For the last century, one enduring cliché has been that when America sneezes, the world catches a cold. But now the big power with the sniffles is China.

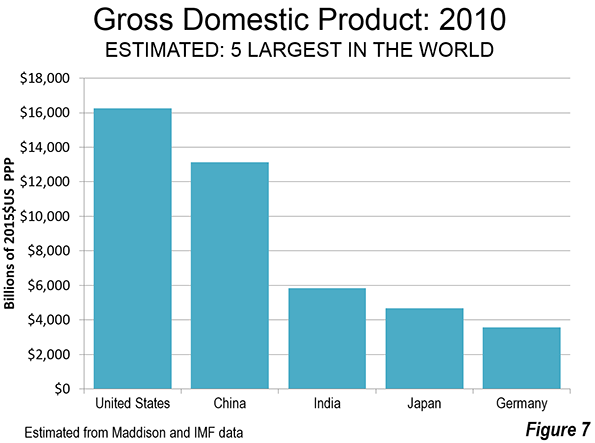

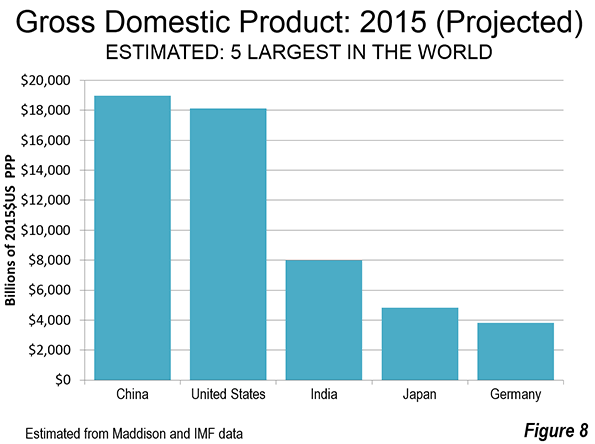

China’s rise has been the most profound development of the past half century, turning a moribund, rural country into a highly urbanized economic superpower. Hundreds of millions have been lifted out of poverty, and markets around the world reshaped. China alone accounted for a whopping 24.1% of global economic growth from 2003 to 2013. according to the IMF.

This also means that when China stumbles, as it is now, the impact is widely felt. The current economic slowdown, and the government’s reaction to it, notably currency devaluation and possible controls of capital flight, could impact economies today much as American crises brought on a global depression in the 1930s and ushered in a global recession seven years ago.

Some claim that China is headed toward a total financial meltdown. But it seems more prudent to assess the impact of China’s economic retreat with the caveat that this may be a short-term phenomenon, as the country showed remarkable resiliency through the recent global recession. However, in the short term, there are several categories of cities which may feel some downdraft from China’s slowdown.

The Luxury Cities

Outside of the stock market, probably the biggest impact of China’s swoon will be in real estate. Real estate and hospitality, mostly hotels, accounted for 65% of the $6.4 billion in U.S. investment by Chinese interests in the first half of 2015. Owning property is something of an obsession among Chinese, in part due to an instinctive distrust of the stock market. Despite all the attention paid by Western media to the Chinese stock market crash, only one in 30 Chinese own stock.

Chinese have been investing heavily in overseas real estate now for a decade, and for the most part those investments are concentrated, not surprisingly, in what I call the “luxury cities,” wealthy global hubs where some Chinese also want to settle but historic returns also have been highest. This has been a major part of the outflow of capital from China, which has been accelerated by the perception of a weakening economy.

But now there are indications that the Communist Party is ready to impose greater restrictions on private overseas investment, which could start slowing the outflow of funds into real estate, notes Mollie Carmichael, an analyst at John Burns Real Estate Consulting. This could upend economies in many parts of the high-income world.

Globally the most popular cities for Chinese real estate investors are spread over a wide territory, including such places as Vancouver, Toronto, Australia’s Melbourne and Sydney, Singapore and London. Some experts are already warning of a crash in multi-family apartment across Australia. Each of these cities has a sizable Chinese minority. The huge Chinese investment in Vancouver began before the transfer of Hong Kong back to China from Britain, but the flow of money has continued in recent years.

These impacts also will be felt in the United States, where Chinese rank second only to Canadians as real estate investors. Buyers from China, Hong Kong and Taiwan spent $22 billion on U.S. homes in the year ending March 2015, up 72% from the same period in 2013 according to the National Association of Realtors. But this surge may be coming to an end, particularly in coastal Southern California, the San Francisco Bay Area, New York and Hawaii, which have been favorites among of Chinese investors. John Burns reports an imminent decline in Chinese investment activity in Orange County, a hotbed for flight capital.

These areas, not incidentally, have also been hotbeds of real estate inflation in the bubble era and again more recently. A slowdown in Chinese investment could halt, or even reverse, some of the big bets being made there. Of course, this could also be music to the ears of prospective new American investors, and homebuyers, who now do not have to deal with competition from Chinese investors.

The Commodity Economy

Some of the biggest impacts of China’s slowdown have been in commodities, notably oil, gas and food. As demand for these products decline, the impact on cities around the world that depend on this sector could be severe. This is most evident in the developing world, from Brazil to Nigeria to South Africa; a drop in Chinese investment, notes Brookings, could be disastrous for African countries that have grown to rely on capital from the Middle Kingdom.

Also at risk are Canadian cities such as Calgary as well as Australian cities, notably Perth, that also have gotten rich selling raw materials to China. Australia, with an economy and population less than a 10th that of America’s, exports twice to the Middle Kingdom than the United States.

Any slowdown in China will help undermine oil prices. None of this will be good for such places asHoustonOklahoma City and much of Louisiana, which are already hurting from supply competition with OPEC. Similarly a decline in farm prices, also related to China’s flagging demand, could hit such farm-oriented metropolitan areas as Omaha, Fargo and Minneapolis. The Great Plains, which has thrived from the commodity boom, could take a bit of a hit.

Yet there’s good news here, particularly for American consumers and those in developing countries, whose food prices have eased. Low energy prices also could help “downstream” producers of oil products, such as refineries, petrochemical facilities and some pharmaceuticals companies. This, notes Houston economist Bill Gilmer, could actually help industrial parts of Houston, particularly along the ship channel, amidst negative impacts on businesses involved in energy exploration and development.

The Industrial Sector

China’s ascendency has been powered by its factories. Foreign companies that supply the high-end machinery that they use will be hurt, including many in Germany and Switzerland. Exports are already falling from South Korea, a manufacturing powerhouse increasingly dependent on China trade. This means trouble for Seoul, Munich and the Ruhr urban area. The Port of Hamburg, Germany’s largest, is already seeing a decline in its exports to China.

Here in the United States, a slowdown could hurt companies like Caterpillar and John Deere, which have sent loads of earth-moving and other equipment to assist China’s massive building boom, as well as to developing countries who buy the equipment needed to meet Beijing’s once seemingly insatiable appetite.

It would also hurt American centers of precision manufacturing such as Milwaukee and greater Detroit; last year Michigan exported $3.4 billion in machinery to China. The Wolverine States’exports to the Middle Kingdom have surged 1,500% since 2000, far outstripping gains in the rest of the world. Ohio, another bellwether industrial area, has seen the Chinese share of its exports grow from 2% in 2000 to close to 8% last year. Small industrial towns like Peoria and agricultural equipment firms in places like Fargo could be threatened by a commodity decline. The impacts will be felt heavily on the West Coast as well, particularly around Seattle; some 20% of Washington’s exports go to China, led by aircraft.

Some might see China’s decline as a harbinger of better times for American, Japanese or European producers, but the impact may be exactly the opposite. It may well be as well that Chinese companies, faced with a slowdown at home and not great prospects elsewhere, will redouble their efforts in the United States. This is already a concern in the U.S. steel industry, which sees Chinese devaluation and the oversupply of steel there leading to ever fiercer price competition.

Some believe that a weakened China will open itself up to penetration by America’s highly advanced service sector. But this is certainly not the intention of the Chinese. Last year I visited Shenzhen’s Qianhai development, which by 2020, according to local authorities, anticipates attracting some $65 billion in investment, a working population of 650,000 people generating annual gross domestic product of around $25 billion. It is squarely aimed at the global service business and located in one of the world’s newer and most spectacular megacities.

Rather than cede ground when under attack, the Communist Party seems headed back toward reliance on what they hope are streamlined state-owned companies and a massive new trillion yuan stimulus to spur demand; in other words, back to the future. They will likely continue to intensify their repression of domestic dissent.

This will outrage those of us who believe in human rights and free markets. But China’s leaders may not be so concerned about the tender sensibilities of investment bankers, civil rights advocates, economists or the Western media. Their priority is maintenance of the regime, which depends on continued improvement of Chinese living standards. Whether we benefit or not is likely a matter of indifference to the leaders of a self-confident people now trying to establish their Asian preeminence, and could from that vantage point seek to become the No. 1 power in the world.

This piece originally appeared at Forbes.

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo of SEG Plaza electronics market by Bobbie Johnson, licensed under Creative Commons.

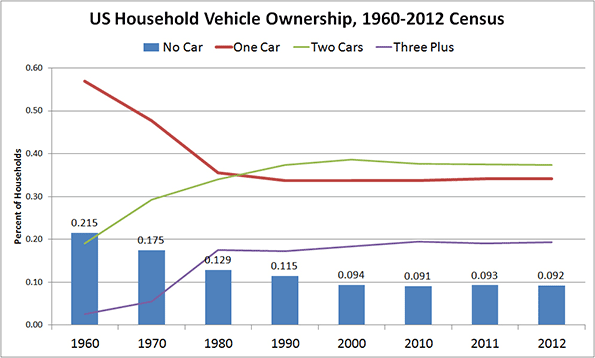

Chart 1 Source: Oak Ridge National Laboratory; Transportation Energy Data Book. Table 8.5.

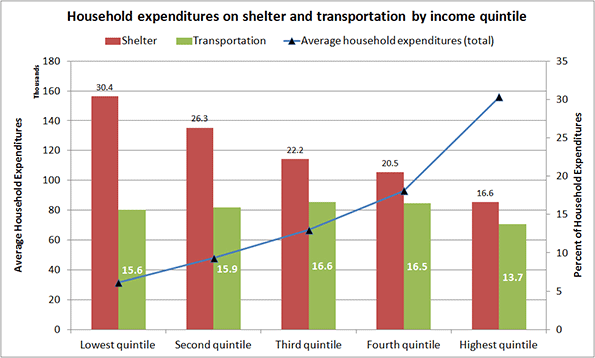

Chart 1 Source: Oak Ridge National Laboratory; Transportation Energy Data Book. Table 8.5. Chart 2 Source: Statistics Canada, Survey of Household Spending. Table 2: Budget Shares Of Major Spending Categories By Income Quintile, 2012.

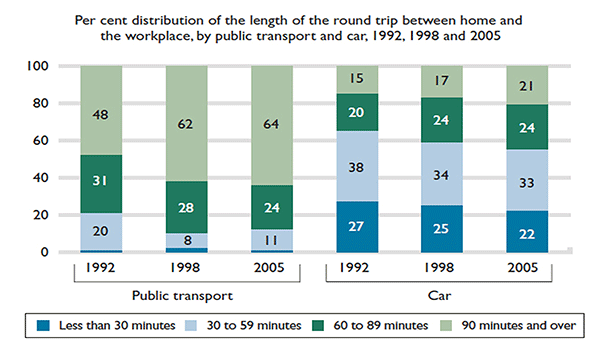

Chart 2 Source: Statistics Canada, Survey of Household Spending. Table 2: Budget Shares Of Major Spending Categories By Income Quintile, 2012. Chart 3 Source: Statistics Canada, General Social Survey, Trip Duration, 1992, 1998, and 2005.

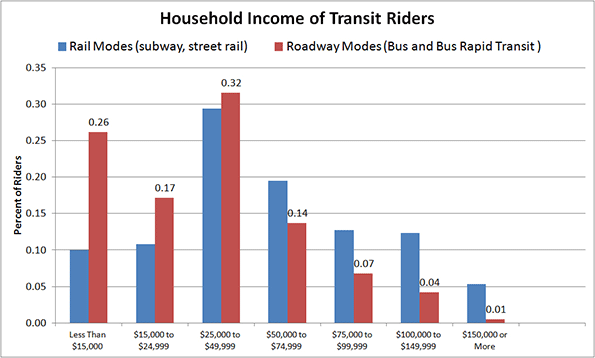

Chart 3 Source: Statistics Canada, General Social Survey, Trip Duration, 1992, 1998, and 2005. Chart 4 Source: American Public Transportation Association, A Profile of Public Transportation Passenger Demographics and Travel Characteristics, 2007.

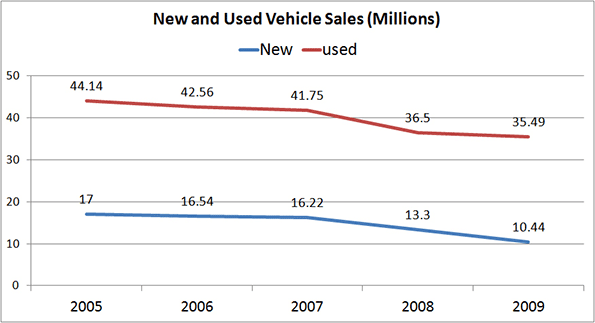

Chart 4 Source: American Public Transportation Association, A Profile of Public Transportation Passenger Demographics and Travel Characteristics, 2007. Chart 5 Source: NIADA’s Used Car Sales Industry Report; Relative Size of Car Markets for New and Used Cars, 2010.

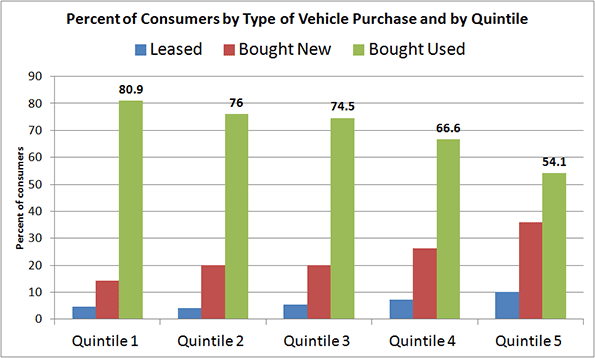

Chart 5 Source: NIADA’s Used Car Sales Industry Report; Relative Size of Car Markets for New and Used Cars, 2010. Chart 6 Source: Laura Paszkiewicz, The Cost and Demographics of Vehicle Acquisition, Consumer Expenditure Survey Anthology, 2003 (61) Division of Consumer Expenditure Surveys, US Bureau of Labor Statistics.

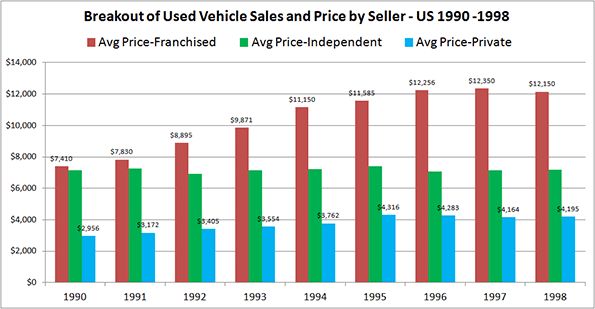

Chart 6 Source: Laura Paszkiewicz, The Cost and Demographics of Vehicle Acquisition, Consumer Expenditure Survey Anthology, 2003 (61) Division of Consumer Expenditure Surveys, US Bureau of Labor Statistics. Chart 7 Source: The Used Vehicle Market in Canada, DesRosiers Automotive Consultants Inc., 2000.

Chart 7 Source: The Used Vehicle Market in Canada, DesRosiers Automotive Consultants Inc., 2000.