The first two years of the Obama Administration have been historic and eventful. The first openly liberal president in a generation has dramatically increased government spending and intervention in the nation’s economy. The federal deficit soared to $1.65 trillion dollars and 35% of Americans now receive some type of government assistance.

The President seems to view the American economy through the prism of an academician. His vision of America held that his New Economy would be supported by the troika of plentiful Green jobs, new federal employment, and a revitalized and robust union based economy.

Give him credit. President Obama has held true to his vision even if the economy, and the American people, did not.

The “Green Jobs” of Mr. Obama’s new economy have not materialized despite huge government incentives. The president’s New Energy for America plan called for a federal investment of $150 billion over the next decade to catalyze the private sector to build a clean energy future.

- Provide short-term relief to American families facing pain at the pump

- Help create five million new jobs by strategically investing $150 billion over the next ten years to catalyze private efforts to build a clean energy future.

- Within 10 years save more oil than we currently import from the Middle East and Venezuela combined

- Put 1 million Plug-In Hybrid cars – cars that can get up to 150 miles per gallon – on the road by 2015, cars that we will work to make sure are built here in America

- Ensure 10 percent of our electricity comes from renewable sources by 2012, and 25 percent by 2025

- Implement an economy-wide cap‐and‐trade program to reduce greenhouse gas emissions 80 percent by 2050

The President’s plan called for renewable energy to supply 10% of the nation’s electricity by 2012, rising to 25% by 2025. The problem with his vision was that America was already generating 11.4% of its electricity from renewable sources when he delivered his speech. Ironically, most renewable energy comes from hydro-power, a source disdained by many greens. (US Energy Information Administration, Electric Power Monthly, June 2010.). T. Boone Pickens’s plan to build wind farms across the Great Plains was the most publicized private response to Obama’s vision never materialized. The U.S. Chamber of Commerce reported on March 10th that 351 “shovel ready” energy projects were stalled nationally due to “a tangle of state and local regulations”. These 351 projects were to create 1.9 million jobs and infuse the economy with “a $1.1 trillion short-term shot in the arm”. William Kovacs, senior vice-president of the chamber said, “In fact, there weren’t any shovel ready projects.”

In the end, the outpouring of new technologies and jobs in the new “green” economy simply never materialized.

Indeed, despite the grand vision of a Green economy, America remains deeply dependent on others for its energy.

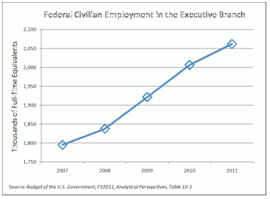

The second leg of Obama’s troika was new government employment. He was successful in signing his health care reform into law but delayed implementation to 2014. The 2010 election that changed 63 House seats to the Republicans, has acted to unwind much of this legislation. If not repealed outright, Obamacare will likely face starvation from Republican cuts in funding necessary to implement the 2,900 page law with its hundreds of new federal regulations. Federal civilian employment in the president’s 2012 budget, will be 15 percent higher in 2011 than it was in 2007. This effort is also likely to be stymied.

The second leg of Obama’s troika was new government employment. He was successful in signing his health care reform into law but delayed implementation to 2014. The 2010 election that changed 63 House seats to the Republicans, has acted to unwind much of this legislation. If not repealed outright, Obamacare will likely face starvation from Republican cuts in funding necessary to implement the 2,900 page law with its hundreds of new federal regulations. Federal civilian employment in the president’s 2012 budget, will be 15 percent higher in 2011 than it was in 2007. This effort is also likely to be stymied.

Union workers, the third leg of Obama’s troika, were well served in the first two years of the Obama Administration. The United Auto Workers inherited ownership in General Motors and Chrysler, and obtained federal protection of their relatively high wages and Cadillac health care benefits. Had GM and Chrysler been allowed to enter Chapter 11 bankruptcy, it’s likely both would have been drastically reduced. Under the health reform act, union workers received exemptions from taxation for their Cadillac health care plans – unlike those of private companies.

According to the most recent Employer Costs for Employee Compensation survey from the U.S. Bureau of Labor Statistics, as of December 2009, state and local government employees earned total compensation of $39.60 an hour, compared to $27.42 an hour for private industry workers – a difference of over 44 percent. This includes 35 percent higher wages and nearly 69 percent greater benefits. (Adam Summers Reason Foundation – Comparing Private Sector and Government Worker Salaries May 10, 2010).

Will union members be able to hold their ground or be forced into major concessions during the coming deconstruction? State governors like Christie (NJ), Daniels (IN), Kasich (OH), and now Governor Walker of Wisconsin are taking on the unions head-on for the first time in generations. New conservative majorities in state house around the country are deconstructing collective bargaining agreements, above market wage gains, and Cadillac fringe benefits. Labor’s gains, and political clout, may have peaked in 2008.

Will President Obama adhere to his academician’s vision of the New Economy or will he be forced to succumb to the realities of the coming Great Deconstruction? Congress is arguing whether it can afford $4 billion in cuts to a $3 trillion budget in order to avoid an imminent government shutdown.

Overlooked and more momentous is that for the first time since World War II, both houses of Congress – and some in both parties – are debating how to enact massive cuts in government spending. This is the beginning of the Great Deconstruction. Like the proverbial snowball rolling downhill, the $4 billion cuts of March 2011 could eventually canonball into hundreds of billions of actual spending reductions as the federal government deconstructs.

The Government Accounting Office released a report on March 1st entitled ‘Opportunities to Reduce Potential Duplication in Government Programs, Save Tax Dollars, and Enhance Revenue.’ The report identified $200 billion in annual waste from duplicative federal programs. The agency found 82 federal programs to improve teacher quality; 80 to help disadvantaged people with transportation; 47 for job training and employment; and 56 to help people understand finances. Finding ways to cut billions in federal spending is not be the problem. Finding politicians with the political will to withstand the barrage of criticism from impacted constituents is another matter.

The Great Deconstruction has already begun. Will President Obama, clearly a savvy politician, recognize this inexorable reality of this gathering force, leap in front of it, and claim ownership? Or will he stick to his academician’s vision and allow the snowball of deconstruction to roll over him?

Robert J Cristiano PhD is the Real Estate Professional in Residence at Chapman University in Orange, CA and Head of Real Estate for the international investment firm, L88 Investments LLC. He has been a successful real estate developer in Newport Beach California for thirty years.

Other works in The Great Deconstruction series for New Geography

Deconstruction: The Fate of America? – March 2010

The Great Deconstruction – First in a New Series – April 11, 2010

An Awakening: The Beginning of the Great Deconstruction – June 12, 2010

The Great Deconstruction :An American History Post 2010 – June 1, 2010

A Tsunami Approaches – Beginning of the Great Deconstruction – August 2010

The Tea Party and the Great Deconstruction – September 2010

The Great Deconstruction – Competing Visions of the Future – October 2010

The Post Election Deconstructors – Mid-term Election Accelerates Federal Deconstruction – November 2010

The State Government Deconstructors – November 2010