“Indeed by some accounts, most embarrassingly in a recent Time magazine cover, the shift to green technologies has already created a “thriving” economy.”

Blog

-

Contributing Editor MICHAEL LIND on The Socratic Gadfly regarding the pledge

First, yes, Michael Lind is spot on. We should be pledging to other people, not the government.

-

Contributing Editor AARON RENN on Archizoo

A piece (also reflecting on the “zillions of pictures to illustrate the vast emptiness of Detroit) in the Urbanophile blog by Aaron Renn on “Detroit as the New American Frontier” was resurrected in the New York Times and Time magazine. “One thing this massive failure has made possible is ability to come up with radical ideas for the city, and potentially to even implement some of them. Places like Flint and Youngstown might be attracting new ideas and moving forward, but it is big cities that inspire the big, audacious dreams. And that is Detroit.”

-

From Mahwah to Rahway

I have never lived in New Jersey. Indeed, of the 49 states where I have driven a car, New Jersey was 47th or 48th on the list. And it is only in the last couple of years that I’ve lived close enough to visit the state regularly – I now live less than an hour from Mahwah.

Years ago, I made some initial hypotheses about the Garden State:

1. New Jersey is extraordinarily wealthy.

2. New Jersey has the best highway system in the country.

3. New Jersey deserves the moniker “The Garden State.”

4. New Jersey embodies the American Dream.Let’s see how these have withstood the test of time.

I spent a year in Africa in 1996-97, and visited New Jersey shortly after my return. By comparison, everything seemed wealthy – supermarkets, Walmart, hot & cold running water, public parks. But add to that the mile upon mile of suburban homes, each with a well-maintained yard, an SUV or two parked out in front, and real estate prices that I certainly couldn’t have afforded. Is it any wonder that I thought the streets were paved with gold? Driving along I-80 in my 12 year old Ford Taurus, surrounded by Mercedes, Lexus, Volvo and Acura cars, I felt like a country bumpkin cousin come for a visit.

We stayed with some friends who lived in city center Passaic, an old rust belt town. Not rich – I agree – but hardly poor. Suffice it to say that the poverty rate in New Jersey (real poverty – not the fictional sort compiled by the Census Bureau) is vanishingly small.

The Great Recession has tarnished this view a bit, but still, New Jersey is a fabulously wealthy state. Is there any other place in the world where so many are so rich?

As a native Oregonian traveling back east for the first time, I expected crumbling highways, littered sidewalks, huge traffic jams, hopelessly polluted air, and so forth. On this score, New Jersey disappoints. Indeed, I was astonished at how well maintained and how efficient the road network was. And if – adjusted for the amount of traffic – New Jersey doesn’t have the best highway system in the world, it certainly comes close.

There are many highways – Routes 17, 23 and 46 come to mind – that are four-lane divided highways with few or no traffic lights, but are not limited access. This turns out to be very efficient. Local businesses are well-served (they don’t all have to congregate at exits), traffic still flows at 55 mph or so, and they don’t compromise safety too much. The amount of traffic that uses Route 23 between Butler and US 46 is phenomenal, and yet the road also serves as a main commercial street for a large region.

It is for highways like this that the term “jug handle” was invented, for in order to turn left or to make a u-turn, it is necessary to exit right and go around the jug handle. I heard this term first (and only) in New Jersey.

Still, I have some complaints. The toll collections on the Turnpike or the Garden State Parkway are hopelessly inefficient, and lead to huge traffic jams. Further, signage throughout the state is less than ideal; if you don’t know where you’re going, you can get very lost in New Jersey. And the Great Recession has changed things: I’ve noticed more potholes and less maintenance in the past couple of years.

The highways seem to have a bias against Philadelphia. Some bizarre Rube Goldberg contraption connects Philly with the New Jersey Turnpike. And famously, I-95 – otherwise uninterrupted from Presque Isle to Miami – skips the stretch from New Brunswick to Trenton. Philadelphia from my house is at least 30 miles farther than it needs to be (not that that’s been any problem). Was W.C. Fields a New Jersey native?

New Jersey is a beautiful state. Coming from the West, one crosses the Delaware River on I-80, and then crosses spectacular mountains for the first 30 miles or so. The Jersey Shore is very nice – all the way down to Cape May (excepting, perhaps, Atlantic City). The Palisades are wonderful, as is the Hoboken/Jersey City skyline as seen from the Staten Island Ferry.

Finally, New Jersey embodies the American Dream. My wife and I make a monthly shopping run to Jersey City for ethnic food. Journal Square is a place that always makes me feel patriotic, for there one finds Indian, Honduran, Cuban, Filipino, Chinese, Thai, Korean, Mexican, and who knows what other kinds of grocery stores and restaurants. Nearby Newark Avenue is little India west of Kennedy Ave., and little Manila on the other side. Only in America? Maybe on a much smaller scale also in Canada or Australia. But Jersey City is living proof of the universal principles on which our country is founded: Life, Liberty and the Pursuit of Happiness.

I know many immigrants who, over the course of 20 years, moved from a shared room in Jersey City, to an apartment in a place like Passaic, to a suburban home in Pompton Lakes or Woodbridge. The American Dream is real and happens every day in New Jersey.

The Great Recession may have set this back a few years, but there is enough entrepreneurial energy in a place like Jersey City to more than justify faith in the future of America.

Is this a great country, or what?

I had a colleague who, when I asked where she grew up, shamefacedly and apologetically admitted “New Jersey.” I recall a Kojak episode where all the bad guys came from “Jersey.” There’s the Woody Allen quip: “the spirit of the Lord inhabits the entire universe except for some parts of Northern New Jersey.”

There are politicians who want to make the American Dream unaffordable, if not actually illegal. New Jersey gets a bad rap. But I like New Jersey. And some day – when I’m rich – I might get a chance to actually live there.

Daniel Jelski is Dean of Science & Engineering State University of New York at New Paltz.

-

The Essence and Future of Texas vs. California

I know there have been a lot of articles and references to Texas vs. California recently in this blog, but, well, there’s a new one with some genuinely new contributions to the argument ("America’s Future: California vs. Texas", Trends magazine, hat tip to Jeff). And it says some nice things about Houston too, so how can I pass on it? The beginning of the article is here – including an overview of both states’ situations – but here are some key additional excerpts:

…Both the Brookings Institution and Forbes Magazine studied America’s cities and rated them for how well they create new jobs. All of America’s top five job-creating cities were in Texas. It’s more than purely economics and regulation can explain, though. Texas – and Houston in particular – has a broad mix of Hispanics, whites, Asians, and blacks with virtually no racial problems. Texas welcomes new people and exemplifies genuine tolerance. When Hurricane Katrina hit, Houston took in 100,000 people. Not surprisingly, Houston has more foreign consulates than any American city other than New York and Los Angeles.

…

But, how did this happen? What’s wrong with California, and what’s right with Texas? It really comes down to four fundamental differences in the value systems embodied in these states:First, Texans on average believe in laissez-faire markets with an emphasis on individual responsibility. Since the ’80s, California’s policy-makers have favored central planning solutions and a reliance on a government social safety net. This unrelenting commitment to big government has led to a huge tax burden and triggered a mass exodus of jobs. The Trends Editors examined the resulting migration in “Voting with Our Feet,” in the April 2008 issue of Trends.

Second, Californians have largely treated environmentalism as a “religious sacrament” rather than as one component among many in maximizing people’s quality of life. As we explained in “The Road Ahead for Housing,” in the June 2009 issue of Trends, environmentally-based land-use restriction centered in California played a huge role in inflating the recent housing bubble. Similarly, an unwillingness to manage ecology proactively for man’s benefit has been behind the recent epidemic of wildfires.

Third, California has placed “ethnic diversity” above “assimilation,” while Texas has done the opposite. “Identity politics” has created psychological ghettos that have prevented many of California’s diverse ethnic groups and subcultures from integrating fully into the mainstream. Texas, on the other hand, has proactively encouraged all the state’s residents to join the mainstream.

Fourth, beyond taxes, diversity, and the environment, Texas has focused on streamlining the regulatory and litigation burden on its residents. Meanwhile, California’s government has attempted to use regulation and litigation to transfer wealth from its creators to various special-interest constituencies.

They go on to make six forecasts:

- …expect to see California’s loss of jobs to Nevada accelerate…

- …expect to see a backlash in California and across the country against regulations, especially green initiatives that can’t clearly demonstrate a positive ROI…

- Watch for the smart money, including venture capital, to begin migrating to Texas for start-ups in many areas, including energy, info-tech, manufacturing, and biotech. Just as Delaware’s tax laws once encouraged numerous businesses to incorporate there, even when they had no connection to the state, Texas will become a magnet for new businesses by offering cheap land, a favorable regulatory environment, a business-friendly culture, and a large supply of skilled labor. Unless California revamps dramatically, expect to see its economy languish, even as the recovery takes off.

- To make its business climate even more business-friendly, Texas will invest heavily in secondary education and work hard to attract the best talent to its research universities (note the recent Tier 1 proposition and funding). Keep an eye especially on the University of Texas, which already has a first-rate campus and faculty. Within 10 years, UT, as the locals call it, may well rival Stanford or Berkeley.

- Other states will adopt tort reform measures pioneered in Texas. Unlike California and most other states, Texas has been aggressive in minimizing the enormous burden of frivolous lawsuits…

- Look to Texas to become a cutting-edge cultural mecca. Houston has always offered a vibrant cultural scene, ever since the Alley theater company was founded there in 1947 by Nina Eloise Whittington Vance. In the 1950s, John and Dominique de Menil moved to Houston with one of the most significant private collections of art in the world and began donating art and money to the Houston Museum of Fine Arts. Both institutions have grown to world-class status since then. In the coming years, this trend will spread to the major cities of Texas (take that, Dallas!), attracting the best talent and money and shifting the cultural balance of the nation away from New York and San Francisco.

I can personally vouch for #5. I was just visiting my brother out in CA, and a friend of his with a small store was being hit with a large disability discrimination lawsuit for a minor oversight (handicapped parking was marked on the ground and had the requisite walkways and ramps, but lacked a pole sign). Evidently this has become a cottage industry in California, where lawyers guide the disabled through stores looking for very minor violations of a vague law (things like high shelves or tables), then sue (expecting a quick settlement, of course). Under CA law, discrimination guilt is assumed if there’s anything in the store the disabled can’t do that a normal customer can do, regardless of the availability of employees to provide assistance. His friend was clearly exasperated with the unwinnable situation. Just plain nuts.

As Jim Goode says, "You might give some serious thought to thanking your lucky stars you’re in Texas."

When the Fat Lady Sings: The Fate of Commercial Real Estate

During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing trillions of investor equity. The Federal Government pushed TARP, a $700 billion bail-out, through Congress to rescue the beleaguered financial institutions. The collapse of the financial system was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

***********************************

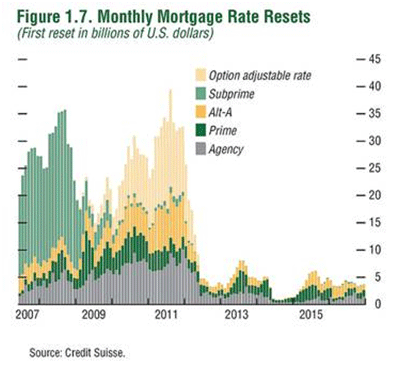

Like the Roaring Twenties of a century ago, the real estate bull market of the last ten years crashed in dramatic style in late 2008. The collapse of the residential market was led by massive defaults in ill-conceived “sub-prime loans”. Millions of American homes are now in default and in the process of loan modification, abandonment or foreclosure. There is no end in sight as Prime, Alt-A, and Option ARM loan resets come due beginning in 2010.

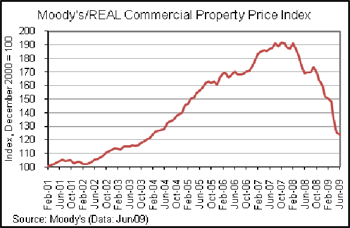

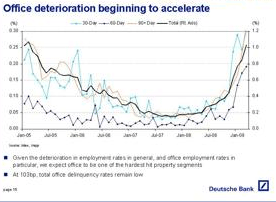

Lurking around the corner, literally unnoticed by the average American worried about keeping his home, is a similar crisis in commercial real estate. For over a year commercial property values have been plummeting and have not begun to recover. A drive through both major cities and suburbia tells the story. Vacant stores, empty shopping malls, cancelled mixed use developments and eerily empty car lots presage bad things to come.

We have discussed the origins of the housing crash before and the role played by feckless politicians and over-ambitious bankers. Now this crisis has spread to the commercial sector. Banks and commercial lenders saw in the new housing starts an equally promising demand for new shopping malls and suburban offices. Lenders forgot about pre-leasing requirements and made speculative loans on buildings that had no pre-leasing. As with housing, the rule book was thrown out the window. Like the aftermath of any wild party, there is hell to pay in the morning. It is morning in the commercial marketplace and the fat lady is singing.

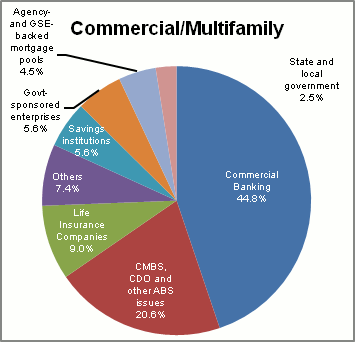

Depository institutions hold about half of the $3.2 trillion of debt on US commercial property. The default rate in the first quarter of 2009 was just 2.25%. Sounds OK until you do the math and realize that $36 billion was in default and it is just beginning. The FDIC puts troubled banks on “the problem list”. In early 2008, there was one bank on the list. At the end of June 2009 there were 416, up from 305 at the end of the first quarter when the default rate was just 2.25%. Total assets at these problem institutions total $299 billion. The problem is that the total reserves of the FDIC are just $42 billion. The FDIC has closed over 100 banks and one good estimate is that they will close around 10% of US banks, 500 to 1,000, before the crisis runs its course. The losses will dwarf the $394 billion of the RTC and may surpass a trillion dollars. Is there any wonder why banks are loathe to make new loans?

So what happens to commercial real estate? With prices plummeting, there must be some great buys out there, one must assume. But do not bet on it. This was not just an earthquake. The plates shifted, and like musical chairs, when the music stops there will be fewer chairs and many people left standing. Consolidation is the next step. There will be the inevitable drop in rents and with it property values. The better and stronger tenants will flee the less attractive Class B and Class C space and move to Class A properties. Class A properties will survive due to full occupancy and stable cash flow. But the lesser properties that were leased will empty.

Like the suddenly quiet auto malls with the empty Pontiac, Saturn and Chrysler dealerships, lesser properties will lose their anchor grocery stores, Targets, and big box users. With the anchors gone, and traffic with it, the mom and pop small businesses cannot survive. There is no future for the marginal Class C shopping center. Tenants will flee to better locations and more affordable lease rates. Class A offices will survive. Well located and attractive Class B properties may muddle through at reduced revenues – if they can survive the refinancing maze. But, the poorly located Class C office will remain a “see-through” for years to come. Old, tired, and mostly vacant Class C office buildings line the crumbling freeways of Detroit, Cleveland, Youngstown, and countless smaller rust belt cities where excess capacity has eliminated the need for new development.

A year from now, the landscape of America will be forever changed. The office and retail markets will be vastly different than they look today. Not much of it will be good. Five years from now, will empty shopping centers and auto dealerships remain shuttered or will they be rebuilt or torn down and their use converted to something more productive? Will our politicians cease their meddling in the market and allow the market to heal itself? These are questions that will haunt our economy for the next decade.

***********************************

This is the fourth in a series on The Changing Landscape of America. Future articles will discuss real estate, politics, healthcare and other aspects of our economy and our society.

Robert J. Cristiano PhD is a successful real estate developer and the Real Estate Professional in Residence at Chapman University in Orange, CA.

PART ONE – THE AUTOMOBILE INDUSTRY (May 2009)

PART TWO – THE HOME BUILDING INDUSTRY (June 2009)

PART THREE – THE ENERGY INDUSTRY (July 2009)

PART FOUR – THE ROLLER COASTER RECESSION (September 2009)

Think Globally, Regulate Locally

It was during a recent tour of a sun-baked Los Angeles schoolyard that theories on state regulations developed by the latest Nobel Prize-winning economist came into focus. The Da Vinci Design Charter School is an oasis in an asphalt desert. Opened this year by the appropriately named Matt Wunder, the school draws 9th and 10th graders from some of the most difficult and dangerous learning environments in the country, and introduces them to a demanding, creative atmosphere.

The school is located just south of Los Angeles Airport. Wunder is taking advantage of the area’s proliferation of aerospace companies, and is building relationships with the likes of Boeing and Northrop Grumman, which offer financial and educational assistance. This is not the standard thinking one finds in the mammoth Los Angeles Unified School District.

As we walked the playground we came upon two dirt-spewing holes in the blacktop, spaced about 50-feet apart. We discovered an actual human being with a shovel digging what looked like the beginnings of a mine shaft. The reason?

California State regulations, as established by the California Architects Board, require all basketball hoops on public school campuses to be cemented into 50-inch deep holes. That’s four-feet-two inches for a basketball hoop!

Now I am sure some scientifically sound earthquake testing at a California university found that such precautions are necessary if we are ever struck with a 9.9-Richter scale disaster. Of course, if such a thing happened we would have bigger problems than basketball rims keeling over. But a larger point became clear: In a school where creative leadership is making life-long impacts on the lives of children, the “long arm” of Sacramento has reached into the very soil, regulating how deep to dig ditches for recreational equipment. In so doing the State not only increases “construction” costs, but also incurs our disenchantment, as we consider a government that “trusts” local decision-making on curriculum, but not on hole digging.

The theories of Elinor Ostrom, one of this year’s two Nobel Prize-winners in economics, tie in here with stunning irony. Ostrom, a political scientist at Indiana University, won the prize for her historical and economic analysis concerning the “tragedy of the commons”: the theory that, without some form of regulation, when people fish or farm “common” (non-private) property they will tend to abuse the privilege and hurt all interests in the end.

A major underpinning of this theory is how these rule sets are most effectively developed. Ostrom found, in studies dating back centuries, that local parties –- sometimes non-governmental ones — almost always determine the best regulations, based on deliberated self-interest as opposed to centralized (and, often, distant) institutions.

As Vernon Smith, a past economics Nobel laureate himself, recently commented on Ostrom’s work, “A fatal source of disintegration is the inappropriate application of uninformed external authority, including intervention to prevent application of efficacious rules to political favorites.” As rule-making becomes more removed from the actual location of execution, there’s a loss of “local knowledge” regarding conditions. And “interests” that tend to gather around centralized institutions have a disproportionate influence on legislation.

At a recent conference on sustainable planning at Pepperdine University, I sat in on a discussion of “natural resource management” and heard a relevant story of competing, predominantly left-leaning interests. In one corner were the “green” energy folks who had attempted to build a massive solar “farm” in the Mojave Desert. In the same, uh, other corner, were the defenders of the desert tortoise. Not wanting to get anyone in trouble, I will just say that officials from several State and Federal departments were present to talk about how, once again, centralized decision-making had sunk an impressive project.

Apparently, when alerted to the possibility of frying turtles under the heat of these huge solar mirrors, local park authorities provided a proposal to mitigate the loss of these reptiles through a variety of measures from fencing along the highways to moving the turtles to non-developed areas. This was not good enough for State decision-makers who, from the exalted heights of Sacramento, determined that the only legitimate course of conservation would be to land-swap the entire 8,000+-acre land parcel for another similar and suitable section for these animals. As one local official recounted, “If the goal of the policy is to save tortoises, we had that plan, which also kept the solar project alive. But the goal of the policy was to do a land exchange, which is stopping the project, and not doing all that much better for the tortoises.”

My point in raising these two of what could be thousands of examples of overreach by the administrative state is not to dismiss government’s central and important role in advising, and, at points, regulating the actions of citizens in areas ranging from public safety to sustainable planning. Rather, it’s to demonstrate what happens when policy goals are subsumed by prescriptive policy created at levels (such as Sacramento in a state the size of California) which cannot possibly allow for unique local conditions. The goal is not just child safety, or saving tortoises, but to accomplish these in a certain way that may, in fact, prevent these greater benefits to the public good.

This style of governance exasperates the well-intentioned in both the private and public sector, as it prevents the liberty necessary for creative and customized policy-making. This common sense approach to policy-making is, apparently, what they give out Nobel Prizes for these days.

It was Alexis De Tocqueville who most famously realized that the genius in American governance was decentralized administration , an aspect directly contrary to the European bureaucratic experience. In words that could have appeared in Professor Ostrom’s classic, Governing the Commons, De Tocqueville wrote over 150 years ago, “When the central administration claims to replace completely the free cooperation of those primarily interested, it deceives itself or wants to deceive you. A central power, however enlightened… cannot gather to itself alone all the details of the life of a great people.”

Let us not be so deceived.

Pete Peterson is Executive Director of Common Sense California, a multi-partisan non-profit organization that supports civic engagement in local/regional decision-making. His views here are not meant to represent CSC. Pete also teaches a course on civic participation at Pepperdine University’s School of Public Policy.

Contrived Sustainability

The draft reauthorization of the federal surface transportation program (highway and transit) in the House of Representatives is filled with initiatives to reduce greenhouse gas emissions, often by seeking to encourage compact development (smart growth) policies. Dr. Ronald D. Utt of the Heritage Foundation discovered an interesting definition in the draft: “sustainable modes of transportation” means public transit, walking, and bicycling” (Section 333(P)7, page 219, accessed November 18, 2009).

This definition would mean that a Toyota Prius that emits one-half as many grams of greenhouse gases per passenger mile as a transit system (not an unusual occurrence) is not sustainable transportation, while the transit system is. There will be more cases like this as time goes on, as vehicle fuel economy improves and the impact of alternative fuel technology is expanded. This is irrational and the worst kind of ideology.

It is possible, of course, that this is simply sloppy legislative drafting. But given the persistence of the compact development lobby and its contribution to pending legislation in Washington in the face of respected research demonstrating its scant potential, something else may be operating. The wording may betray an agenda more concerned with forcing people to accept the favored (and anti-suburban) lifestyles that an urban elite has long sought to impose on others than it is to reduce greenhouse gases. Sustainability in greenhouse gas emissions is not about the hobby horses of one group of advocates or another, it is rather about reducing greenhouse gas emissions as efficiently as possible. The Transportation and Infrastructure Committee and the rest of Washington needs to focus on ends, not means.

Provisions that pick particular strategies, without regard to their effectiveness, have no place in a crusade so much of the scientific community has characterized in apocalyptic terms. Moreover, such disingenuousness, in the longer run, could whittle away the already apparently declining support for reducing greenhouse gas emissions.

California: The Housing Bubble Returns?

To read the periodic house price reports out of California, it would be easy to form the impression that house prices are continuing to decline. Most press reports highlight the fact that house prices are lower this year than they were at the same time last year. This masks the reality of robust house price increases that have been underway for nearly half a year. The state may have forfeited seven years of artificially induced house price escalation in just two years but has recovered about one-fifth of it since March.

California Housing Market Since 2000: In 2000, the average median house price among California markets with more than 1,000,000 population was $291,000. The Median Multiple (median house price divided by median household income) was 4.5, making houses in California approximately 50% more costly relative to incomes than in the rest of the nation.

According to the California Association of Realtors, the average median price peaked at $644,000 between 2005 and 2007, depending upon the particular market. This nearly 140% price increase translated into a more than doubling of the Median Multiple, to 9.2.

Median prices fell rapidly from the peak, dropping at their low point to an average of $315,000. The average Median Multiple fell to 4.4, slightly below the 2000 level, but still well above the national level. All markets reached their low points in the first part of 2009.

It is at this point that the business press lost track of what was going on. Of course, year on year price declines continued, but only because the price declines had been so severe early 2008. Since the bottoming out of house prices, there have been strong gains. As of September, the average median house price among the major metropolitan areas was $383,000, a nearly 20% increase from the low point. Moreover, in dollar terms, median house prices recovered nearly 20% of their loss from the peak to the low point.

| Major California Markets: Median House Prices: 2000 to Present | ||||||

| Metropolitan Area (MSA) | 2000 | Peak | Low Point | 2009/09 | Loss: Peak to Low Pt | Change from Low-Pt |

| Los Angeles: Los Ang. County | $ 215,900 | $ 605,300 | $ 295,100 | $ 351,700 | -51.2% | 19.2% |

| Los Angeles: Orange County | $ 316,200 | $ 747,300 | $ 423,100 | $ 496,800 | -43.4% | 17.4% |

| Riverside-San Bernardino | $ 144,000 | $ 415,200 | $ 156,800 | $ 172,400 | -62.2% | 9.9% |

| Sacramento | $ 172,000 | $ 394,500 | $ 167,300 | $ 184,200 | -57.6% | 10.1% |

| San Diego | $ 231,000 | $ 622,400 | $ 321,000 | $ 386,100 | -48.4% | 20.3% |

| San Francisco | $ 508,000 | $ 853,900 | $ 399,000 | $ 536,100 | -53.3% | 34.3% |

| San Jose | $ 448,000 | $ 868,400 | $ 445,000 | $ 553,000 | -48.8% | 24.3% |

| Average | $ 290,700 | $ 643,800 | $ 315,300 | $ 382,900 | -52.1% | 19.4% |

| Exhibit: Median Multiple | 4.5 | 9.2 | 4.4 | 5.2 | ||

| Above Historic Norm (3.0) | 50% | 208% | 46% | 73% | ||

| Derived from California Association of Realtors and National Association of Realtors data | ||||||

| Note: California Association of Realtors divides the Los Angeles MSA into Los Angeles and Orange counties | ||||||

Profligate Lending: It is critical to note that the inflated house prices that existed two to three years ago were wholly artificial. Prices had been driven up by the special and hopefully never to be repeated conditions of profligate lending, which increased demand.

California: Regulating Away Housing Affordability: But the increase in demand alone would not have been enough to produce the unprecedented house price increases had public officials and voters not established a veritable mish-mash of housing supply regulations. The house price increases were driven ever higher by these severe land use restrictions, which prevented housing markets state from meeting demand.

Supply restrictions, which go under various names, such as compact development, urban containment and “smart growth,” have been a feature of California housing for some time. Examples of such policies are urban growth boundaries, building moratoria and expensive development impact fees which disproportionately tax new homes for the expanded community infrastructure a rising population requires.

As more loose lending practices increased the demand for home ownership, the inability (and unwillingness) of the state’s land use regulations prevented the housing supply from increasing in a corresponding manner. With demand for housing far outstripping supply, prices had nowhere to go but up. The result was short term house price escalation that may have never occurred before in a first-world nation.

Contrast with Healthy Housing Supply Markets: There was a stark contrast with house price increases in the liberally regulated markets around the nation. For example, in Atlanta, Dallas-Fort Worth and Houston, house prices remained near or below the historic Median Multiple norm of 3.0, as the supply vent was allowed to operate. This is despite the fact that there was a strong underlying increase in demand for home ownership (measured by domestic migration) in these and other liberally regulated markets. In the California markets, on the other hand, there was overall negative underlying demand, with significant domestic out-migration. Of course, speculation ran rampant in California, as could be expected in any market where asset values are responding to a severe shortage of supply relative to demand.

By the 1990s, Dartmouth’s William Fischel had associated California’s high house prices relative to the nation with the intensity of its land use regulation. In 1970, as the more severe regulations were beginning, house prices in California were at approximately the same level relative to incomes as in metropolitan areas in the rest of the nation.

California’s disproportionate losses are illustrated by the fact that its major metropolitan areas have less than twice as many total owned houses as those in Texas (Dallas-Fort Worth, Houston, San Antonio and Austin), yet experienced gross value losses 85 times as great as the Texas metropolitan areas by Meltdown Monday (September 15, 2008, when Lehman Brothers failed).

Recent Price Increase Rate Exceeds the Bubble: While widely unnoticed, the post-bottom median house price has increased 20%. In six months or less, the average median price increase among California metropolitan areas exceeded the annual price increase for all of the bubble years except one, which was 22% in 2004. The 2009 price increase rate, annualized, is nearly double that. As a result, despite the widely reported bubble collapse, California’s housing affordability now is worsening relative to the rest of the nation. The prospect could be for further inflation of the bubble, with the passage of Senate Bill 375, which is likely to lead to even more intensive land use restrictions, on the false premise that higher densities will materially reduce greenhouse emissions. As governments increasingly force development to occur only where it prefers, the property owning winners can extract much higher prices than would occur if there were more competition.

This of course will mean that the more dense housing units built will be even more expensive, even as the market is prohibited from supplying the larger detached homes that households overwhelmingly prefer. All this will make California less competitive, something the increasingly uncompetitive Golden State could do without.

Another View: The recent price escalation, however, may be illusory. The widely read California real estate blog, Dr. Housing Bubble suggests that the first wave of “sub-prime” loan failures that constituted the bubble burst could be followed by a second wave over the next few years, driven by “option arm” mortgage resets. The Doctor notes that these loans are concentrated in California and other ground zero states (Florida, Arizona and Nevada), unlike the previous wave, which was more evenly spread around the nation.

In the End: Regulation Will Lose the Day: Thus, the “jury is still out.” The bubble may be re-inflating in California, or another bust could be on the horizon. However, in a state that has given new meaning to regulatory excess, the longer run prospects call for artificially higher housing prices, unaffordable to much of the state’s middle class. This means that California will continue to become an ever-more bifurcated state, between an aging, largely affluent coastal homeowning population and, well, just about everyone else.

Photograph: Los Angeles (Porter Ranch in the San Fernando Valley)

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

Long Beach Freeway Saga

The Los Angeles Times reports progress toward completion of the Long Beach Freeway (I-710) gap between Valley Boulevard in East Los Angeles and Pasadena, with a geologic study finding a tunnel alignment to be feasible. Real progress is overdue. My great aunt and great uncle were forced out of their house in the early 1960s in South Pasadena by the California Highway Department, in anticipation of building the freeway. I suspect the house is still there.

For nearly one-half century, South Pasadena residents have opposed building the “Meridian” route that would have dissected the city. They were not against the freeway per se, but rather preferred the “Westerly” route, which would have skirted the city. The state had selected the Meridian route. In the middle 1980s, while a member of the Los Angeles County Transportation Commission, I served on a special route selection committee chaired by former county supervisor Peter F. Schabarum. Under our legislative authority, we also selected the Meridian route. Nothing came of it.

It is to be hoped that serious efforts to close the gap will be underway soon.