Democrats are still looking for explanations for their stunning rejection in the midterms — citing everything from voting rights violations and Middle America’s racist orientation to Americans’ inability to perceive the underlying genius of President Barack Obama’s economic policy.

What they have failed to consider is the albatross of contemporary liberalism.

Liberalism once embraced the mission of fostering upward mobility and a stronger economy. But liberalism’s appeal has diminished, particularly among middle-class voters, as it has become increasingly control-oriented and economically cumbersome.

Today, according to most recent polling, no more than one in five voters call themselves liberal.

This contrasts with the far broader support for the familiar form of liberalism forged from the 1930s to the 1990s. Democratic presidents from Franklin D. Roosevelt to Bill Clinton focused largely on basic middle-class concerns — such as expanding economic opportunity, property ownership and growth.

Modern-day liberalism, however, is often ambivalent about expanding the economy — preferring a mix of redistribution with redirection along green lines. Its base of political shock troops, public-employee unions, appears only tangentially interested in the health of the overall economy.

In the short run, the diminishment of middle-of-the-road Democrats at the state and national level will probably only worsen these tendencies, leaving a rump party tied to the coastal regions, big cities and college towns. There, many voters are dependents of government, subsidized students or public employees, or wealthy creative people, college professors and business service providers.

This process — driven in large part by the liberal attachment to economically regressive policies such as cap and trade — cost the Democrats mightily throughout the American heartland. Politicians who survived the tsunami, such as Sen. Joe Manchin in West Virginia, did so by denouncing proposals in states where green policies are regarded as hostile to productive local industries that are major employers.

Populism, a traditional support of liberalism, has been undermined by a deep suspicion that President Barack Obama’s economic policy favors Wall Street investment bankers over those who work on Main Street. This allowed the GOP, a party long beholden to monied interests, to win virtually every income segment earning more than $50,000.

Obama also emphasized an urban agenda that promoted nationally directed smart growth, inefficient light rail and almost ludicrous plans for a national high-speed rail network. These proposals appealed to the new urbanist cadre but had little appeal for the vast majority of Americans who live in outer-ring neighborhoods, suburbs and small towns.

The failure of Obama-style liberalism has less to do with government activism than with how the administration defined its activism. Rather than deal with basic concerns, it appeared to endorse the notion of bringing the federal government into aspects of life — from health care to zoning — traditionally controlled at the local level.

This approach is unpopular even among “millennials,” who, with minorities, represent the best hope for the Democratic left. As the generational chroniclers Morley Winograd and Michael Hais point out, millennials favor government action — but generally at the local level, which is seen as more effective and collaborative. Top-down solutions from “experts,” Winograd and Hais write in a forthcoming book, are as offensive to millennials as the right’s penchant for dictating lifestyles.

Often eager to micromanage people’s lives, contemporary liberalism tends to obsess on the ephemeral while missing the substantial. Measures such as San Francisco’s recent ban on Happy Meals follow efforts to control the minutiae of daily life. This approach trivializes the serious things government should do to boost economic growth and opportunity.

Perhaps worst of all, the new liberals suffer from what British author Austin Williams has labeled a “poverty of ambition.” FDR offered a New Deal for the middle class, President Harry S. Truman offered a Fair Deal and President John F. Kennedy pushed us to reach the moon.

In contrast, contemporary liberals seem more concerned about controlling soda consumption and choo-chooing back to 19th-century urbanism. This poverty of ambition hurts Democrats outside the urban centers. For example, when I met with mayors from small, traditionally Democratic cities in Kentucky and asked what the stimulus had done for them, almost uniformly they said it accomplished little or nothing.

A more traditional liberal approach might have focused on improvements that could leave tangible markers of progress across the nation. The New Deal’s major infrastructure projects — ports, airports, hydroelectric systems, road networks — transformed large parts of the country, notably in the West and South, from backwaters to thriving modern economies.

When FDR commissioned projects such as the Tennessee Valley Authority, he literally brought light to darkened regions. The loyalty created by FDR and Truman built a base of support for liberalism that lasted for nearly a half-century.

Today’s liberals don’t show enthusiasm for airports or dams — or anything that may kick up some dirt. Deputy Assistant Secretary of the Interior Deanna Archuleta, for example, promised a Las Vegas audience: “You will never see another federal dam.”

Harold Ickes, FDR’s enterprising interior secretary, must be turning over in his grave.

The administration would have done well to revive programs like the New Deal Works Progress Administration and Civilian Conservation Corps. These addressed unemployment by providing jobs that also made the country stronger and more competitive. They employed more than 3 million people building thousands of roads, educational buildings and water, sewer and other infrastructure projects.

Why was this approach never seriously proposed for this economic crisis? Green resistance to turning dirt may have been part of it. But undoubtedly more critical was opposition from public- sector unions, which seem to fear any program that threatens their economic privileges.

In retrospect, it’s easy to see why many great liberals — like FDR and New York City Mayor Fiorello LaGuardia — detested the idea of public-sector unions.

Of course, green, public-sector-dominated politics can work — as it has in fiscally challenged blue havens such as California and New York. But then, a net 3 million more people — many from the middle class — have left these two states in the past 10 years.

If this defines success, you have to wonder what constitutes failure.

This article originally appeared in Politico.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University and an adjunct fellow with the Legatum Institute in London. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050

, released in February, 2010.

Photo: Tony the Misfit

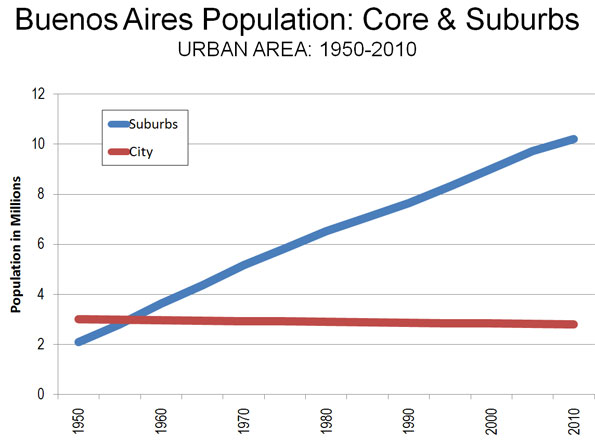

Population and Distribution: According to the last census (2001), the city of Buenos Aires had fewer people than in 1947,

Population and Distribution: According to the last census (2001), the city of Buenos Aires had fewer people than in 1947,

The suburban poverty is far more pervasive to the southwest and the southeast. Many neighborhoods look similar to modest suburbs in Mexico City, though without the pervasive informal settlements. More people live in informal settlements in the suburbs than in the city, with estimates putting the number at above 500,000.

The suburban poverty is far more pervasive to the southwest and the southeast. Many neighborhoods look similar to modest suburbs in Mexico City, though without the pervasive informal settlements. More people live in informal settlements in the suburbs than in the city, with estimates putting the number at above 500,000.