The next culture war will not be about issues like gay marriage or abortion, but about something more fundamental: how Americans choose to live. In the crosshairs now will not be just recalcitrant Christians or crazed billionaire racists, but the vast majority of Americans who either live in suburban-style housing or aspire to do so in the future. Roughly four in five home buyers prefer a single-family home, but much of the political class increasingly wants them to live differently.

Theoretically, the suburbs should be the dominant politically force in America. Some 44 million Americans live in the core cities of America’s 51 major metropolitan areas, while nearly 122 million Americans live in the suburbs. In other words, nearly three-quarters of metropolitan Americans live in suburbs.

Yet it has been decided, mostly by self-described progressives, that suburban living is too unecological, not mention too uncool, and even too white for their future America. Density is their new holy grail, for both the world and the U.S. Across the country efforts are now being mounted—through HUD, the EPA, and scores of local agencies—to impede suburban home-building, or to raise its cost. Notably in coastal California, but other places, too, suburban housing is increasingly relegated to the affluent.

The obstacles being erected include incentives for density, urban growth boundaries, attempts to alter the race and class makeup of communities, and mounting environmental efforts to reduce sprawl. The EPA wants to designate even small, seasonal puddles as “wetlands,” creating a barrier to developers of middle-class housing, particularly in fast-growing communities in the Southwest. Denizens of free-market-oriented Texas could soon be experiencing what those in California, Oregon and other progressive bastions have long endured: environmental laws that make suburban development all but impossible, or impossibly expensive. Suburban family favorites like cul-de-sacs are being banned under pressure from planners.

Some conservatives rightly criticize such intrusive moves, but they generally ignore how Wall Street interests and some developers see forced densification as opportunities for greater profits, often sweetened by public subsidies. Overall, suburban interests are poorly organized, particularly compared to well-connected density lobbies such as the developer-funded Urban Land Institute (ULI), which have opposed suburbanization for nearly 80 years.

The New Political Logic

The progressives’ assault on suburbia reflects a profound change in the base of the Democratic Party. As recently as 2008, Democrats were competitive in suburbs, as their program represented no direct threat to residents’ interests. But with the election of Barack Obama, and the continued evolution of urban centers as places with little in the way of middle-class families, the left has become increasingly oriented towards dense cities, almost entirely ruled by liberal Democrats.

Obama’s urban policies are of a piece with those of “smart growth” advocates who want to curb suburban growth and make sure that all future development is as dense as possible. Some advocate radical measures such as siphoning tax revenues from suburbs to keep them from “cannibalizing” jobs and retail sales. Some even fantasize about carving up the suburban carcass, envisioning three-car garages “subdivided into rental units with street front cafés, shops and other local businesses” while abandoned pools would become skateboard parks.

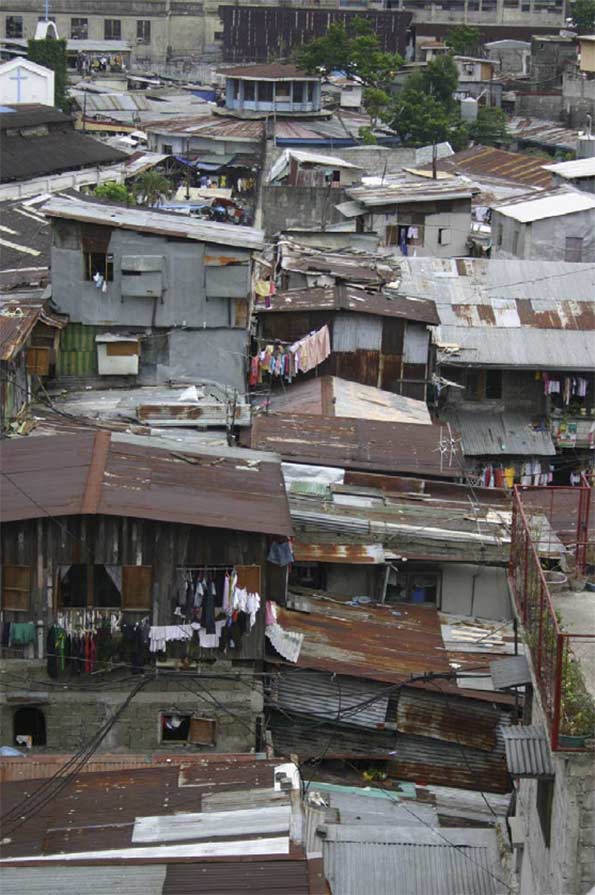

At the end of this particular progressive rainbow, what will we find? Perhaps something more like one sees in European cities, where the rich and elite cluster in the center of town, while the suburbs become the “new slums” that urban elites pass over on the way to their summer cottages.

Political Dangers

The abandonment of the American Dream of suburban housing and ownership represents a repudiation of what Democrats once embraced and for which millions, including many minorities, continue to seek out. “A nation of homeowners,” Franklin D. Roosevelt asserted, “of people who own a real share in their land, is unconquerable.”

This rhetoric was backed up by action. It was FDR, and then Harry Truman, who backed the funding mechanisms—loans for veterans, for example—that sparked suburbia’s growth. Unlike today’s progressives, the old school thought it good politics to favor those things that most people aspire to achieve. Democrats gained ground in the suburbs, which before 1945 had been reliably and overwhelmingly Republican.

Even into the 1980s and beyond, suburbanites functioned less as a core GOP constituency than as the ultimate swing voters. As urban cores became increasingly lock-step liberal, and rural Democrats slowlyfaded towards extinction, the suburbs became the ultimate contested territory. In 2006, for example, Democrats won the majority of suburban voters. In 2012, President Obama did less well than in 2008, but still carried most inner and mature suburbs while Romney trounced him in the farther out exurbs. Overall Romney eked out a small suburban margin.

Yet by 2014, as the Democratic Party shifted further left and more urban in its policy prescriptions, these patterns began to turn. In the 2014 congressional elections, the GOP boosted its suburban edge to 12 percentage points. The result was a thorough shellacking of the Democrats from top to bottom.

Will demographics lead suburbs to the Democrats?

Progressive theory today holds that the 2014 midterm results were a blast from the suburban past, and that the key groups that will shape the metropolitan future—millennials and minorities—will embrace ever-denser, more urbanized environments. Yet in the last decennial accounting, inner cores gained 206,000 people, while communities 10 miles and more from the core gained approximately 15 million people.

Some suggest that the trends of the first decade of this century already are passé, and that more Americans are becoming born-again urbanistas. Yet after a brief period of slightly more rapid urban growth immediately following the recession, U.S. suburban growth rates began to again surpass those of urban cores. An analysis by Jed Kolko, chief economist at the real estate website Trulia, reports that between 2011 and 2012 less-dense-than-average Zip codes grew at double the rate of more-dense-than-average Zip codes in the 50 largest metropolitan areas. Americans, he wrote, “still love the suburbs.”

What is also missed by the Obama administration and its allies is the suburbs’ growing diversity. If HUD wants to start attacking these communities, many of their targets will not be whites, but minorities, particularly successful ones, who have been flocking to suburbs for well over a decade.

This undermines absurd claims that the suburbs need to be changed in order to challenge the much detested reign of “white privilege.” In reality, African-Americans have been deserting core cities for years, largely of their own accord and through their own efforts: Today, only 16 percent of the Detroit area’s blacks live within the city limits.

These trends can also be seen in the largely immigrant ethnic groups. Roughly 60 percent of Hispanics and Asians, notes the Brooking Institution, already live in suburbs. Between the years 2000 and 2012, the Asian population in suburban areas of the nation’s 52 biggest metro areas grew by 66 percent, while that in the core cities expanded by 35 percent. Of the top 20 areas with over 50,000 in Asian population, all but two are suburbs.

Left to market forces and natural demographic trends, suburbs are becoming far more diverse than many cities, meaning that in turning on suburbia, progressives are actually stomping on the aspirations not just of privileged whites but those of many minorities who have worked hard to get there.

Another huge misreading of trends relates to another key Democratic constituency, the millennial generation. Some progressives have embraced the dubious notion that millennials won’t buy cars or houses, and certainly won’t migrate to the suburbs as they marry and have families. But those notions are rapidly dissolving as millennials do all those things. They are even—horror of horrors!—shopping atWal-Mart, and in greater percentages than older cohorts.

Moreover, notes Kolko, millennials are not moving to the denser inner ring suburban areas. They are moving to the “suburbiest” communities, largely on the periphery, where homes are cheaper, and often schools are better. When asked where their “ideal place to live,” according to a survey by Frank Magid and Associates, more millennials identified suburbs than previous generations. Another survey in the same year, this one by the Demand Institute, showed similar proclivities.

Stirrings of Rebellion

So if the American Dream is not dead among the citizens, is trying to kill it good politics? It’s clear that Democratic constituencies, notably millennials, immigrants and minorities, and increasingly gays—particularly gay couples—are flocking to suburbs. This is true even in metropolitan San Francisco, where 40 percent of same-sex couples live outside the city limits.

One has to wonder how enthusiastic these constituents will be when their new communities are “transformed” by federal social engineers. One particularly troubling group may be affluent liberals in strongholds such as Marin County, north of San Francisco, long a reliable bastion of progressive ideology.

Forced densification–the ultimate goal of the “smart growth” movement—also has inspired opposition in Los Angeles, where densification is being opposed in many neighborhoods, as well as traditionally more conservative Orange Country. Similar opposition has arisen in Northern Virginia suburbs, another key Democratic stronghold.

These objections may be dismissed as self-interested NIMBYism, but this misses the very point about why people move to suburbs in the first place. They do so precisely in to avoid living in crowded places. This is not anti-social, as is alleged, but an attempt—natural in any democracy—to achieve a degree of self-determination, notes historian Nicole Stelle Garrett.

Aroused by what they perceive as threats to their preferred way of life, these modern pilgrims can prove politically effective. They’ve shown this muscle while opposing plans not only to increase the density in suburbs, and also balking at the shift of transportation funding from roads, which suburbanites use heavily, to rail transit. This was seen in Atlanta in 2012 when suburban voters rejected a mass transit plan being pushed by downtown elites and their planning allies. Opposition to expanding rail service has also surfaced in the Maryland suburbs of Washington.

Suburbs and 2016 Election

To justify their actions against how Americans prefer to live, progressives will increasingly cite the environment. Climate change has become the “killer app” in the smart growth agenda and you can expect the drumbeat to get ever louder towards the Paris climate change conference this summer.

Yet the connection between suburbs and climate is not as clear as the smart growth crowd suggests. McKinsey and other studies found no need to change housing patterns to reduce greenhouse gases, particularly given improvements in both home and auto efficiency. Yet so great is their animus that many anti-suburban activists seem to prefer stomping on suburban aspirations rather seeking ways to make them more environmental friendly.

As for the drive to undermine suburbs for reasons of class, in many ways the assault on suburbia is, in reality, a direct assault on our most egalitarian geography. An examination of American Community Survey Data for 2012 by the University of Washington’s Richard Morrill indicates that the less dense suburban areas tended to have “generally less inequality” than the denser core cities; Riverside-San Bernardino, for example, is far less unequal than Los Angeles; likewise, inequality is less pronounced in Sacramento than San Francisco. Within the 51 metropolitan areas with more than 1 million people, notes demographer Wendell Cox, suburban areas were less unequal (measured by the GINI Coefficient) than the core cities in 46 cases.

In the coming year, suburbanites should demand more respect from Washington, D.C., from the media, the political class and from the planning community. If people choose to move into the city, or favor density in their community, fine. But the notion that it is the government’s job to require only one form of development contradicts basic democratic principles and, in effect, turns even the most local zoning decision into an exercise in social engineering.

As America’s majority, suburbanites should be able to deliver a counterpunch to those who seem determined to destroy their way of life. Irrespective of race or generation, those who live in the suburbs—or who long to do so—need to understand the mounting threat to their aspirations Once they do, they could spark a political firestorm that could reshape American politics for decades to come.

This piece first appeared at Real Clear Politics.

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Suburbs photo courtesy of BigStockPhoto.com.