Over the past decade Los Angeles has steadily declined. It currently has one of the the highest unemployment rates (roughly 12.5%) in the U.S, and there’s little sign of a sustained recovery. The city and county have become a kind of purgatory for all but the most politically connected businesses, while job creation and population growth lag not only the vibrant Texas cities but even aged competitors such as New York.

Rather than address general business conditions, which sorely need fixing, L.A. Mayor Mayor Antonio Villaraigosa and the other ruling elites have instead focused on revitalizing the city’s urban core, which has done little to boost the region’s overall economy in generations. The most recent example of such foolishness is a $1.5 billion plan to build a football stadium, named Farmers Field, downtown,unanimously approved by the city’s City Council and backed by the city’s “progressive” state delegation.

Like most of the dominant political class, California Senator and former City Council member Alex Padilla cites the sad state of the local economy as justification for approving the plan. But, in reality, it’s hard to find something more profoundly irrelevant than a football stadium.

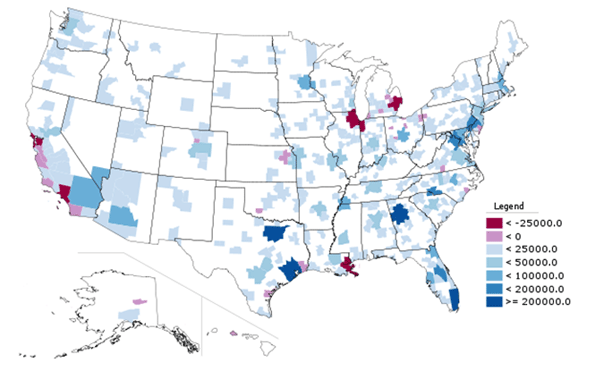

Indeed years of independent investigations have discovered that urban vanity projects like sports teams and convention centers add little to permanent employment or overall regional economic well-being. As a Minneapolis Fed study revealed, consumers simply shift their expenditures from other activities to the new stadium. Certainly mega-stadiums have done little to boost sad-sack, depopulating cities such as St. Louis, Baltimore or Cleveland.

Commitments to mega-projects tend to further drive urban areas into debt, largely by issuing more bonds that taxpayers are obligated to pay back. One particularly gruesome case can be found in Harrisburg, Pa., whose underwriting of a minor league baseball team helped push the city into bankruptcy. To get the stadium deal, Los Angeles, already over-indebted and suffering a poor credit rating, will issue another $275 million.

Such projects often obscure the real and more complex challenge of nurturing broad-based economic growth. This would require substantive change in a city or regional political culture. Instead the football stadium services two basic political constituencies: large unions and big-time speculators, particularly in the downtown area. The fact that the stadium will be built with union labor, for example, all but guaranteed its approval by the city’s trade union-dominated council.

Downtown developers and “rent-seeking” speculators, the other group behind the project, have siphoned hundreds of millions in tax breaks and public infrastructure in the past decade. They have done so – subsidizing companies from other parts of Los Angeles, entertainment venues and hotels — in the name of a long-held, impossible dream of turning downtown Los Angeles into a mini-Manhattan. Perhaps no company has pushed this more effectively than the stadium developer Anschutz Entertainment Group, a mass developer of generic entertainment districts around the world. AEG has expanded its influence by doling out substantial financial donations to Mayor Villaraigosa and others in the city’s economically clueless political class.

This explains how the stadium was exempted from the state’s draconian anti-greenhouse gas legislation. The city promises that the stadium will be the “most transit-friendly” football stadium in the nation, which strikes locals as absurd. Football crowds tend to be drawn largely from affluent types who don’t live anywhere close to downtown and rarely take public transit to their jobs, much less over the weekend. D.J. Waldie, a leading Los Angeles writer, described the entire project as “cloaked in green snake oil.”

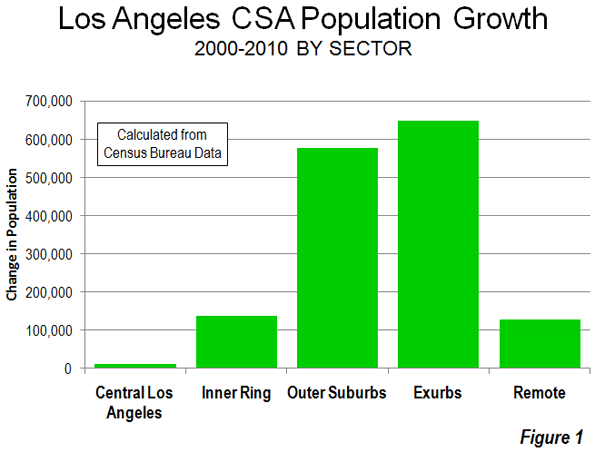

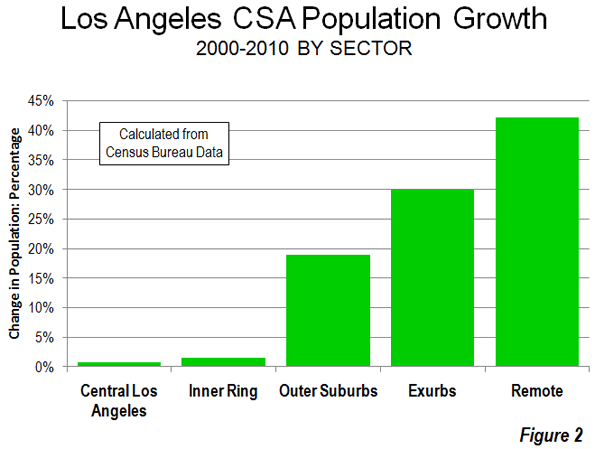

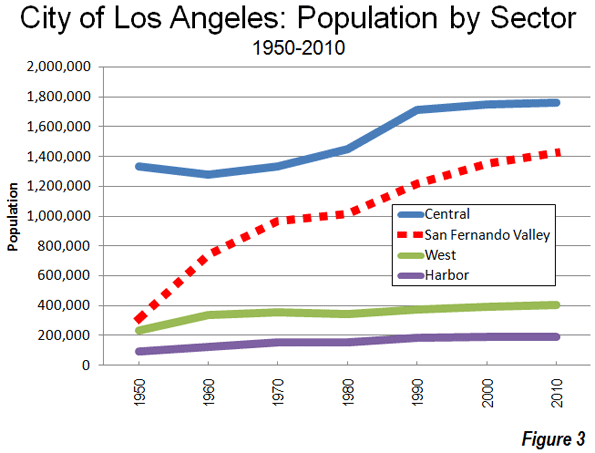

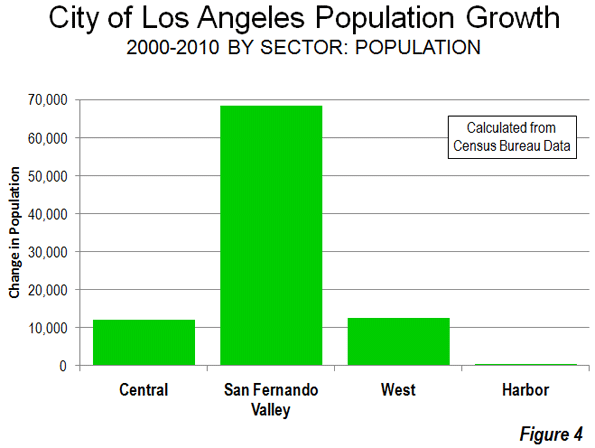

An even more nebulous claim is that downtown needs the investment in order to drive regional growth. To be sure, recent years have seen the growth of a central city restaurant scene, and some 30,000 residents now live in the area compared to closer than 20,000 a decade ago. Yet just outside the immediate, highly-subsidized core, population growth in the surrounding parts of central city over the past decade stood at a mere 0.7%, the lowest rate since the 1950s. The vast majority of the region’s population growth took place in the far-flung regions of the San Fernando Valley.

As an economic engine, downtown LA simply does not warrant the attention, nor the special treatment, that the city’s ruling elites give it. For one thing, it represents a far smaller part of the city’s economy when you compare it to the urban cores of Washington, D.C., or New York City. Indeed, in New York and D.C. roughly 20% of all employment is in the central core; in Los Angeles it’s barely 2.5%.

And, despite all the hype, fewer people now work in downtown L.A than in the 1980s and 1990s, when the area was populated by corporations and small businesses, many in manufacturing and trade, instead of hip hangouts. A more recent analysis shows that, despite all the hype, the downtown area has created virtually no new net jobs over the past decade.

LA’s leaders should therefore focus on the systematic causes for the region’s ailing economy. One source of the problem lies in tough environmental rules that, although lifted on behalf of football, clamp on growth of virtually every other industry, including the city’s port and manufacturing sector. Powerful green interests, for example, make any plan to modernize the port all but impossible. This could prove catastrophic when the widening of the Panama Canal will allow aggressive, cheaper posts in the Gulf or Southeast U.S. to compete with the Pacific Asian trade that has driven LA’s port economy for decades.

Los Angeles’ huge industrial sector has also been a victim of the regulatory tsunami. Manufacturers have lost roughly one-third of their jobs over the past decade as firms head out to more congenial regions with less onerous regulatory burdens. Sadly, Los Angeles has benefited little from the recent upsurge in manufacturing nationwide when compared with metropolitan areas such as Detroit, Salt Lake City and San Antonio.

Even Hollywood, an industry less affected by green regulations, has begun to lose steam. Film production has dropped by more than half over the past 15 years. LA’s share of film and television production has eroded as well, with much of the new work headed to Toronto, New Mexico, New Orleans, New York and Atlanta. All these cities offer richer incentives to attract productions than the world’s self-proclaimed “entertainment capital.”

Faced with these serious regional challenges, officials should place less emphasis on football and creating another generic downtown and more on the city’s uniquely vibrant and heavily immigrant-driven small-business sector, which has been stifled by the state’s regulatory excess as well as the city’s legendary bureaucracy. Business consultant Larry Kosmont notes that the system is particularly tough on smaller, less politically connected firms. “It usually takes two to three times more to process anything in L.A., compared even to surrounding cities,” Kosmont told the Wall Street Journal. “It makes a big difference if you are a major Korean airline or AEG or if you are an independent entrepreneur.”

Yet to date these entrepreneurs receive little respect from City Hall. They are unlikely to be granted the sort of papal dispensations from green legislation so readily given to the football stadium and other downtown projects. Until the disconnect of the leaders from the city’s real economic essence ends, Los Angeles, a city uniquely blessed by its population, climate and location, will continue to flounder, a perpetual underperformer among America’s great urban areas.

This piece originally appeared at Forbes.com.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University, and an adjunct fellow of the Legatum Institute in London. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050, released in February, 2010.

Photo "LA Night Lights" by flickr user Steve Jurvetson