The village of Kiryas Joel is a perfect illustration of how demographic differences can play out spatially. An enclave of ultra-orthodox Satmar Hasidic Jews tucked in the woods of Orange County, about 60 miles north of New York City, Kiryas Joel is an uncharacteristically high-density settlement filled with individuals whose high birth rate and dependence on federal aid often incurs the anger of the upper-middle class suburbs that surround it.

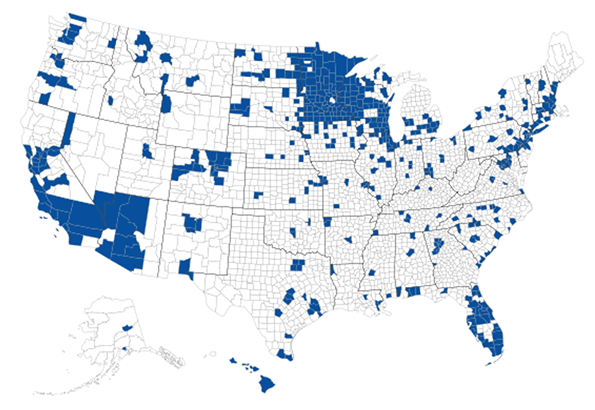

Between a few hills in a picturesque but otherwise none-too-remarkable part of a mostly automobile-oriented suburban county of New York City, the settlement of Kiryas Joel has the distinction of being one of the fastest-growing communities in the entire country. In 1980, the Census recorded its population at around 2,080 people; by 2010, it had over 20,000. While such rates might not cause public officials in Nevada, Arizona or Idaho to bat an eyelash, in a slow-growth state like New York, this is unusual—all the more so because, prior to 1975, Kiryas Joel didn’t exist.

The original founders were a group of Jews belonging to the Satmar Hasidic dynasty. Most lived in Brooklyn, and, like so many who fled to the suburbs at that time, the first arrivals in “KJ” were escaping what they perceived as the ills and crowds of the big city.

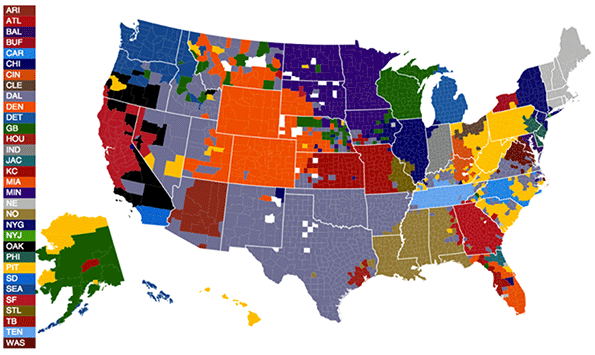

The community has an Orthodox and Haredi population that surpasses virtually everywhere in the world outside of Israel. Its ethos is distinctive for its vocal opposition to Zionism: no Satmar Hasidim would ever culturally identify with Israel; the Hebrew lettering in its signs use Yiddish orthography. While the population in Williamsburg burgeoned, it was only a matter of time before the surrounding, secular neighborhoods of Brooklyn encroached on the enclave. After scouting several sites in New Jersey and Staten Island (rejected fiercely by locals), they discovered an area 60 miles north of their prior home, which at the time was still lightly populated, dirt-cheap and primarily exurban in character.

Kiryas Joel grows largely through natural increase. It has among the highest birth rates of any municipality not just in the US, but in the developed world. In 2010, an astonishing 730 of 1000 women between ages 20 and 34 gave birth, a high figure even for many developing countries. Hasidic women marry young, usually shortly after completing the equivalent of high school. They do not practice birth control, so they then almost immediately begin to have children every year or two, resulting in a community with the nation’s lowest median age: thirteen years. It’s an extreme outlier, since no other place in the country has a median age under 20.

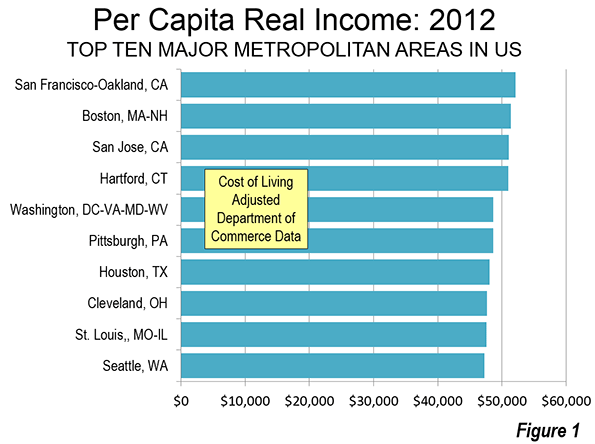

The community can claim a number of distinctions, but among those for which it is the most notorious is that it is the poorest municipality with a population of over 10,000 in the entire country, with many estimates placing approximately 70 percent of the population at incomes that would qualify them as below the federal poverty line. About half of the residents receive food stamps, while one-third receive Medicaid benefits. This poverty correlates directly to the fact that virtually none of the women work full-time jobs, and a significant number of the men devote most of their lives to studying the Torah and Talmud; not even 40 percent of them have the equivalent of a high school degree, and the low levels of English proficiency make them further unemployable.

Visually, its most prominent feature is its housing. It may not be architecturally distinctive, but the density is atypical for outer suburbs, even considering that these are outer suburbs to the nation’s largest and most densely populated city. Since the median household size is nearly six people, homes are both thickly clustered together and crowded within.

And they’re expanding, often using construction standards that appear dubious.

Virtually none of the housing is single-family. Approximately 95 percent is attached, a higher rate than much of New York City, meaning yards are virtually unheard of, which explains why the streets become a play area so much of the time. And more multifamily goliaths are popping up along the forested fringe.

In its earliest years, Kiryas Joel was almost exclusively residential. Those (mostly male) KJ residents who worked would often take buses for the lengthy trip back to the City. A Park-and-Ride service is still available on the village’s outskirts. But in more recent years, the community has become increasingly self-contained, with retail tucked in the street level of these large residential complexes, as well as basic services to meet other needs.

With more than one synagogue, multiple commercial buildings, emergency response, and dedicated recreational space, it broadly occupies the goods-and-services domain one might expect of a smaller city of 20,000 inhabitants.

Bearing in mind that Kiryas Joel is surrounded on all sides by mid-century homes on large, wooded lots, accessed only by undulating rural collector roads, it is really the most urban community around. It’s safe to say that KJ comprises the highest concentration of pedestrian activity in the entire area, at least on the Sabbath day, when its residents do not ride, and probably every other day of the week as well.

The community bears more than a passing resemblance to other religiously inspired outliers in the United States, also characterized by fundamentalist interpretations of their sacred texts, atypically high birth rates, and an overt repudiation of certain contemporary mores. Certain Anabaptists (particularly the Amish) and the Fundamentalist Church of Jesus Christ of Latter-Day Saints come to mind. Perhaps the principles that shape the way of life of Satmar Hasidim are not as distinct as they may initially seem. Kiryas Joel isn’t the only exurban settlement of Hasidic or Haredi Jewry in metro New York. While Kiryas Joel is the largest, most of the others share its growth rate and are likely only to escalate in public visibility in the years ahead.

Kiryas Joel embodies a collision of values written many times over. Apparently, the surrounding population in the Town of Monroe has vigorously protested its further growth because it represents suburban sprawl. The irony of such an accusation is obvious. Not only was the development pattern of the 1960s and 1970s a glorification of a decentralized, anti-urban ethos that many deride as sprawl, most recent development in Orange County comes far closer to the “sprawling” densities of Monroe than does Kiryas Joel.

Even if Kiryas Joel is not unique, it’s still such an anomaly that it is impossible to ignore. It’s a greenfield development more tightly packed than the densest neighborhoods in many American cities. It required no market analyses to determine if a sufficient demand existed to support such high density; the demand was obvious to the rabbinical leadership. The Town of Monroe did not overtly incentivize the development of this concentrated settlement through density bonuses in order to bolster its tax base (quite the opposite). While KJ looks nothing like the Traditional Neighborhood Development (TND) planned communities that have popped up across exurbs throughout the country, it shares at least a few of their objectives: mixed uses and high densities promote the sort of walkability that an increasing number of suburbanites find appealing. And for the Satmar Hasidim, walkability is essential.

The community remains antithetical to what most of its neighbors would define as the “American Dream” as it applies to housing—a catchphrase that by now is hackneyed, not just from overuse, but from the narrow cultural implications it evokes. Yet Kiryas Joel continues to boom in population The American Dream is diversifying exponentially, fueled by disparate, self-actualizing initiatives, and manifesting in ways that depend largely upon their location. Kiryas Joel is just one example of many that are only “bad” or “good” when compared to their counterparts, whose own goodness or badness depends just as much on subjective judgment. The escalating elasticity of the American Dream must therefore concede to another catchphrase: live and let live.

Eric McAfee is an itinerant urban planner/emergency manager who fuses his cross county (and trans-national) travels and love of contemporary landscapes into his blog, American Dirt (http://dirtamericana.com/). A longer and slightly different version of this post originally appeared in American Dirt: Part I and Part II.

Photos by the author.