Less than a decade ago, major American energy companies were investing billions in constructing new terminals for importing liquefied natural gas — the cooled, dense state of methane that makes it economical for it to be transported by ship. Today, some of those same companies are contemplating spending billions to retrofit those facilities in order to export LNG.

What happened in the interim? Natural gas boomed in the U.S., thanks to major discoveries of unconventional gas deposits in shale rock and new extraction techniques. In 2011, the U.S. Energy Information Administration raised its estimate for “technically recoverable” natural gas reserves in the U.S. from 353,000 billion cubic feet to 827,000 billion cubic feet. At $4 for every million BTU, natural gas isn’t that much more expensive than coal, which trades at a little over $2 per million BTU but produces twice as much greenhouse gas and significantly more air pollution.

A “gas glut”

Despite increased demand and a push to replace coal-fired power with natural gas, the U.S. is suffering what experts call a “gas glut.”

“The real problem for shale gas is demand — they don’t know where to put all of it,” says Ben Schlesinger, an independent consultant to the natural gas industry. Meanwhile, Europe is paying two to three times the prices in the U.S., and countries that are entirely dependent on LNG, including Japan, Taiwan and South Korea, are paying even more — between $20 and $30 per million BTU.

Europe also has security and political reasons for wanting access to U.S. gas. Its current primary source, Russia, has shown a willingness to use Europe’s dependence as a bargaining chip. In three of the past five winters, Russia has cut off the supply of gas to some part of Europe in a dispute over prices and other issues.

Currently there are plans for up to three LNG export terminals on the U.S. gulf coast, and one on the Pacific coast of Canada, in Kitimat. Historically, the only LNG export facility in the U.S. was in Kenai, Alaska. LNG ships bound for Japan have departed from the terminal since the 1960s, but it’s slated to be shut down in the near future. If the first two export plants in the U.S., both converted import facilities, come online by 2015 as projected, they would be the first constructed in the U.S. in 40 years.

The next Qatar?

Whether or not the U.S. will become “the next Qatar,” which is the largest exporter of natural gas in the world, will depend on a number of factors. Together, these variables will determine whether investors think LNG export terminals are worth the risk, and whether or not the U.S. will even be capable of sending its bounty overseas.

First, U.S. gas consumption must remain low. That means no “Pickens Plan” for using our natural gas reserves to fuel our trucking fleet, and no quick changeover from coal to natural gas for energy production. Second, we have to continue to drill at the rapid pace set over the past few years. More than half the natural gas consumed in the U.S. today comes from wells drilled in the last three years, and unconventional wells deplete rapidly, unlike conventional gas fields.

Economics and more responsible drilling practices suggest that the drilling bonanza will continue, however. Pennsylvania, for example, could turn into the a state literally covered with wells. One engineer at Cornell speculated the state could eventually be home to as many as 100,000.

“The increase [in unconventional natural gas production] has been so dramatic it’s amazing,” says Schlesinger. Ten years ago, production was a tenth what it is today, and fracking technology is evolving rapidly. If current trends in the U.S. continue — slow turnover of old power plants, reduced demand due to efficiency — it’s likely that much of that gas will be sent overseas as LNG.

Christopher Mims is a contributor to Good, Technology Review and The Huffington Post, and is a former editor at Scientific American and Grist.org. He tweets @mims.

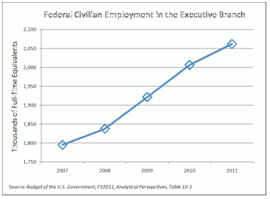

Photo by jermlac

The second leg of Obama’s troika was new government employment. He was successful in signing his health care reform into law but delayed implementation to 2014. The 2010 election that changed 63 House seats to the Republicans, has acted to unwind much of this legislation. If not repealed outright, Obamacare will likely face starvation from Republican cuts in funding necessary to implement the 2,900 page law with its hundreds of new federal regulations. Federal civilian employment in the president’s 2012 budget, will be 15 percent higher in 2011 than it was in 2007. This effort is also likely to be stymied.

The second leg of Obama’s troika was new government employment. He was successful in signing his health care reform into law but delayed implementation to 2014. The 2010 election that changed 63 House seats to the Republicans, has acted to unwind much of this legislation. If not repealed outright, Obamacare will likely face starvation from Republican cuts in funding necessary to implement the 2,900 page law with its hundreds of new federal regulations. Federal civilian employment in the president’s 2012 budget, will be 15 percent higher in 2011 than it was in 2007. This effort is also likely to be stymied.