Average pay varies widely among U.S. cities, but those chasing work opportunities would do well to keep an eye on costs as well. Salaries may be higher on the East and West coasts, but for the most part, equally high prices there mean that the fatter paychecks aren’t necessarily getting the locals ahead.

To determine which cities actually offer the highest real incomes, Mark Schill, research director at Praxis Strategy Group, conducted an analysis for Forbes of the 53 largest metropolitan statistical areas, adjusting annual earnings by a cost factor that combines median home values from the U.S. Census (20%) with a measure of regional price differences from the U.S. Bureau of Economic Analysis (80%).

The takeaway: When cost of living is factored in, most of the metro areas that offer the highest effective pay turn out to be in the less glitzy middle part of the country.

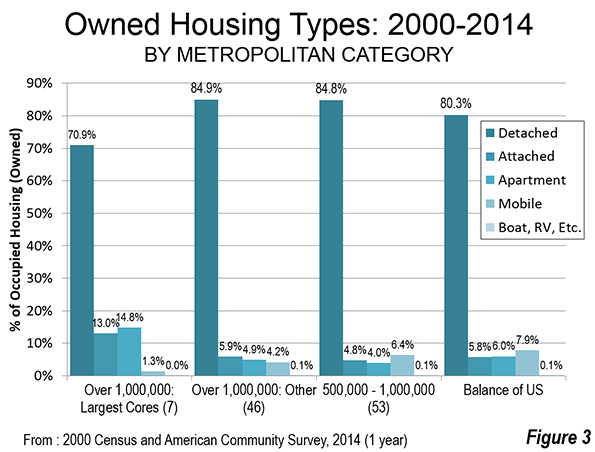

Ranking first is the Houston-the Woodlands-Sugar Land metro area, followed by one high-cost outlier: San Jose-Sunnyvale-Santa Clara, Calif., aka Silicon Valley. Although average wages in the San Jose area are $38,000 higher than Houston’s $60,096, the much lower cost of living in Houston means residents there are effectively slightly better off. Adjusted for costs, Houston’s average real income is $62,136. A big contributing factor is Houston’s low home prices: the ratio of the median home price there ($215,000 in the third quarter) to median annual household income is 3.1, compared to 7.5 in the San Jose area (median 3Q home price: $795,000).

San Jose’s high ranking is somewhat of an anomaly: the very high salaries paid by the tech industry in a metro area made up of largely affluent suburban communities go a long way to make up for the high prices. San Jose’s prices were the third highest among major U.S. metro areas in 2013, the most recent year for which the BEA has data — 21.3% above the national average — while the average annual wage of $98,247 as of this year ranks first.

Another example of a higher-cost success story is the Hartford, Conn., metro area, which ranks fourth on our list with adjusted annual real earnings of $54,590. One of the lowest-density regions in the country, it boasts many small, prosperous communities with high housing prices surrounding a largely impoverished but small core city (population: 125,000 ). In 2011, the Harford metro area was ranked by Brookings as the most productive metropolitan region in the world.

But for the most part, it’s the low-cost heartland that dominates the top 15 of our ranking of Cities Where Your Salary Stretches The Furthest. Manufacturing powerhouse Detroit-Warren-Dearborn ranks third with cost-adjusted annual earnings of $55,950. The metro area is comfortably affordable, including an average home price value of $136,400, but also boasts strong wages given the area’s high concentration of factory and engineering jobs, which tend to pay better than other industries, particularly for blue-collar workers.

Low costs are an advantage that unites a number of the top-ranked heartland metro areas, including Cleveland-Elyria (seventh), where prices of goods and services are 10.5% below the national average, and Cincinnati (ninth), where prices are 9.5% below the national average. In all these areas, the cost of a house is about 20% of what passes for normal in Silicon Valley.

Hip, But Increasingly Not Worth It

Perhaps the biggest surprise in our survey is the low rankings of the “cool” cities that are widely discussed as the places that offer the best economic opportunities.

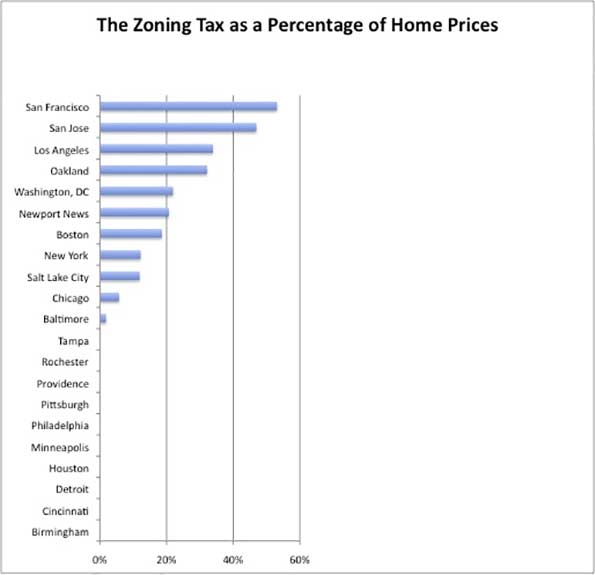

Take for instance San Francisco, a city that has become the epicenter of “disruptive” tech companies Uber, Lyft, Airbnb, Salesforce.com that are changing our service economy, as well as Twitter. With an average annual salary of $74,794, you would think people would be fat and happy in Baghdad by the Bay. But soaring home prices — median value, $657,300 — have raised costs so high that the area ranks a poor 41st on our list.

The tech boom has also raised prices in Austin, which ranked fifth when we last did this ranking in 2012, but falls to 19th this year. Over the past year, the average home value in the Texas capital has risen by $24,000, twice the increase experienced in the rest of the country. Median prices now average $217,9000, well above the national median of $188,000 for all large metropolitan regions. This is still not ridiculous, but costs do seems to be eroding some of Austin’s still powerful advantage.

Similarly, greater New York City also fared poorly, ranking 33rd, in large part due to high housing prices and the overall cost of living: prices there are 22.3% above the national average, according to BEA data, making it the second-costliest metro area in the nation.

Some of the biggest gaps between cost of living and salary are in Southern California, which has experienced significant house price gains without the income growth that makes San Jose more competitive. Already high, prices in San Diego-Carlsbad (51st), Los Angeles-Long Beach-Anaheim (52nd) and Riverside-San Bernardino (last among the 53 largest metro areas) have all risen considerably above the national average.

Long-Term Implications

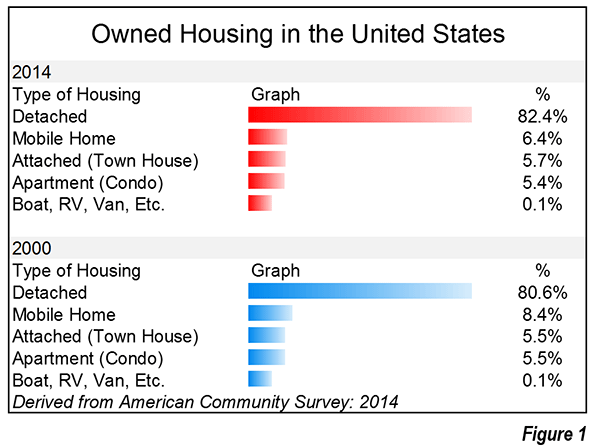

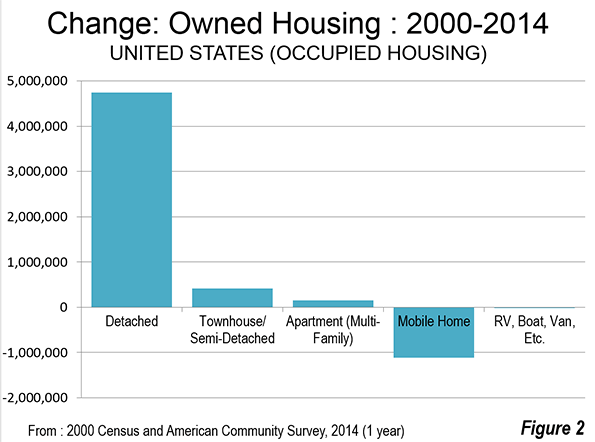

Our paycheck analysis does not impact everyone equally. Given the central role of housing, for example, long-term residents who bought their homes before prices began to rise dramatically can keep a bigger portion of their take-home pay, and if they decide to sell, they’ll benefit greatly from inflated values. More directly impacted may be young adults and immigrants, most of whom do not own their own homes, and often lack the resources to buy in the more expensive markets.

Over time this could influence where young families and singles chose to migrate. Since 2010, according to an upcoming study by Cleveland State’s Center for Population Dynamics, there has been a marked shift of college educated workers aged 25 to 34. While between 2008 and 2010, metro areas like San Francisco, New York, Los Angeles, San Jose and Chicago enjoyed the biggest upticks in this coveted population, over the most recently studied period, 2010-13, the leaders were generally less expensive places like Nashville, Pittsburgh, Orlando, Cleveland, San Antonio, Houston and Dallas-Ft. Worth.

This suggests that areas that have both high-wage jobs and low costs are likely to gain momentum in coming years, particularly if the economy expands. This is not to say that people do not like the excitement and culture associated with San Francisco, Los Angeles or New York, but many may be finding that the price of admission to these fabled places may be too high.

This could be a great opportunity for less-heralded communities, from Arizona and Texas to Ohio, to gain more educated workers and the companies that require them.

| Metropolitan Average Annual Earnings Adjusted for Cost of Living and Home Values | ||

| Rank | MSA Name | Adjusted Ave Annual Earnings |

| 1 | Houston-The Woodlands-Sugar Land, TX | $62,136 |

| 2 | San Jose-Sunnyvale-Santa Clara, CA | $56,147 |

| 3 | Detroit-Warren-Dearborn, MI | $55,950 |

| 4 | Hartford-West Hartford-East Hartford, CT | $54,590 |

| 5 | Dallas-Fort Worth-Arlington, TX | $54,497 |

| 6 | Atlanta-Sandy Springs-Roswell, GA | $53,922 |

| 7 | Cleveland-Elyria, OH | $53,841 |

| 8 | Pittsburgh, PA | $53,726 |

| 9 | Cincinnati, OH-KY-IN | $53,405 |

| 10 | St. Louis, MO-IL | $53,115 |

| 11 | Charlotte-Concord-Gastonia, NC-SC | $52,508 |

| 12 | Birmingham-Hoover, AL | $51,710 |

| 13 | Kansas City, MO-KS | $51,460 |

| 14 | Memphis, TN-MS-AR | $51,339 |

| 15 | Boston-Cambridge-Newton, MA-NH | $50,373 |

| 16 | Columbus, OH | $50,369 |

| 17 | Chicago-Naperville-Elgin, IL-IN-WI | $50,351 |

| 18 | Nashville-Davidson–Murfreesboro–Franklin, TN | $50,168 |

| 19 | Austin-Round Rock, TX | $50,154 |

| 20 | Minneapolis-St. Paul-Bloomington, MN-WI | $50,117 |

| 21 | Indianapolis-Carmel-Anderson, IN | $49,790 |

| 22 | Oklahoma City, OK | $49,771 |

| 23 | Seattle-Tacoma-Bellevue, WA | $49,514 |

| 24 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | $48,976 |

| 25 | Louisville/Jefferson County, KY-IN | $48,807 |

| 26 | Milwaukee-Waukesha-West Allis, WI | $48,341 |

| 27 | Denver-Aurora-Lakewood, CO | $48,287 |

| 28 | Washington-Arlington-Alexandria, DC-VA-MD-WV | $48,102 |

| 29 | Buffalo-Cheektowaga-Niagara Falls, NY | $48,071 |

| 30 | New Orleans-Metairie, LA | $47,956 |

| 31 | San Antonio-New Braunfels, TX | $47,837 |

| 32 | Rochester, NY | $47,660 |

| 33 | New York-Newark-Jersey City, NY-NJ-PA | $47,649 |

| 34 | Jacksonville, FL | $47,230 |

| 35 | Raleigh, NC | $47,164 |

| 36 | Richmond, VA | $47,002 |

| 37 | Grand Rapids-Wyoming, MI | $46,480 |

| 38 | Phoenix-Mesa-Scottsdale, AZ | $46,281 |

| 39 | Tampa-St. Petersburg-Clearwater, FL | $45,826 |

| 40 | Baltimore-Columbia-Towson, MD | $45,184 |

| 41 | San Francisco-Oakland-Hayward, CA | $45,082 |

| 42 | Portland-Vancouver-Hillsboro, OR-WA | $44,451 |

| 43 | Salt Lake City, UT | $43,857 |

| 44 | Sacramento–Roseville–Arden-Arcade, CA | $43,254 |

| 45 | Miami-Fort Lauderdale-West Palm Beach, FL | $42,976 |

| 46 | Las Vegas-Henderson-Paradise, NV | $42,960 |

| 47 | Providence-Warwick, RI-MA | $42,827 |

| 48 | Orlando-Kissimmee-Sanford, FL | $42,463 |

| 49 | Tucson, AZ | $42,264 |

| 50 | Virginia Beach-Norfolk-Newport News, VA-NC | $42,226 |

| 51 | San Diego-Carlsbad, CA | $37,395 |

| 52 | Los Angeles-Long Beach-Anaheim, CA | $35,691 |

| 53 | Riverside-San Bernardino-Ontario, CA | $34,040 |

| Figure is the average annual wages, salaries and proprietor earnings adjusted for cost of living usine BEA Regional Price Parities (80%) and variation in Census median home value among the 53 regions (20%). Data Sources: EMSI 2015.2 Employment Data, U.S. Bureau of Economic Analysis Regional Price Parities, U.S. Census American Community Survey | ||

| Analysis by Mark Schill, mark@praxissg.com | ||

This piece first appeared at Forbes.com.

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo by w:Flickr user Bill Jacobus [CC-BY-2.0], via Wikimedia Commons