Just under a year before she crawled over Kevin Rudd to claim the Prime Minister’s office, Julia Gillard visited the United States in her then capacity as Australia’s Education Minister. Her stay in Los Angeles took in the Technical and Trades College, where she brushed up on the teaching of “green skills,” a subject close to her heart. “Here in Los Angeles," she told the media that day, “under the leadership of Governor Schwarzenegger, this is a state that is looking to the future; this is a state that is leading on climate change adaption; and this is a state that’s leading on green skills and I’ve seen that on display today at this college.”

The date was 5 October 2009. As far as dud forecasts go, these platitudes don’t match Lincoln Steffens on the Soviet Union – “I’ve seen the future and it works” – but they’re bad enough. Today Schwarzenegger has gone, his reputation in tatters, and California, reduced to issuing IOU’s to pay its bills, teeters on the brink of bankruptcy.

Australians have long seen California as a trend-setter, given the common Anglophone culture and semi-arid climate on the Pacific Rim. There’s also the shared love of motor car mobility and suburban independence, and a voracious appetite for tech and entertainment products pouring out of Hollywood and Silicon Valley. But these days the Golden State is just as likely to fill Australians with unease. They find themselves infected with a strain of the green-welfare-utopianism that brought California to its knees.

Sure, this doesn’t show up in official statistics; at least not yet. Gillard and Treasurer Wayne Swan never tire of reminding Australians they are “the envy of the world”: unemployment at 4.9 per cent, GDP growth of 3 percent (or more) this financial year, government debt to GDP ratio of just 23 percent and a projected budget surplus in 2013. In April, the IMF predicted that Australia would be the best performing advanced economy over the coming two years. The government and its allies in the elite media are hyper-vigilant about containing discussion of the nation’s affairs within this bounteous frame.

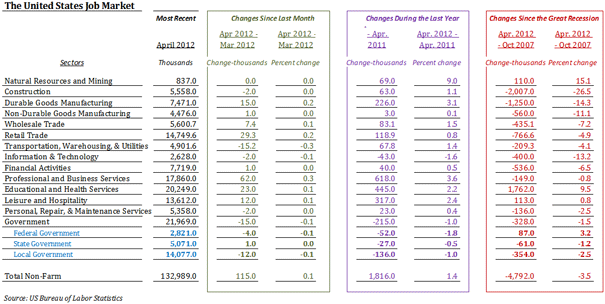

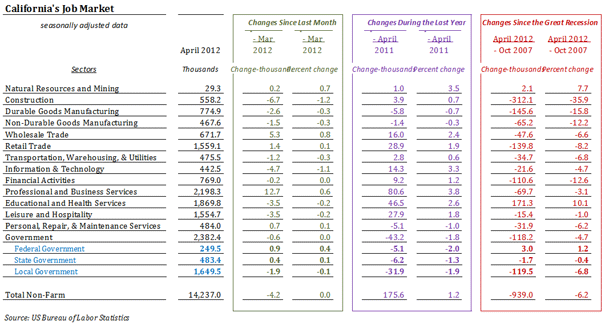

It’s hard to reconcile Australia’s position with the plight of California, which routinely attracts phrases like “basket case.” Unemployment is running at around 11per cent, significantly above the national US average of 8.2 percent, and Governor Jerry Brown is struggling with an intractable budget deficit of around $US20 billion. Thousands of teachers and other public servants are being laid off, and revenue imposts are driving businesses to other states. One commentator went so far as to say “California’s situation is in some ways more worrisome than Greece’s,” since it represents 14 per cent of the American economy, while Greece only accounts for 2 per cent of the EU.

But if any of this is supposed to make Australians feel good about their lot, it doesn’t. However benign the headline figures look, they’re in a restive mood. The Westpac-Melbourne Institute index of consumer sentiment continues to languish in negative territory, and the latest Roy Morgan Monthly Business Confidence Survey recorded a 57 percent fall in businesses which believe “Australia will have good economic conditions in the next 12 months”. Astonishingly, the recent Boston Consulting Group consumer sentiment survey found that Australians feel less financially secure than the average European, even less secure than Spaniards, whose economy is in meltdown.

Nor is much love flowing to Gillard and Swan. Stuck in opinion-poll hell – support for the government has been around 30 percent for over a year – they would be thrown out in a landslide if an election were held today.

Why are Australians so low when their economy is so high? The chattering classes are in a funk over this conundrum. People should be showering this fine progressive government with praise, they insist. In patronising tones so familiar around inner Sydney and Melbourne, one columnist scribbled “we are, as a nation, chucking a full-on, all-screaming, all-door slamming teenager temper tantrum … Maybe it’s time we grew up and realised how good we’ve got it.” Others suggest more sober explanations.

Topping the list is Gillard’s absurd $23 a tonne carbon tax, effective from 1 July this year. Most pundits are loath to concede that, in international terms, the measure is quite radical and Gillard only embraced it to appease the Greens. From the comfort of their armchairs, they dismiss fears about the tax as irrational. After all, Treasury modelling indicates that the effect on growth will be minuscule and, under the government’s package, households will be over-compensated for cost of living increases. If only the Opposition would drop its inflammatory attacks, they maintain, the pessimism would disappear.

Some blame the negative wealth-effect of sliding house prices and shrinking superannuation funds, battered by stock market volatility.

No doubt, such factors do contribute to the malaise, along with loss of faith in a parliament hit by financial and sexual scandals implicating the Speaker and a Labor MP. But opinion-makers who refuse to look beyond the headline figures are concealing the larger story. Across a range of traditional industries, workers grasp that the economy is shifting in directions that could erode the foundations of their mobility and independence. Understanding more than they are given credit for, they fear that the current Labor Government, beholden to Greens and academic elites, and hiding behind stodgy rhetoric, is driving or exploiting those shifts. The most visible manifestations of this are the carbon tax and other green agendas.

These workers have cause to be worried, if they glance across the Pacific. In his close analysis of the California crisis, US demographer Joel Kotkin starts with the premise that “California consolidated itself as a bastion of modern progressivism.” Drawing on extensive evidence, Kotkin exposes the suffocating influence of radical environmentalists, progressive high-tech venture capitalists, Hollywood moguls, and civil rights attorneys, who have given California escalating energy costs – 50 per cent above the US average and rising – and dwindling fossil-fuel energy exploration and production, America’s sixth highest tax rates, also rising, coupled with proposals to skew the tax system in favour of the super-rich against microbusinesses, the third heaviest tax burden on business out of the 50 states, enormous subsidies and tax breaks for solar and other renewable-energy producers, and complex labour laws.

“California’s green policies”, says Kotkin, “affect the very industries – manufacturing, home construction, warehousing, and agribusiness – that have traditionally employed middle and working class residents”. With reason, Kotkin calls these developments The New Class Warfare. There is indeed a class dimension to discontent in the United States and Australia, and it has nothing to do with the confected class-war rhetoric coming out of the Obama Administration – “we must all pay our fair share” – and the Gillard Government –“spreading the benefits of the [mining] boom”.

John Black, a demographic profiler and former senator, points out that since Labor came to power in 2007, “public administration, education, and health sector jobs have accounted for almost six out of ten of the 760,000 jobs created, instead of the longer term two out of ten.” The health industry alone has grown by 260,000 jobs in four years, a figure that equates to some 2.6 per cent of the whole workforce. Over those years, manufacturing, which accounts for 8.3 of total employment, lost close to 100,000 jobs.

Last year, “health care and social assistance” replaced “retail trade” as the largest occupational category profiled by the Australian Bureau of Statistics, while “manufacturing” along with “agriculture, forestry and fishing”, traditional blue-collar hubs, were the only categories to contract. "Education and training" and "public administration and safety" ranked higher than "transport, postal and warehousing" and "wholesale trade".

Job-shedding by a succession of manufacturing, retail and construction firms has dominated recent news bulletins. According to Black, if not for growth in the publicly-funded sector, the employment rate would be closer to 7 than 5 percent.

If Gillard and Swan are to be believed, such shifts are beyond their control. In a major address on the economy in February, Gillard explained that “the level of the dollar – and the pace of its rise – has broken some business models and forced economic restructuring”. Displaying Marie Antoinette levels of indifference, she declared “these are powerful, economy-wide transformations, perhaps best thought of as ‘growing pains’.” If you thought this posed a complex challenge, think again. “The equation is simple,” she said, “skills brings jobs, and skills bring job security.”

Here Gillard genuflects to the progressive dogma that education is the answer to every economic problem. It’s hardly surprising that a movement dominated by academics, researchers, educators and university administrators should claim ownership of the path to salvation. But Gillard has it back-to-front. In activities like manufacturing, economic growth brings jobs, which bring skills, not the other way around.

It’s true that the mining boom and Australia’s safe credit rating have driven the dollar to near or above parity with the greenback. It’s also true that this has exerted pressures on the export and import-competing sector. But government action has intensified these pressures. Labor is ideologically committed to social gentrification and expansion of the white-collar professional classes, particularly in social services, even if this means transferring resources from productive industries that will slow down, stagnate, shrink or vanish.

While Gillard and Swan would never be so candid, their allies in Australia’s bulging university system, the public sector unions and the Greens aren’t so inhibited. Nor are Labor figures like former Prime Minister Paul Keating, who criticised the Opposition’s attack on the carbon tax in these startling terms:

… in this country, 80 per cent of people work in the tertiary economy, in services, in the industry like – as we are tonight, in the service economy. And, the new industries, the green industries, are service industries, not the old manufacturing. Manufacturing’s moved to the east [meaning East Asia]. It’s the service industries that are the new growth industries. So, to turn your back on the mechanism which allocates the capital out of the old industries and into the new ones is to turn your back on the future.

If Gillard Labor cared about blue-collar and other routine jobs, not to mention the small business sector, they would switch to policy settings that spur growth in industries like manufacturing, retail, transportation and logistics, construction and forestry. Cutting spending, reducing company and other business taxes, junking green taxes and green tape, withdrawing from the debt market and liberalising industrial relations would hand employers more flexibility to cope with the high dollar and low cost competitors in Asia.

Clearly, this isn’t the government’s priority. Instead they have introduced a carbon tax and a mining tax, and in last month’s budget dropped a proposed cut in company tax, they are throwing at least $2.7 billion at various green schemes, not including the “winner picking” $10 billion Clean Energy Fund, they have adopted a Renewable Energy Target of 20 per cent by 2020, they are pouring vast sums of money into higher education to the tune of $5 billion a year including an additional $5.2 billion in the budget, some of which will find its way into a maze of “sustainability institutes,” they have lifted the cap on university places and embarked on a radical plan to expand the proportion of 25 to 34 year olds with a bachelor’s degree to 40 per cent by 2025, they have re-regulated the labour market and imposed a system which, according to the chairman of BHP-Billiton, “is just not appropriate and doesn’t recognise today’s realities,” they have laid the groundwork for new multi-billion-dollar programs in aged, disability and mental health care, employing tens of thousands of new carers, and they have endorsed an industrial tribunal decision that boosts the pay of these workers by up to 65 percent.

California here we come.

John Muscat is a co-editor of The New City, where this piece first appeared.

Photo of Australian Parliament House by BigStockPhoto.com.