So much talk of the Cleveland comeback with our downtown building boom and Republican National Convention-fueled makeover makes it difficult not to think about our mid-1990s civic renaissance. In 1995, The New York Times headline proclaimed ” ‘Mistake by the Lake’ Wakes Up, Roaring” as downtown’s stadiums and lakefront development created a “new face and new style of a city that for a long time had little panache.”

But it wasn’t just the media who became enchanted with our freshly minted charms — even the scholars were feeling it. The academics, however, had a Lake Erie-sized caveat. There was a divide in the region’s comeback, noted the authors of the 1997 study “The Rise and Fall and Rise of Cleveland,” with areas separated by characteristics of “capital investment and disinvestment, industrialization and deindustrialization, suburbanization and ghettoization, white flight and a black underclass, the growth of services, and a [high-skill and low-skill] dual economy.”

Prophetic then, those words serve as a warning now. The paradox of Cleveland’s comeback, if not an urban American comeback, is that the more a city returns, the greater the number who get left behind.

Rob English splits his time between Baltimore and Cleveland. He has been doing so for nearly three years.

A former Army infantryman, he serves as supervising organizer for the Greater Cleveland Congregations, a network of local faith and community-based organizations working for social justice. His experience in Baltimore since 1997 gives him a different perspective on his work in Cleveland today. “You have to meet people where they’re at, listen to them, and find ways to act in their mutual interest,” he says.

English marched with the Cleveland group in late May after the Michael Brelo trial verdict to demand comprehensive criminal justice reform. As the demonstrators from about 40 religious congregations walked arm-in-arm along downtown streets to City Hall and the Justice Center, it was peaceful — unlike what happened in Baltimore a month earlier. There, the death of 25-year-old Freddie Gray in police custody prompted violent social unrest.

“Baltimore is about seven to 10 years ahead of Cleveland,” says English.

Odd as it sounds, what English means is that Baltimore’s economic resurgence has been longer in the making — and that may be a good thing for Cleveland.

Baltimore’s signature project, the cleanup and rehabilitation of Baltimore’s Inner Harbor with its world-class aquarium and science center, began in the 1980s. Oriole Park at Camden Yards, an architectural model for Progressive Field, opened in 1992.

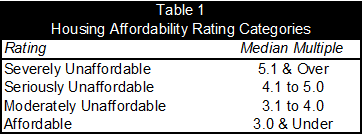

With the beautification came a change in the city’s demographics. Today, nearly 27 percent of Baltimore residents have college degrees, compared to 16 percent in Cleveland. Baltimore’s median income ($41,385) is $15,000 higher than here. Cleveland’s poverty rate sits at 35 percent, 12 percentage points more than Baltimore.

But the benefits in Charm City are not evenly distributed. White city residents earn nearly double that of black city residents. Baltimore also had the ninth worst wage disparity between high- and low-income workers in the nation, according to the Martin Prosperity Institute. So, while the physical redevelopment is apparent in the eyes of all Baltimoreans, the effect is uneven in their temperaments.

English, 46, recalls a talk he had with an African-American woman from East Baltimore several years back. She could see the Inner Harbor off in the distance from her neighborhood.

“Let me tell you about my anger,” she told him. “Every morning when I wake up and take the kids to the bus stop, every morning I look down and see the harbor, and every morning I get angrier.”

Her experience is more than an isolated one, says English. In Baltimore, people saw aspects of the city improve year after year. Yet so many weren’t a part of it. Eventually tensions built, and the Freddie Gray incident ignited it.

“Now, Cleveland is beginning a renaissance,” English says. “But there is room to come together so you’re not two cities.”

——–

Thomas P.M. Barnett’s book The Pentagon’s New Map is more than a decade old. But its message is no less relevant.

“Disconnectedness defines danger,” he argues.

For the expert geostrategist, the world is split between two types of geographies: the Core, where “globalization is thick with network connectivity, financial transactions, liberal media flows, and collective security,” and the Gap, or areas disconnected from globalization and defined by poverty, low education rates and “the chronic conflicts that incubate the next generation” of instability.

“We ignore the Gap’s existence at our own peril,” concludes Barnett.

It is a useful model in understanding what’s occurring in Northeast Ohio.

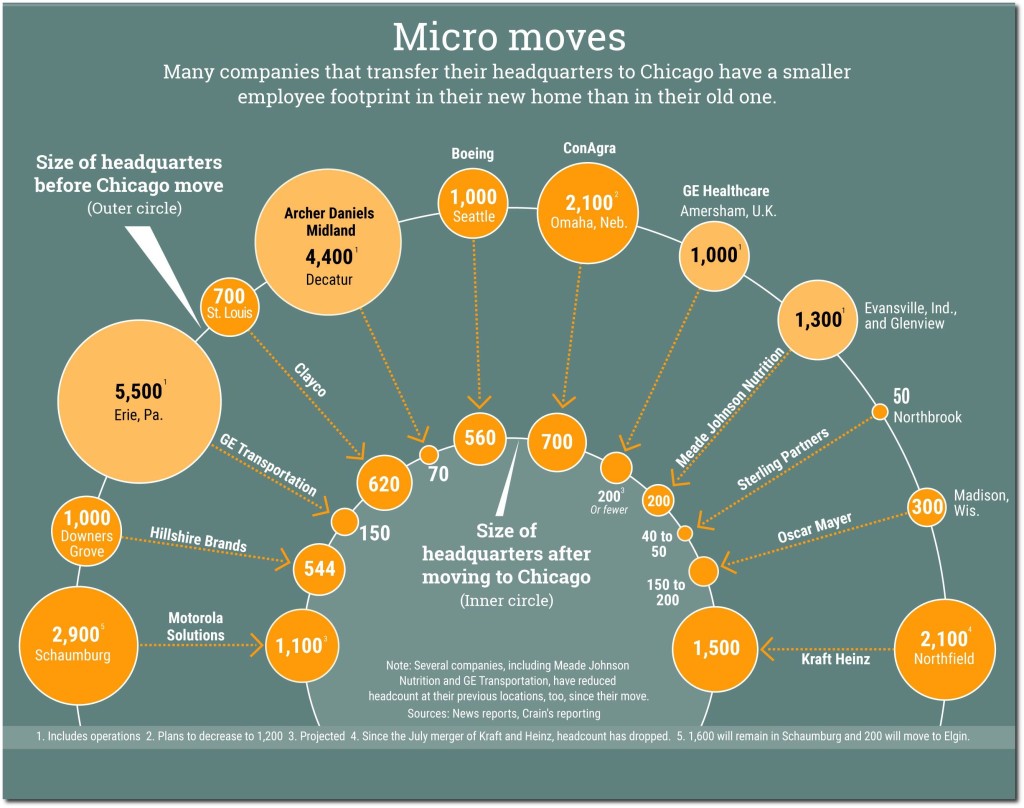

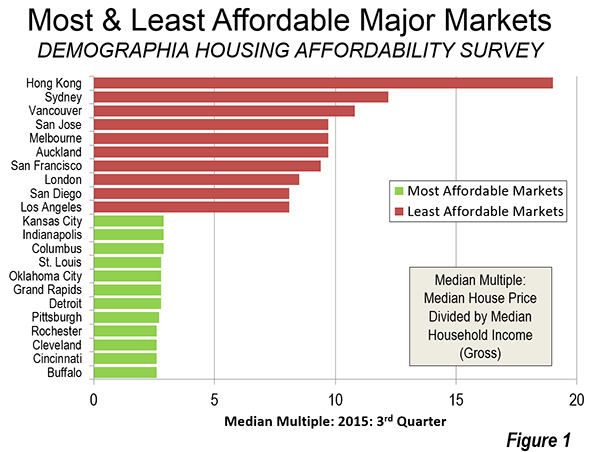

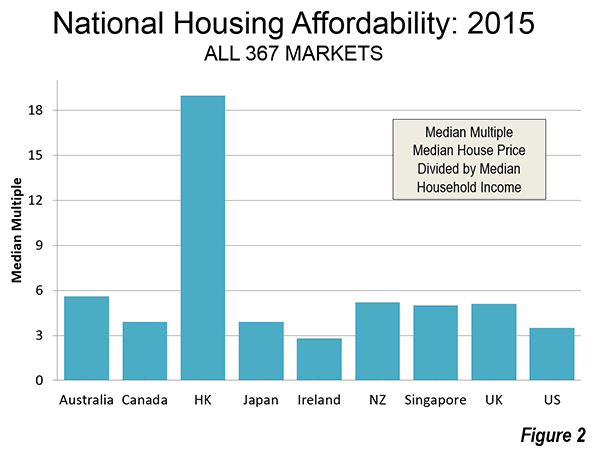

Consider that, according to a Brookings Institution study, Cleveland and Seattle led the nation with the biggest percentage increases in high-income households from 2012 to 2013. Yet, research from Rutgers University revealed Cleveland also has one of the largest increases in neighborhoods with concentrated poverty since 2000.

This division is further evident when mapping the concentration of Northeast Ohio residents with college degrees. Higher educated areas are centered in downtown, Ohio City, Tremont, Detroit Shoreway and AsiaTown, which have each seen double-digit percentage increases in residents with college degrees since 2000, as well as along the lakeshore, near University Circle and in various suburban and exurban clusters. Meanwhile less educated areas are grouped in the city of Cleveland outside the urban core and in the rural exurbs.

Simply, areas of Cleveland that are revitalizing are part of the globalizing Core. The isolate neighborhoods, or those experiencing higher levels of violence and poverty, comprise the Gap.

In fact, for a number of quality of life indicators, outcomes in various East Side neighborhoods are below that of developing nations. A recent PolitiFact article showed that infant mortality rates were worse in select East Cleveland neighborhoods than in North Korea, Uzbekistan, Zimbabwe and the Gaza Strip.

According to data by Case Western Reserve University, homicide rates for sections of the city are similarly comparable. In 2010, homicide rates in Ward 1, comprising parts of the southeast side, and Ward 9, which entails Glenville, are similar to Guatemala and El Salvador.

What’s happening here is not unlike cities such as Chicago, Baltimore, Miami and Brooklyn, New York, where the spatial patterns of having and not having mean poverty gets pushed together, not alleviated. When cities evolve as separate and unequal, they create a deepening sense of alienation and marginalization.

“The economic and social frustration could be expressed in more recourse to violence,” says Mark Joseph, director of the National Initiative on Mixed-Income Communities at Case Western Reserve University.

Revitalizing neighborhoods have more “eyes on the street,” says Joseph, who examined the effect in the Second City while at the University of Chicago. And more vigilant policing can “push gangs into more constrained areas of the city and into more conflict with each other.”

In the first nine months of 2015, for example, there was a 40 percent increase in gun homicides compared to 2014.

“As we are seeing in our city, innocent bystanders suffer the consequences as well as those directly targeted,” Joseph says.

In a span of a month, a 5-year-old, a 3-year-old and a 5-month-old were all victims of drive by shootings from gang violence that has boiled over in various East Side neighborhoods.

After the youngest, Aavielle Wakefield, was killed, Cleveland police chief Calvin Williams stood at the crime scene on East 143rd Street in Cleveland’s Mount Pleasant neighborhood. It was night. The street was lit by the television crews. With Mayor Frank Jackson by his side, the chief demurred about the senseless tit for tat, the need to catch the perpetrators.

Suddenly, his face went from firm to fragile. “To the family … it’s tough … it’s tough,” he said in tears. “This should not be happening to our city. And we got to do something about it.”

——–

“I have looked into the eyes of children soldiers overseas,” says English, who served a platoon leader stationed in Somalia. “I see the same look in Cleveland and Baltimore. That is what decades of disinvestment has created in our urban areas. It’s got to stop.”

Click to Enlarge

English was in Baltimore in April when the riots erupted about 20 miles away from the harbor. The city was on needles. English and a few co-workers received alerts about young people near Mondawmin Mall turning violent.

The message was to go where the rioting was occurring, with the intent to stem the unrest.

When English arrived, a CVS was being looted and burned. As a community organizer, English attempted to do what organizers do: connect to the disconnected. But he wasn’t succeeding.

“I looked at the young people in the eyes,” he recalls. “I lost my soul. I couldn’t connect with them.”

Anthony Body, a 29-year-old Glenville resident and member of the Cleveland Community Police Commission, sees similarities here.

“There is a sense of hopelessness,” he says.

Isolation fuels the cycle of disenfranchisement. Without exposure to positive outcomes, there can only be so much progress. Body says due to the lack of role models in his neighborhood people were influenced by the lifestyle of rappers, drug dealers and the garbage man.

“There is nothing wrong with being a garbage man,” he says. “But in order to choose Option B, you had to be exposed to Option B.”

The realities of his neighborhood have taken a personal toll. Body has lost at least one family member or friend to violence every year since 2006.

“All the trauma. The trauma of no job, the trauma of violence — the lack of family or social support — the schools,” he says, “it all drags on you when you try to better your life, so that when difficulty hits, you just go back to what you know.”

No doubt, the persistence of violence is not just a Cleveland problem, but a national one. Homicides are up sharply in Washington, D.C., Milwaukee, St. Louis and Baltimore.

On a mid-October trip to Ohio, FBI director James B. Comey wondered aloud: After years of declining violent crime in cities, why the uptick? “I’m not here announcing any big initiative or program,” Comey said, “but we have a lot of smart people who we brought on board after 9/11 who may be able to help look at the issue differently.”

Cheap heroin from Mexico and the turf battles to supply what has become a nationwide heroin epidemic was one likely scenario, he offered.

“What we’re in the midst of is a drug war,” says Hough resident and writer Mansfield Frazier, who likens today’s violence to the St. Valentine’s Day Massacre that left seven men dead in Prohibition-era Chicago.

For Khrystalynn Shefton, a housing development manager at the Famicos Foundation — a community development corporation in Glenville and Hough — this drug war is not just an urban problem, but an everyone problem. It’s limiting the potential for struggling neighborhoods to appreciate.

Shefton tells the story of a friend who lives off Rockefeller Park in a beautifully renovated home in Glenville. On a recent Sunday, she was enjoying tea in her sunroom. “A guy pulls up, straps up and does heroin in front of her house,” Shefton says. When he was done, the man left down Martin Luther King Jr. Boulevard to head toward Interstate 90 and back to the suburbs.

“The pain for me in this renaissance is that as a city we have not figured out that ‘I am my brother’s keeper,’ ” she says. “It’s all connected — the ills in the suburbs and the city.”

The roots of urban violence run deeper than the existence of a drug war. In September, the Cincinnati Enquirer investigated the Queen City’s rise in gun violence. What Cincinnati was witnessing ran counter to conventional wisdom that crime goes up in bad economic times and down in good times, offered Mayor John Cranley.

“This is the best economy we’ve had since the Great Recession and yet crime is up,” Cranley explained. “So it’s more likely to be linked to social and cultural than economic reasons.”

Of course, one could argue that the violence is linked to social and cultural issues stemming from economic reasons. Simply, the economy has changed rapidly since so many worked in the plants. Good economic times have been divorced from so many people, if not a generation of so many people.

The Georgetown Public Policy Institute found that four out of the five jobs lost since the Great Recession required a high school degree or less. “The shift in the workforce from less-educated to more-educated has been a slow and steady process,” notes the authors.

In the early 20th century, Cleveland was a magnet for European immigrants, Puerto Ricans and African-Americans because industry needed labor to produce economic growth. Manufacturing built our middle class. It enabled people to move up.

In 1990, for example, more than 50 percent of Cuyahoga County’s African-American residents lived in heavily segregated East Side city neighborhoods, while today that number is down to 30 percent.

That said, large-scale launchpad industries for formerly blue-collar communities are now nonexistent. Cleveland lost its old magnetism. But the children and grandchildren of the city’s factory-floored forefathers remain.

And they are idle. Thirty-eight percent of Cleveland’s males are not in the labor force. In black majority neighborhoods such as Union Miles, Central and Glenville, those numbers approach 50 percent.

When English first began canvassing Rust Belt cities, the Texas native was amazed at the number of black men standing on the corners. In Baltimore, he got to know many of them.

“We have always been on the corners,” English recalls one of them telling him. “The difference then is that we had lunch pails, and we were waiting for a ride to the steel mills.”

While English has been making that point for years, corporate and civic leadership in Baltimore are just now coming around to it, he says. “The unrest in Baltimore and the day-to-day violence in Cleveland — it’s a jobs issue.”

Body, a good neighbor ambassador supervisor with the Northeast Ohio Sewer District, echoes the sentiment. “People where I live just want opportunity,” he says. “They want to work. Every generation up to recently had [opportunities to work] handed down, somewhere in between it stopped being handed down.”

Body, who earned a business degree from Malone University while on a football scholarship, considers himself blessed. His parents and higher education taught him critical-thinking skills. He became better prepared for today’s economy. He found his place — and Glenville is a part of it.

“I’m still playing the dozens and breaking bread with my community,” he says. “I’m trying to express to folks there is another way.”

But too many of them can’t see it, he says. “The feeling in most folks is disappointment for not being able to join with it.”

——–

There is an understanding in geopolitics that everything local is global. What you see happening on the corner is tied together, whether that’s a vacant house and a skeletal factory or a condo development and state-of-the-art medical research facility.

It is correlated to Cleveland’s relationship with and relevance in the world. One set of aesthetics are birthed by severing from our economic past, and the other birthed from ties to our economic future.

In between these aesthetics are people.

Yes, a younger, more educated generation has found aspiration in Cleveland’s core. Yet to think Cleveland can come back by deepening the pattern of isolation versus prosperity is to ignore a basic tenant of modernization: With evolution comes progress — not just economically, but humanly.

Cleveland’s rebirth is in its infancy. The city is still alive in the shadows of all it has lost, making it possible for a consciousness to be reborn right.

Part of this entails learning from the lessons of Baltimore. There, like in Cleveland, the city’s economic transformation is largely spearheaded by the education and medical sectors centered around Johns Hopkins University and Johns Hopkins Hospital in East Baltimore.

Recently, in the face of Baltimore’s social unrest, the two institutions joined in an initiative called HopkinsLocal. The point is simple: Tackle social and health issues in Baltimore by engaging the city’s poorest residents and preparing the unprepared. By 2018, they plan to fill 40 percent of targeted positions by hiring from within the city’s most distressed communities. In all, it is one of the more robust buy local anchor institution policies in the nation.

Locally, programs to do something similar with anchor institutions have been developed, particularly the Evergreen Cooperatives. The worker-owned co-ops based in Cleveland’s East Side are contracted out to sell local goods and services to global institutions such as the Cleveland Clinic. While innovative, the efforts need scaling. Discussions are happening in Cleveland to do just that.

For English, the urgency couldn’t have come too soon.

“It’s a generational moment,” he says. “In the future, people will look back to now and ask, ‘How did we respond?’ “

This piece first appeared in Cleveland Magazine.

Richey Piiparinen is a Senior Research Associate who leads the Center for Population Dynamics at the Levin College of Urban Affairs at Cleveland State University. His work focuses on regional economic development and urban revitalization.