In this era of tea-partying revolutionary-era dress-ups, one usually associates secessionism with the far right. But if things turn sour for the present majority in Washington, you should expect a whole new wave of separatism to emerge on the greenish left coast.

In 1975 Ernest Callenbach, an author based in Berkeley, Calif., published a sci-fi novel about enviro-secessionists called Ecotopia; a prequel, Ecotopia Rising, came out in 1981. These two books, which have acquired something of a cult following, chronicle–largely approvingly–the emergence of a future green nation along the country’s northwest coast.

Aptly described by Callenbach as “an empire apart,” this region is, in real life, among the world’s most scenic and blessed by nature. Many in this part of America have long been more enthusiastic about their ties to Asia than those with the rest of the country. It is also home to many fervent ecological, cultural and political activists, who often feel at odds with the less enlightened country that lies beyond their soaring mountains.

Until the election of Barack Obama, the Pacific Northwest certainly was separating from the rest of America–at least in attitude. After George W. Bush’s victory the 2004 presidential election, the Seattle weekly The Stranger published an angry editorial about how coastal urbanites needed to reject “heartland values like xenophobia, sexism, racism and homophobia” and places where “people are fatter and dumber and slower.”

Such a narrow, cynical view of the rest of the country is in line with Callenbach’s Ecotopia novels, in which the bad guys–representatives of American government and corporations–are almost always male, overweight and clueless about everything from technology to tending to the earth.

Of course, would-be Ecotopians have much of which to be proud. The three great cities of the region–San Francisco, Portland and Seattle–easily rank among the most attractive on the continent. They all boast higher-than-average levels of education and–at least around San Francisco and Seattle–some of the world’s deepest concentrations of high-tech companies.

Yet for all their promise, the Ecotopian regions cannot claim to have missed the current recession. Downtown Seattle currently suffers a vacancy rate in excess of 20%, the highest in decades; last year apartment rental rates dropped 13.8%, the steepest decline among American metros. Meanwhile vacancies in the Silicon Valley area south of San Francisco have soared to above 20%. By early this year, there was enough unoccupied office space in the Valley to fill 15 Empire State Buildings.

This may seem a bit counter-intuitive for a region that boasts the headquarters of

But easily the weakest of the economies has been Portland, which lacks the presence of major anchor firms like those in greater Seattle or the Bay Area. Portland’s unemployment rate has been well over 10% since late last year.

A wave of youthful migration has made the city a slacker haven for the past decade and, in turn, exacerbated unemployment figures. Homeless kids now crowd the downtown area, which, although far from destitute, does appear pretty grungy in places.

Yet, like the Ecotopians in the Callenbach novels, Portland residents and politicians seem nonplussed about their anemic economic performance. After all, the city voted heavily–despite solid opposition from the rest of the state–to raise Oregon’s taxes on wealthy individuals and corporations, a move likely to deter new in-bound investment.

“You don’t have a big focus here on economic development,” observes Stephen B. Braun, dean of the School of Management at Portland’s Concordia University. “There’s much more emphasis on quality of life than on making a living.”

The proof: Portland may have high unemployment, but the big idea around city hall is not how to promote jobs but about investing an additional $600 million in bike lanes.

All these places, of course, avidly endorse green jobs even if there’s little prospect they could replace the jobs being lost in the fading blue-collar sectors. A growing green job sector needs a vibrant economy that produces things and builds new buildings, notions that have little currency across much of the region.

This anti-growth attitude reflects that of Callenbach’s Ecotopia, which favors a “stable state” economy over job or wealth creation. Ecotopian politics explicitly ban both population increases and the private automobile.

While the mayors of Portland, San Francisco and Seattle are hardly that extreme, they could propose policies that would make driving more burdensome. And they certainly seem to do wonders in chasing would-be baby-makers out of the city. All three cities have among the lowest percentages of children of any in the U.S.

Perhaps the toughest issue facing the Ecotopian political economy lies with the issue of class. Callenbach’s Ecotopia adopts something of an anarchic socialism; the cities of the real ecotopia have tended toward ever greater class bifurcation.

San Francisco, for example, boasts one of the highest per capita incomes in the nation and remains a favorite destination for inherited wealth, whether among individuals or nested in nonprofits. Yet according to the Public Policy Institute of California, if the cost of living is applied, San Francisco ranks high among urban counties in terms of its concentration of poverty.

It doesn’t help that the city’s economy has been hemorrhaging corporate headquarters and mid-range middle-class jobs for decades. High-end workers commute to

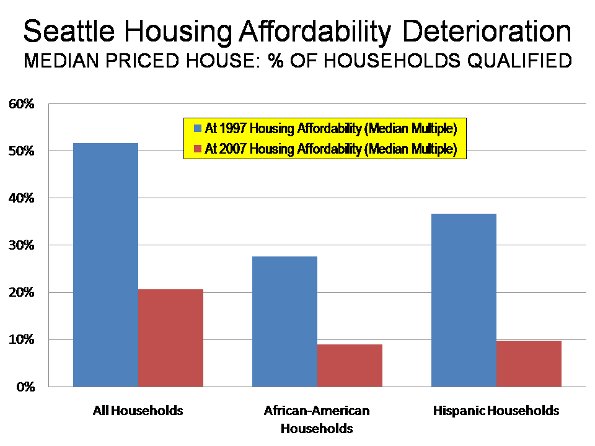

As middle-class jobs disappear, Ecotopia’s cities increasingly resemble restrictive communities that are anything but diverse. As analyst Aaron Renn has pointed out, Portland and Seattle stand as among the whitest big cities in the nation. And San Francisco’s once vibrant African-American population has been dropping for decades.

In the coming years this pattern will likely become more pronounced in Seattle and Portland as well. These cities continue to attract many well-educated people, particularly from California, who in turn bring with them both significant accumulated wealth and anti-growth attitudes.

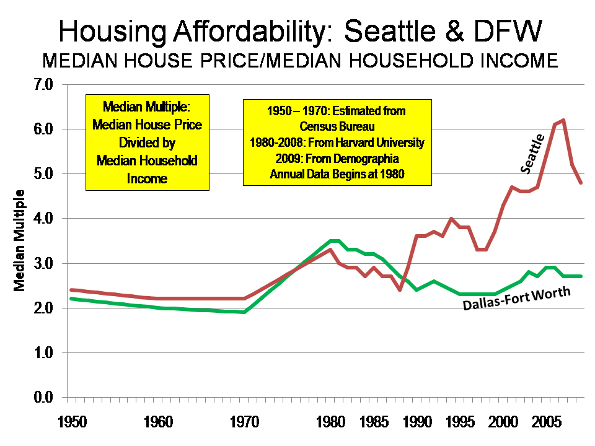

Strict “green” planning regimes are also accelerating the decline of the local middle class by driving housing prices up, greatly diminishing the once wide affordability for the middle class. Seattle’s regulatory environment, according to one recent study, has bolstered housing prices in the region by $200,000 since 1989. The percentage of families who could afford a median price home in the area has fallen by more than half.

Many observers see a similar outcome from Portland’s widely ballyhooed planning regime. Despite the massive acceptance by planners as something of a model for the restored city, the vast majority of all job and population growth in the region has occurred at the less pricey fringes, including across the river in Vancouver, Wash., which lies outside the fearsome Portland planning regime.

So what is the future for the region, and particularly the eco-cities? If the country starts moving toward the center, and even the right, you can expect Ecotopian sentiment to rise again, perhaps not to the point of secession but expressed in attitude.

But this may not be all bad. As America’s population grows and other regions rise, perhaps it’s helpful for the various parts of the country to experiment with different systems. Short of civil war, there’s something to be said for relentless, even if sometimes daft, experimentation at the local level. The rest of country may not follow all their strictures, but our would-be Ecotopians could produce some interesting and even usable ideas.

This article originally appeared at Forbes.com.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050

, released in Febuary, 2010.