With the Obama proposal to get some money for infrastructure, it is time to revisit the payoff from investments in transportation. Investments that improve the performance of transportation in the US will pay for themselves in 17 years through increased economic activity and the resulting gains in federal tax revenue. The rate of return for national investments in transportation is 7%, significantly more than the cost of borrowing. Recently released research verbalizes a theory of why the performance of infrastructure matters for the economy.

Transportation provides the foundation for all economic activity. Transportation is used to bring labor and inputs to places of production, to deliver final goods and services to end users and to bring customers to the market place. How well is it doing its job? In an economy the size of the US even small improvements can mean big dollar gains. Making the investment to improve transportation performance can result in a measurable return on investment with a payback period that is well short of the life-expectancy of most transportation infrastructure.

Just as infrared is the invisible part of the spectrum of light, it often seems that infrastructure is the invisible part of the economy. It has become popular – especially since the turn of the century – to think of the economy as increasingly dependent on the insubstantial and the ethereal – emailing, e-trading, e-commerce. The reality is that all commerce – even e-commerce – eventually depends on transportation infrastructure. After all, someone has to get the computer components from the factory to the e-business; and when the computer hardware breaks down, someone will likely use transportation infrastructure to get to the place of business to fix it. No e-commerce can occur until transportation infrastructure is used to get the equipment to the location where rare earth minerals are extracted and to take those minerals to the factory – usually on another continent – where workers arrive via transportation infrastructure to build the computers in the first place. In many ways, there can be no commerce – “e“ or otherwise – without bricks-and-mortar infrastructure.

Despite repeated outcries for additional funding, transportation spending in the US was more than $100 billion under budget in the first decade of the new century. While there is much debate about how much to spend on transportation, since 1980 (1990), federal spending on transportation in the US has been $152.3 billion ($125.5B) less than budgeted. Federal spending on transportation exceeded budget in only four years: 2011 by $6.5 billion (the most ever), 2012 by $4.4 billion, 1996 by about $3 billion, and 1995 by $50 million. The $10.9 billion spending over-budget in 2011 and 2012 was necessary to fulfill commitments from 2009, when spending was under-budget by an extraordinary $40.7 billion. Excluding 2009, the average annual under budget since 1980 (1990) was $3.5 billion ($3.8 billion).

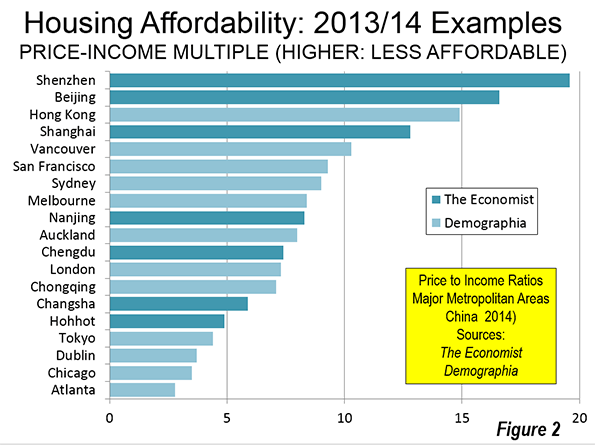

Figure 1 Federal Spending Over/Under-Budget 1980-2012

Data Source: Budget of the United States, Transportation Budget Authority FY 2011, Table 3.1 Outlays by Superfunction and function, updated with Table 5.1 from FY2014 tables; actual spending through 2012. Red on either line indicates spending over budget for that year. Author’s calculations.

Table 1 Federal Spending Under-Budget by Decade

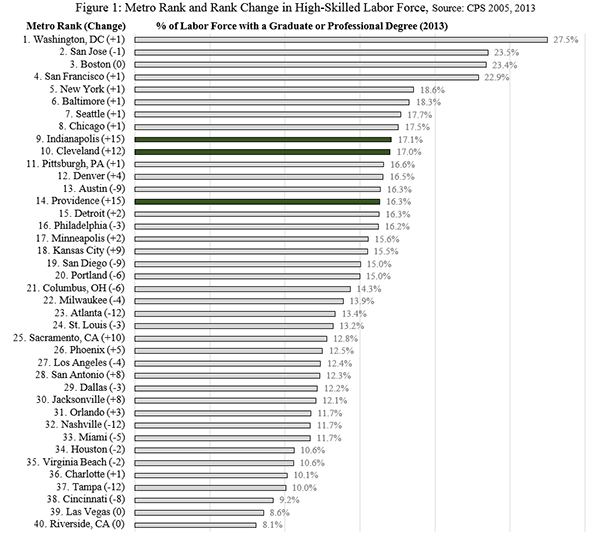

Worse yet, transportation policy has been allowed to stagnate: the strategic economic goals and performance measures in the Department of Transportation’s 2014 performance plan are nearly identical to the 2002 plan. Economic competitiveness is one of the strategic goals set by the US Department of Transportation (Performance Plan FY2014, available at www.dot.gov). By their definition, economic competitiveness means maximizing the economic returns of the network and keeping the transportation system responsive to consumer needs. This may sound like the kind of initiative that would allow the US to stay globally competitive. However, these strategic goals are little changed from ten years ago; and most of the performance measures in the 2014 economic strategy were the same in 2002. Each strategic goal is also associated with a line-item in the federal budget, making them more than just slogans, making them actual cost centers.

Figure 2 Department of Transportation Performance Plans

Clearly, what the US needs now is better planning and strategic project selection, plus streamlined delivery processes to increase the productivity of infrastructure investment. Most of the existing transportation infrastructure could not handle the coming surge in demand. The surge is not only the result of organic growth in the size of the country, but also from an increase in the fundamental reliance of our economy on the use of transportation infrastructure. The result will be a nation falling further and further behind our global competitors.Yet, the world that business moves in has changed significantly as has the way that business moves. The service sector – the fastest growing part of the economy – is increasingly dependent on transportation. The services sector has the second fastest growing usage of transportation services (after construction) and remains the fastest growing sector in the US economy. Measuring the economy’s response to a change in the demand for transportation services, DOT-RITA conclude that “an investment in … transportation will have a greater economic impact than an equally sized investment in trade or utilities.” Investments to improve air transportation services would have the biggest economic impact. Except for rail transportation, the impact of improving the nation’s airports is bigger than investments in government and information services.

Table 2 World Economic Forum, Global Competitiveness Report 2009-2010

*The European Union economy is the largest in the world (CIA, 2013). Scores are the result of responses to questions in the format: “How would you assess the quality of [X] in your country? (1 = extremely underdeveloped; 7 = extensive and efficient by international standards),” where [X] is “Basic Infrastructure”, “Roads”, Railroads”, etc. Scores for 2009-2010, US rank for transportation infrastructure was little change in 2012-2013 (13th). Details available at http://www.weforum.org/

What will it cost?

The US has more airports, roads and railways than any other country in the world – only Russia, China and Brazil have more waterways. However, the US is not alone in needing massive investments in infrastructure.

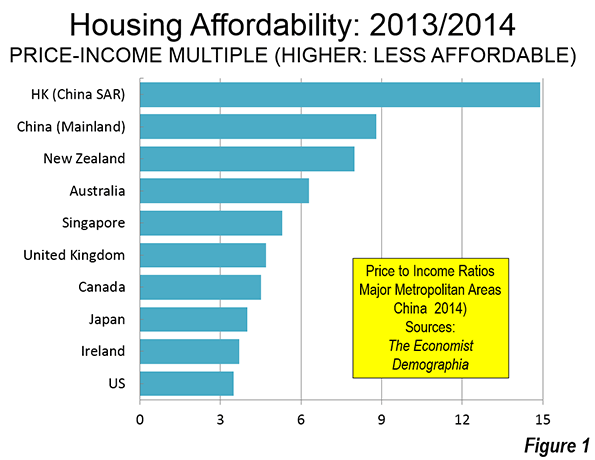

The total investment needed for all infrastructures worldwide is estimated at $53 trillion through 2030, with a total of $15.5 trillion just for transportation. The Organization for Economic Cooperation and Development and others estimate a cost equivalent to 3.5% of GDP to improve infrastructure across all sectors – water, energy and transportation. A report from McKinsey Global Institute (McKinsey Infrastructure Practice) calculates that this investment is 60% more than all spending in the last 18 years; and more than the estimated value of today’s worldwide infrastructure. Consulting firm Booz Allen projects the cumulative infrastructure spending needs for the US (and Canada) from 2005 to 2030 to be $936 billion for road and rail and $432 billion for airports and seaports (about $1.4 Trillion total). Dividing this between the US and Canada in proportion to real GDP, just over $1.2 trillion is needed to upgrade the performance of US transportation infrastructure to first class.

For the purpose of demonstration, let’s assume that the entire $1.2 trillion is invested in the US in 2014. The latest models demonstrate that the economic gains would begin to appear as higher GDP per capita in 2018. The economy starts 2018 at a level that is higher than it would have been without the investment in infrastructure. By 2025, the economy is larger by an amount greater than the initial investment in 2014. In financial terms, the investment has a 17 year payback period – substantially shorter than the life expectancy of transportation infrastructure. Taking 25% of the gain each year as government revenue (average government tax revenue as a percent of GDP in the US), the cumulative increased tax revenue will exceed the cost by 2025. A standard, basic financial analysis well-understood by both business executives and policy-makers shows a 7% internal rate of return – a number significantly higher than the borrowing costs for financing transportation infrastructure investments in the United States.

Paying For It

But what about the rest of the story: where does the initial funding come from to make the needed performance improvements? There is no “free ride” here – the construction and renovation of transportation infrastructure carries a hefty price tag that has to be paid one way or another. The options currently under discussion among researchers and policy makers in the United States are:

1. The status quo – which has not worked in over 20 years.

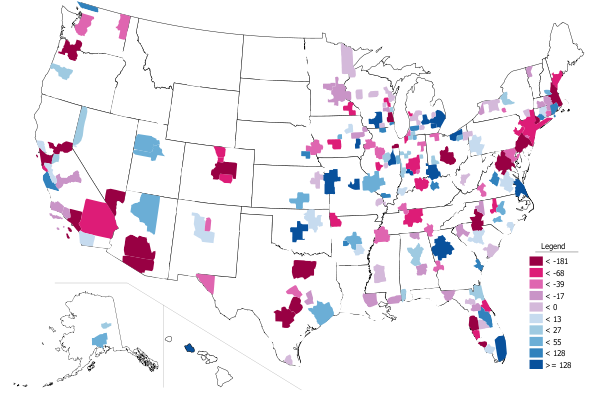

2. Reducing demand – One way to improve performance is to discourage the use of transportation infrastructure. Joel Kotkin reports the work of demographer Wendell Cox on the new migration to America’s “Efficient Cities” – resulting in net outmigration from America’s most congested cities. Smaller populations are one way that the demands on infrastructure may fall naturally – but with potentially undesirable consequences for economic growth. While American’s do more driving than any other nation on earth, there is some new evidence that the long standing trend of increasing driving is tailing off.

3. Increasing user fees — Unfortunately, user fees are wrought with difficulties. First, “congestion pricing” fees are used to reduce demand rather than as a way to generate a revenue stream (with the obvious exception of some toll roads). There are several specific challenges: federal barriers to implementing fees and transaction costs are the most obvious. While the impact of fees as a revenue mechanism may be modest, there are additional implications for land use patterns and policies. Urban Land Institute provides an important cautionary note on tolling that could be applied to user fees in general. If the fees are permanent and not limited to rewarding investors in a particular facility, local policies will need to be established regarding the distribution of income beyond the designated payback period. The alternative, of course, is to tie the period of the fees to the reward and repayment of investors.

4. Public-Private Partnerships — Also known as PPP or P3 – cover a spectrum of financing options ranging from private concession operators to privately owned roads. At the lowest level on the PPP spectrum are private operators who raise their own financing for upfront costs and ongoing operations for concessions such as food service on highway plazas or newspaper stands inside train stations. Their revenue generally comes from sales. At a higher level, risk is allocated between public and private partners (e.g., public carries demand risk, private carries construction risk). Financing is often shared and comes in the form of both equity and debt. The revenue stream to repay debt (or reward equity investors) comes from user fees. In “build, operate, transfer” (BOT) cases, the government’s role changes from manager, operator and financier to regulator. Effective government controls on safety and security, anti-competitive behavior (access, pricing, service quality, etc.) are critical to the success of these projects. The final level is a purely private project which is used for public purposes. The private owner/operator builds the facility. A revenue stream is necessary to service debt, repay financial loans/borrowings, and reward capital investment. Freight railroads in the US are a good example of privately financed infrastructure in the US.

There is no lack of private money – especially under the current conditions of Federal Reserve intervention in the economy. According to a 2013 study by consulting firm McKinsey, an additional $2.5 trillion will be made available for infrastructure financing by 2030 if institutional investors meet their target allocations. The trouble is finding ways to direct revenue back to the private investors.

Other Revenue Streams

How do we create that revenue stream to attract private investment into public infrastructure? Americans are notoriously opposed to paying for public goods. Branded revenue opportunities are just coming on the table in the US but have been used wide and far in other countries.

Branded revenue streams – or private advertising in public spaces – has come a long way since realtors put their faces on benches or lawyers put their names on the backs of city buses. Branding now extends to the infrastructure itself. New York City’s Metropolitan Transit Authority added branding to turnstiles and train doors. More opportunities exist, including entrances, escalators, stairs, trains, overpasses, poles, walls, and even floors. Phoenix and Denver expect to earn up to $1 million in annual revenue from wrapping light rail trains in advertisements.

Branding is not limited to print, either. New York, Chicago and Santa Monica are exploring LED advertising on the sides of busses. Dayton, Champaign-Urbana, Toledo (TARTA) and Kansas City (KCATA) have audio ads timed to promote businesses along routes. Just as advertising in metro transit is no longer limited to framed posters on subway platforms, highway advertising is no longer just for billboards. Why not, as pictured here, allow branding on overpasses? In November 2010 (USA Today November 22), cash-strapped California considered generating a much-needed revenue stream by allowing advertisements on emergency (“Amber-alert”) highway signs. But even these signs are virtual antiques. Ideas for where and what can accommodate an attractive yet discrete opportunity for a branded revenue stream are only limited by the number of pixels that can be used in an electronic display.

The Way Forward

All is not doom and gloom. There is a new, improving trend in the performance of transportation infrastructure in the United States. These improvements are a reflection of broad-based initiatives on both the supply and the demand sides. Meanwhile, the US continues to decline in the global rankings for poor transportation infrastructure (World Economic Forum, Global Competitiveness Index, shown earlier). Although US road, rail and even port rankings manage to stay in or near the top 20 in the world in the rankings, the US airport infrastructure quality ranking fell from 9th in the world in 2007-2008 to 32nd in 2010-2011 (currently at 30th).

The underlying question is not how much to invest it is how that investment can deliver improvements in infrastructure. Analysts at McKinsey estimate that streamlining infrastructure delivery alone could generate 15% in cost savings. Clearly, additional funding alone is not enough. We also need innovative ways to fund, build, maintain and operate the vital transportation structures that support economic activity.

Acknowledgements: Some of this material was previously published as STP Working Paper 2014_02, Calculating the Real Economic Payoff of Infrastructure. The Let’s Rebuild America initiative at the US Chamber of Commerce is headed by Janet Kavinoky. Funding for the project was also provided by the National Chamber Foundation in Washington, D.C. The original project team for developing indices to measure the performance of infrastructure in the United States was led by Michael Gallis and Associates of Charlotte, NC. The author is grateful to Kamna Pandey in New Dehli (India) for her slide show on revenue streams.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Dr. Trimbath’s credits include appearances on national television and radio programs and the Emmy® Award nominated Bloomberg report Phantom Shares. She appears in four documentaries on the financial crisis, including Stock Shock: the Rise of Sirius XM and Collapse of Wall Street Ethicsand the newly released Wall Street Conspiracy. Dr. Trimbath was formerly Senior Research Economist at the Milken Institute. She served as Senior Advisor on United States Agency for International Development capital markets projects in Russia, Romania and Ukraine. Dr. Trimbath teaches graduate and undergraduate finance and economics.

This piece was originally published by IO Sustainability.