Forty years after the decline of the steel industry, Pittsburgh has emerged from the ashes of deindustrialization to become the new Emerald City. Its formidable skyline gleams with homegrown names—PPG, UPMC, and PNC. Touted as the “most livable city” by the likes of The Economist and Forbes, its highly literate and educated workforce has contributed to a robust and diverse local economy known as a center for technology, health care, and bio-science. It is a leader in startup businesses. Uber and Ford’s announcement in 2016 that they would base development of their self-driving cars in Pittsburgh, rather than in Silicon Valley, is a telling example of the power of high-tech image and low costs.

Pittsburgh also ranks high in housing affordability. Residents can easily walk or bike to public libraries, museums, and arts and entertainment venues. Some see Pittsburgh as a model for economic development and a new urbanism that could revitalize the Rust Belt and other former industrial regions.

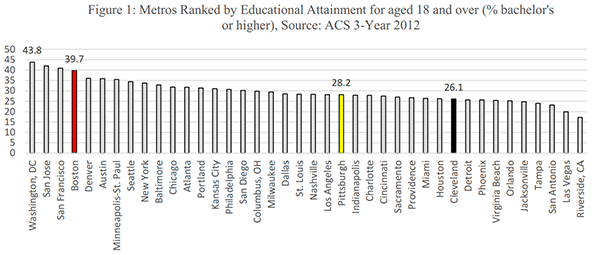

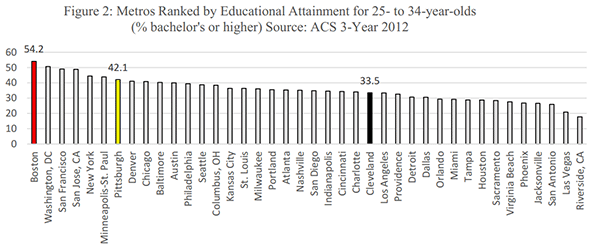

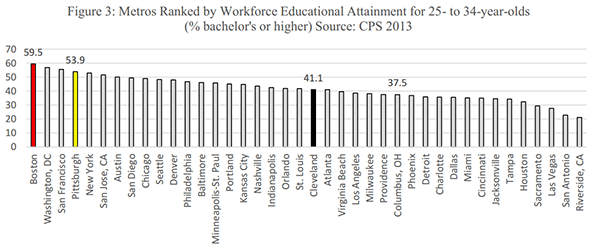

In short, Pittsburgh seems to have responded more effectively to the challenges of deindustrialization than many other cities. Hunter Morrison, winner of the American Planning Association’s 2015 Burnham Award for his work on regional planning in northeastern Ohio, notes that Pittsburgh has done better than Cleveland in several areas. It has retained more of its residents, largely minority households; stabilized its working-class neighborhoods without relying on gentrification; and steadily attracted educated millennials. Morrison also says that Pittsburgh has held on to its historic working-class culture and civic identity more than have other legacy communities. “The concept of the ‘Steelers Nation,’” he says, “goes well beyond a marketing campaign and appears to be embedded as a deeply felt personal identity by people of all classes. The retention of dialect, food, symbols, team colors, and attitude is remarkable and, I would argue, increasingly unique.”

But is there really such a thing as Pittsburgh exceptionalism? Or, as with other successful cities, do we need to ask: A renaissance for whom? Residents like Kathleen Newman, a working-class studies scholar and professor at Carnegie Mellon, see gentrification expanding with Pittsburgh’s drive to attract high-tech industries. This threatens the city’s remaining working-class neighborhoods and its already small African American middle class. Some resistance to gentrification has emerged—protests over the construction of high-income housing and a Whole Foods Market in Pittsburgh’s East Liberty neighborhood, for instance. Residents are also proposing their own alternatives for affordable housing.

And there are more fundamental questions: Can—does—Pittsburgh’s success extend beyond city limits? Can it resurrect its broader Rust Belt region? What can Pittsburgh do—what can we do—for the broader regions that it has left behind?

Pittsburgh was always more than its city limits. The seven counties composing the metropolitan region include surrounding towns that contributed to Pittsburgh’s industrial might in the 20th century, such as Braddock, Homestead, Aliquippa, and McKees Rocks. But the area beyond Pittsburgh, extending from these towns through western Pennsylvania, has not experienced the revitalization that has transformed the city. From Weirton, West Virginia, to the west, Uniontown to the south, Johnstown to the east, and Sharon to the north, economic recovery has been, at best, uneven across the region. Apart from a few newer suburbs like Cranberry and some older revitalization projects, such as the Waterfront complex in Homestead, the region continues to be plagued by the long-term effects of deindustrialization and disinvestment. Along with underperforming schools, violence, and pollution—including, according to a recent report, lead contamination—the region still struggles with employment and population declines. The Bureau of Labor Statistics shows wide swings in employment over the last decade, but non-farm employment in the Pittsburgh metropolitan area declined by about 15,000 between October 2016 and March 2017. A University of Pittsburgh study reports that 23 percent of Pittsburgh residents live in poverty, and 43 percent earn less than 200 percent of the poverty level. Furthermore, outside its urban core, a larger number of individuals actually live in poverty than in Pittsburgh itself. In the seven-county Pittsburgh metropolitan statistical area, fully 79 percent of the people living in poverty reside outside the city limits.

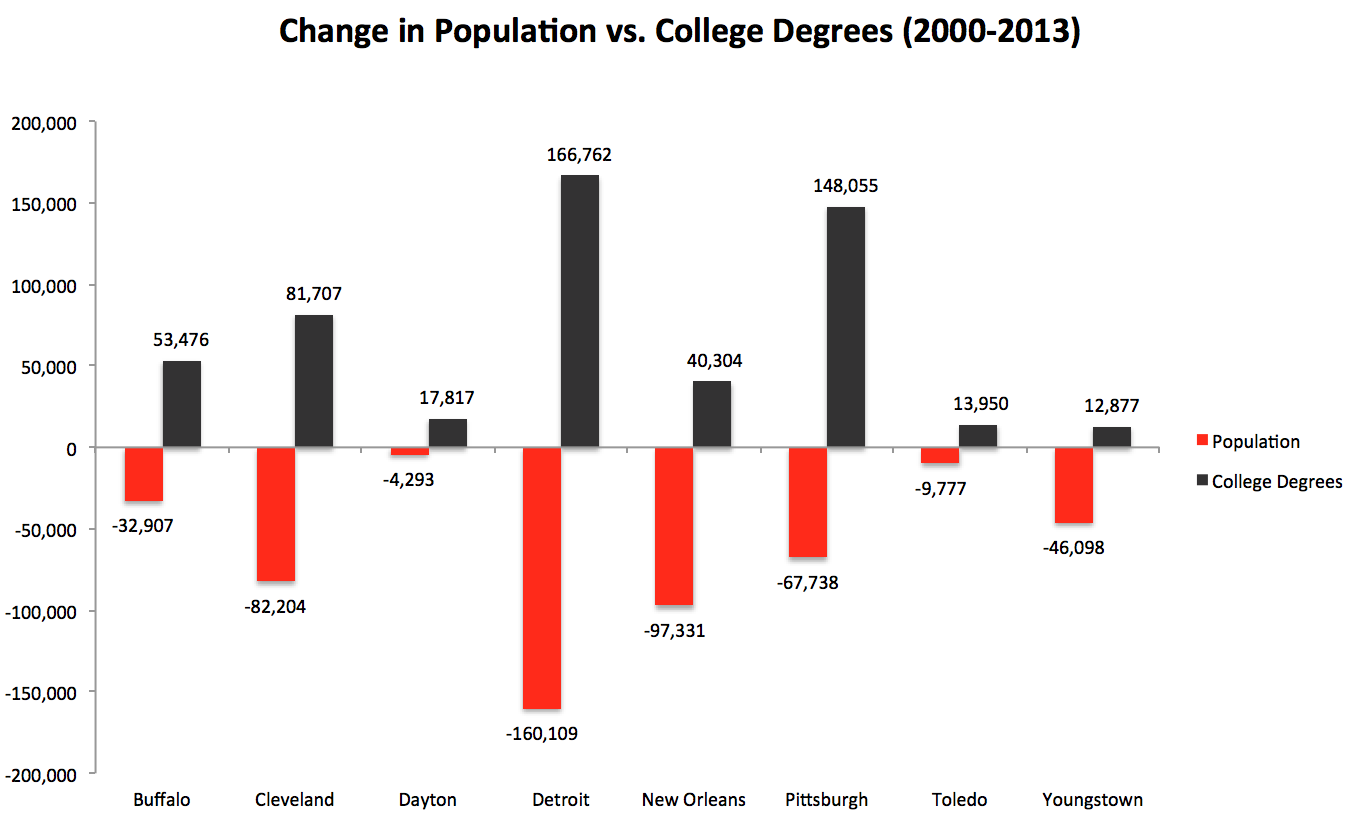

Both the city and the surrounding area are also losing population. Census data show that Pittsburgh’s Allegheny County lost almost 4,000 people in 2015 and 2016, while the seven-county region lost nearly 9,000 people on top of the more than 6,700 lost in the previous year.

The Pittsburgh story, then, involves more than a shining city on many hills. As a case study for thinking about economic development and urban planning, we have to go beyond the city itself. If you drive out of the busy downtown, away from the academic neighborhoods, and past the new suburbs, you cannot help but see the remains of the troublesome legacy of deindustrialization. Deteriorating factories, empty parking lots, dilapidated housing, and vacant lots all bear witness to the continuing material and social costs of economic restructuring. Urbanists, developers, and politicians have much to learn by expanding their view of Pittsburgh.

IN 2013, CARNEGIE MELLON University organized the 25th anniversary conference of the original Remaking Cities Congress. Pittsburgh was chosen as both site and symbol for its “25-year transformation from an industrial economy to a knowledge economy.” The conference brought together 300 leading national and international urban and city planners, economic development specialists, and architects to consider the state of efforts to revitalize deindustrialized communities. Many conference participants praised Pittsburgh as a prime example of the new urbanism that promotes walkability, diverse housing, quality architecture and design, increased density, mixed-use neighborhoods, smart public transportation, and commitment to sustainability and quality of life.

The plenary speakers included urbanologist Richard Florida, the Brookings Institution’s Bruce Katz, the architect David Lewis, and Prince Charles, who had played a pivotal role in organizing the initial conference. Alongside numerous self-congratulatory presentations about how cities were reinventing themselves, however, ran a darker undercurrent of uncertainty. In his plenary presentation, Florida noted how the new urbanism was fostering inequality, outmigration, and racial divisions. His analysis became the foundation of his new book, The New Urban Crisis: How Our Cities Are Increasing Inequality, Deepening Segregation, and Failing the Middle Class—and What We Can Do about It.

Florida had been in a good position to observe changes in Pittsburgh and other cities associated with the knowledge economy. He taught at Carnegie Mellon while researching his book The Rise of the Creative Class: And How It’s Transforming Work, Leisure, Community and Everyday Life, which argued for the power of technological determinism in shaping urban regeneration and economic growth. Initially published in 2002, the book instantly became a touchstone for economic developers and urban planners. Esquire magazine named Florida one of the “Best and Brightest” in 2005, and Businessweek called him a Voice of Innovation in 2006. Within several years, Florida became a beacon for those suggesting that postindustrial cities should concentrate on attracting a “creative class” of writers, painters, musicians, software developers, engineers, and doctors.

At the Remaking conference, however, Florida focused (as he does in his new book) on the unintended consequences of the growing knowledge economy he had earlier championed. While obliquely addressing Pittsburgh and its region, his analysis of the growing inequality, injustice, and resentment shown toward this and other cities captured, among other things, the growing populist unrest in western Pennsylvania and eastern Ohio—a pattern that would play out a few years later in the 2016 election.

Florida’s change of heart did not surprise Chapman University professor Joel Kotkin. As Kotkin argued in The Human City: Urbanism for the Rest of Us and The New Class Conflict, the new urbanism lay at the heart of an emerging class conflict. Unlike industrial conflicts between owners and laborers, this class conflict pitted a postindustrial elite made up of high-tech oligarchs and policy, media, and academic experts against the middle and working classes. According to Kotkin, the rise of the knowledge economy and new urbanist planning strategies had erased the idea that the city could be a place of hope for advancement for those in poverty. Instead, the poor, many of them people of color, were displaced by rising housing costs as white residents returned to the city and developers created a “Disneyland” of “restaurants, shops, and festivals.” For Kotkin, the American dream could now be found in the suburbs, where it was cheaper to live and survive in uncertain economic times. He argued that suburbs have become more racially diverse, and people with lower incomes had more opportunities to own property and build community.

But Kotkin’s suburbanist dream has also come under scrutiny. Urbanists have claimed that suburban sprawl increases demand for land usage and water, police, and fire services, as well as car dependency. The opioid epidemic has also reached the suburbs. Long commutes disconnect suburban residents from community life. Online shopping causes suburban malls to close, shattering local retail economies. Shoddy construction and poor materials long associated with suburban tract housing have become increasingly apparent.

Most crucially, studies make clear that poverty has grown most rapidly in suburban areas. Florida has countered Kotkin’s optimism. “The suburbs,” he has written, “are no longer the apotheosis of the American Dream and the engine of economic growth.” Citing David Lewis, he wrote that “the future project of suburban renewal would likely make our vast 20th-century urban renewal efforts look like a walk in the park.”

Debates between urbanists and suburbanists have consequences for planning and policy—just as the rift between metropolitan residents and other Americans has political consequences. In the 2016 presidential election, voting patterns in Pittsburgh and western Pennsylvania reflect this divide. While many commentators focused on racial, educational, gender, and generational gaps, The Atlantic’s Ronald Brownstein argued that none of these divides “proved more powerful than the distance between the Democrats’ continued dominance of the largest metropolitan areas, and the stampede toward the GOP almost everywhere else.” Nationally, Democrats won an average of 72 percent of the vote in counties with an urban core. But they lost in suburbs, midsize cities, and small and very small cities, and the farther these places were from cities, the bigger the loss for Democrats.

The voting in Pittsburgh and western Pennsylvania followed the national trend. Real Clear Politics reported that Hillary Clinton won culturally cosmopolitan areas “most commonly seen as centers of economic growth, political power, or cultural production,” but Trump made gains in the popular vote in traditional Democratic areas like Cleveland, Detroit, Buffalo, St. Louis, Pittsburgh, and other smaller cities in the middle of the country, when their decaying suburbs and exurbs were lumped into the tallies.

Pittsburgh and Allegheny County voted Democratic at 56 percent. This was only slightly lower than the levels of 2008 and 2012. But in surrounding counties in western Pennsylvania, support for Democratic candidates dropped. With larger turnouts in areas with greater Republican support, like Butler and Westmoreland Counties, western Pennsylvania could not deliver the votes necessary for the Democrats to win Pennsylvania. In addressing the decline in support for Democrats even in the city, Pittsburgh Mayor Bill Peduto said it best: “What we saw [on Election Day] was Democrats voting Republican.”

Clearly, the Republicans and Trump were successful in reducing support in what had been traditional Democratic areas by mining the divide between urban and suburban/rural areas, benefiting from the politics of resentment toward urbanism and economic elites.

FOLLOWING THE ELECTION, deliberations over new urbanism, urban-suburban identities, and the urban crisis have intensified as part of the debate over our future economic policy. The competing narratives have been shaped by such think tanks as Brookings and New America, representing a range of liberal and conservative political viewpoints.

For example, New America co-founder Michael Lind joined with Kotkin to produce a new report arguing that the solution to America’s economic problems lies in the revitalization of the heartland. In “The New American Heartland: Renewing the Middle Class by Revitalizing Middle America,” Lind and Kotkin reject the view that the coasts, epitomized by Silicon Valley in California and the finance industry in New York, should be the drivers of the American economy. They claim that what they call the “Gulf of Mexico watershed”—an admittedly imprecise geographic area—better reflects an ongoing population and economic shift away from the coasts toward middle America. This New American Heartland includes the older manufacturing rust belt, broad agricultural regions, and resource-extracting areas along the Gulf Coast. In other articles, Kotkin suggests this was the very region responsible for the election of Donald Trump.

Lind and Kotkin reject both Democrats’ and Republicans’ belief that America’s economic future is tied to knowledge, media, and finance industries that require the higher-skilled and better-educated employees located in coastal areas, and they also point out that even knowledge workers are leaving the coasts. While they do not deny that automation and offshoring have reduced employment in manufacturing and goods-producing industries, they believe that “the tradable sector” is far more essential to American prosperity than its share of current employment suggests. This sector includes manufacturing, industrial agriculture, energy, and minerals, fields that are dominated by large firms and complex supply chains. Once again indirectly criticizing the failures of urbanists’ visions of technology as the source of economic growth, they argue that every city and county cannot be Silicon Valley, and that the lower housing and energy costs and weaker regulatory environment in the “New Heartland” will drive future economic growth and development.

Lind and Kotkin’s political colors become more apparent in their discussion of the role of government in revitalizing the New American Heartland. They call for the government to supplement efforts of the private sector, but they also warn that “misguided regulations” could “thwart economic development.” For example, they note that regulatory attempts to mitigate the “possible” harms of climate change only increase the costs of fossil fuels. They are more concerned about possible dangers to energy industries, American jobs, and productivity growth. Instead, they suggest, the federal government should largely limit its support to basic science research and development, infrastructure, and tax support for state and local government and public-private partnerships.

Brookings scholar Bruce Katz and Jennifer Bradley, director of the Center for Urban Innovation at the Aspen Institute, offer a similar but decidedly smaller geographic analysis, minus the anti-coastal attacks and criticism of technology industries. In The Metropolitan Revolution: How Cities and Metros Are Fixing Our Broken Politics and Fragile Economy, they argue that metro areas, like Greater Pittsburgh, will drive economic growth because they are home to clusters of universities, local businesses, hospitals, museums, and advanced technology and manufacturing industries, what Katz and Bradley call “innovation districts.” They encourage planners and government officials to develop new strategies based on “Emergent Metros.”

Like Lind and Kotkin, Katz and Bradley raise doubts about the role of the federal government. They believe that the metropolitan revolution is “exploding this tired construct” about federal solutions. Instead, they argue, cities and metro areas “are becoming the leaders in the nation: experimenting, taking risk, making hard choices and asking for forgiveness, not permission.” This, they suggest, will lead to “only one logical conclusion: the inversion of the hierarchy of power in the U.S.”

That inversion, however, would put business elites and their closely affiliated local foundations in power. The examples that Katz and Bradley highlight all involved a shift in power from elected government officials to unelected business and economic leaders and nongovernmental organizations, leaving local electorates, community groups, and neighborhoods with little power to do anything other than rubber-stamp the decisions made by local elites. They minimize the involvement of popular movements in urban issues. They contrast both the Occupy and Tea Party movements with their metropolitan revolution, which they describe as “reasoned rather than emotional, leader driven rather than leaderless, born of pragmatism and optimism rather than despair and anger.”

In contrast, Richard Florida envisions a more critical and stronger role for government in supporting urban transformational changes. In The Urban Crisis, he argues that a “disconnect between the vital economic role of cities and our policymakers’ neglect of them” has led to a crisis. Florida still believes, as he wrote in The Rise of the Creative Class, that cities are most economically successful when they bring together the three “Ts”—technology, talent, and tolerance. Cities remain platforms for innovation, wealth creation, social and progressive values, and political freedom, and these, in turn, contribute to the health of suburbs and outlying areas. However, he now argues that cities must resist the “winner-take-all urbanism” that fosters economic inequality and segregation. He offers seven keys for more equitable development: reforms in building, zoning codes, and tax policies; infrastructure investment to spur density and clustering and to limit sprawl; affordable rental housing in central locations; turning low-wage service jobs into family-supporting work; addressing poverty through greater investment in people and places; helping build stronger and more prosperous international urban cities; and empowering local communities and local leaders to strengthen their own economies. No doubt many of these reforms would make cities more affordable and attractive to the middle and working classes, but they would also require massive government subsidies. For Florida, then, the federal government has a central role to play in alleviating the urban crisis.

The real problem for Florida is not the coastal elites and tech hubs and oligarchs so vilified by Lind and Kotkin. Rather, the problem lies with “urbanized knowledge capitalism” itself, which has clear winners and losers, as evidenced by the economic segregation, wage and income inequality, and home unaffordability that plague the urban centers of knowledge capitalism. This urban crisis is not limited to coastal areas. It affects cities and metros of all sizes across the country. To address the underlying crisis of this “secular stagnation,” Florida believes, the federal government must move beyond the usual but vague debates over infrastructure spending and make “strategic investments in the kinds of infrastructure that can underpin more clustered and concentrated urban development.”

WHAT IS MISSING FROM the larger discussions of urban and regional development are any fully formed progressive solutions. Even the most progressive of recent political campaigns offered little. While Bernie Sanders championed “New Deal Reforms” and a “new Bill of Rights” that, he claimed, would create “an economy that works for all, not just the very wealthy,” other than making housing affordable and increasing wages and benefits, he put forth no concrete plans for dealing with the broader crisis of urban and regional economies. Some of Richard Florida’s more progressive pillars found their way into Martin O’Malley’s campaign, but that never got off the ground.

More recently, the Center for American Progress has put forward a progressive solution, a report entitled “Toward a Marshall Plan for America: Rebuilding our Towns, Cities, and the Middle Class.” It argues for developing a commission to design a “domestic Marshall Plan for jobs and community investment.” The Marshall Plan Commission would be “under the direction of national, regional, and local leaders.” They would “seek input from urban and rural leaders who represent labor, business, education, health, faith, community, economic development, and racial justice to help understand the problem; lift up promising practices; develop bold ideas; particularly for people who did not attend college.” The plan encourages the building of “community institutions that support incomes, employment, and mobility” through greater infrastructure spending, investment in education, public employment, improvements in access to child care and health care, tax reform, and increased wages and social security, among other strategies. Overall, the plan can be read as a provisional “New Deal Lite,” a thinly disguised re-do of the center’s contributions to Hillary Clinton’s economic platform, with belated attention to the working class and nonmetropolitan America.

There is a good reason why no one has offered clearer strategies, though. As Pittsburgh shows, there are no easy answers to challenges facing metro regions. When we look beyond that city’s core, we clearly see that even the place most often praised for having gotten economic renewal right still battles uneven development and inequities just beyond the city limits. None of the strategists offer much hope for the many former mill towns and rural communities in western Pennsylvania. Without a new and enduring infusion of economic vitality, smaller towns and rural areas outside the upscale metropolitan hubs will show persistent signs of economic struggle. Some may be beyond repair.

It isn’t that the Pittsburgh story is wrong. It is simply incomplete. The narratives about this city, like the broader debates among new urbanists and economic and urban planners, do not fully consider the continuing costs of deindustrialization, disinvestment, globalization, and neoliberal austerity programs on individuals and communities. These personal, community, and national costs rival the displacements caused by natural disasters and armed conflicts. The devastation of economic change has left far too many with limited options and little power to improve their lives or communities.

Even if someone could offer clear solutions, however, their proposals would still have to surmount political gridlock. Neither party seems poised to take on this crisis in any effective way, which only contributes to the disillusionment of many voters and to a growing divide that, as Brownstein argues, splits urban residents from those living in suburbs, small towns, and rural areas.

Even with the best of intentions, urban planners and economic developers are complicit in sustaining the broken socioeconomic system that Florida suggests is central to the urban crisis. They need to recognize that the problem goes beyond even secular stagnation, segregation, gentrification, inclusion, regional integration, and the business and government efforts so prominent in their narratives. The problem is with capitalism as it currently exists—its reliance on inequality and racism, and its externalization of its social costs. This is not to say that economic and social improvements cannot be made through some of the reforms suggested previously. But they won’t solve the underlying problems that come from capitalism’s subordination of social needs to its economic necessities.

Urbanists need to consider long-term strategies based on values, and not just spatial considerations, that address the concrete needs of people. What makes our urban and regional crisis seem so intractable, ultimately, is this very tension between market forces and ethical and moral solutions.

This piece originally appeared in The American Prospect.

John Russo is the former co-director of the Center for Working-Class Studies at Youngstown State University and currently a visiting scholar at Georgetown University’s Kalmanovitz Initiative for Labor and the Working Poor.

Photo by Dllu (Own work) [CC BY-SA 4.0], via Wikimedia Commons