman Sachs, will be the ones to pay for the Democrats’ increasingly extravagant redistributionist demands.

Overall the kulaks do not seem impressed with candidates, such as Hillary Clinton and Jeb Bush, who are essentially creatures of dueling oligarchies. The kind of acceptance of corporate leadership that dominated Republican politics through much of the past half century is now fading, and the results are a GOP fractured not only by ideology but also by class. The big money may be on the corporate side, but there are a lot more Kulaks than grandees when it comes to voting.

In Russia, the forces of the state managed to destroy the kulaks, cementing a legacy of economic stagnation, particularly in the countryside, that remains today. America’s war on the kulaks may be less bloody-minded, but if it is not somehow halted, both our economy and the country’s intrinsic entrepreneurial spirit will fade. We may end up looking all too much like contemporary Russia, an oligarch-dominated kleptocracy that holds out increasingly little promise to its own people, and provides no real role model to the rest of the world.

This piece first appeared at The Daily Beast.

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo: Main Street America Russell, Kansas by http://www.cgpgrey.com [CC BY 2.0], via Wikimedia Commons

Chart 1 Source: Oak Ridge National Laboratory; Transportation Energy Data Book. Table 8.5.

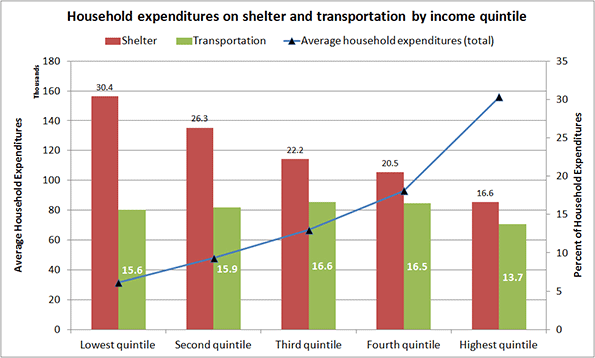

Chart 1 Source: Oak Ridge National Laboratory; Transportation Energy Data Book. Table 8.5. Chart 2 Source: Statistics Canada, Survey of Household Spending. Table 2: Budget Shares Of Major Spending Categories By Income Quintile, 2012.

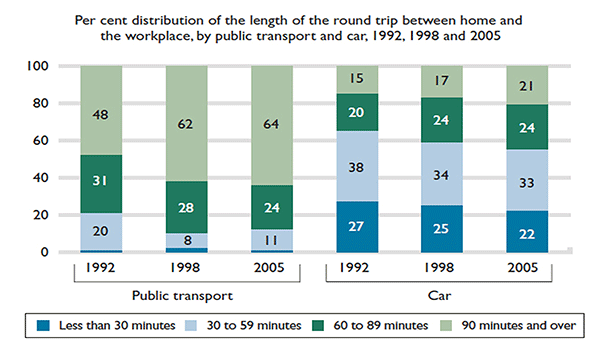

Chart 2 Source: Statistics Canada, Survey of Household Spending. Table 2: Budget Shares Of Major Spending Categories By Income Quintile, 2012. Chart 3 Source: Statistics Canada, General Social Survey, Trip Duration, 1992, 1998, and 2005.

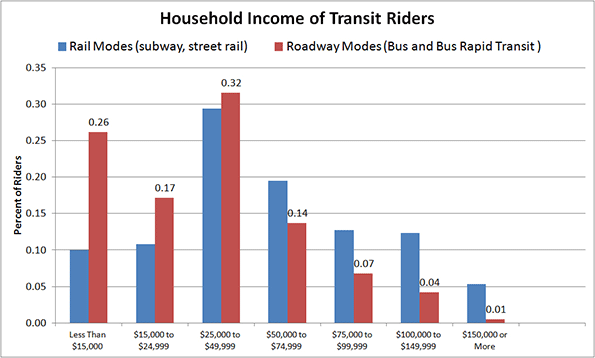

Chart 3 Source: Statistics Canada, General Social Survey, Trip Duration, 1992, 1998, and 2005. Chart 4 Source: American Public Transportation Association, A Profile of Public Transportation Passenger Demographics and Travel Characteristics, 2007.

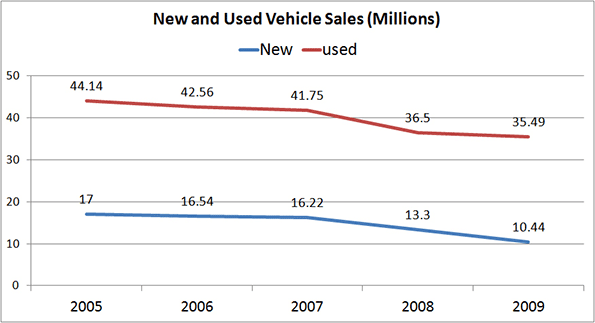

Chart 4 Source: American Public Transportation Association, A Profile of Public Transportation Passenger Demographics and Travel Characteristics, 2007. Chart 5 Source: NIADA’s Used Car Sales Industry Report; Relative Size of Car Markets for New and Used Cars, 2010.

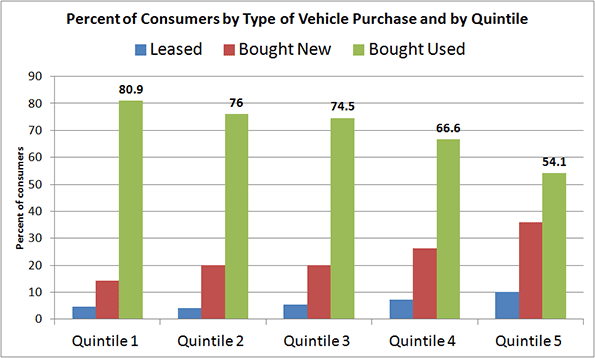

Chart 5 Source: NIADA’s Used Car Sales Industry Report; Relative Size of Car Markets for New and Used Cars, 2010. Chart 6 Source: Laura Paszkiewicz, The Cost and Demographics of Vehicle Acquisition, Consumer Expenditure Survey Anthology, 2003 (61) Division of Consumer Expenditure Surveys, US Bureau of Labor Statistics.

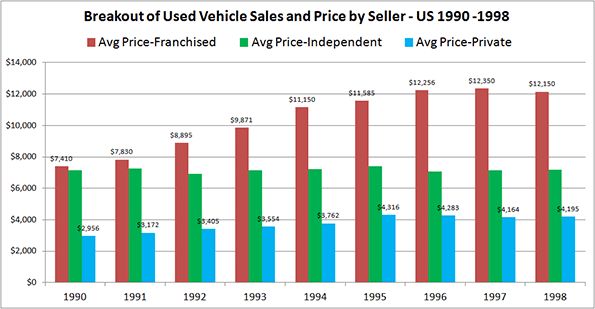

Chart 6 Source: Laura Paszkiewicz, The Cost and Demographics of Vehicle Acquisition, Consumer Expenditure Survey Anthology, 2003 (61) Division of Consumer Expenditure Surveys, US Bureau of Labor Statistics. Chart 7 Source: The Used Vehicle Market in Canada, DesRosiers Automotive Consultants Inc., 2000.

Chart 7 Source: The Used Vehicle Market in Canada, DesRosiers Automotive Consultants Inc., 2000.