Over four decades, the Great Lakes states have been the sad sack of American geography. This perception has been reinforced by Detroit’s bankruptcy filing and the descent of Chicago, the region’s poster child for gentrification, toward insolvency.

Yet despite these problems, the Great Lakes’ future may be far brighter than many think. But this can only be accomplished by doubling down on the essential DNA of the region: engineering, manufacturing, logistics, a reasonable cost of living and bountiful natural resources. This approach builds off what some local urbanists, notably Jim Russell, have dubbed “rust belt chic.”

With a population of 58 million, the Lakes region boasts a $2.6 trillion economy equal to that of France and far larger than the West Coast’s. (We define the region geographically as comprising the western ends of New York and Pennsylvania, northeastern Minnesota, and Ohio, Indiana, Illinois, Michigan and Wisconsin.) Despite the growth in auto manufacturing in the South, the Great Lakes region still accounts for the vast majority of jobs in the resurgent industry, now operating at record levels of capacity.

Since 2007, Michigan, Indiana, Ohio and Wisconsin have ranked among the top five states for growth in industrial jobs, adding a half million new manufacturing jobs since 2009.

To build on this progress the region needs to focus on its human assets. This starts with by far the nation’s largest concentration of engineers, some 318,000, which stems from the oft unappreciated fact that manufacturing employs the majority of scientists and engineers in the nation. It also accounts for almost 70% of corporate research and development. This includes disciplines such as mechanical engineering, which according to a recent EMSI study, has enjoyed steady job and income growth over the past 20 years.

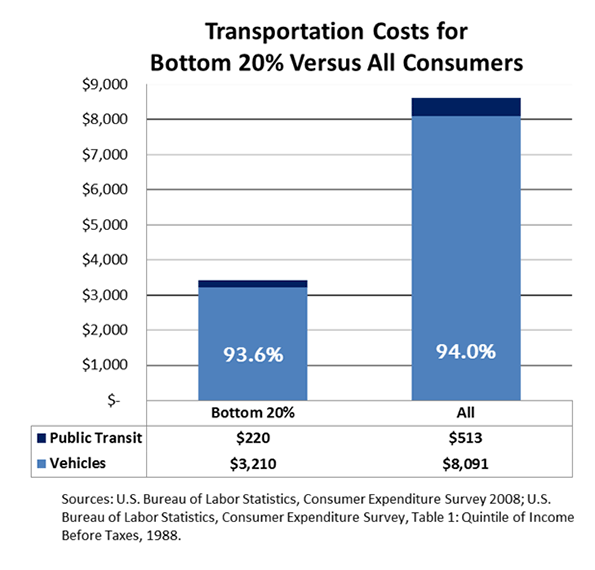

Another critical asset is the concentration of skilled trades, the workers most sought after by employers, according to a recent Manpower survey. To keep this advantage, the area needs to focus on educating its workforce — particularly in neglected inner city neighborhoods — with skill training for jobs that actually exist and are expected to grow. This is already occurring in some states, such as Ohio.

To be sure, traditional manufacturing jobs, particularly for the unskilled and semi-skilled, likely will never come back in large numbers. But the earnings level for skilled workers will remain well above the national average, and may increase even further as shortages develop.

Some dismiss such blue-collar strengths as a critical weakness. They suggest that area residents might decamp for places like Silicon Valley where they can find livelihoods cutting hair and providing other personal services for the digerati.

Of course, no sane Great Lakes leader would endorse this approach in public, but many, instead of embracing “rustbelt chic” prefer to recreate a faux version of America’s left coast. This obsession goes back at least a decade, reaching its most risible level during the time of former Michigan Gov. Jennifer Granholm. Her strategy focused on turning its cities — including Detroit — into “cool” burgs.

This clearly did little to turn around either already beleaguered state or cities; “cool” did not save Detroit from bankruptcy. Indeed cool represents just one variation in a myriad of Rust Belt elixirs, including casinos, convention centers, “and creative class oriented arts districts. Virtually all the strategies being adopted in Detroit have already been applied in Cleveland, including by the same entrepreneur, Quicken Loans Chairman Dan Gilbert, with very little tangible economic benefit.

Yet despite this history, Detroit — the poster child of public malfeasance — once again is pinning its hopes on luring the “creative class” to Motor City. It starts with the usual stab at subsidizing housing, office and retail around the central core. This is being jump-started by taking Quicken Loans jobs already in the area’s suburbs, meaning little net regional advantage.

Even more absurd, Michigan taxpayers are being asked to pony up to as much as $440 million for a new stadium in Detroit for the Red Wings hockey team. In contrast to this beneficence, many remaining established, older smaller neighborhood businesses — many of them deeply entrenched in the Rust Belt economy — get stuck with ever higher tax bills and reduced levels of public service.

To be sure, this approach can succeed in building hipster cordon sanitaire — a miniaturized but utterly derivative urban district — that can be shown to investors and visiting, and usually core-centric, journalists. It also can enrich speculators and those politicians who service them, but represents a marginally effective means of reviving the city, much less the regional, economy.

Instead of chasing hipsters , Cleveland urban strategist Richey Piiparinen suggests cities such as his rebuild their economies from the ground up, tapping the strong industrial skills, work ethic and resilient culture deeply embedded in the region. Large factories may not return en masse to Cleveland, Detroit or Chicago, but a strong industrial economy and a culture embracing hard work could stir growth in service-related fields as well.

Geography and location provide other opportunities . The area’s natural resources — the Great Lakes contain one-fifth of the world’s supply of fresh water — constitute a profound competitive advantage against drought stricken economies in the Inland West, the southern Great Plains and parts of the Southeast. Water is an essential element in many industrial processes, including fracking, a serious issue in parts of the Rust Belt. Miles of attractive coastline could be used to lure not only factories, but high-tech businesses, tourists and educated professionals who can choose their location.

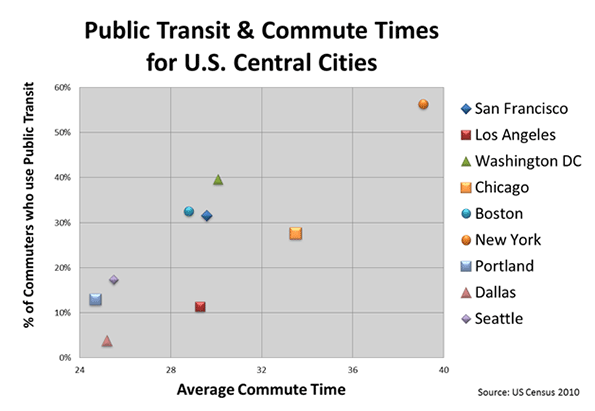

The Great Lakes also are a natural conduit for the $250 billion trade with Canada, with its vast resource-based economy and growing population . Instead of funding better bars, art galleries and sports venues, or hoping to attract tourists and conventioneers to traipse to Cleveland in December, what the region really needs, noted a recent Brookings report, is better infrastructure, such as bridges, ports, freight rail and roads.

Critical too are the region’s strong engineering schools. Of the nation’s top 10, four — Carnegie Mellon, Purdue, the University of Michigan, and the University of Illinois at Champagne-Urbana — are located in the Rust Belt. The Great Lakes may not be home to the Ivy League, but it remains the nursery of practical applied intelligence.

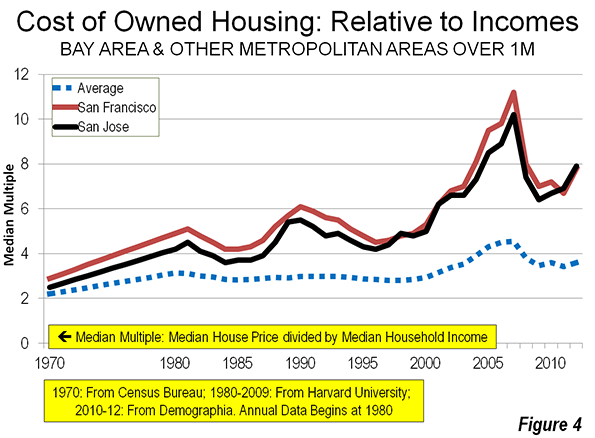

Emerging demographic trends could also play a positive role. The millennial generation will soon be approaching the age when they wish to start businesses, get married, have children and buy homes. A good target would be those seeking a single-family home and a reasonable cost of living; both are increasingly difficult to attain in much of the Northeast and coastal California where the cost of housing, even adjusted to income, can be easily two to three times higher.

Indeed, despite decades of demographic stagnation, the region already boasts higher percentages of people under 15 than the Northwest, the Northeast (including New York) and has about the same percentage of kids as the rapidly growing Southeast. For a new generation, the Great Lakes could emerge as a destination, not a place to avoid.

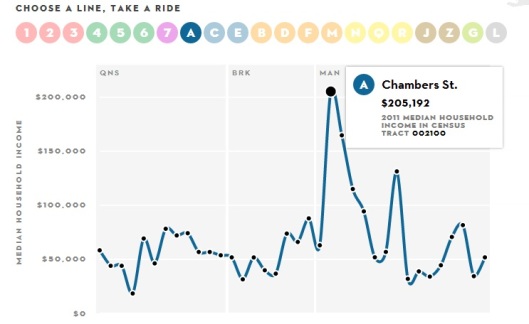

This requires the region becoming more attractive to newcomers, whether from abroad or within the country. As urban analyst Aaron Renn suggests, the Great Lakes has to become more culturally open to outsiders and immigrants. Cities such as Cleveland, Chicago, and Detroit were once magnets for immigrants from Europe and people coming from America’s rural hinterlands, notably the south.

Restoring appeal to outsiders does not mean denying the region’s proud past, and throwing away its historic assets, but instead focusing on its core values. For many reasons — geography, weather, history — the region cannot remake itself into California, the Pacific Northwest or the Northeast Corridor. Instead the Great Lakes can best restore its legacy as an aspirational region by focusing on the very real things that constitute its historic DNA.

Joel Kotkin is executive editor of NewGeography.com and Distinguished Presidential Fellow in Urban Futures at Chapman University, and a member of the editorial board of the Orange County Register. He is author of The City: A Global History and The Next Hundred Million: America in 2050. His most recent study, The Rise of Postfamilialism, has been widely discussed and distributed internationally. He lives in Los Angeles, CA.

This piece originally appeared at Forbes.

Great Lakes map by BigStock.