In 2008, US transit posted its highest ridership since 1950, a development widely noted and celebrated in the media. Ridership had been increasing for about a decade, however, 2008 coincided with the highest gasoline prices in history, which gave transit a boost.

Less reported was the fact that despite higher ridership, transit’s market share (of transit and motor vehicles) has fallen since the 1950s. In 1955, transit’s market share was over 10%. By 2005, transit’s share had dropped to 1.5%, but recovered only to 1.6% in 2008. Transit’s all time peak ridership was in 1945, driven up by World War II and gas rationing. It is thus not surprising that national transit ridership (boardings) declined 3.8% in 2009 as gasoline prices moderated.

Market Share by Major Urban Area

Demographia has released urban area roadway and transit market share estimates for 2008, based upon Federal Transit Administration and Federal Highway Administration data. The table below compares 2008 with 1983 market share data for 56 urban areas with a corresponding metropolitan area population of more than 900,000 (complete data).

| Urban Areas: Roadway & Transit Market Share: 2008 | ||||||

| Ranked by 2008 Transit Market Share | ||||||

| With 25 Year (1983) Comparison | ||||||

| 2008 | 1983 | Roadway Share % Change | ||||

| Rank | Urban Area | Roadway Share | Transit Share: | Roadway Share | Transit Share: | |

| 1 | New York | 89.0% | 11.0% | 87.7% | 12.3% | 1.5% |

| 2 | San Francisco | 95.0% | 5.0% | 93.7% | 6.3% | 1.4% |

| 3 | Washington | 95.5% | 4.5% | 96.1% | 3.9% | -0.6% |

| 4 | Chicago | 96.1% | 3.9% | 94.2% | 5.8% | 2.0% |

| 5 | Honolulu | 96.2% | 3.8% | 93.2% | 6.8% | 3.2% |

| 6 | Boston | 96.7% | 3.3% | 97.5% | 2.5% | -0.8% |

| 7 | Seattle | 97.2% | 2.8% | 97.6% | 2.4% | -0.4% |

| 8 | Philadelphia | 97.3% | 2.7% | 96.0% | 4.0% | 1.4% |

| 9 | Portland | 97.7% | 2.3% | 97.6% | 2.4% | 0.1% |

| 10 | Salt Lake City | 97.8% | 2.2% | 99.1% | 0.9% | -1.3% |

| 11 | Los Angeles | 98.1% | 1.9% | 98.1% | 1.9% | 0.0% |

| 12 | Denver | 98.2% | 1.8% | 98.5% | 1.5% | -0.3% |

| 13 | Baltimore | 98.3% | 1.7% | 97.7% | 2.3% | 0.6% |

| 14 | Pittsburgh | 98.6% | 1.4% | 97.3% | 2.7% | 1.3% |

| 15 | Miami-West Palm Beach | 98.7% | 1.3% | 98.8% | 1.2% | -0.1% |

| 16 | Atlanta | 98.8% | 1.2% | 98.0% | 2.0% | 0.8% |

| 16 | Cleveland | 98.8% | 1.2% | 98.0% | 2.0% | 0.8% |

| 16 | Las Vegas | 98.8% | 1.2% | 99.6% | 0.4% | -0.8% |

| 16 | Minneapolis-St. Paul | 98.8% | 1.2% | 98.8% | 1.2% | 0.0% |

| 16 | San Diego | 98.8% | 1.2% | 99.3% | 0.7% | -0.5% |

| 21 | San Jose | 99.0% | 1.0% | 99.0% | 1.0% | 0.0% |

| 22 | Austin | 99.1% | 0.9% | 99.7% | 0.3% | -0.6% |

| 22 | Houston | 99.1% | 0.9% | 99.0% | 1.0% | 0.1% |

| 22 | Milwaukee | 99.1% | 0.9% | 98.3% | 1.7% | 0.8% |

| 22 | Sacramento | 99.1% | 0.9% | 99.0% | 1.0% | 0.1% |

| 22 | San Antonio | 99.1% | 0.9% | 98.7% | 1.3% | 0.4% |

| 27 | St. Louis | 99.2% | 0.8% | 99.0% | 1.0% | 0.2% |

| 28 | Buffalo | 99.3% | 0.7% | 98.5% | 1.5% | 0.8% |

| 28 | Providence | 99.3% | 0.7% | 98.9% | 1.1% | 0.4% |

| 30 | Charlotte | 99.4% | 0.6% | 99.3% | 0.7% | 0.1% |

| 30 | Cincinnati | 99.4% | 0.6% | 98.7% | 1.3% | 0.7% |

| 30 | Dallas-Fort Worth | 99.4% | 0.6% | 99.4% | 0.6% | 0.0% |

| 30 | Hartford | 99.4% | 0.6% | 98.7% | 1.3% | 0.7% |

| 30 | Orlando | 99.4% | 0.6% | 99.7% | 0.3% | -0.3% |

| 30 | Phoenix | 99.4% | 0.6% | 99.4% | 0.6% | 0.0% |

| 30 | Rochester | 99.4% | 0.6% | 98.9% | 1.1% | 0.5% |

| 30 | Tucson | 99.4% | 0.6% | 98.9% | 1.1% | 0.5% |

| 38 | Detroit | 99.5% | 0.5% | 98.8% | 1.2% | 0.7% |

| 38 | Fresno | 99.5% | 0.5% | 99.3% | 0.7% | 0.2% |

| 38 | New Orleans | 99.5% | 0.5% | 97.4% | 2.6% | 2.2% |

| 38 | Norfolk-Virginia Beach | 99.5% | 0.5% | 99.2% | 0.8% | 0.3% |

| 38 | Riverside-San Bernardino | 99.5% | 0.5% | 99.6% | 0.4% | -0.1% |

| 43 | Columbus | 99.6% | 0.4% | 98.6% | 1.4% | 1.0% |

| 43 | Louisville | 99.6% | 0.4% | 98.9% | 1.1% | 0.7% |

| 43 | Memphis | 99.6% | 0.4% | 99.4% | 0.6% | 0.2% |

| 43 | Tampa-St. Petersburg | 99.6% | 0.4% | 99.5% | 0.5% | 0.1% |

| 47 | Bridgeport | 99.7% | 0.3% | 99.8% | 0.2% | -0.1% |

| 47 | Jacksonville | 99.7% | 0.3% | 99.4% | 0.6% | 0.3% |

| 47 | Kansas City | 99.7% | 0.3% | 99.4% | 0.6% | 0.3% |

| 47 | Nashville | 99.7% | 0.3% | 99.4% | 0.6% | 0.3% |

| 47 | Raleigh | 99.7% | 0.3% | 99.9% | 0.1% | -0.2% |

| 47 | Richmond | 99.7% | 0.3% | 99.1% | 0.9% | 0.6% |

| 53 | Indianapolis | 99.8% | 0.2% | 99.3% | 0.7% | 0.5% |

| 54 | Birmingham | 99.9% | 0.1% | 99.5% | 0.5% | 0.4% |

| 54 | Oklahoma City | 99.9% | 0.1% | 99.9% | 0.1% | 0.0% |

| 54 | Tulsa | 99.9% | 0.1% | 99.6% | 0.4% | 0.3% |

| Unweighted Average | 98.7% | 1.3% | 98.3% | 1.7% | 0.4% | |

| All Urban Areas Combined | 98.4% | 1.6% | 97.5% | 2.5% | 0.9% | |

| Based upon passenger miles | ||||||

| Core urban areas in metropolitan areas with more than 900,000 population in 2009. | ||||||

| Derived from Federal Transit Administration and Federal Highway Administration data | ||||||

| Los Angeles and Mission Viejo urban areas combined | ||||||

| San Francisco, Concord and Livermore urban areas combined | ||||||

| Historic transit market share data at http://www.publicpurpose.com/ut-usptshare45.pdf | ||||||

| Maryland commuter rail (MARC) assigned to Washington, DC | ||||||

In 1983, transit systems started receiving support from federal taxes on gasoline. This was also the first year that the National Transit Database reported on the same annual basis as it does today. One justification for using funds from road users was the hope of attracting people from cars to transit. The national data above and the urban area below show that the overwhelming share of new travel has, nonetheless, continued to be captured by motor vehicles rather than transit. Among the 56 urban areas, 13 experienced gains in transit market share from 1983 to the peak year of 2008, while 37 posted losses and six had no change. Transit was able to capture only 0.9% of new urban travel between 1983 and 2008, while roadways captured 99.1%. (Note 1).

The Top 10: Still a New York Story

#1: New York: The nation’s predominant urban area remains New York, with an 11.0% transit market share. In 2008, 41% of the national transit ridership (passenger miles) was in New York, with much of it either in or focused upon New York City. The New York City Transit Authority, and a host of local public and private systems, principally serve New York City destinations and account for a remarkable 38% of the nation’s transit ridership. Even so, transit’s market share dropped from 12.3% in 1983. As a result, the roadway market share in New York increased 1.5% between 1983 and 2008, the fourth largest gain in the nation. Transit attracted 8.7% of the new demand between 1983 and 2008, while roadways attracted 91.3%.

#2: San Francisco: San Francisco had the nation’s second highest transit market share in 2008, at 5.0%. This is a decline from 6.3% in 1983. Nonetheless, San Francisco moved up from 6th place in 1983. This produced a 1.4% increase in the roadway market share between 1983 and 2008, the fifth largest gain in the nation. Transit accounted for 2.2% of the new demand, while roadways attracted 97.8%.

#3: Washington: Washington placed third in transit market share in 2008, at 4.5%. This represents a gain from 3.9% in 1983 and an improvement from 6th place. Washington was the only urban area among the top five to experience an increase in transit market share. Much of Washington’s transit increase was on its expanding Metrorail system and the MARC commuter rail system (most of the ridership on this Maryland based system commutes to Washington. Overall, transit in Washington has attracted 5.1% of new travel over the past 25 years, while roadways attracted 94.9% of new demand.

#4: Chicago: Chicago ranked fourth in transit market share, at 3.9%. In 1983, Chicago had ranked 3rd, with a market share of 5.8. The roadway market share in Chicago increased 2.0% from 1983 to 2008, the third largest road travel gain in the nation. Transit attracted 1.3% of new demand over the period in Chicago, while roadways attracted 98.7%.

#5: Honolulu: Honolulu ranked fifth in transit market share, at 3.8%. This is a significant drop from 1983, when Honolulu ranked 2nd in the nation, with a transit market share of 6.8%. Honolulu’s roadway market share gain was the largest in the nation between 1983 and 2005, at 3.8%. Transit ridership also dropped in Honolulu from 1983 to 2008, so that roadways accounted for all new travel.

#6: Boston: Boston ranked sixth in transit market share in 2008, at 3.3%. This is a gain from 2.5% in 1983, when Boston ranked 9th. Much of Boston’s increase is attributable to its commuter rail expansion. Transit captured 4.1% of new demand, while roadways attracted 95.9%.

#7: Seattle: Seattle’s principally all bus transit system ranked 7th in 2008 with a market share of 2.8%. This is an increase from 2.4% in 1983, when Seattle ranked 10th. Transit captured 3.1% of new travel over the past 25 years, while roadways accounted for 96.9%.

#8: Philadelphia: Philadelphia slipped from the 5th largest transit market share in 1983 (4.0%) to 8th in 2008, at 2.7%. Philadelphia’s transit system, one of the most comprehensive in the nation, captured just 1.4% of new travel over the last quarter century, while roadways captured 98.6%.

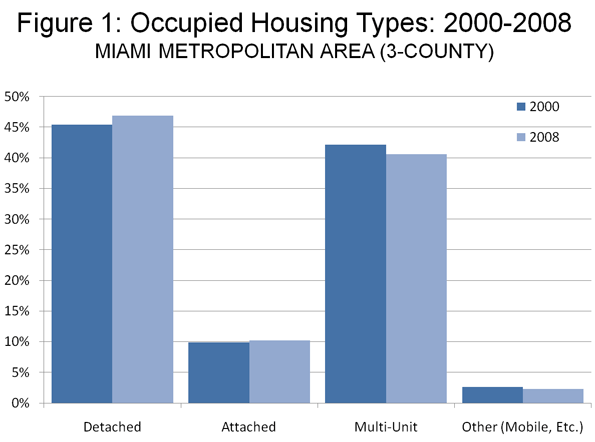

#9: Portland: Portland ranked 9th in transit market share in 2008, at 2.3%. This is a decline from 2.4% in 1983 and occurred despite opening the most extensive new light rail system in the nation over the period. Transit attracted 2.2% of new travel over the period, while roadways attracted 97.8%.

#10: Salt Lake City: Salt Lake City, at 10th, is a new entrant to the top 10 transit market share urban areas, with a share of 2.2%. In 1983, Salt Lake City ranked 34th, with a transit market share of 0.9%. Even with this increase, however, roadways captured the bulk of new travel, at 96.2%, while transit attracted 3.8%, due to transit’s small 1983 base.

Other Urban Areas: There were also notable developments among the urban areas that did not place in the top 10 in 2008 transit market share.

Las Vegas: Las Vegas improved its ranking more than any other urban area, moving from 49th in 1983 to 16th in 2008 (in a tie with Atlanta, San Diego, Cleveland and Minneapolis-St. Paul). In 1983, Las Vegas had a transit market share of 0.4%, which improved to 1.2% in 2008. This was an especially notable achievement, because Las Vegas experienced substantial population growth over the period. During the period, Las Vegas established a 100% competitively contracted transit system, the only such transit system in the nation and has seen ridership expand by more than 10 times. Nonetheless, as in other gaining urban areas, such as Salt Lake City and Washington, the transit ridership base was so small that roadways captured nearly all the new demand, at 98.6% (transit obtained 1.4%).

Atlanta: Atlanta both (1) was the fastest growing larger urban area in the developed world between 1983 and 2008 and (2) built the second most new rail capacity in the nation, in its expansion of the MARTA Metro (trailing only Washington’s Metro). Yet, Atlanta’s transit market share fell from 2.0% to 1.2% between 1983 and 2008, with transit attracting only 0.9% of new travel.

New Rail Urban Areas: Transit market shares generally failed to increase in urban areas opening new light rail or metro systems over the period (excludes urban areas with new rail systems that were not open at the beginning of fiscal year 2008).

- Six urban areas with new rail systems experienced market share declines, including Portland, Baltimore, Houston, Sacramento, St. Louis and Buffalo.

- Four urban areas with new rail systems had static transit market shares, including Los Angeles, Minneapolis-St. Paul, San Jose and Dallas-Fort Worth.

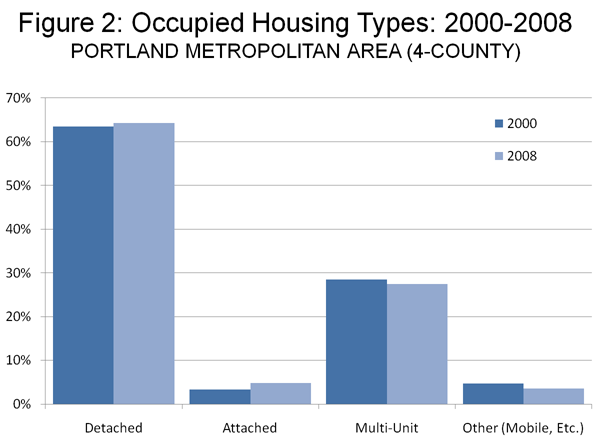

- Three urban areas with new rail systems experienced transit market share increases. The largest increase was in Salt Lake City (and the largest of any urban area). Denver and Miami-West Palm Beach also experienced increases.

Where from Here? It might have been expected that transit would have attracted far higher ridership numbers when gasoline prices achieved such heights. Yet, nationally, transit market share increase was only from 1.5% to 1.6%, even as roadway demand was declining modestly.

Transit’s principal marketing problem lies in its problem serving destinations outside downtown. Downtowns typically account for only 10% of urban area employment. Some trips in an urban cannot even be made on transit. For example, Portland’s extensive transit system connects only about two-thirds of the jobs and residences within the (Tri-Met) service area (Note 2). Further Tri-Met’s award deserving internet trip planner shows that some trips to outside downtown destinations can require more than two hours, even when light rail is used.

Note 1: This data relates only to passenger transportation. Urban roadways, unlike transit, also carry a substantial amount of local and intercity freight, which is not reflected in this data.

Note 2: According to Metro’s 2004 Regional Transportation Plan, 78% of the residences and 86% of the jobs in the Tri-Met service area were within walking distance (1/4 mile) of a transit stop. This means that approximately 67% of residences and jobs are within 1/4 mile of a transit stop (0.78 * 0.86). Metro’s plans envision this figure dropping to 59% by 2020 (this data does not include Clark County in Washington, part of which is in the urban area).

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”