The “global city” is one of the dominant themes related to urban success today. In this model, cities serve both as huge agglomerations of top specialized talent and also as “control nodes” of the global economy serving as key sites for the production of financial and producer services demanded by the new globalized economy. In her seminal book on the subject, Saskia Sassen noted New York, London, and Tokyo as the paradigmatic examples of the global city.

The status of global cities, however, is protean, and not all “global cities” are created equal or occupy a similar status. Tokyo, for example, is clearly fading in the face of the shift of economic power from Japan to the Chinese sphere of influence – Shanghai, Beijing, Hong Kong and Singapore.

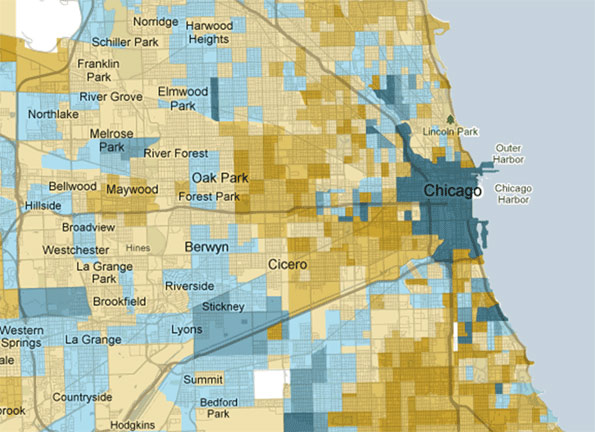

Chicago has long prided itself as one of those cities, and consistently rated in the top ten global cities in various surveys. It’s a huge business services hub, financial hub, transport hub, cultural center, and massive draw for talent. The greater Loop area is clearly a classic global city area, densely packed with knowledge workers, with gleaming towers all around – over a hundred of which went up in the last decade. The transformation of the Loop and the surrounding neighborhoods in the last 20 years has been nothing short of stunning and remains a testament to the record of both Mayor Daleys.

Even at its best, the global city model has its weaknesses, such as extreme income inequality, but at least it seems to provide a model that works in an era when so many urban formulas have failed. Chicago, for example, has used its global city status to avoid the rot that has hit so many Midwestern cities.

But for Chicago, though its global city side is running strong, there’s a serious problem. Although impressive both economically and awe-inspiring in its physical form, the greater Loop economy is just too small – especially relative to the size of the region. This suggests that the Chicago region cannot rely primarily on the global city to carry its economy.

This might seem difficult to believe given that the greater Loop is the second largest business district in the United States and home to over half the region’s office space. But it can be easily illustrated by comparing Chicago employment to that in Manhattan. Here’s a comparison of total jobs in Manhattan vs. all of Cook County, Illinois.

Source: Quarterly Census of Employment and Wages

As you can see, Manhattan has almost as many jobs as all of Cook County, and the two are converging. Given trends in both cities, it doesn’t seem unreasonable to think that in the near future Manhattan may actually have more jobs than Cook County. Not only are there more jobs in Manhattan, but they pay significantly higher wages. Here is a comparison of the average weekly wage between the two:

Source: Quarterly Census of Employment and Wages

Manhattan wages dropped as a result of the financial crash, but still remain 70% higher than Cook County – and until the crash had been pulling away. They may be surging again as Wall Street has been a notable beneficiary of the bailouts. But the difference in scale is significant under any circumstances. Manhattan, with a mere tenth of the regional population, has about as many jobs as Cook County, which has over half the regional population. The wealth and income engine of Manhattan is simply of a different order and power than any other US city. As a result, the global city side of New York for which Manhattan is a proxy really can pay the freight for not just the outer boroughs, but also the greater region and the budgets of not only New York but to some extent New Jersey and Connecticut as well.

By contrast, Chicago’s global city side, strong as it is, simply cannot perform the same role in powering its region and state. Though estimates are that it encompasses something like 600,000 people participate in it, and though the Loop along with select suburban business districts are legitimately thriving, this economy is just too small to support the entire region. In fact it can’t pay the bills even for the rest of Chicago itself, much less the region or state, especially considering that the non-global city parts are basically Rust Belt in character. That’s one reason local government finance is in such rough shape. The city is facing a deficit of about $650 million and the state’s unfunded future liabilities are upwards of $160 billion.

Clearly, Chicago needs to continue focusing on expanding the size of its Loop economy and ensuring that it remains a top global city destination in the future. But unlike some other places that can hang their hat on that if they want, Chicago has to go beyond just being a global city and also be something more. After all, Chicago does not enjoy a “lock” on any industry, like New York with finance and media, or even Houston in energy, the Bay Area in technology or Los Angeles in entertainment. In almost every major business category it is not the lead player, which allows for greater economies of agglomeration and, perhaps even more importantly, a powerful and enduring global signature.

But bluntly, the world city economy is too diffused and small to offer much to the 90% of its people who aren’t a part of that. In short, Chicago needs more “outside the Loop” thinking.

A critical aspect of the challenge here lies with improving the state and local business climate, recently rated as one of the worst in the country by Chief Executive magazine. If you’re a hedge fund partner, architect, or celebrity chef, things are great. But for bread and butter type businesses and workers, which constitute the vast majority of the economy, things are quite different. That’s why everyone from the CEO of Caterpillar,based three hours from the city, on down is publicly complaining and threatening to move.

Fixing this means finally rooting out the corruption that undermines confidence in local government, restructuring state and local finances to provide more certainty to investors, continuing to focus on education, addressing the infrastructure investment deficit, and radically reducing the red tape that plagues small and medium sized businesses.

None of these are sexy or easy. In fact, the CEO of the Chicagoland Chamber of Commerce recently said he’s not putting any faith in claims by Rahm Emanuel, the new mayor that red tape relief is on the way, reflecting the level of skepticism in the local business community right now. Today businesses in the city literally need a city ordinance passed in order to do seemingly simple things like add an awning or get a sidewalk café permit – something that is totally at the discretion of the alderman. The Chicago Reader recently reported that this sort of “ward housekeeping” accounts for over 95% of city council legislation. Clearly this approach is toxic to business. That’s why these items are absolutely mission critical items to creating a regional economy that can actually generate employment and pay the bills going forward. Glamor jobs and prestige employers downtown just aren’t going to cut it by themselves anymore.

Aaron M. Renn is an independent writer on urban affairs based in the Midwest. His writings appear at The Urbanophile.

Photo by Doug Siefken