Like most big cities that get the nod, Houston has spruced itself up for the Super Bowl, planting flowers and concentrating in particular on the rough stretches between Hobby Airport and NRG Stadium. Yet it’s unlikely the city’s reputation will be much enhanced by the traveling media circus that accompanies these games.

The last time the city hosted the Super Bowl, in 2004, the Washington Post called it “super ugly.” The website Thrillist recently named Houston “the worst designed city” in America, with the usual kind comments about porn shops near offices, lack of walking districts, fat people and awful traffic. For good measure, 24/7 Wall Street named it among the 25 worst cities in America.

Casting shade on Houston is nothing new. In his best-selling 1946 travelogue Inside U.S.A., the journalist John Gunther described Houston as having “a residential section mostly ugly and barren, without a single good restaurant and hotels with cockroaches.” The only reasons to live in Houston, he claimed, were economic ones; it was a city “where few people think about anything but money.”

Gunther clearly did not see a great future for the place, predicting that it would have only a million people by now. In fact, the Houston metropolitan area’s population now stands at 6.6 million with the city itself a shade under 2.3 million. At its current rate of growth, Houston could replace Chicago as the nation’s third-largest city by 2030.

Why would anyone move to Houston? Start with the economic record.

Since 2000, no major metro region in America except for archrival Dallas-Fort Worth has created more jobs and attracted more people. Houston’s job base has expanded 36.5%; in comparison, New York employment is up 16.6%, the Bay Area 11.8%, and Chicago a measly 5.1%. Since 2010 alone, a half million jobs have been added.

Some like Paul Krugman have dismissed Texas’ economic expansion, much of it concentrated in its largest cities, as primarily involving low-wage jobs, but employment in the Houston area’s professional and service sector, the largest source of high-wage jobs, has grown 48% since 2000, a rate almost twice that of the San Francisco region, two and half times that of New York or Chicago, and more than four times Los Angeles. In terms of STEM jobs the Bay Area has done slightly better, but Houston, with 22% job growth in STEM fields since 2001, has easily surpassed New York (2%), Los Angeles (flat) and Chicago (-3%).

More important still, Houston, like other Texas cities, has done well in creating middle-class jobs, those paying between 80% and 200% of the median wage. Since 2001 Houston has boosted its middle-class employment by 26% compared to a 6% expansion nationally, according to the forecasting firm EMSI. This easily surpasses the record for all the cities preferred by our media and financial hegemons, including Washington (11%) and San Francisco (6%), and it’s far ahead of Los Angeles (4%), New York (3%) and Chicago, which lost 3% of its middle-class employment.

Voting With Their Feet

Urbanistas may revile Houston but the metro area’s population has grown more than any other U.S. metropolis in the new millennium, up by 1.2 million between 2000 and 2010. The most recent figures show Houston’s population expanded 159,000 between 2014 and 2015, the most of any U.S. metro area.

Much of this is a result of people moving from elsewhere, roughly 500,000 net since 2000. In comparison, New York, Los Angeles, Chicago and even the Bay Area have suffered considerable migration losses.

It may be popular to suppose the new Texans are just a bunch of losers looking for cheap rent and low taxes. But the recent rate of increase in the population of educated 25- to 34-year-old educated people in Houston tops that of the San Jose area, and easily exceeds that of competitors like New York, Los Angeles and Boston. Houston has been getting not only bigger but also smarter.

Like domestic migrants, foreigners like the idea of jobs, particularly decent paying ones. Since 2000 Houston’s foreign-born population has grown 60%, roughly three times the expansion in New York, San Jose and San Francisco, and more than five times that of Los Angeles or Chicago. In the last decennial Census, Houston ranked second, just behind New York, in total numbers of new foreign-born residents.

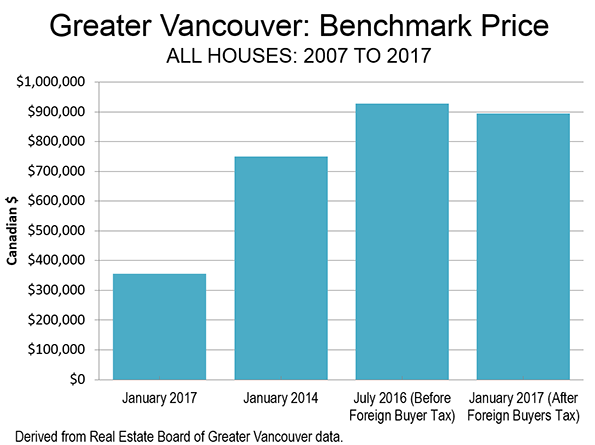

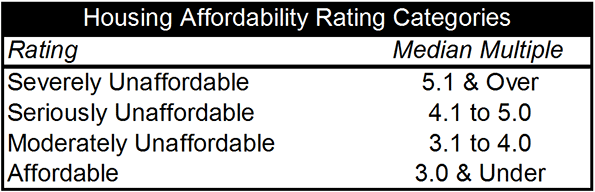

So, what’s the appeal? Even the most civically minded Houstonians will admit it’s not the weather — particularly the humid, brutal summers — or the topography, which makes a plate seem mountainous. More critical is housing prices. Per demographer Wendell Cox, housing prices in Houston, adjusted for income, are roughly one-third those of coastal California and half those in places like metropolitan New York, Boston and Seattle.

Houston simply offers a more congenial setting for upward mobility than its more celebrated rivals. The National Association of Home Builders/Wells Fargo Bank Housing Affordability Index finds more than 60% of homes in the Houston metro area are affordable for median-income families, compared with only 15% in Los Angeles, once ground zero for the dream of aspirational homeownership. Overall, when incomes and costs are weighed, Houston ranks at or near the top of places where paychecks stretch the farthest.

Life After Oil

Some have predicted that with the fall in oil prices, Houston would experience a sharp decline, repeating the disastrous experience of the early 1980s. The energy sector has lost some 67,000 jobs but the economy has not collapsed. Patrick Jankowski, chief economist for the Greater Houston Partnership, notes that, unlike the early 1980s, overall employment has not declined. To be sure last year’s gains — some 15,000 net jobs — are meager compared to the remarkable 120,000 increase experienced in 2014. This year Jankowski predicts better, but hardly robust growth of nearly 30,000 jobs.

Though some sectors of the real estate market are clearly overbuilt, notably luxury housing and high end office space, construction remains buoyant, particularly in the lower end of the single family market. David Wolff, one of the area’s largest land developers and former head of the transit agency, Metro, lived through the 1980s crash and frankly expected a harder landing this time. “It’s like being in the middle of a gun battle, and picking yourself up from the floor and being amazed you don’t have a bullet hole,” Wolff says.

The change in administrations has also boosted confidence. “It is nice to have a president who doesn’t hate your major industry, “Wolff quips. He and others also point to the port, which is booming, the massive and expanding Texas Medical Center and anti-business practices in blue states, such as New York and California, as contributing to the region’s increasing economic diversity.

Andrew Segal, head of Boxer Properties, one of the city’s leading owners of Class B real estate, sees little decline in either rents or demand for his buildings. Energy may never regain the prominence it once had, he argues, but other sectors have emerged, and the city itself has greatly enhanced its urban amenities, parks, and educational offerings. “It’s getting more diversified like Dallas and cooler like Austin. The ’80s simply did not come back.”

The Secret Sauce

My Center for Opportunity Urbanism colleague Anne Snyder suggests Houston’s resiliency stems largely from its culture of openness. One of the most diverse metro areas in the country, Houston long has been accessible for newcomers of all kinds. In contrast to more hierarchical, the planning-oriented regimes elsewhere, she writes, “ creative friction – unchaperoned and prescribed – is Houston’s secret sauce.”

Low prices and vast landscapes, she notes, allow space for minorities to set up businesses, buy houses, open a dizzying array of shops and restaurants. Houston’s much-maligned strip malls, notes architect Tim Cisneros, are the “immigrant’s friend,” allowing for small businesses to start with lower rents and easy parking.

Not all Houstonians like the way the place works. Local intellectuals and some in the media have been pushing for the Bayou City to renounce its no-zoning policies and embrace the top-down “smart growth” approach that dominate places like California, Oregon and many areas of the Northeast.

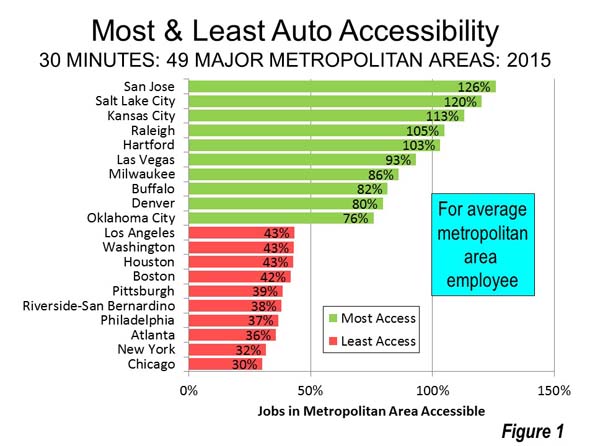

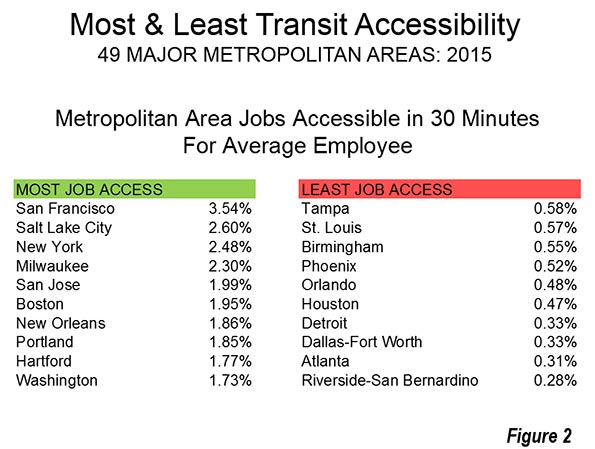

And to be certain, there are trade-offs. Although there are some promising walkable districts — both in the city and in some of the planned developments on the periphery — most Houstonians rely on their cars to get around, shop and eat at strip malls. And to be sure, entrenched poverty, inequality and inadequate schools remain all too common, but minorities, at least, are far more likely to own a house there than in more regulated places like New York, Los Angeles or Boston.

Houstonians also show their optimism by making the ultimate bet on the future: children. Per the American Community Survey’s Houston ranks in the top five cities for elementary-age school children per family among the 53 major metropolitan areas, well ahead of places like Chicago, Los Angeles, New York, and San Francisco, which placed 45th.

Jobs, housing, diversity, and the movement of families have driven Houston’s success. An upbeat attitude, and openness to outsiders, has made Houston a super city, Super Bowl or not.

Joel Kotkin is executive editor of NewGeography.com. He is the Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University and executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The Human City: Urbanism for the rest of us, was published in April by Agate. He is also author of The New Class Conflict, The City: A Global History, and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo: Hequals2henry [CC BY-SA 3.0], via Wikimedia Commons