The recent announcement that California’s unemployment again nudged up to 12 percent—second worst in the nation behind its evil twin, Nevada—should have come as a surprise but frankly did not. From the beginning of the recession, the Golden State has been stuck bringing up a humbled nation’s rear and seems mired in that less-than-illustrious position.

What has happened to my adopted home state of over last decade is a tragedy, both for Californians and for America. For most of the past century, California has been “golden” not only in name but in every kind of superlative—a global leader in agriculture, energy, entertainment, technology, and most important of all, human aspiration.

In its modern origins California was paean to progress in the best sense of the word. In 1872, the second president of the University of California, Daniel Coit Gilman, said science was “the mother of California.” Today, California may worship at the altar of science, but increasingly in the most regressive, hysterical, and reactionary way.

California’s dominant ruling class—consisting of public-employee unions, green jihadis, and Democratic machine politicians—has no real use for science as Gilman saw it: as a way to create prosperity for its citizens. Instead, the prevailing credo of the state has been how to do everything possible to return to its pre-settlement condition, with little regard for what that means to the average Californian.

Nowhere was California’s old technological ethos more pronounced than in agriculture, where great Californians such as William Mulholland, creator of the Los Angeles Aqueduct, and Pat Brown, who forged the state water project, created the greatest water-delivery system since the Roman Empire. Their effort brought water from the ice-bound Sierra Nevada mountains down to the state’s dry but fertile valleys and to the great desert metropolis of Southern California. Now, largely at the behest of greens, California agriculture is being systematically cut down by regulation. In an attempt to protect a small fish called the Delta smelt, upward of 200,000 acres of prime farmland have been idled, according to the state’s Department of Conservation. Even in the current “wet” cycle, California’s agricultural industry, which exports roughly $14 billion annually, is slowly being decimated. Unemployment in some Central Valley towns tops 30 percent, and in cases even 40 percent.

And now, notes my friend, Salinas Mayor Dennis Donohue, green regulators are imposing new groundwater regulations that may force the shutdown of production even in areas like his that have their own ample water supplies.

Salinas was the home town of John Steinbeck, author of The Grapes of Wrath and great chronicler of Depression-era California. Today for many in hardscrabble, majority-Latino Salinas, home to 150,000 people, The Grapes of Wrath is less lyrical than real. “California,” notes Donohue, a lifelong Democrat, “remains intent on job destruction and continued hyper-regulation.”

California’s pain is not restricted to farming towns. The state’s regulatory vigilantes have erected a labyrinth of rules that increasingly makes doing almost anything that might contribute to increased carbon emissions—manufacturing, conventional energy, home construction—extraordinarily onerous. Not surprisingly, the state has not gained middle-skilled jobs (those requiring two years of college or more) for a decade, while the nation boosted them by 5 percent and archrival Texas by a stunning 16 percent over the same time period.

There is little chance that the jobs lost in these fields will ever be recovered under the current regime. As decent blue-collar and midlevel jobs disappear, California has gone from a rate of inequality about the national average in 1970, to among the most unequal in terms of income. The supposed solution to this—Gov. Jerry Brown’s promise of 500,000 “green jobs”—is being shown for what it really is, the kind of fantasy you tell young children so they will go to sleep.

Many Californians who aren’t slumbering are moving out of the state—and not only the pathetic remains of the old Reaganite majority. According to the most recent census, those leaving the state include old boomers, middle-aged families, and increasingly, many Latinos as well. Outmigration rates from places like Los Angeles and the Bay Area now rival those of such cities as Detroit. In the last decade, California’s population grew only 10 percent, about the national average, largely due to immigrants and their offspring. Population increases in the Bay Area were less than half that rate, while the City of Los Angeles gained fewer new residents—less than 100,000—than in any decade since the turn of the last century!

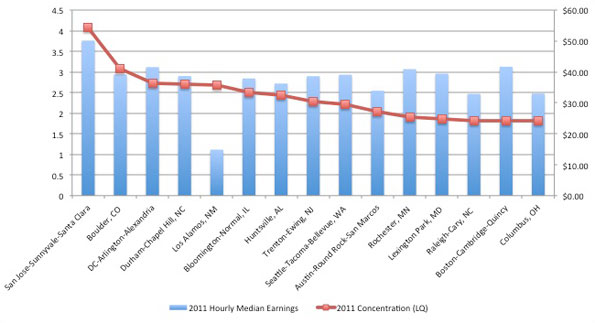

Increasingly, California no longer beckons ambitious newcomers, except for a handful of the most affluent, best educated, and well connected. Through the 1980s and even through the late ’90s, the aspirational classes came to California. Now they head to other, more opportunity-friendly places like Austin, Houston, Dallas, Raleigh-Durham, even former “dust bowl” burghs like Des Moines, Omaha, and Oklahoma City. Meanwhile, Golden California, particularly its expensive, ultragreen coast, gets older and older. Marin County, the onetime home of the Grateful Dead and countless former hippies, is now one of the grayest urban counties in the country, with a median age of 44.

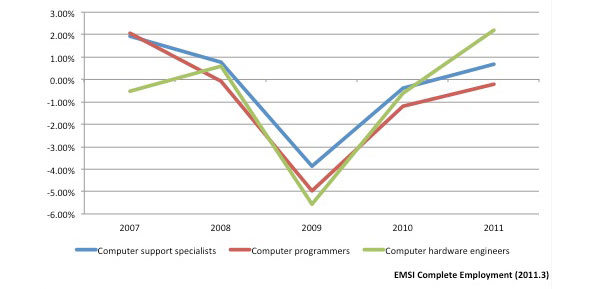

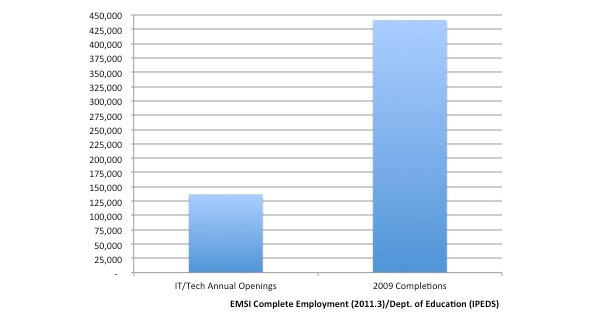

Of course, the self-described “progressive” mafia that runs California will point to Silicon Valley and its impressive array of startups. But for the most part, firms like Google, Twitter, and Facebook employ only a small cadre of highly educated workers. Overall, during the past decade the state’s high-tech employment fell by almost 4 percent, while Texas’s science-based employment grew by a healthy 11 percent. The sad reality is that turning T-shirt-wearing kids like Mark Zuckerberg into multibillionaires doesn’t do much to reduce unemployment, which even in San Jose—the largely blue-collar “capital” of Silicon Valley—now hovers around 10 percent.

Magazine cover stories and movies cannot obscure the fact that entrepreneurial growth—the state’s most critical economic asset—has now stalled. In fact, according to a study by Economic Modeling Specialists Inc., last year the Golden State ranked 50th among the states in creating new businesses.

California remains rich in promise, home to spectacular scenery; a great Pacific location; leading firms like Apple and Disney; and a still-impressive residue of talented, diverse, entrepreneurial, and ingenious people. But the state will never return until the success of the current crop of puerile billionaires can be extended to enrich the wider citizenry. Until the current regime is toppled, California’s decline—in moral as well as economic terms—will continue, to the consternation of those of us who embraced it as our home for so many years.

This piece originally appeared at The Daily Beast.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University, and an adjunct fellow of the Legatum Institute in London. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050, released in February, 2010.

Photo by wstera2.