Local democracy has been a mainstay of the US political system. This is evident from the town hall governments in New England to the small towns that the majority of Americans choose to live in today.

In most states and metropolitan areas, substantial policy issues – such as zoning and land use decisions – are largely under the control of those who have a principal interest: local voters who actually live in the nation’s cities, towns, villages, townships and unincorporated county areas. This may be about to change. Two congressional initiatives – the Boxer-Kerry Cap and Trade Bill and the Oberstar Transportation Reauthorization Bill – and the Administration’s “Livability Partnership” take direct aim at local democracy as we know it.

The Boxer-Kerry Bill: The first threat is the proposed Senate version of the “cap and trade” bill authored by Senator Barbara Boxer-Kerry (D-California) and Senator John Kerry (D-Massachusetts). This bill, the Clean Energy Jobs and American Power Act (S. 1733), would require metropolitan planning organizations (MPOs) to develop greenhouse gas emission reduction plans. In these plans, the legislation would require consideration of issues such as increasing transit service, improvements to intercity rail service and “implementation of zoning and other land use regulations and plans to support infill, transit-oriented development or mixed use development.” This represents a significant step toward federal adoption of much of the “smart growth” or “compact development” agenda.

At first glance, it may seem that merely requiring MPOs to consider such zoning and land use regulations seems innocent enough. However, the incentives that are created by this language could well spell the end of local control over zoning and land use decisions in the local area.

True enough, the bill includes language to indicate that the bill does not intend to infringe “on the existing authority of local governments to plan or control land use.” Experience suggests, however, that this would provide precious little comfort in the behind-the-scenes negotiations that occur when a metropolitan area runs afoul of Washington bureaucrats.

The federal housing, transportation and environmental bureaucracies have also been supportive of compact development policies. As these agencies develop regulations to implement the legislation, they could well be emboldened to make it far more difficult for local voters to retain control over land use decisions. There could be multiple repeats of the heavy-handedness exercised by the EPA when it singled out Atlanta for punishment over air quality issues. In response, the Georgia legislature was, in effect, coerced into enacting planning and oversight legislation more consistent with the planning theology endorsed by EPA’s bureaucrats. No federal legislation granted EPA the authority to seek such legislative changes, yet they were sought and obtained.

There is also considerable support for the compact development agenda at the metropolitan area level. The proclivity of metropolitan and urban planners toward compact development is so strong as to require no encouragement by federal law. The emerging clear intent of federal policy to move land use development to the regional level and to densify existing communities could encourage MPOs to propose plans that pressure local governments to conform their zoning to central plans (or overarching “visions”) developed at the regional level. Along the way, smaller local jurisdictions could well be influenced, if not coerced into actions by over-zealous MPO staff claiming that federal law and regulation require more than the reality. It would not be the first time. Further, MPOs and organizations with similar views can be expected to lobby state legislatures to impose compact development policies that strip effective control of zoning and land use decisions from local governments.

Surface Transportation Reauthorization: The second threat is the Surface Transportation Authorization Act (STAA or reauthorization) draft that has been released by Chairman James Oberstar (D-Minnesota) of the House Transportation and Infrastructure Committee. This bill is riddled with requirements regarding consideration of land use restrictions by MPOs and states. Unlike the Boxer-Kerry bill, the proposed STAA includes no language denying any intention to interfere with local land use regulation authority.

Like the Boxer-Kerry Bill, the Oberstar bill significantly empowers the Department of Transportation and the Environmental Protection Agency and poses similar longer term risks.

The Administration’s “Livability Agenda:” These legislative initiatives are reinforced by the Administration’s “Livability Agenda,” which is a partnership between the EPA, the Department of Housing and Urban Development and the Department of Transportation. Among other things, this program is principally composed of compact development strategies, including directing development to certain areas, which would materially reduce the choices available to local government. Elements such as these could be included in an eventual STAA bill by the Obama Administration.

The Livability Agenda: Regrettably, the Boxer-Kerry bill, the Oberstar bill and the “Livability Agenda” will make virtually nothing more livable. If they are successful in materially densifying the nation’s urban areas, communities will be faced with greater traffic congestion, higher congestion costs and greater air pollution. Despite the ideology to the contrary, higher densities increase traffic volumes within areas and produce more health hazards through more intense local air pollution. As federal data indicates, slower, more congested traffic congestion produces more pollution than more freely flowing traffic, and the resulting higher traffic volumes make this intensification even greater.

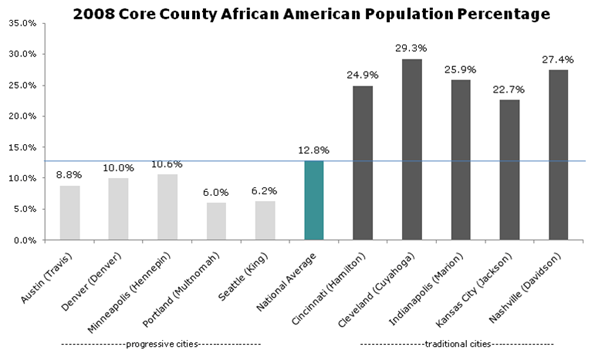

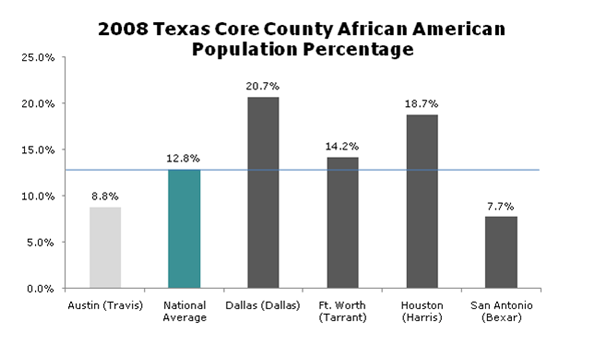

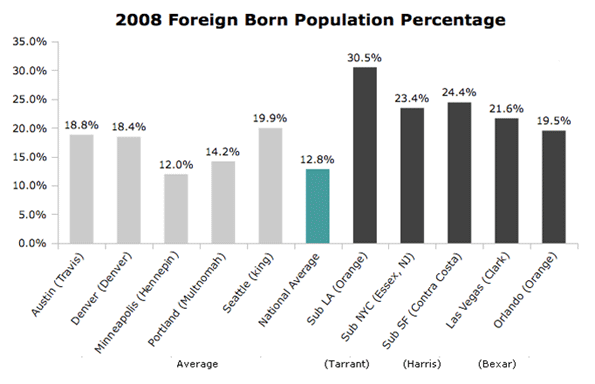

There are also devastating impacts on housing affordability that occur when “development is directed.” This tends to increase land prices, which makes houses more expensive. This hurts all future home buyers and renters, particularly low income and minority households, since rent increases tend to follow housing prices. It is particularly injurious to low income households, which are disproportionately minority. The large gap between majority and minority home ownership rates likely widen further. So much for the American Dream for many who have not attained it already.

The Marginal Returns of Compact Development Policies: These compact development initiatives continue to be pursued even in the face of research requested by the Congress indicating that such policies have precious little potential. The congressionally mandated Driving and the Built Environment report indicates that driving and greenhouse gas emissions could be higher in 2050 than in 2000 even under the maximum deployment of compact development strategies.

Local Governments at the Table? The nation’s local governments should “weigh in” on these issues now, while the legislation is being developed. If they wait, they could find bullied by EPA and MPOs to follow not what the local voters want, but what the planners prefer. Local democracy will be largely dead, a product of a system that concentrates authority – and perceived wisdom – in the hands of the central governments, at the regional and national level.

Even more, local citizens and voters need to be aware of the risk. It will be too late when MPOs or other organizations, whether at their own behest or that of a federal agency, force the character of neighborhoods to be radically changed, as Tony Recsei pointed out is

already occurring in Australia.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”