Our country is six years into the Great Recession, the biggest economic downturn since the Great Depression. It’s been replete with reports of home foreclosures, collapsing commuter towns, and young people struggling to become home owners. The term “generation rent” is often used in the media to describe the struggles of aspiring young people.

This is really a problem of upward mobility, and how little the political system has responded to this problems of “generation rent” and those who have lost their homes. The current lack of action can be contrasted with the two very different periods in our economic history – the Roaring Twenties and the Great Depression.

When discussing home ownership, many often bring up the efforts of Franklin Delano Roosevelt during the Great Depression. FDR called a nation of homeowners “unconquerable.” But his administration really built on the ideas of previous administrations. Herbert Hoover, while serving as Warren Harding and Calvin Coolidge’s Secretary of Commerce, lent his support the “Own Your Own Home Campaign” of the Federal National Mortgage Association. This campaign touted the benefits of home ownership to the American people. And when Hoover became president, he created the Federal Home Loan Bank Board which chartered and supervised federal savings and loan institutions and created Federal Home Loan Banks to lend money to finance home mortgages. The purpose of this bank was to make homeownership cheaper for lower income people. It also represented a portion of Hoover’s efforts to fight the depression, and those efforts often went unrecognized by the American people both then and now. Hoover said home ownership could "change the very physical, mental and moral fiber of one’s own children."

After being elected president, Roosevelt created the Federal Housing Administration which insured homes made by banks and other lenders. The agency made it possible for people to pay for homes over three decades, before this period most homes were paid for through a three to five year loans. This program, followed up by Harry Truman’s support of veteran’s home loans and the home mortgage interest deduction, helped turn a nation of urban tenement dwellers into a nation of suburban home owners. Today, the federal government spends billions in subsides to ensure people have the opportunity to own their own homes.

Urbanist Richard Florida discusses the issue of home ownership in the 2010 book The Great Reset. In his interesting but misguided book, he correctly points out that too many people attained loans in the housing bubble and that high rates of homeownership hobble the labor market, as owning a home makes it harder for the job seeker to move. He also faults the Obama Administration for trying to do too much to prop up the mortgage market and recommends that the government quit supporting home ownership and start supporting renting to a greater extent. He said Fannie Mae has already taken steps in this direction by allowing people who experienced foreclosure to rent their houses.

But Florida is overstating the importance of renting in the lives of the American people, as we have a strong heritage as an upwardly mobile, ownership society that stretches back to the homesteading legislation pushed by Thomas Jefferson and Abraham Lincoln. But there’s no doubting that we’re a more mobile society than in the homesteading days. While FDR built on the work of his Republican predecessors, today’s leaders also have a template in the cooperative housing movement. According to the National Association of Housing Cooperatives, cooperative housing is defined as when “people join together on a democratic basis to own and control the housing or community facilities where they live.” Each month those who live in a housing cooperative pay their share of the expenses while sharing the benefits of the cooperative. According to the NAHC, 1.2 million families live in cooperative housing in the United States.

What if we could create more forms of cooperative housing to make sure families have the opportunity to own a home and at the same time have a certain amount of mobility? Could a new Cooperative Housing Authority, with funding from Fannie Mae, buy up foreclosed houses and charge a monthly below market rate to a family? All such houses could be considered a part of the CHA and the family in the house would share in the profits of the authority. If and when the family moves, they’ll be entitled to those profits which could be used for rent or a down payment on a house. Such a program would help commuter towns who are suffering from high gas prices and foreclosures.

But a Cooperative Housing Authority would also be a conduit for affordable housing in America’s big cities and the surrounding suburbs, as the added supply of new housing forces the cost down. This would be an asset to certain cities where the supply of affordable housing is dwindling due to gentrification. Like most cooperative housing, the housing could take various forms: condos, townhomes and single family homes. I would suspect single family homes would be the most popular because they are the preference of most Americans.

A Federal Community Land Trust could be along with a CHA another way to deal with affordable housing shortages. Like any land trust, it could add civic buildings, commercial spaces and community assets to the areas where the housing exits. This would ensure mixed/use type neighborhoods where residents would have access to shopping and civic life nearby.

Returning to FDR’s administration, during the 1930s the government constructed what was called garden suburbs outside of major cities: Greenbelt, Maryland; Greenhills, Ohio; and Greendale, Wisconsin. The garden suburbs were intended to house rural people who were migrating to the city as well as poor urban workers. The project was a two way street, as the government provided the road grid and cheap credit for the suburbs while aspiring families provided the mortgage payments. These garden suburbs – designed to be suburban with some green (trees and parks) – provided a template for the mass automobile suburbanization that occurred in the 1950s.

Of course, urbanists have never quit critiquing this suburban development model since it emerged. Like many in the city planning world, Lewis Mumford was horrified at the way suburbanization played out after World War II:

"The planners of the New Towns seem to me to have over-reacted against nineteenth-century congestion and to have produced a sprawl that is not only wasteful but–what is more important–obstructive to social life."

Mumford advocated the regional city – a city that included an urban core surrounded by well-planned suburbs, as he also rejected the densely packed cities of the decades before the war.

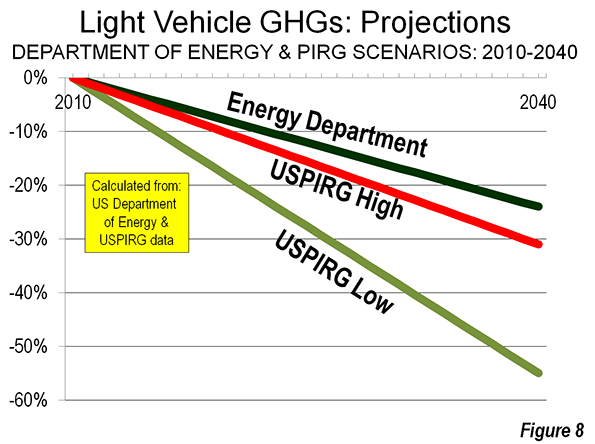

Could a FCLT and CHA work to create family friendly suburbs with mixed use development, and in turn save families money on energy and at the same time spare the environment more greenhouse gas pollution? I think that it could, and if these developments were to become a reality, Lewis Mumford’s vision of a regional city might look like a reality.

Jason Sibert is a freelance writer who has lived in the St. Louis Metro Area since the late 90s. He worked for the Suburban Journals for a decade and his work has appeared in various publications over the last four years.

Chicago housing cooperative photo by Jennifer D. Ames.