Urban risk may be understood as a function of hazard, exposure, and vulnerability.1 In metro New Orleans, Katrina-like storm surges constitute the premier hazard (threat); the exposure variable entails human occupancy of hazard-prone spaces; and vulnerability implies the ability to respond resiliently and adaptively—which itself is a function of education, income, age, social capital, and other factors—after having been exposed to the hazard.

This essay measures the extent to which, after the catastrophic deluge triggered by Hurricane Katrina in 2005, residents of metro New Orleans have shifted their settlement patterns and how these movements may affect future urban risk.2 What comes to light is that, at least in terms of residential settlement geographies, the laissez faire rebuilding strategy for flooded neighborhoods proved to be exactly that.

“The Great Footprint Debate” of 2005-2006

An intense debate arose in late 2005 over whether low-lying subdivisions heavily damaged by Katrina’s floodwaters should be expropriated and converted to greenspace. Most citizens and nearly all elected officials decried that residents had a right to return to all neighborhoods. Planners and experts countered by explaining that a population living in higher density on higher ground and surrounded by a buffer of surge-absorbing wetlands would be less exposed to future storms, and would achieve a new level of long-term sustainability.

Despite its geophysical rationality, “shrinking the urban footprint” proved to be socially divisive, politically volatile, and ultimately unfunded. Officials thus had little choice but to abrogate the spatial oversight of the rebuilding effort to individual homeowners, who would return and rebuild where they wished based on their judgment of a neighborhood’s viability.

Federal programs nudged homeowners to return to status quo settlement patterns. Updated flood-zone maps from FEMA’s National Flood Insurance Program, for example, would provide actuarial encouragement to resettle in prediluvial spaces, while the federally funded, state-administered Louisiana Road Home Program’s “Option 1”—to rebuild in place, by far the most popular of the three options—provided grant money to do exactly that.

“Shrinking the urban footprint” became heresy; “greenspacing” took on sinister connotations; and rebuilding in flooded areas came to be valorized as a heroic civic statement. Actor Brad Pitt’s much-celebrated Make It Right Foundation, for example, pointedly positioned its housing initiative along a surge-prone canal, below sea level and immediately adjacent to the single worst Katrina levee breach, to illustrate that if a nonprofit “could build safe, sustainable homes in the most devastated part of New Orleans, [then it] would prove that high-quality, green housing could be built affordably everywhere.”3 Ignoring topography and hydrology gained currency in the discourse of community sustainability even as it flew in the face of environmental sustainability.

A Brief History of New Orleans’ Residential Settlement Patterns, 1718-2005

Topography and hydrology have played fundamental roles in determining where New Orleanians settled since the city’s founding in 1718. The entire region, lying at the heart of the dynamic deltaic plain of the Mississippi River, originally lay above sea level, ranging from a few inches along the marshy perimeter, to a few feet along an interior ridge system, to 8 to 12 feet along the natural levee abutting the Mississippi River.

From the 1700s to the early 1900s, the vast majority of New Orleanians lived on the higher ground closer to the Mississippi. Uninhabited low-lying backswamps, while reviled for their (largely apocryphal) association with disease, nonetheless provided a valuable ecological service for city dwellers, by storing excess river or rain water and safeguarding the city from storm surges. Even the worst of the Mississippi River floods, in 1816, 1849, and 1871, mostly accumulated harmlessly in empty swamplands and, in hindsight, bore more benefits than costs. New Orleanians during the 1700s-1900s were less exposed to the hazard of flooding because the limitations of their technology forced them to live on higher ground.4

Circumstances changed in the 1890s, when engineers began designing and installing a sophisticated municipal drainage system to enable urbanization to finally spread across the backswamp to the Gulf-connected brackish bay known as Lake Pontchartrain. A resounding success from a developmental standpoint, the system came with a largely unforeseen cost. As the pumps removed a major component of the local soil body—water— it opened up cavities, which in turn allowed organic matter (peat) to oxidize, shrink, and open up more cavities. Into those spaces settled finely textured clay, silt, and sand particles; the soil body thus compacted and dropped below sea level. Over the course of the twentieth century, former swamps and marshes in places like Lakeview, Gentilly, and New Orleans East sunk by 6-10 feet, while interior basins such as Broadmoor dropped to 5 feet below sea level. New levees were built along the lakefront, and later along the lateral flanks, were all that prevented outside water from pouring into the increasingly bowl-shaped metropolis.

Nevertheless, convinced that the natural factors constraining their residential options had now been neutralized, New Orleanians migrated enthusiastically out of older, higher neighborhoods and into lower, modern subdivisions. Between 1920 and 1930, nearly every lakeside census tract at least doubled in population; low-lying Lakeview increased by 350 percent, while parts of equally low Gentilly grew by 636 percent. Older neighborhoods on higher ground, meanwhile, lost residents: Tremé and Marigny dropped by 10 to 15 percent, and the French Quarter declined by one-quarter. The high-elevation Lee Circle area lost 43 percent of its residents, while low-elevation Gerttown increased by a whopping 1,512 percent.5

The 1960 census recorded the city’s peak of 627,525 residents, double the population from the beginning of the twentieth century. But while nearly all New Orleanians lived above sea level in 1900, only 48 percent remained there by 1960; fully 321,000 New Orleanians had vertically migrated from higher to lower ground, away from the Mississippi River and northwardly toward the lake as well as into the suburban parishes to the west, east, and south.6

Subsequent years saw additional tens of thousands of New Orleanians migrate in this pattern, motivated at first by school integration and later by a broader array of social and economic impetuses. By 2000, the Crescent City’s population had dropped by 23 percent since 1960, representing a net loss of 143,000 mostly middle-class white families to adjacent parishes. Of those that remained, only 38 percent lived above sea level.7

Meanwhile, beyond the metropolis, coastal wetlands eroded at a pace that would reach 10-35 square miles per year, due largely to two main factors: (1) the excavation through delicate marshes of thousands of miles of erosion-prone, salt-water-intruding navigation and oil-and-gas extraction canals, and (2) the leveeing of the Mississippi River, which prevented springtime floods but also starved the delta of new fresh water and vital sediment. Gulf waters crept closer to the metropolis’ floodwalls and levees, while inside that artificial perimeter of protection, land surfaces that once sloped gradually to the level of the sea now formed a series of topographic bowls straddling sea level.

When those floodwalls and levees breached on August 29, 2005, sea water poured in and became impounded within those topographic bowls, a deadly reminder that topography still mattered. Satellite images of the flood eerily matched the shape of the undeveloped backswamp in nineteenth-century maps, while those higher areas that were home to the historical city, quite naturally, remained dry.

But the stark geo-topographical history lesson could only go so far in convincing flood victims to move accordingly; after all, they still owned their low-lying properties, and real estate on higher terrain was anything but cheap and abundant. Besides, New Orleanians in general rightfully felt that they had been scandalously wronged by federal engineering failures, and anything short of full metropolitan reconstitution came to be seen as defeatist and unacceptable. Most post-Katrina advocacy thus focused on reinforcing the preexisting technological solutions that kept water out of the lowlands, rather than nudging people toward higher ground. “Shrink the urban footprint” got yelled off the table; “Make Levees, Not War” and “Category-5 Levees Now!” became popular bumper-sticker slogans; and “The Great Footprint Debate” became a bad memory.

Resettlement in Vertical Space

The early repopulation of post-Katrina New Orleans defied easy measure. Residents living “between” places as they rebuilt, plus temporarily broken-up families, peripatetic workers, and transient populations all conspired to make the city’s 2006-2009 demographics difficult to estimate, much less map. The 2010 Census finally provided a precise number: 343,829. By 2014, over 384,000 people lived in Orleans Parish, or eighty percent of the pre-Katrina figure. Of course, not all were here prior; one survey determined roughly 10 percent of the city’s postdiluvian population had not lived here before 2005.8

How had the new population resettled in terms of topographic elevation? We won’t know precisely until 2020, because only the decennial census provides actual headcounts aggregated at sufficiently high spatial resolution (the block level) for this sort of analysis; annual estimates from the American Community Survey do not suffice. Thus we must make do with the 2010 Census. While much has changed during 2010-2015, the macroscopic settlement geographies under investigation here had largely had fallen into place by 2010.

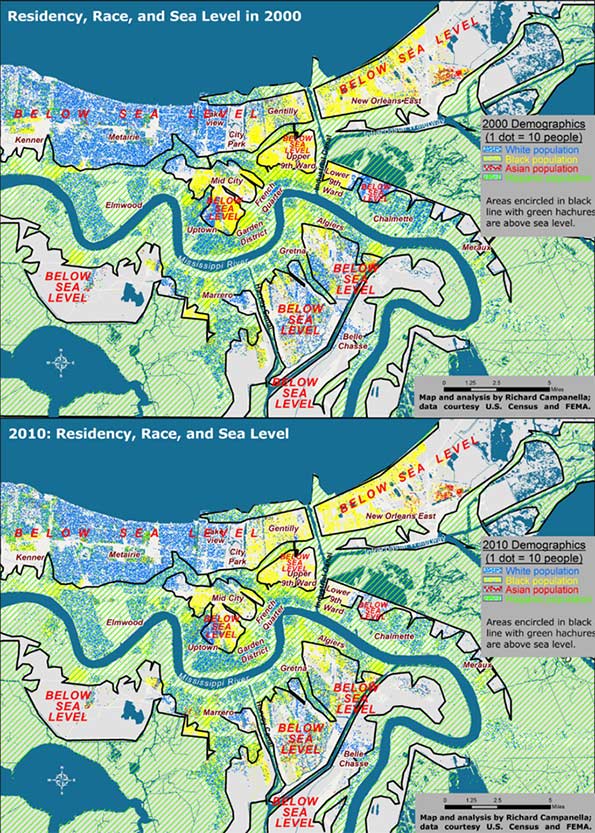

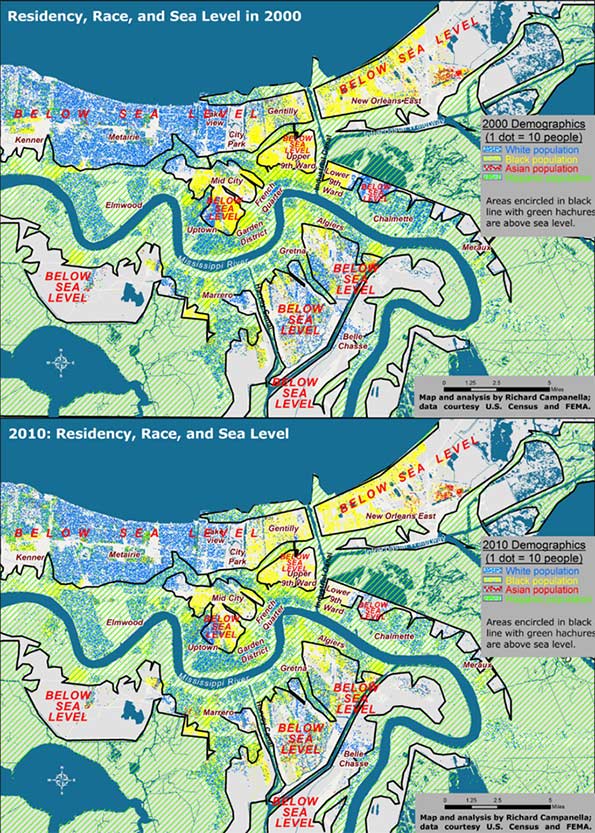

Figure 1. Residential settlement above and below sea level, 2000 and 2010; analysis and maps by Richard Campanella.

When intersected with high-resolution LIDAR-based digital elevation models, the 2010 Census data show that residents of metro New Orleans shifted to higher ground by only 1 percent compared to 2000 (Figure 1). Whereas 38 percent of metro-area residents lived above sea level in 2000, 39 percent did so by 2010, and that differentiation generally held true for each racial and ethnic group. Whites shifted from 42 to 44 percent living above sea level; African Americans 33 to 34 percent, Hispanics from 30 to 29 percent, and Asians 20 to 22 percent.

Clearly, elevation did not exercise much influence in resettlement decisions, and people distributed themselves in vertical space in roughly the same proportions as before the flood. Yet there is one noteworthy angle to the fact that the above-sea-level percentage has risen, albeit barely (38 to 39 percent): it marked the first time in New Orleans history that the percent of people living below sea level has actually dropped.

What impact did the experience of flooding have on resettlement patterns? Whereas people shifted only slightly out of low-lying areas regardless of flooding, they moved significantly out of areas that actually flooded, regardless of elevation. Inundated areas lost 37 percent of their population between 2000 and 2010, with the vast majority departing after 2005. They lost 37 percent of their white populations, 40 percent of their black populations, and 10 percent of their Asian populations. Only Hispanics increased in the flooded zone, by 10 percent, in part because this population had grown dramatically region-wide, and because members of this population sometimes settled in neighborhoods they themselves helped rebuild.

The differing figures suggest that while low-lying elevation theoretically exposes residents to the hazard of flooding, the trauma of actually flooding proved to be, sadly, much more convincing.

Resettlement in Horizontal Space

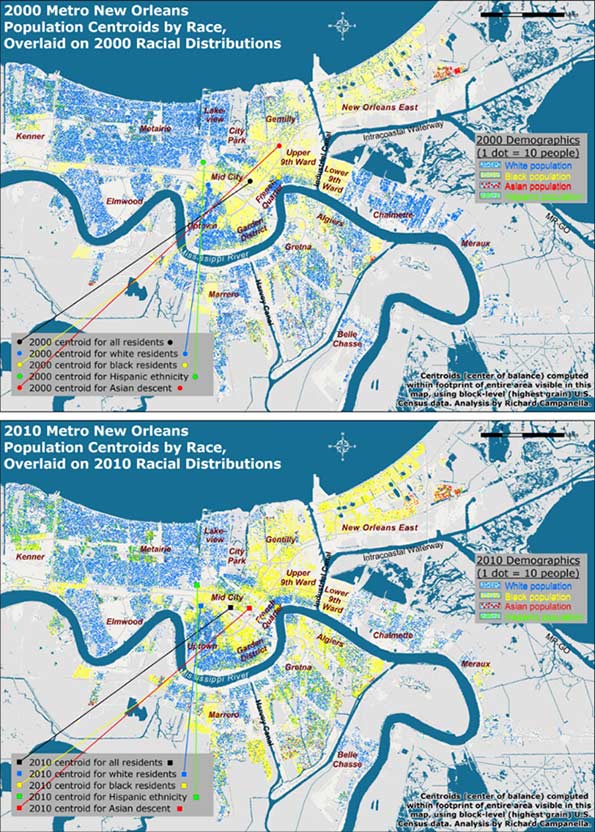

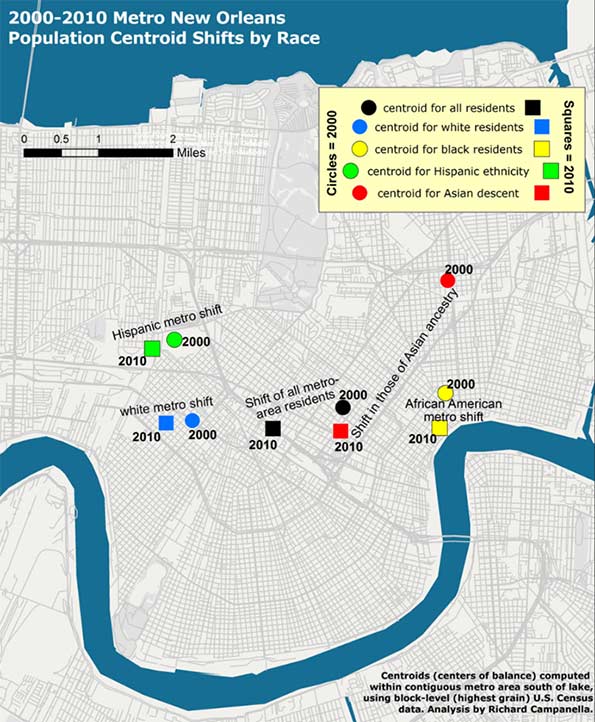

Contrasting before-and-after residential patterns in horizontal space may be done through traditional methods such as comparative maps and demographic tables. What this investigation offers is a more singular and synoptical depiction of spatial shifts: by computing and comparing spatial central tendencies, or centroids.

A centroid is a theoretical center of balance of a given spatial distribution. A population centroid is that point around which people within a delimited area are evenly distributed.9

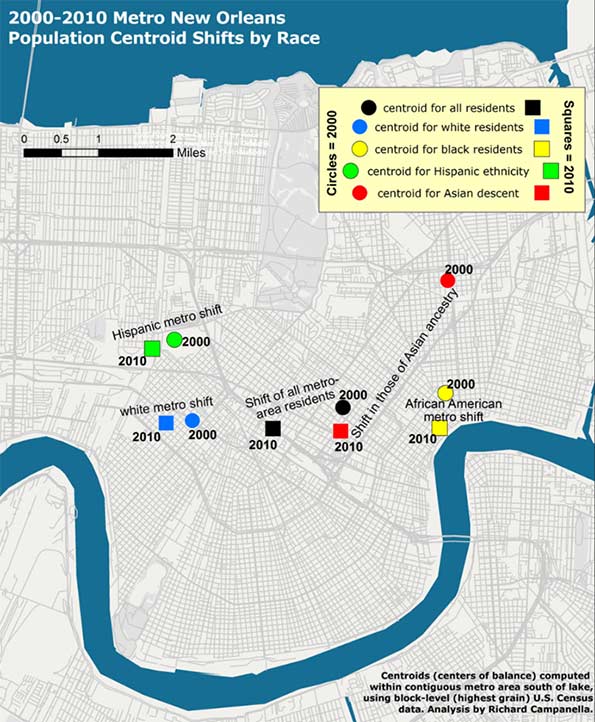

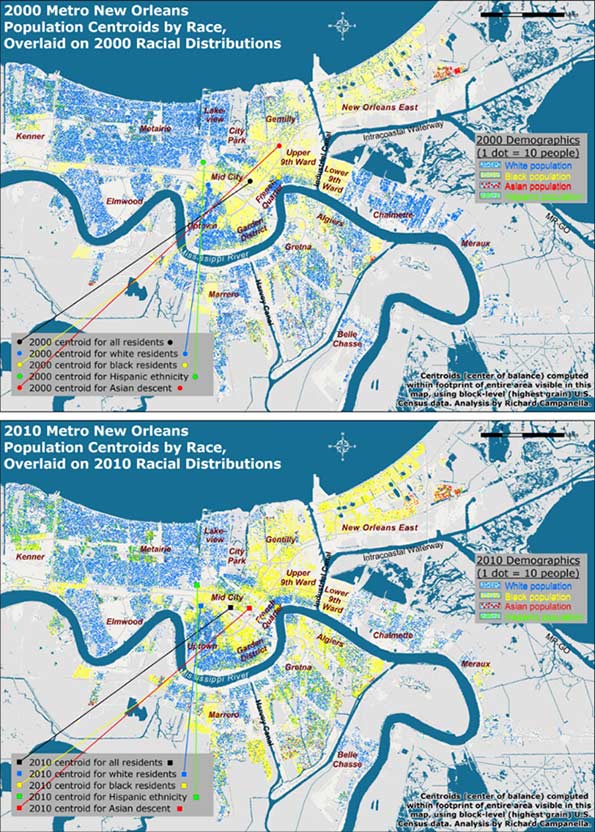

Centroids capture complex shifts of millions of data with a single point. But they do not tell the entire story. A centroid for a high-risk coastal area, for example, may shift inland not because people have moved away from the seashore, but because previous residents decided not to return there. It’s also worth noting it takes a lot to move a centroid, as micro-scale shifts in one area are usually offset by countervailing shifts elsewhere. Thus, apparent minor centroid movements can actually be significant. Following are the centroid shifts for metro New Orleans broken down by racial and ethnic groups (Figures 2 and 3).

In 2000, five years before the flood, there were 1,006,783 people living within the metro area as delineated for this particular study, of whom 512,696 identified their race as white; 435,353 as black; 25,941 as Asian; and 50,451 as Hispanic in ethnicity. Five years after the flood, these figures had changed to 817,748 total population, of whom 416,232 were white; 327,972 were black; 27,562 were Asian, and 75,397 were Hispanic.10 When their centroids are plotted, they show that metro residents as a whole, and each racial/ethnic sub-group, shifted westward and southward between 2000 and 2010, away from the location of most of the flooding and away from the source of most of the surge, which generally penetrated the eastern and northern (lakeside) flanks of the metropolis.

Did populations proactively move away from risk? Not quite. What accounts for these shifts is the fact that the eastern half of the metropolis bore the brunt of the Katrina flooding, and the ensuing destruction meant populations here were less likely to reconstitute by 2010, which thus nudged centroids westward. Additionally, flooding from Lake Pontchartrain through ruptures in two of the three outfalls (drainage) canals disproportionally damaged the northern tier of the city, namely Lakeview and Gentilly. Combined with robust return rates in the older, higher historical neighborhoods along the Mississippi, as well as the unflooded West Bank (which sit to the south and west of the worst-damaged areas), they abetted a southwestward shift of the centroids. In a purely empirical sense, this change means more people now live in less-exposed areas. But, as we saw with the vertical shifts, the movements are more a reflection of passive responses to flood damage than active decisions to avoid future flooding.

Figure 2. Population centroids by race and ethnicity for metro New Orleans, 2000-2010; see next figure for detailed view. Analysis and maps by Richard Campanella.

Figure 3. A closer look at the metro-area population centroid shifts by race and ethnicity, 2000-2010; analysis and map by Richard Campanella.

Reflections

Resettlement patterns in metro New Orleans have only marginally reduced residential exposure to the hazard of storm surge. In the vertical dimension, metro-area residents today occupy below-sea-level areas at only a slightly lower rate than before the deluge, 61 percent as opposed to 62 percent, although that change represents the first-ever reverse (decline) of the century-long drift into below-sea-level areas. Likewise, residents’ horizontal shifts, which were in southwestward directions, seemed to suggest a movement away from hazard, but these shifts were more a product of passive than active processes .

Metro New Orleans, it is important to note, has substantially reduced its overall risk—but mostly thanks to its new and improved federal Hurricane & Storm Damage Risk Reduction System (HSDRRS) rather than shifts in residences. No longer called a “protection” system, the Risk Reduction System is a $14.5 billion integrated network of raised levees, strengthened floodwalls, barriers, gates, and pumps built by the U.S. Army Corps of Engineers and its contractors to protect the metropolis from the surges accompanying storms with a 1-percent chance of occurring in any given year.11 The HSDRRD, which worked well during Hurricane Isaac’s surprisingly strong surge in 2012, has given the metropolis a new lease on life, at least for the next few decades. But all other risk drivers—the condition of the coastal wetlands, subsidence and sea level rise, social vulnerability, and, as evidenced in this paper, exposure—have either slightly worsened, only marginally improved, or generally remained constant.

The exposure-related patterns reported here reflect who won the “Great Footprint Debate” ten years ago.12 Months after Katrina, when it became clear that no neighborhoods would be closed and the urban footprint would persist, decisions driving resettlement patterns in the flooded region effectively transferred from leaders to homeowners. Rather inevitably, the laissez faire rebuilding strategy proved to be exactly that, and people generally repopulated areas they had previously occupied, though at markedly varied densities.

Ten years later, the resulting patterns are a veritable Rorschach Test. Some observers look to the 75-90 percent repopulation rates of certain flooded neighborhoods and view them as heroically high, proof of New Orleanians’ resilience and love-of-place. Others point to the 25-50 percent rates of other areas and call them scandalously low, evidence of corruption and ineptitude. Still others might point to the thousands of scattered blighted properties and weedy lots and concede—as St. Bernard Parish President David Peralta admitted on the ninth anniversary of Hurricane Katrina—that “we probably should have shrunk the footprint of the parish at the very beginning.”13

As for the HSDRRS, continual subsidence and erosion vis-à-vis rising seas, coupled with costly and as-yet undetermined maintenance and certification responsibilities, will gradually diminish the safety dividend provided by this remarkable system. The nation’s willingness to pay for continued upkeep, meanwhile, may grow tenuous; indeed, it’s not even a safe bet locally. Voters in St. Bernard Parish, which suffered near-total inundation from Katrina, defeated not once but twice a tax to pay for drainage and levee maintenance, a move that may well increase flood insurance rates.14

Residents throughout the metropolis appear to be repeating the same mistakes they made during the twentieth century: of dismissing the importance of natural elevation, of over-relying on engineering solutions, of under-maintaining these structures in a milieu of scarce funds, and of developing a false sense of security about flood “protection.”

We need to recognize the limits of our ability to neutralize hazards—that is, to presume that levees will completely protect us from storm surges—while appreciating the benefits of reducing our exposure to them. Beyond the metropolis, this means aggressive coastal restoration using every means available as soon as possible, an effort that may well require some expropriations. Within the metropolis, it means living on higher ground or otherwise mitigating risk. In the words of University of New Orleans disaster expert Dr. Shirley Laska, “mitigation, primarily elevating houses, is [one] way to achieve the affordable flood insurance…. It is possible to remain in moderately at-risk areas using engineered mitigation efforts, combined with land use planning that restricts development in high-risk areas.”15

Planning that restricts development in high-risk areas: this was the same reasoning behind the “shrink the urban footprint” argument of late 2005—and anything but the laissez faire strategy that ensued.

Bio

Richard Campanella, a geographer with the Tulane School of Architecture, is the author of “Bienville’s Dilemma,” “Geographies of New Orleans,” “Delta Urbanism,” “Bourbon Street: A History,” and other books. His articles may be read at http://richcampanella.com , and he may be reached at rcampane@tulane.edu or @nolacampanella on Twitter.

Acknowledgements

The author wishes to thank Gulf of Mexico Program Officer Kristin Tracz of the Walton Family Foundation, Dr. Shirley Laska, and the Gulf Coast Restoration Fund at New Venture Fund, and Tulane School of Architecture, as well as Garry Cecchine, David Johnson, and Mark Davis for their reviews.

1 David Crichton, “The Risk Triangle,” in Natural Disaster Management, edited by J. Ingleton (Tudor Rose, London, 1999), pp. 102-103.

2 In this paper, “metro New Orleans” means the conurbation (contiguous urbanized area shown in the maps) of Orleans, Jefferson, western St. Bernard, and upper Plaquemines on the West Bank (Belle Chasse); it excludes the outlying rural areas of these parishes, such as Lake Catherine, Grand Island, and Hopedale, and does not include the North Shore or the river parishes.

4 Richard Campanella, Bienville’s Dilemma: A Historical Geography of New Orleans and Geographies of New Orleans (University of Louisiana Press, 2006, 2008); R. Campanella, Delta Urbanism: New Orleans (American Planning Association, 2010); R. Campanella, “The Katrina of the 1800s Was Called Sauve’s Crevasse,” Times-Picayune, June 13, 2014, and other prior works by the author.

5 H. W. Gilmore, Some Basic Census Tract Maps of New Orleans (New Orleans, 1937), map book stored at Tulane University Special Collections, C5-D10-F6.

6 Richard Campanella, Bienville’s Dilemma: A Historical Geography of New Orleans (University of Louisiana Press, 2008) and other prior works by the author.

7 Coincidently, 38 percent of all residents of the contiguous metropolis south of Lake Pontchartrain also lived above sea level in 2000. Thus, at both the city and metropolitan level, three out of every eight residents lived above sea level and the other five resided below sea level. All figures calculated by author using highest-grain available historical demographic data, usually from the U.S. Census, and LIDAR-based high-resolution elevation data captured in 1999-2000 by FEMA and the State of Louisiana.

9 Defining the study area is essential when reporting centroids. New Orleans proper, the contiguous metro area, and the Metropolitan Statistical Area, which includes St. Tammany and other outlying parishes, would all have different population centroids. This study uses the metro area south of the lake shown in the accompanying maps. It is also important to use the finest-grain—that is, highest spatial resolution—demographic data to compute centroids, as coarsely aggregated data carries with it a wider margin of error. This study uses block-level data from the decennial U.S. Census, the finest available.

10 Figures do not sum to totals because some people chose two or more racial categories while others declined the question, and because Hispanicism is viewed by the Census Bureau as an ethnicity and not a race.

12 Richard Campanella, Bienville’s Dilemma: A Historical Geography of New Orleans (University of Louisiana Press, 2008), pp. 344-355.

13 David Peralta, as quoted by Benjamin Alexander-Bloch, “Hurricane Katrina +9: Smaller St. Bernard Parish Grappling with Costs of Coming Back,” Times-Picayune/NOLA.COM, August 29, 2014.

14 Mark Schleifstein, “St. Bernard Tax Defeat Means Higher Flood Risk, Flood Insurance Rates, Levee Leaders Warn,” Times-Picayune/NOLA.COM, May 4, 2015, http://www.nola.com/environment/index.ssf/2015/05/st_bernard_tax_defeat_means_hi.html ; see also Richard Campanella, “The Great Footprint Debate, Updated,” Times-Picayune/NOLA.COM, May 31, 2015.

15 Shirley Laska, email communication with author, April 12, 2015.

It’s the best of times and the worst of times in Los Angeles.

Los Angeles is now attracting notice as a so-called “global city,” one of the world’s elite metropolises. It is ranked #6 in the world by AT Kearney and tied for 10th in a report by the Singapore Civil Service College that I contributed to. Yet it also has among the highest big city poverty rates in the nation, and was found to be one of the worst places in America for upward mobility among the poor. Newspaper columns are starting to refer to LA as a “third world city.”

Though the Bay Area gets the headlines, the LA region likes to boast it’s coming on strong in tech. With a diverse set of marquee names including Snapchat, Tinder, Oculus, and SpaceX, LA’s startup scene continues to grow. But tech growth overall has been middling, ranking 28th out of the country’s sixty-six largest region in information job growth, according to a recent Forbes survey.

More disturbing, job growth has also been slow, ranking 35th overall, at a time when it’s long time rivals in the Bay Area occupy the top job and tech rankings. Some of this reflects the loss of a key industry, aerospace, but also the departure of major corporations such as Lockheed, Northrup Grumman, Occidental Petroleum, and Toyota, which has left LA’s once vaunted corporate community but is a shell of its former self.

Yet LA’s glitz factor remains potent. The fashion industry has gained considerable recognition. Tom Ford set up shop and brought his runway show to the city. Locally grown brands like Rodarte have a major following. LA also is increasingly a global center of gravity in the art world.

Yet behind the glitz, in the city of Los Angeles, aging water mains regularly erupt and the streets and sidewalks decay, with the city’s own report estimating it has an $8.1 billion infrastructure repair backlog.

One report chronicles the flight of cash-strapped New York creatives fleeing to sunny, liberating, and less expensive LA. Another how high prices and the Southern California grind are sending those same creatives packing.

What’s going on here?

What we are witnessing is LA changing in the context of the two tier world —divided between rich and poor — that we live in. This has been made worse by a city that has excessively focused on glamour at the expense of broad based opportunity creation.

Los Angeles may be a creative capital and a great place to live as a creative worker, but it was always much more than that. It was also a great place to build the middle class American Dream or run a business that employed people at scale. For example, it was and still today remains the largest manufacturing center in the United States. Yet it has lost half of its manufacturing job base since 1990. That’s over half a million manufacturing jobs lost in the region since then, with over 300,000 of those just since 2000. Unlike Detroit, Houston, Nashville and even Portland, the region has not benefited at all from the resurgence of US manufacturing since 2009.

Manufacturing decline, of course, is hardly unique to LA, but the city’s problems are particularly acute because region is so huge and diverse, being both the second largest metro area in the country, and the most diverse major region in America. LA has a higher share of Hispanic population than any major metro apart from San Antonio – one twice as high as the Bay Area. The LA/Inland Empire’s 8.4 million Hispanics would by themselves be the fourth largest metro area in the country, and are more than the total number of people living in the Bay Area. The area also has over a million black residents.

With their heavily well-educated populations the Bay Area and Boston can perhaps get away with operating as sort of luxury boutiques for upscale whites and Asians, however dubious a decision that may be. Not so LA.

The problem is that LA and California more broadly have adopted the luxury boutique mindset. Policies are made in ways that favor the glamorous industries like Hollywood, high tech, and the arts – industries that don’t employ a lot of aspiring middle class people, particularly Hispanics or blacks.

These policies include strongly anti-growth land use and environmental policies designed to produce the kind pristine playgrounds favored by glamour industries and creative elite. But they have rendered the region increasingly unaffordable to all but the highly affluent or those who were lucky enough to buy in long ago.

Tech firms and entertainment companies can afford to pay their key workers whatever they need to live in LA. That’s tougher for more workaday businesses. Ditto for business regulations, where many industries don’t have the margins to spend on things like a phalanx of compliance attorneys.

Now that high prices are starting to hurt younger hipsters who want to join the creative industries, this is starting to get attention. But if it’s a problem for young, educated Millennials, it’s a disaster for the working class.

LA does deserve credit for potentially opportunity expanding investments in transit. But if transit can be seen as a potential winner, most political leaders seem more concerned with finding ways to simply attempt to politically reallocate some money to those being squeezed by their policies, all at the expense of growth. The $15 minimum wage is Exhibit A. Like rent control, a high minimum wage benefits a few lucky winners while harming others and making it harder to justify business investment that would create more jobs and entry level opportunities onto the ladder of success, while raising consumer prices. The fact that nearly half of LA’s workers might be covered by the new minimum is a damning testament to the erosion of the region’s middle class job base.

The real measure of success for LA is not how many runway shows, startups, and elite rankings it can achieve, but whether it can recover its role as an engine of opportunity for its large and diverse population to achieve their American Dream. Local leaders would be better served looking for policies that will expand opportunity instead of the ones they are following that actually reduce it.

Aaron M. Renn is a Senior Fellow at the Manhattan Institute for Policy Research and a Contributing Editor at its magazine City Journal.

In our modern economy, the biggest wellspring of new jobs isn’t the information sector, as hype might lead some to think, but the somewhat nebulous category of business services. Over the past decade, business services has emerged as easily the largest high-wage sector in the United States, employing 19.1 million people. These are the white-collar jobs that most people believe offer a ladder into the middle class. Dominated by administrative services and management jobs, the sector also includes critical skilled workers in legal services, design services, scientific research , and even a piece of the tech sector with computer systems and design. Since 2004, while the number of manufacturing and information jobs in the U.S. has fallen, the business services sector has grown 21%, adding 3.4 million positions.

Given these facts, mapping the geography of business services employment growth is crucial to getting a grip on the emerging shape of regional economies. And because business services cover such a wide spectrum of activities, there is no one kind of area that does best. Business services thrive in a host of often different environments, far more so than the more narrow patterns we see in manufacturing or information. To generate our rankings of the best places for business services jobs, we looked at employment growth in the 366 metropolitan statistical areas for which BLS has complete data going back to 2003, weighting growth over the short-, medium- and long-term in that span, and factoring in momentum — whether growth is slowing or accelerating. (For a detailed description of our methodology, click here.)

Tech-Service Hubs

Increasingly much of what we call tech is really about business services. Companies that primarily use technology to sell a product generally require many ancillary services, from accounting and public relations to market research. Apple, Google, and Facebook clearly demand many services, and that’s one reason why San Jose-Sunnyvale-Santa Clara ranks first on our big metro areas list (those with at least 450,000 jobs). Since 2009, business service employment has expanded 34.7% in the area; just last year the sector expanded 7.9%. The Bay Area’s other tech rich region, San Francisco-Redwood City-South San Francisco, ranks second.

This linkage of tech with business services can be seen in other information-oriented parts of the country. Both third-ranked Raleigh, N.C., and No. 5 Austin, Texas, are also tech hubs, and boast rapidly expanding business service sectors. They are also much less expensive places to do business, which may suggest these areas will be well positioned to capture more service jobs if bubble-licious stock and real estate prices undermine some of the economic logic that has driven business in the Bay Area.

The key here may also be cultural. Workers in business services tend to be well educated, and younger employees may well share the lifestyle preferences that have led workers to the Bay Area, as well as such moderately hip places as Austin. Their higher wages help defray the spiraling costs of living in these desired locations and millennials’ and, at least until their 30s, keep them closer to the urban core.

Sun Belt Service Boom Towns

The balance of our top 10 business service locations are all in the Sun Belt. For the most part, these are lower cost places that have enough amenities and transportation links to attract and nurture business service firms. The strongest example is Nashville, ranked fourth on our list, where business service employment has soared 41.4% over the past five years. Much of this growth is tied to health services, entertainment and staffing services.

The re-emergence of No. 10 Atlanta-Sandy Springs-Roswell is particularly marked, as we saw in our overall rankings. Business service growth has led economist Marci Rossell to predict a net gain of 140,000 jobs for the metro area this year, which would be the first time it has netted more than 100,000 since 1999.

The Traditional Big Players

Business services have long clustered in the largest American cities. But with the exception of the Bay Area, greater Dallas and Atlanta, few of our biggest metro areas did particularly well on our list. Indeed of those areas with over 2 million business service jobs, the next highest ranking belongs to No. 21 Houston, which has seen a healthy 27.8% growth in this sector since 2009.

Other mega-regions have not done nearly as well. The largest business service economy, that of New York City, with over 4.1 million jobs in this sector, ranks 29th, with good but not spectacular 20.5% growth over the past five years. But New York, as we have seen on our overall list of The Best Cities For Jobs, consistently outpaces its major rivals. Chicago lags on our business services list in 42nd place, with 18.1% growth over the past five years, and Los Angeles, which once saw itself as a serious challenger to New York, ranks 44th, with 17.4% job growth over that span.

Perhaps the biggest surprise has been the relatively weak record of the capital area. A major beneficiary of the stimulus, it appears now to be slipping in ways no one could have anticipated. The Washington- Arlington- Alexandria MSA, with over 2.5 million business service jobs, ranked 65th out of the 70 largest metro areas; neighboring Silver Spring-Frederick- Rockville won the dubious distinction of coming in dead last, the only large metro area to actually lose business service jobs. Washington’s “beltway bandits” have long thrived during periods of government growth. But after a boom during the early stimulus, Republican controls on spending have filtered into the business service economy. “D.C.,” noted the Washington City Paper, “went from the star of the recession to the runt of the recovery.”

Potential Rising Stars

Some might type-cast business service jobs as the domain of large metropolitan regions, clustered particularly in well-developed downtowns. Yet growth also is occurring in small and mid-sized cities, which often enjoy lower costs than their big city cousins. These are clearly some advantages to being in a big urban center in terms of amenities and face-to-face connections, but smaller cities are generally more attractive to middle class families, particularly to middle managers who might not be able to live decently in the hyper-expensive areas.

One prime example is our fastest growing mid-sized region, Provo-Orem, Utah, where business service employment has surged 46.5% since 2009 to 29,600 jobs. Located south of Salt Lake City, and home to Brigham Young University, the area has long attracted manufacturers and tech firms, who provide a base for business service providers. Indeed small and mid-sized college towns have seen some of the most rapid growth. This includes our No. 1 small and overall metro area, Auburn-Opelika Ala., which has posted 66.7% growth in business services employment since 2009 (albeit off a small base – total employment in the metro area is just 60,700). Just behind is Tuscaloosa, Ala., another small town built around a big university (“Roll Tide”) and some smaller colleges. (For our overall top 10 list, click here.)

But, as we have seen elsewhere, business service growth also tends to be strongest in areas with expanding other industries. For example, Fayetteville-Springdale-Rogers, Ark., ranked fourth on our mid-sized metro area list, is also home to Walmart, a company that provides opportunities for local business service firms. Overall 11 of the top 12 areas for business service job growth are small and one, Provo-Orem, is midsized.

These rapidly growing service regions could prove big winners in the years ahead. As telecommunication technology consistently destroys the tyranny of distance, more service firms may find it less expensive, and convenient, to locate their activities elsewhere. Just as manufacturing shifted out of the bigger cities, we could soon see a movement of business service providers as well, which would be a great boom to hundreds of small and medium-size regions.

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Michael Shires, Ph.D. is a professor at Pepperdine University School of Public Policy.

Big Tiger Paw” by Josh Hallett – originally posted to Flickr as Big Tiger Paw. Licensed under CC BY 2.0 via Wikimedia Commons.

Read about how we selected the 2015 Best Cities for Job Growth

We used five measures of growth to rank MSAs over the past 10 years. “Large” areas include those with a current nonfarm employment base of at least 450,000 jobs. “Midsize” areas range from 150,000 to 450,000 jobs. “Small” areas have as many as 150,000 jobs. This year’s rankings reflect the new Office of Management and Budget definitions of MSAs for all series released after March 2015. As a result, the MSA listed in this year’s rankings do not necessary correspond directly to those listed in prior years. In some instances, MSAs were consolidated with others — for example Pascagoula, MS, was combined with the Gulfport-Biloxi, MS, MSA to form the new Gulfport-Biloxi-Pascagoula, MS, MSA. Others were separated from previously consolidated MSAs and in still other instances individual counties were shifted from one MSA to another. The bottom line is that this year’s rankings are based on good time series for the newly defined MSAs but may not be precisely comparable to those listed in prior years. The total number of MSAs included in this year’s rankings has risen from 398 to 421. This year’s rankings reflect the current size of each MSA’s employment.

| 2015 MSA Prof & Bus Svcs Large MSA Ranking |

Area |

2015 Prof & Bus Svcs Weighted INDEX |

2014 Prof & Bus Svcs Emplmt (1000s) |

Total Prof & Bus Svcs Emplmt Growth Rate 2013-2014 |

Total Prof & Bus Svcs Emplmt Cum Growth

2009-2014 |

2015 MSA Prof & Bus Svcs Overall Ranking |

| 1 |

San Jose-Sunnyvale-Santa Clara, CA |

65.9 |

212.7 |

7.9% |

34.7% |

13 |

| 2 |

San Francisco-Redwood City-South San Francisco, CA Metro Div |

65.4 |

256.9 |

9.0% |

42.3% |

15 |

| 3 |

Raleigh, NC |

62.6 |

113.1 |

8.6% |

36.5% |

22 |

| 4 |

Nashville-Davidson–Murfreesboro–Franklin, TN |

59.1 |

136.8 |

4.3% |

41.4% |

38 |

| 5 |

Austin-Round Rock, TX |

57.3 |

150.3 |

4.3% |

37.2% |

44 |

| 6 |

Dallas-Plano-Irving, TX Metro Div |

57.2 |

437.4 |

6.8% |

29.7% |

45 |

| 7 |

West Palm Beach-Boca Raton-Delray Beach, FL Metro Div |

54.9 |

103.9 |

5.9% |

25.0% |

51 |

| 8 |

Riverside-San Bernardino-Ontario, CA |

53.8 |

144.8 |

8.3% |

19.5% |

54 |

| 9 |

Charlotte-Concord-Gastonia, NC-SC |

52.5 |

177.2 |

4.4% |

26.8% |

62 |

| 10 |

Atlanta-Sandy Springs-Roswell, GA |

51.6 |

469.1 |

5.2% |

24.0% |

67 |

| 11 |

Grand Rapids-Wyoming, MI |

51.1 |

79.5 |

2.7% |

31.5% |

68 |

| 12 |

Miami-Miami Beach-Kendall, FL Metro Div |

50.3 |

156.8 |

5.0% |

25.8% |

77 |

| 13 |

Kansas City, KS |

50.3 |

87.9 |

4.5% |

28.0% |

78 |

| 14 |

Memphis, TN-MS-AR |

50.1 |

97.2 |

3.8% |

26.9% |

80 |

| 15 |

Portland-Vancouver-Hillsboro, OR-WA |

49.9 |

164.8 |

3.8% |

25.4% |

81 |

| 16 |

Louisville/Jefferson County, KY-IN |

49.2 |

84.8 |

6.1% |

20.9% |

86 |

| 17 |

Columbus, OH |

48.9 |

179.0 |

4.0% |

24.8% |

89 |

| 18 |

Hartford-West Hartford-East Hartford, CT NECTA |

48.8 |

70.4 |

4.8% |

21.3% |

92 |

| 19 |

Jacksonville, FL |

48.7 |

99.7 |

3.2% |

23.3% |

93 |

| 20 |

Las Vegas-Henderson-Paradise, NV |

48.3 |

119.7 |

5.4% |

20.6% |

97 |

| 21 |

Houston-The Woodlands-Sugar Land, TX |

48.0 |

469.1 |

3.8% |

27.8% |

100 |

| 22 |

Salt Lake City, UT |

47.5 |

115.5 |

2.3% |

26.1% |

102 |

| 23 |

Indianapolis-Carmel-Anderson, IN |

47.4 |

156.5 |

1.1% |

26.2% |

103 |

| 24 |

Oakland-Hayward-Berkeley, CA Metro Div |

47.2 |

184.1 |

5.1% |

23.1% |

105 |

| 25 |

Fort Lauderdale-Pompano Beach-Deerfield Beach, FL Metro Div |

46.8 |

139.2 |

4.3% |

19.9% |

109 |

| 26 |

Providence-Warwick, RI-MA NECTA |

45.9 |

66.7 |

2.9% |

17.2% |

112 |

| 27 |

Sacramento–Roseville–Arden-Arcade, CA |

45.0 |

120.9 |

4.2% |

21.1% |

116 |

| 28 |

San Antonio-New Braunfels, TX |

44.9 |

123.3 |

5.7% |

17.6% |

117 |

| 29 |

New York City, NY |

44.5 |

682.2 |

4.1% |

20.5% |

120 |

| 30 |

Anaheim-Santa Ana-Irvine, CA Metro Div |

44.4 |

281.6 |

4.3% |

17.2% |

121 |

| 31 |

Seattle-Bellevue-Everett, WA Metro Div |

43.8 |

235.2 |

3.5% |

21.9% |

125 |

| 32 |

Fort Worth-Arlington, TX Metro Div |

42.9 |

114.0 |

3.1% |

21.6% |

131 |

| 33 |

Camden, NJ Metro Div |

41.6 |

81.1 |

2.8% |

16.1% |

140 |

| 34 |

Warren-Troy-Farmington Hills, MI Metro Div |

41.5 |

246.5 |

1.4% |

26.6% |

141 |

| 35 |

Orlando-Kissimmee-Sanford, FL |

41.4 |

187.8 |

4.4% |

14.8% |

143 |

| 36 |

Oklahoma City, OK |

41.4 |

81.9 |

4.7% |

16.3% |

144 |

| 37 |

Denver-Aurora-Lakewood, CO |

41.4 |

242.0 |

2.7% |

20.4% |

145 |

| 38 |

Cincinnati, OH-KY-IN |

41.0 |

171.4 |

3.7% |

17.3% |

147 |

| 39 |

Phoenix-Mesa-Scottsdale, AZ |

40.1 |

318.4 |

2.5% |

17.6% |

151 |

| 40 |

Tampa-St. Petersburg-Clearwater, FL |

39.8 |

203.9 |

1.9% |

21.1% |

154 |

| 41 |

San Diego-Carlsbad, CA |

39.4 |

236.1 |

3.3% |

14.8% |

160 |

| 42 |

Chicago-Naperville-Arlington Heights, IL Metro Div |

39.1 |

669.9 |

1.7% |

18.1% |

162 |

| 43 |

Minneapolis-St. Paul-Bloomington, MN-WI |

37.9 |

304.0 |

3.0% |

17.1% |

174 |

| 44 |

Los Angeles-Long Beach-Glendale, CA Metro Div |

37.4 |

613.8 |

0.5% |

17.4% |

181 |

| 45 |

Boston-Cambridge-Newton, MA NECTA Div |

36.4 |

331.8 |

1.8% |

16.5% |

190 |

| 46 |

Urban Honolulu, HI |

36.2 |

66.9 |

1.4% |

16.3% |

191 |

| 47 |

Birmingham-Hoover, AL |

36.2 |

65.5 |

5.3% |

10.6% |

192 |

| 48 |

Detroit-Dearborn-Livonia, MI Metro Div |

35.9 |

123.0 |

2.2% |

19.4% |

196 |

| 49 |

St. Louis, MO-IL |

35.6 |

204.0 |

2.0% |

13.2% |

200 |

| 50 |

Kansas City, MO |

35.1 |

83.3 |

3.4% |

14.4% |

204 |

| 51 |

Cleveland-Elyria, OH |

32.8 |

148.5 |

1.2% |

14.9% |

220 |

| 52 |

Milwaukee-Waukesha-West Allis, WI |

31.7 |

123.2 |

-0.4% |

17.5% |

229 |

| 53 |

Omaha-Council Bluffs, NE-IA |

31.2 |

71.1 |

-1.1% |

14.9% |

232 |

| 54 |

Orange-Rockland-Westchester, NY |

31.0 |

86.6 |

2.0% |

12.1% |

234 |

| 55 |

Philadelphia City, PA |

30.5 |

89.1 |

1.9% |

10.3% |

237 |

| 56 |

New Orleans-Metairie, LA |

29.2 |

74.0 |

0.4% |

9.6% |

242 |

| 57 |

Middlesex-Monmouth-Ocean, NJ |

29.1 |

141.2 |

1.0% |

12.4% |

244 |

| 58 |

Nassau County-Suffolk County, NY Metro Div |

27.2 |

167.6 |

-0.4% |

11.8% |

256 |

| 59 |

Richmond, VA |

26.8 |

100.3 |

2.4% |

10.1% |

260 |

| 60 |

Montgomery County-Bucks County-Chester County, PA Metro Div |

26.5 |

192.8 |

1.6% |

8.8% |

262 |

| 61 |

Virginia Beach-Norfolk-Newport News, VA-NC |

26.1 |

104.3 |

2.0% |

5.8% |

264 |

| 62 |

Pittsburgh, PA |

25.8 |

173.6 |

0.2% |

13.5% |

267 |

| 63 |

Bergen-Hudson-Passaic, NJ |

25.1 |

140.7 |

-0.5% |

11.1% |

275 |

| 64 |

Rochester, NY |

23.5 |

66.3 |

-0.5% |

10.1% |

286 |

| 65 |

Washington-Arlington-Alexandria, DC-VA-MD-WV Metro Div |

21.3 |

584.9 |

1.3% |

5.8% |

300 |

| 66 |

Newark, NJ-PA Metro Div |

19.9 |

212.7 |

0.0% |

4.6% |

306 |

| 67 |

Northern Virginia, VA |

17.4 |

374.6 |

-0.2% |

4.6% |

325 |

| 68 |

Buffalo-Cheektowaga-Niagara Falls, NY |

17.0 |

71.8 |

-0.2% |

2.2% |

330 |

| 69 |

Albany-Schenectady-Troy, NY |

16.5 |

51.4 |

-0.6% |

2.6% |

332 |

| 70 |

Silver Spring-Frederick-Rockville, MD Metro Div |

15.9 |

121.7 |

-0.1% |

-0.2% |

336 |