Barrels of ink and money have been devoted to predictions of where Americans will migrate, particularly younger ones. If you listen to big developer front groups such as the Urban Land Institute or pundits like Richard Florida, you would believe that smart companies that want to improve their chances of cadging skilled workers should head to such places as downtown Chicago, Manhattan and San Francisco, leaving their suburban office parks deserted like relics of a bygone era.

A close look at recent migration data shows that a significant number of younger people do indeed prefer urban life and can endure, temporarily at least, the high housing costs that go with it. However, the data also show that as they age, Americans continue, in general, to shift to suburbs, and later smaller communities, looking to buy homes and start families. Last week we explored an expert analysis of these trends by demographer Wendell Cox that showed distinctly different migration patterns from 2007 to 2012 among different age groups. (See: “The Geography Of Aging: Why Millennials Are Headed To The Suburbs“) In this article we will look at the metro areas that they went to.

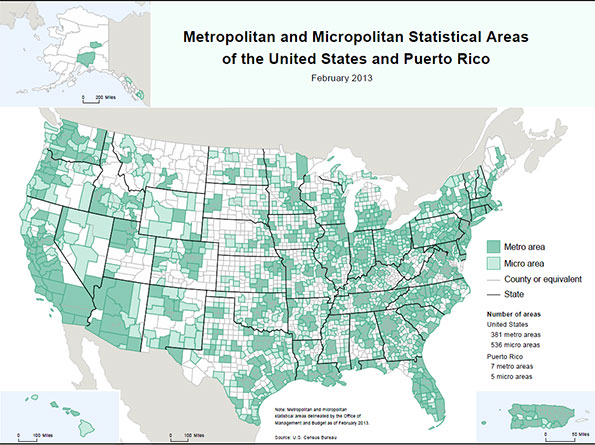

Our analysis is based on 15-year age cohorts of the working-age population: people who in 2007 were 15-29, 30-44 and 45-59. We looked at the changes in the population numbers of these cohorts five years later in 2012 in the 51 U.S. metropolitan statistical areas with a population over 1 million.

Youth Magnet Cities

Most attention tends to go to the youngest of these cohorts, which aged from 15-29 in 2007 to 20-34 in 2012. It includes students, the unmarried and childless — people in the earliest stages of their careers. This is historically the age group most likely to move from one region to another. Although the vast majority of this cohort live in suburbs or smaller towns, our research does show sizable increases in their numbers in many of the larger, expensive cities, particularly those with strong economies.

From 2007 to 2012, tech-heavy cities generally saw the biggest growth in numbers in this age group. The San Francisco metro area placed first among the largest U.S. metro areas with a 20.7% increase in its population in this age group. Young people, it should be expected, tend to be less sensitive to ultra-high rents (particularly if they work for a successful company or their parents subsidize them). It was followed by Seattle (20.3% growth), Washington, D.C. (18.1%), and Austin, Texas (18.1%).

But tech centers were not the only gainers. Some up-and-coming metro areas, notably Orlando, Las Vegas and New Orleans, also registered high levels of youth migration.

In contrast many of the country’s large “hip and cool” cities did not fare nearly as well. Despite its endless self-promotion as a youth magnet, New York placed 19th (8.6% growth, though in absolute numbers in gained the most in this demographic, 323,000), while Los Angeles was 31st and Boston 22nd. Chicago, the much hyped (and hoped for) magnet for the young promoted by the Urban Land Institute in a recent Wall Street Journal article, places 41st – its population in this demographic actually dropped 0.6%. The lowest rungs are dominated by the traditional Rust Belt hard-luck cases: Cleveland (47th), Buffalo (48th), Rochester (49th), Detroit (50th) and last-place Riverside-San Bernardino, which lost 9.4% of its population in this age cohort from 2007 to 2012.

View Full List Gallery at Forbes: The Cities Where Working-Age Americans Are Moving

But Where Do They Go After 35?

As we explained in the last article, perhaps the most important group to watch is the one that aged from 30-44 in 2007 to 35-49 in 2012. This is the group just ahead of the millennials, and the one most likely to provide hints of where the millennials will move as 20 million enter their 30s over the next decade: the dreaded (at least for some) age of marriage, settling down and, in most cases, starting families. This group has shown remarkably different proclivities than the younger cohort. For one thing, they are not going to San Francisco, which drops to 30th place in this cohort – the city lost a net 0.7% of the age group from 2007 to 2012. Other high-cost urban areas also did very poorly with this demographic, including Boston (40th, -2.3%), New York (45th, losing a net 3.9%, or 161,000 people), San Jose (46th), Los Angeles (47th) and Chicago (49th, -5.2%).

Who wins this group may be critical, since these are people entering their prime who earn more than younger cohorts, particularly in this economy. Census Bureau data indicates that average household incomes are 28% higher where heads of households are 35-45 years old than those in the 25-34 cohort. The gap grows to 34% against householders who are 45 to 54. This group seems very sensitive to both job markets and housing prices. With the exception of the Washington, D.C., area (No. 6), whose government-driven economy continues to flourish, virtually all the top 10 cities enjoy strengthening private-sector economies and relatively low housing prices. At the top of the list is the New Orleans area, whose population in this age group rose 19.3% from 2007 to 2012. The Big Easy’s gains are related, at least in part, to the return of people who fled after Katrina, but it also reflects a newfound demographic vitality backed by substantial economic improvements. It is followed by Miami, San Antonio and Raleigh. Houston and Oklahoma City also did well.

These are the cities that will appeal most to aging millennials, suggests generational chronicler Morley Winograd. Older millennials, he notes, tend to be very interested in home ownership, family and being good parents. The tough economic times they face, plus often crushing college debt, will force many of them to move not to “luxury cities” where they could never afford a home suitable for child-raising, but to places that are, as he puts it, “less expensive and certainly downscale from the places where they grew up.”

Mature Adult Markets

The migration patterns are similar, although not uniformly so, in the next cohort, aged between 50 and 64 in 2012. Mostly still working, and earning close to peak wages, this generation tended to move to less expensive cities as well. New Orleans also ranks first, with a 7.9% gain in this cohort from 2007 to 2012. Low housing costs are another factor in New Orleans’ rebound. You can say much the same for other Sun Belt metro areas, such as San Antonio (third in this demographic with a 7.3% gain), No. 4 Tampa-St. Petersburg (5.0%), No. 5 Austin and No. 7 Oklahoma City.

Interestingly, the California rankings in this cohort are almost the mirror image of the youth brigade. Riverside-San Bernardino, last in the youth list, for example, ranked second, while Sacramento, 43rd on the youth list, seems to get more appealing as people age. In the 30something group, the area rises to 32nd, and boasts a strong ninth place ranking in growth in the 50-64 cohort (+2.0%).

Editorialists at local papers, such as the Sacramento Bee, are obsessed with increasing density and luring hipsters. Yet the California capital region, while not drawing many younger people, does very well in luring adult migrants from the far more expensive, and denser, Bay Area and Los Angeles-Orange County. In contrast, in this cohort, San Francisco ranks 40th with a 4.4% decline in population, Los Angeles-Orange County 44th (-5.6%), and San Jose 49th (-7.3%).

The Upshot For Investors And Companies

A look at these three working-age cohorts suggests a far more complex, and possibly perplexing, challenge to both companies and regions. our demographic analysis suggests the movement of the youngest workers to “hip, cool”cities that is so celebrated by ULI and other professional urban boosters faces some serious time constraints, particularly as workers age.

High-profile companies such as Google (itself located in very suburban Mountain View) seek outposts in places like downtown Chicago or New York, where youthful labor, often less expensive, is readily available. But most companies in technology — particularly those with an engineering focus as opposed to social media — depend heavily on older, skilled workers, most of whom live in suburbs. Much the same can be said of professional services, and finance and industrial companies.

This may explain in part why, despite the claims made by urban boosters, office space construction and absorption is currently considerably stronger in suburbs than in the core cities. A recent Costar report says suburban San Jose, Sacramento, San Jose, Austin, Kansas City and Charlotte are enjoying particularly strong net office absorption. This trend, largely ignored in the media, may accelerate in the future.

The key again is millennials as they enter their 30s. Like previous generations, many will end up either living in suburbs, or moving to less expensive cities as they get ready to buy homes and start families. The notion that “everyone” wants to move, and more importantly stay, in expensive core cities no doubt appeals to journalists based in places like Washington, D.C., San Francisco or Manhattan. But the actual reality is far more complex and more favorable to the continued dispersion of the workforce. Banking on the shifting tastes of 20somethings only works for so long; in the end, only a minority of workers remain Peter Pans, living their youthful urban dreams well into their 40s and 50s.

View Full List Gallery at Forbes: The Cities Where Working-Age Americans Are Moving

This story originally appeared at Forbes.

Joel Kotkin is executive editor of NewGeography.com and Distinguished Presidential Fellow in Urban Futures at Chapman University, and a member of the editorial board of the Orange County Register. He is author of The City: A Global History and The Next Hundred Million: America in 2050. His most recent study, The Rise of Postfamilialism, has been widely discussed and distributed internationally. He lives in Los Angeles, CA.

Unemployed woman photo by BigStockPhoto.com.