This piece originally appeared in the Village Voice.

After a charmed first decade in politics, Mayor Mike Bloomberg is mired in his first sustained losing streak.

His third term has been shaky, marked by the Snowpocalypse, the snowballing CityTime scandal, the backlash to Cathie Black and “government by cocktail party,” and the rejection by Governor Andrew Cuomo of his plan to change how public-school teachers are hired and fired. With just a couple more years left in office, Bloomberg is starting to look every one of his 70 years.

Soon, he’ll be just another billionaire.

The mayor’s legacy is remarkably uncertain—largely because he’s done his best to keep New Yorkers in the dark about what it is he’s really set out to do in office.

In part, this is because the mayor has been far more effective at selling his Bloomberg brand than in getting things done. But it’s also because what he has done—remaking and marketing New York as a “luxury city” and Manhattan as a big-business monoculture—he prefers to discuss with business groups rather than the voting public.

Withholding information while preaching transparency is a Bloomberg trademark. He aggressively keeps his private life private—meaning not just his weekends outside the city at “undisclosed” locations, but also his spending, his charitable giving, and his privately held business.

New Yorkers who have received city, campaign, or Bloomberg bucks in one form or another and who expect to do business again in the future agreed to speak anonymously with the Voice about the mayor’s personality, the intersection of his political and private interests, and the goals he aims to achieve.

Several sources agreed to speak only after hearing what others had said. “It’s Julius Caesar time,” said one source. “There’s lots of knives, but no one wants to be first.” Others refused to be quoted, but encouraged me to give voice to their complaints—which sometimes diverged but often built into a sort of Greek chorus, an indictment of Bloomberg’s mayoralty from those who have seen it in practice, and are vested in it.

“Hanging out with a billionaire does bad things to your brain,” a source said. “It makes you think you’re right.”

The candidate who first ran in 2001 on his private-sector résumé and a deluge of advertising never did bother telling voters much about his agenda.

He pledged in that first run not to raise taxes and to step away from the daily running of his private company if elected to public office, but he brushed aside both vows after the election. In the case of his business, he claimed to have kept his word until his own testimony in a lawsuit unsealed in 2007 showed that he’d been far more active than he’d previously acknowledged.

The vast redevelopment schemes he unveiled in office were never mentioned on the stump.

New Yorkers have no trouble picturing Giuliani’s New York, or Dinkins’s “gorgeous mosaic,” or Koch’s “How’m-I-doing?” New York, or Beame’s bankruptcy, or Lindsay’s “Fun City.”

After two full terms and change, what do you call Bloomberg’s New York? In many ways, the mayor has been merely a caretaker.

While Bloomberg has called himself the “education mayor,” his claimed success with the public schools has been exposed as largely accounting tricks.

When asked to describe the boss’s vision for the city, aides and allies tack post-partisanship on to a checklist of Bloomberg LP buzzwords: transparency, data-driven results, and a CEO fixed on the bottom line. Pressed for actual accomplishments, the city’s post-9/11 resurgence usually is mentioned first.

The attack and its economic fallout played key roles in all three of Bloomberg’s runs, though the story has less to do with strong leadership than with good timing and salesmanship.

The attack itself, along with his opponent Mark Green’s fumbled response to it, helped put Bloomberg over the top in 2001. The ensuing Fed-sponsored low-interest-rate bubble inflated New York’s markets just in time to help rescue the mayor from record-low approval ratings and ensure his re-election in 2005. When that bubble finally burst in 2008, the Wall Street meltdown became the public rationale for the “emergency” third term.

“Post-partisanship” has always meant the party of Bloomberg, a convenient handle for a lifelong Democrat who left the party to avoid a contested primary in New York. After the presidential plotting that occupied most of his second term fell short (the big hit that began his losing streak), Bloomberg aimed for a soft landing with a nakedly undemocratic “emergency” bill to allow himself a third term. Instead, it alienated New Yorkers and wrecked his expensively built reputation as a “post-political” leader in the process.

Transparency has always been something Bloomberg has preferred to pitch rather than practice. In his 1997 business memoir, Bloomberg on Bloomberg—a sometimes valuable guide to the mayor’s approach—he notes that “if public companies change what they’re doing midstream, everyone panics. In a private company like Bloomberg, the analysts don’t ask, and as to the fact that we don’t know where we’re going—so what? Neither did Columbus.” It’s a philosophy Bloomberg brought with him to City Hall.

“Data-driven”? It’s hard to credit that when crime numbers are artificially deflated by re-classifying rapes as misdemeanors, NYC-reported public school gains disappear when compared to outside measures, and when the city’s 65 percent graduation rate is undercut by state tests showing only 21.4 percent of city students are ready for college.

“Bloomberg’s data-driven shtick,” said one source voicing a sentiment repeated by several others, “means no one will tell him anything’s failed.”

As the city’s “CEO,” Bloomberg has managed only to track the ups and downs of Wall Street and the national economy. It’s a strictly replacement-level performance.

New York went through its rainy-day reserves this year and, with the federal stimulus money spent, now faces $5 billion budget holes in each of the next three fiscal years. The coming budget crunch, says Manhattan Institute fellow Sol Stern, stems in large part from the mayor’s penchant for awarding generous contracts to teachers and other public-sector workers that also add to the pension bills the mayor has at times written off as “fixed costs.”

Pushing the idea that the city, like a corporation, has a bottom line, Bloomberg diverts attention from the fundamental issue every mayor faces: what the city ought to be doing.

So what kind of New York has Bloomberg tried to produce?

The “buck-a-year mayor” offered his business success and vast wealth as his main credentials for running New York. In office, he has envisioned a big-business-friendly city supporting a New Deal welfare state.

To make that work, he’s promoted “knowledge workers” as New York’s distinguishing resource, the way that waterways, rail lines, and manufacturing facilities were for industrial cities.

The mayor has often described that group (which, not coincidentally, matches the profile of Bloomberg terminal subscribers) as “the best and brightest,” with no irony intended. The city now acts as its own advertisement to draw in members of the so-called “creative class” who are as likely to work in ICE (Ideas, Culture, Entertainment) as in the city’s traditional FIRE (Finance, Real Estate, Insurance) base. In his typical salesman’s formulation, Bloomberg often suggests that the only alternative to courting that crowd and their wealthy employers would be a cost-cutting race to the bottom.

How else to pay for the array of services the city provides if not by building a safe and beckoning environment for elites and their Ivy-educated service class to live and work in, unmolested by an untidy big city?

That promised environment is the vastly expanded and uninterrupted Midtown Central Business District, a coveted goal of the business and real estate communities for nearly a century—if one viewed with suspicion farther south on Wall Street, where Bloomberg effectively ceded control of Ground Zero to a succession of bumbling governors, a major reason that it’s taken a decade for the Trade Center site to even begin rising back up.

Bloomberg has used a series of mega-plans including his Olympics bid, historic citywide rezoning changes, and pushing the sale of Stuyvesant Town to cut down what remained of working- and middle-class Manhattan. Gone, going, or forcibly shrinking are the Flower District, the Fur District, the Garment District, the Meatpacking District, and the Fulton Fish Market. Even the Diamond District is being nudged out of its 47th Street storefronts and into a city-subsidized new office tower.

“If New York is a business,” the mayor said in 2003, “it isn’t Walmart—it isn’t trying to be the lowest-priced product in the market. It’s a high-end product, maybe even a luxury product. New York offers tremendous value, but only for those companies able to capitalize on it.”

(Perhaps oddly, the mayor is a big booster of Walmart’s push to open stores in the city. Earlier this month, he defended the big-box store’s $4 million donation to a city summer job program, snapping at a Times reporter, “You’re telling me that your company’s philanthropy doesn’t look to see what is good for your company?” Asked how Walmart fits into the mayor’s vision, Deputy Mayor Howard Wolfson told me on Twitter that it “fits into the strategy of creating jobs and capturing tax $$ here that are currently going to NJ and LI.”)

But even as Wall Street has revived, ordinary New Yorkers haven’t benefited from the promised trickle-down.

Middle-class incomes in New York have been stagnant for a decade, while prices have soared, with purchasing power dropping dramatically. Never mind Manhattan—Queens taken as its own city would be the fifth most expensive one in America. While unemployment in the city has dropped below 9 percent, through June the city had replaced only about half of the 146,000 jobs lost during the recession—and the new jobs have mostly been in low-paying retail, hospitality, and food services positions, according to the Drum Major Institute for Public Policy. Poorly paid health care and social-service jobs, often subsidized by the city, make up 17.4 percent of all private-sector jobs as of 2007, a nearly one-third increase since 1990. Only 3 percent of the private-sector jobs in New York are in relatively high-paying manufacturing positions as of 2007, a figure that’s in the low double digits in Los Angeles, Chicago, and Houston. And the jobs expected to appear over the next decade are also clustered at the bottom of the pay scale.

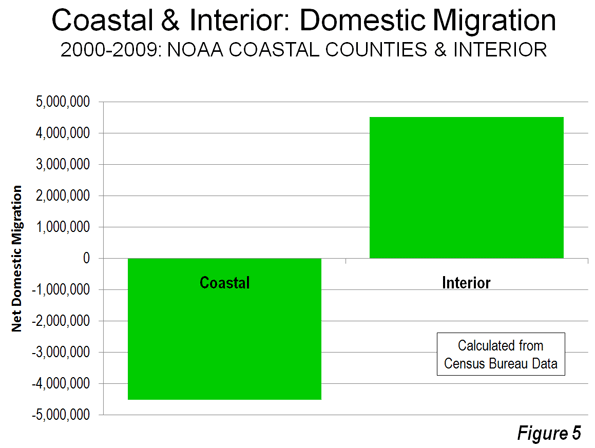

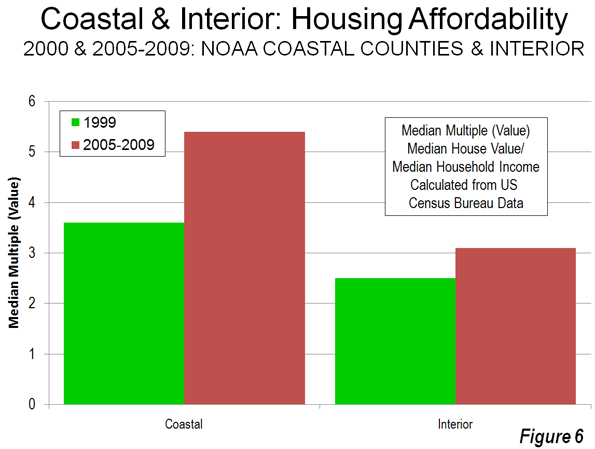

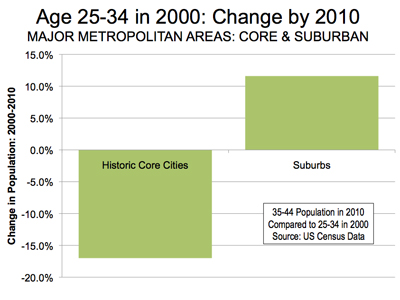

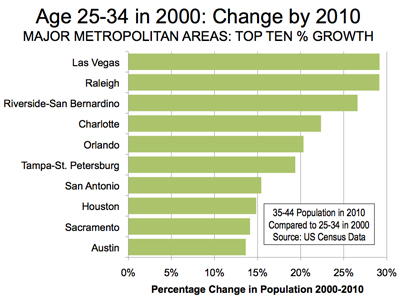

A Marist Poll this year showed a striking 36 percent of New Yorkers under 35 intending to leave in the next five years, with 61 percent of that group citing the high cost of living. New York State already leads the nation in domestic out-migration—and New York City has had more than twice the exit rate of struggling upstate locations like Buffalo and Ithaca. More New Yorkers left the city in every year between 2002 and 2006 than in 1993, when the city was in far worse shape, with sky-high crime rates and an economy on the verge of collapse.

Despite the mayor’s recruiting efforts, people with bachelor’s degrees continue to leave the city in greater numbers than they arrive here, with Brooklyn alone declining by 12,933 such citizens in 2006, according to the Center for an Urban Future, with many of those leaving discouraged by New York’s high costs, and the low quality of the public education available to their children.

Mike Bloomberg thinks everyone’s dream is to come to the city with an MBA and find an inefficiency to exploit and become a billionaire, or at least get a good job with one, argued three unrelated sources who have worked with the mayor, all of whom asked not to be quoted directly on the mayor’s view of himself. His idea that everyone’s dream is to be on Park Avenue, say those sources, has alienated and insulted outer-borough “Koch Democrats.” Their dream is a house, and Mike Bloomberg diminishes that dream because he thinks everyone wants to be him.

As Bloomberg memorably put it while floating his candidacy in early 2001: “What’s a billionaire got to do with it? I mean, would you rather elect a poor person who didn’t succeed? Look, I’m a great American dream.”

Without an impressive public-school system, Bloomberg’s vision for New York falls apart. But the public-school “miracle” the mayor touted for years has proven all pitch and no payoff.

Despite a massive 40 percent hike in per-pupil spending during Bloomberg’s first two terms, along with a 43 percent boost in teacher pay, the “historic” gains the mayor trumpets failed to register at all on the gold-standard national tests taken by the same students. When new state leaders put an end to the state’s easily gamed tests, what was left of the city’s years of paper gains disappeared.

The ever-rising test scores Bloomberg had relentlessly promoted fell almost all the way back to the mundane levels that had prevailed when the mayor took control of the system in 2002. The incredible success he’s claimed in closing the achievement gap between black and Hispanic students and their white and Asian peers that’s vexed generations of educators disappeared entirely by some measures.

Without high-quality schools to produce a cadre of well-educated citizens attractive to employers, Bloomberg’s implicit social contract with New Yorkers—that courting big businesses will help the little guy—breaks down, and the city’s appeal to those businesses is seriously tarnished, along with its long-term appeal to employees with children.

“Bloomberg yoked his education agenda to his ambitions for higher office,” said Stern, who had initially backed both mayoral control of the schools and Bloomberg’s education agenda. “He recognized that the way he was going to prove [to voters nationwide] that he’d given more bang for the buck was through test scores, while at the same time he was also introducing cash incentives to principals and teachers for getting the scores up.” (That program was quietly shuttered this month after a city-commissioned study found the payments had no impact on student performance.)

“So he invited the corruption,” Stern said, adding that he expects a numbers-juicing scandal to hit before Bloomberg leaves office. New Chancellor Dennis Walcott, responding to reports of grade-tampering in the city and a nationwide wave of such scandals, announced his own investigation this month, but it remains to be seen if the school system can fairly probe itself, and with the mayor’s reputation hanging in the balance.

Asked in 2007 how New Yorkers could register their discontent with the schools now that he was presumably term-limited out of office, Bloomberg cracked, “Boo me at parades.”

Some New Yorkers have taken him up on that, but more significantly they’ve also stopped caring enough to vote.

The mayor has indeed governed as the city CEO he promised to be in 2001, redefining public life so that businesses are “clients,” citizens “customers,” and Bloomberg the boss entrusted with the city’s well-being, with no need to consult with the board before acting.

After 1.9 million New Yorkers took to the polls in the 1989 and 1993 contests between Dinkins and Giuliani, less than 1.5 million voted in 2001’s nail-biter, and just 1.3 million turned out in 2005, when the outcome was never in doubt. Bloomberg nonetheless spent $84.6 million running up the score in a 19-point win intended to make him look “presidential.” In 2009, the mayor, responding to internal polls showing most New Yorkers wanted him out, broke the $100 million mark to project inevitability and discourage voters from showing up at all. Despite perfect weather on election day, three out of every four voters didn’t bother to participate. Just 1.2 million New Yorkers voted in an election that Bloomberg won by only 50,000 votes—collecting the fewest winning votes of any mayor since 1919, when there were 3 million fewer New Yorkers and women didn’t have the franchise. For the first time, Bloomberg’s spending failed to translate into popular support.

As the city’s electorate shrank around him—even as its population grew by more than a million people between 1990 and 2010, Bloomberg’s political stature swelled. The voters who just stayed home allowed the mayor to hold on to power despite an outnumbered base of the city’s social and financial elites and the technocratic planners they often bankroll, a political and governing coalition last seen 40 years ago under fellow party-switcher John Lindsay.

“My neighbors [in Manhattan] don’t vote in city primaries,” said a source. “They vote in presidential elections where their vote is useless. They’ve privatized their lives. Private schools, country houses, Kindles instead of libraries, cars instead of trains.”

In exchange for Citizen Bloomberg’s benighted leadership, we’ve accepted a staggering array of conflicts of interest. The mayor’s fortune renders obsolete the “traditional” model of interest groups buying off politicians. He not only does the reverse, buying off interest groups to advance his political agenda but also uses his fortune to staff and support his business. At the same time, he builds the Bloomberg brand that supports it all: Bloomberg LP, the Bloomberg Family Foundation, Bloomberg Terminals, Bloomberg News, Bloomberg View, Bloomberg Government, Bloomberg Law, Bloomberg Markets—not to mention Mayor Bloomberg.

The mayor wrote his own rules in a remarkably deferential 2002 agreement with the city’s toothless Conflict of Interest Board, and then ignored them when it was convenient, continuing to be regularly involved in his company’s affairs and acting in city matters where Bloomberg LP or Merrill Lynch (which until recently owned 20 percent of Bloomberg LP) had a stake.

Top-level City Hall workers, favored legislators, and others have moved freely between City Hall and the mayor’s private interests, keeping it in the “Bloomberg Family.” Bloomberg LP is now run by former Deputy Mayor Dan Doctoroff, while the Bloomberg Family Foundation’s approximately $2 billion endowment is controlled, on a “volunteer” basis, by Deputy Mayor Patti Harris. The prospect of a private Bloomberg jackpot job is on a lot of minds around City Hall and throughout New York.

Craig Johnson, the former state senator who lost a re-election bid after bucking his party to back the mayor in supporting charter schools, was hired this month by Bloomberg Law. “I wasn’t about to let him go to some other company,” Bloomberg said, all but winking. “I was thrilled to see my company hired him. I didn’t have anything to do with that.”

Beyond the $267 million he spent in three mayoral runs, he documented nearly $200 million more in “anonymous” charitable contributions. And that cool half-billion is just the spending Bloomberg has chosen to disclose.

Harris, now City Hall’s highest-paid official, came to the administration from Bloomberg LP. Through her control of Bloomberg’s ostensibly anonymous donations passed through the Carnegie Foundation to local institutions, she’s served as the Medici Mayor’s chief courtier—working for the city while using his private fortune to rent the silence, and occasionally the active assent, of its cultural groups on his behalf. That city giving dropped precipitously when Carnegie was replaced by the new Bloomberg Family Foundation, also run by Harris, which is now spreading cash to potential Bloomberg constituencies nationwide.

As Bloomberg explained in 1997, when Harris worked for Bloomberg LP: “Her sole job is to decide which philanthropic activities are appropriate for our company and to ensure we get our money’s worth when we donate time, money, and jobs. One of Patti’s questions is, ‘When does helping others help us?’… Not only does Patti commit our dollars, she also follows, influences, and directs how our gifts are used, ensuring our objectives are met.”

Elsewhere in his memoir, he adds: “Peer pressure: Its impact in the philanthropic world is hard to overstate.”

Meanwhile, Bloomberg News, supported by income from his sophisticated “Bloomberg terminals,” has grown to employ about 2,500 journalists, and at some of the best rates in the industry.

After offering up vague statements about avoiding conflicts of interests—no easy task when the boss is a potential presidential candidate, mayor of the nation’s biggest city, and one of that city’s wealthiest men—Bloomberg View debuted in May with a remarkable opening editorial. The editors conceded that they didn’t know yet what their principles would be—”We hope that over time a general philosophy will emerge”—but they were confident they would end up aligned with the “values embodied by Mike Bloomberg, the founder of Bloomberg LP.”

In June, brand-name Bloomberg pundit Jonathan Alter launched into an exceptionally vitriolic attack on charter school detractor and former Bloomberg education adviser-turned-foe Diane Ravitch. The piece ran with no acknowledgment of the evident conflict of interest in taking shots at perhaps the most prominent critic of Citizen Bloomberg’s education policies, under the Bloomberg View banner.

Bloomberg seems to view himself as congenitally above such conflicts, explaining in Bloomberg on Bloomberg, “Our reporters periodically go before our sales force and justify their journalistic coverage to the people getting feedback from the news story readers…. In return, the reporters get the opportunity to press the salespeople to provide more access, get news stories better distribution and credibility, bring in more businesspeople, politicians, sports figures and entertainers to be interviewed…. Most news organizations never connect reporters and commerce. At Bloomberg, they’re as close to seamless as it can get.”

Speaking of seamless, in 2000 Bloomberg rolled out a new city section, just in time for the boss’s run. Jonathan Capehart, brought in from Newsday, ended up doing double duty as candidate Bloomberg’s policy tutor and his host in different corners of the city, according to former Times reporter Joyce Purnick’s biography of the mayor, Mike Bloomberg: Money, Power, Politics. When the mayor-elect reached out to Al Sharpton on election night to tell him “things will be different with me as mayor,” it was Bloomberg News employee Capehart who placed the call.

Much as City Hall staffers dream of a Bloomberg job as the big payoff for their loyal labors, few reporters will go out of their way to tweak a potential employer, let alone one who frequently lunches with their current boss. And especially one whose long-rumored ambition is to buy the Times one of these days—a buzz that the mayor’s camp hasn’t discouraged, Berlusconi comparisons be damned. (The Italian prime minister and Ross Perot are two of Bloomberg’s neighbors when he weekends in Bermuda).

Along with Berlusconi, other comparisons heard in various conversations about Bloomberg included his Trump-like leveraging of his name (“It would be me and my name at risk. I would become the Colonel Sanders of financial information services…. I was Bloomberg—Bloomberg was money—and money talked”), his Hearst-like seduction of legislators with private jet rides and self-serving party-jumping, and his Rockefeller-like use of his private fortune on behalf of the state GOP, though for very different reasons.

The lifelong Democrat who became a Republican to dodge the mayoral primary has also given millions to the state GOP (as well as $250,000 to the Republican National Committee in 2002, and $7 million in support of the 2004 Republican convention in Manhattan). The cash shipments continued even after the mayor left the party in 2007 to hitch his star to the misleadingly named “Independence Party”—run in the city by crackpot cultist Lenora Fulani.

While Bloomberg’s support for the GOP dwarfed the money he channeled to the Independence Party, both received just a drop from his enormous bucket of cash—which still made Bloomberg easily the state Republicans’ biggest patron, his table scraps their feast. The party repaid that support in part with their ballot line in 2009, two years after he’d left the party, to go along with his “Independence” line, which proved crucial to his 2001 and 2009 wins, and would have been key had his presidential plans moved forward.

His Albany cash, though, has often failed to pay off. Perhaps that’s because Bloomberg hasn’t been willing or able to salt the state’s interest groups and leadership class as thoroughly as he has the city’s—his political persuasiveness and popularity have always been coterminous with his cash. In each of his terms, major aims—Far West Side development, congestion pricing, and teacher hiring—have been simply abandoned in the capitol without so much as a vote. Those losses came despite dealing with three weak governors before Cuomo, whose dramatic ascent has left the mayor further diminished. (One of Bloomberg’s rare wins in the state capitol, mayoral control of the city schools, was actually given to him by Assembly Speaker Sheldon Silver, the mayor’s most frequent Albany foil—who had withheld the same gift from Mayor Giuliani.)

Given Citizen Bloomberg’s success in buying off the city’s opinion makers, cultural institutions, community groups, and organized protesters, it’s no wonder the mayoralty began to feel too small for him, and he spent the bulk of his second term trying to leverage it into the presidency. While his signature congestion-pricing plan failed in the city, it succeeded in landing him on the cover of Time. He followed up by a nationwide victory tour with then-Chancellor Joel Klein and well-compensated occasional sidekick Sharpton to tout the school system’s “amazing results.”

The master salesman, who talked of transparency while keeping his own cards down, used his fortune to establish at City Hall the “benevolent dictatorship” he saw at Salomon and then employed in his private business: “Nor did so-called corporate democracy get in the way. ‘Empowerment’ wasn’t a concept back then, nor was ‘self-improvement’ or ‘consensus,’ ” Bloomberg writes in his business memoir. “The managing partner in those days made all the important decisions. I suspect that many times, he didn’t even tell the executive committee after he’d decided something, much less consult them before. I’d bet they never had a committee vote. I know they never polled the rest of us on anything. This was a dictatorship, pure and simple. But a benevolent one.”

But dictatorships never last. “Once Bloomberg leaves a room, it doesn’t exist to him,” said one source, skeptical that the mayor would care about maintaining his influence after he exits office. But given the value of his name, he is taking care to be sure that it isn’t damaged in the exit process.

Campaign filings released last Friday show the lame duck nonetheless spent $5.6 million on TV and direct mail spots promoting himself in March and April. And after failing to groom a successor, the mayor has belatedly been trying to institutionalize parts of the Bloomberg way.

“The administration is finally trying to do systematic reform, that’s what [Stephen] Goldsmith is here for,” a source said, referring to the former Indianapolis mayor who emerged as a star of the 1990s “reinventing government” movement, and signed on for Bloomberg’s third term as a deputy mayor. “I think he’s really frustrated. He complains a lot about lawyers.”

While Police Commissioner Ray Kelly reportedly mulls a Republican run, buzz has been building that Bloomberg will support City Council Speaker Christine Quinn, his Democratic partner in changing the term-limits law, as his successor. A slush-fund scandal left her damaged, but a third term she and the mayor pushed through bought her time to recover, along with a chip to cash with him. Mayor Koch last month outright said that Bloomberg had told him he was backing Quinn, before Koch dialed back his words later the same day.

But some of the Bloomberg-for-Quinn hype has come from operatives with reason to find a new patron once the billionaire exits office. The mayor, meanwhile, has reason to want a pliant speaker in his final years.

“Even if he does back her,” a source noted, “he’s not giving her $100 million for a campaign, or to wield as mayor. Once he’s gone, it’s done.”

Contact Harry Siegel at hsiegel@villagevoice.com

Photo courtesy of Be the Change, Inc. :: Photo credit Jim Gillooly/PEI