A few days ago BusinessWeek released a list of the top 40 metropolitan economies based on data compiled at the Brookings Institution’s Metromonitor project. But, as many old media sites tend to do, they’ve locked the list behind a slow-loading slide show in a cheap attempt to drum up page views. Many of the commenters to the original article couldn’t even find the list.

So, in the interest of usability, here’s the top 40 in boring list format:

| 1 | San Antonio, TX |

| 2 | Austin-Round Rock, TX |

| 3 | Oklahoma City, OK |

| 4 | Little Rock-North Little Rock-Conway, AR |

| 5 | Dallas-Fort Worth-Arlington, TX |

| 6 | Baton Rouge, LA |

| 7 | Tulsa, OK |

| 8 | Omaha-Council Bluffs, NE-IA |

| 9 | Houston-Sugar Land-Baytown, TX |

| 10 | El Paso, TX |

| 11 | Jackson, MS |

| 12 | McAllen-Edinburg-Mission, TX |

| 13 | Washington-Arlington-Alexandria, DC-VA-MD-WV |

| 14 | Columbia, SC |

| 15 | Pittsburgh, PA |

| 16 | Harrisburg-Carlisle, PA |

| 17 | Des Moines-West Des Moines, IA |

| 18 | Virginia Beach-Norfolk-Newport News, VA-NC |

| 19 | Honolulu, HI |

| 20 | Rochester, NY |

| 21 | Buffalo-Niagara Falls, NY |

| 22 | Scranton-Wilkes-Barre, PA |

| 23 | Augusta-Richmond County, GA-SC |

| 24 | Colorado Springs, CO |

| 25 | Madison, WI |

| 26 | Albuquerque, NM |

| 27 | Syracuse, NY |

| 28 | Albany-Schenectady-Troy, NY |

| 29 | Kansas City, MO-KS |

| 30 | Raleigh-Cary, NC |

| 31 | Ogden-Clearfield, UT |

| 32 | Boston-Cambridge-Quincy, MA-NH (tied) |

| 32 | New Haven-Milford, CT (tied) |

| 33 | Bridgeport-Stamford-Norwalk, CT |

| 34 | Denver-Aurora-Broomfield, CO (tied) |

| 34 | Baltimore-Towson, MD (tied) |

| 35 | Poughkeepsie-Newburgh-Middletown, NY |

| 36 | Hartford-West Hartford-East Hartford, CT |

| 37 | Indianapolis-Carmel, IN |

| 38 | Memphis, TN-MS-AR |

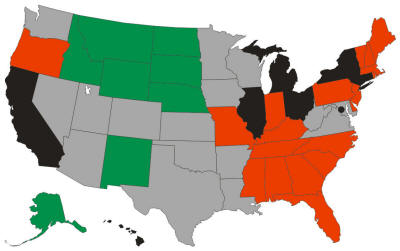

Trends? Looks like energy economies, state capitals, university-heavy towns, generally affordable regions that avoided the housing boom, and a few old industrial centers that suffered the brunt of decline 25 years ago and now may be positioned for an up-swing.

Here’s an explanation of the list methodology:

The Brookings Institution ranked the 100 largest metros by averaging the ranks for four key indicators: employment change, unemployment change, gross metropolitan product, and home price change. Employment was measured by the change from the peak quarter for each metro to the second quarter of 2009. The peak was the quarter in which the metro had the most jobs during the past five years. Unemployment was ranked by measuring the percentage-point change from the first quarter of 2009 to the second quarter of 2009. Gross metropolitan product was measured from the peak quarter to the second quarter of 2009. And the ranking of home prices compared the second quarter of 2009 to the previous quarter. The employment data were provided by Moody’s Economy.com, the unemployment data were collected from the U.S. Bureau of Labor Statistics, and the home price index came from the Federal Housing Finance Agency.

Source: The Brookings Institution’s MetroMonitor

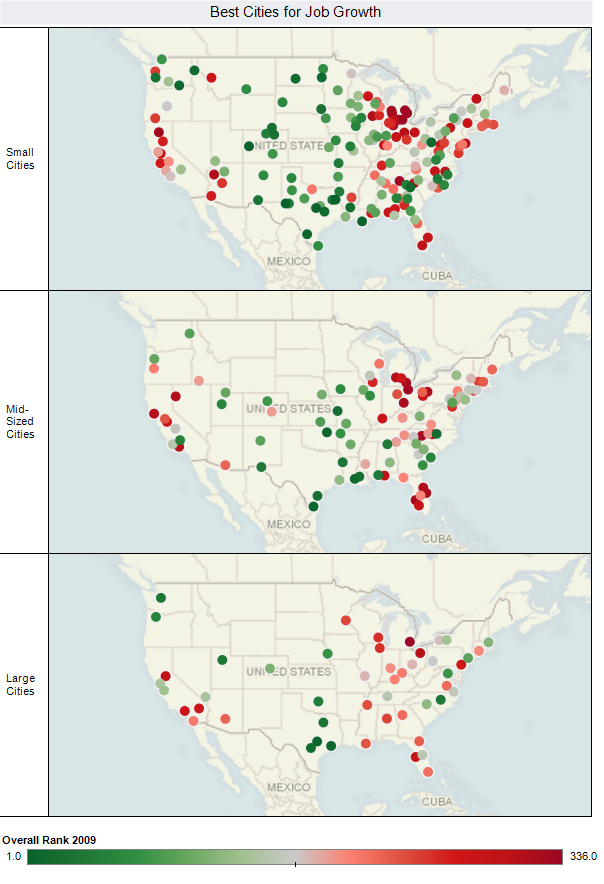

Using employment growth rates as the measurement criteria:

Using employment growth rates as the measurement criteria: