American households face daunting financial challenges. Even those lucky enough not to have suffered huge savings and retirement fund losses in the Great Recession seem likely to pay more of their incomes in taxes in the years to come, as governments attempt pay bills beyond their reasonable financial ability. Beyond that, America’s declining international competitiveness and the easy money policies of the Federal Reserve Board could well set off inflation that could discount further the wealth of households.

In this environment, the last thing governments need do is to raise the cost of anything. It is bad enough that taxes may have to rise and that a dollar will probably buy less. America’s standard of living could stagnate or it could even decline.

The Choice: Smart Growth or Affordability

The Washington Examiner, however, succinctly put the choices that face the nation, states and localities with respect to the largest element of household expenditure — housing. In an editorial entitled “Take Your Pick: Smart Growth or Affordable Housing,” the Examiner noted:

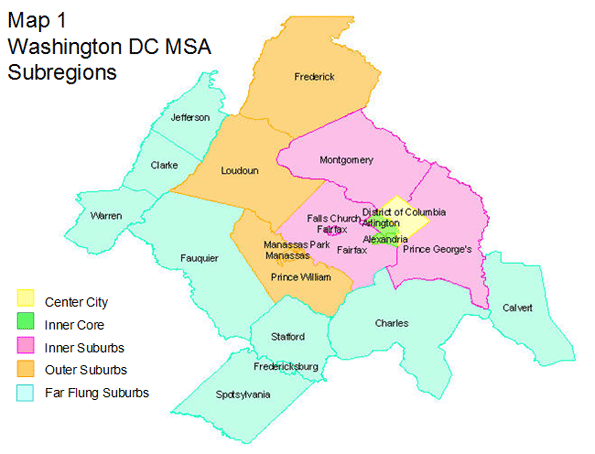

“No matter how much local politicians yammer about how much they support affordable housing, they are the principal cause of the problem via their land use restrictions, such as the urban growth boundary in Montgomery County and large-lot zoning in Loudoun County.”

The editorial was in response to our Demographia Residential Land & Regulation Cost Index, which estimated the extent to which the land to construction ratio had risen in metropolitan regions. The principal finding was that the share of land and regulatory costs to new house prices had risen only with the impostion of more restrictive land use policies. This is principally because strategies such as urban growth boundaries, suburban large lot zoning and geographical growth steering (such as allowing state financial assistance only in areas meeting smart growth criteria) makes land for housing unnecessarily scarce, raising its price just as surely as OPEC’s oil rationing raises the price of gasoline.

Urban planner and mayor of Ventura, California Bill Fulton objected to our attributing these increases to land and regulation, instead suggesting that smart growth increases homes prices much less than we claimed although, he admits, “at least a little“ . The pro-smart growth study Costs of Sprawl — 2000 concedes that a number of smart growth strategies can increase house prices (See Table 15-4). Thus, the debate is not about whether more restrictive land use policies raise the price of housing, but rather by how much.

More often, however, proponents of more restrictive land use regulations have avoided and even denied that the inconvenient truth linking their policies with higher housing costs. Rarely, if ever, have proponents of such policies fully disclosed to elected or appointed officials that more restrictive land use policies would lead to higher house prices. It is doubtful that any urban planning department ever sent representatives to an NAACP chapter to explain how fewer African-Americans would be able to own their own homes, despite already having a one-third lower home ownership rate than non-Hispanic whites. Similarly, the planners probably never told La Raza chapters that Hispanic households, also with a one third less home ownership rate, would find home ownership more costly. Nor was the message delivered to the religious organizations concerned with improving the standard of living for lower income households.

Pervasive Evidence

Yet the evidence that smart growth boost prices substantially seems incontrovertible. An early 1970s research effort led by renowned urbanologist Peter Hall quantified the impacts of the restrictive Town and Country Planning Act of 1947, which brought smart growth measures to England. The result, The Containment of Urban England revealed how strict regulations on development had driven the price of land for development from five to ten times the value of comparable on which development was not permitted, but might be permitted in the future. More recently, Bank of England Monetary Policy Committee member Kate Barker, was commissioned by the Blair Labour government to review housing affordability and land regulation. She attributed England’s more steeply rising house prices relative to continental Europe to its more restrictive land use regulations.

The same effect is evident in the United States. Dartmouth’s William Fischel noted that California house prices were similar to those in the rest of the nation as late as 1970. By 1990, however, California house prices had escalated well ahead of the nation. Fischel found that the higher prices could not be explained by higher construction cost increases, demand, the quality of life, amenities, the property tax reform initiative (Proposition 13), land supply or water issues. His conclusion was that the expansion of land use restrictions were the culprit.

Let Them Eat Cake?

The disregard at least some smart growth proponents show about house prices may be characterized, for example, in a comment on the Planetizen website:

“… smart growth can lead to more expensive housing. So what? At least it’s REAL value, generated by a higher quality of life, easier commutes, more transit options, walkability and a more enriched cultural experience…” (emphasis in original)

Perhaps it never occurred to the proponents of more restrictive land use policies that not all households have the benefit of incomes typical of urban planners or new urbanist architects. One has to question the “REAL values” of smart growth since most housing consumers place their highest emphasis on things like privacy, security and good schools, not always available at a decent price in urban areas.

In fact, higher priced housing reduces the discretionary income that is crucial to an acceptable standard of living to many households. Millions of households will not be in the market for “a more enriched cultural experience” until they can afford the housing they desire.

Housing Affordability and the Cost of Living

It is not accidental that the cost of living is higher (both in nominal terms and relative to incomes) in metropolitan regions where land use regulation is the strongest, such as San Diego, Washington-Baltimore, Seattle or Boston. Nor is it accidental that house prices have escalated to 40 percent above historic norms in Portland, Oregon, where planners have skimped on geographical urban growth boundary expansions, choosing instead to look skyward, seeking higher densities. California’s aspiration under Senate Bill 375 for new housing at 20 units to the acre offers a more than Jakarta level of density (residential densities above 30,000 per square mile) that could escalate the unprecedented exodus of people and businesses.

Higher Housing Costs: The Poverty Connection

The acknowledged relationship between more restrictive land use regulation and higher house prices also applies to standards of living, which are sent lower, and poverty rates, which must inevitably be pushed higher. This constitutes a second inconvenient truth: as discretionary income drops, more households fall into poverty. This creates a difficulty for proponents of more restrictive land use regulation, because there is no constituency for increasing poverty. It is no wonder they have generally discounted, ignored or even denied the nexus between smart growth and higher housing costs.

Considering the financial uncertainty American households face, it is long past time that the choice between smart growth and housing affordability be seriously debated.

—-

Photograph: “Low density” smart growth development adjacent to the urban growth boundary (Hillsboro) in suburban Portland (by author)

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life”