Could oil price manipulation have created the rerun of the Great Depression that we are currently enduring?

Think about it. The doubling of gas prices had a profound effect on disposable income and the affordability of housing, whose subsequent downturn set the stage for economic collapse.

We now know that Wall Street speculation drove oil from $69 a barrel to nearly $150. But this article purports to explain why.

Back in early 2004, the nation’s investment banks began making large investments in oil stocks, which became the so-called “story stocks” of the era. The story was obvious. Emerging nations like China and India were driving up demand for oil, and supplies weren’t keeping pace.

The investment banks had their analysts write papers espousing the profits to be made from oil, and they promoted the commodity itself as an asset class like real estate, stocks, and bonds, suggesting that it was suitable for long-term investment.

To prove their point, the investment banks began investing in oil in the futures market. But their reason had nothing to do with what they were telling investors. It had to do with the long positions they held in oil stocks, which were certain to appreciate with the rise in the value of oil as a commodity. Exxon-Mobil stock, for example, went from around 40 in the spring of 2004 to a high of 95 on December 24, 2007. Merry Christmas and a Happy New Year!

It was around this time that the Petroleum Marketers Association, which represents more than 8,000 retail and wholesale home heating oil companies and gas station owners, began getting hate mail. They were being blamed for gouging the public, even though their costs had more than doubled.

Early in 2008, I received a call from a former stock brokerage client of mine, who is the CEO of a concern with factories and production facilities in China. “Tim, I keep getting these investment letters from the banks telling me how China is slurping up all this oil. But it simply isn’t true. Sure, the country is growing quickly, but no faster than last year, and certainly not enough to double the price of oil in less than a year.”

Around the same time, Art Rosen, the former president of the National-Committee on U.S.- China Relations, also told me that China could not account for all the price spikes in oil. From what he could tell, there was plenty of product readily available at supply terminals throughout the Middle Kingdom.

Now we know how this happened. The investment banks went to regulators to obtain permission to increase their leverage from a factor of 12 to a factor of 40 times capital. Much of that leverage was being applied to the already heavily leveraged oil market, where $10,000 controls over $100,000 of product. In the new scenario, $10,000 in the hands of an investment bank controlled $4 million in product.

The levered effect on the price of oil was such that it began drawing huge amounts of money from stock and bond funds into the commodities markets, and specifically the market for oil. Institutional investors ranging from the Harvard Endowment to sovereign wealth funds got in on the oil action, which rose from $13 billion to over $300 billion in commodities transactions in just three years. At one point the markets were trading 27 barrels of crude oil for each barrel of oil that was actually being consumed in the United States, positions so large that they move the market in the cash commodity. In a single day in the price of oil jumped by more than $25, and yet there were no hurricanes or other supply disruptions that might have accounted for it.

A report out of the MIT Center for Energy and Environmental Policy Research clearly showed that the dynamics of supply and demand for the cash commodity could not have been responsible for such a run-up in oil prices, which reached its steepest levels during an interval when supply was going up and demand was falling.

By this time the price of gas was rising to five dollars a gallon. The owner of a $400,000 house who commuted by car suddenly discovered that that the price of gasoline had doubled and his commute was costing more than his mortgage payment. Something had to give and it was his mortgage. Suddenly, the $400,000 houses were worth $200,000, the mortgages were underwater, and the banks were drowning in red ink. The cascade in housing prices was soon mirrored in the price of oil. The money on Wall Street was now pulling out of the oil patch to drive down the bank shares and their mortgage-backed assets, setting the stage for the deepest economic contraction since the Great Depression.

There’s plenty of blame to go around. But once again (as in Frontrunning and Finance; New Geography.Com), most of it should be borne by the people on Wall Street, best described as a bunch of crumbs held together by dough.

Tim Koranda is a former stockbroker who now works as a professional speechwriter. He can be reached at koranda@alum.mit.edu.

We have previously reported on the development of a carbon neutral, single story 2,150 square foot

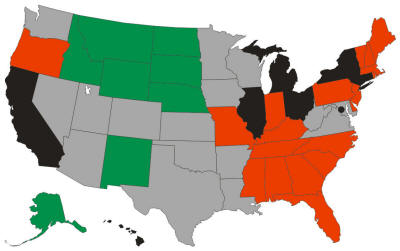

We have previously reported on the development of a carbon neutral, single story 2,150 square foot  Using employment growth rates as the measurement criteria:

Using employment growth rates as the measurement criteria: